Are you feeling overwhelmed by debt and wondering how to take control of your financial situation? Settling debts can often feel daunting, but it's a powerful step toward regaining your peace of mind. In this article, we'll explore a simple letter template that can help you initiate your debt settlement process effectively. So, if you're ready to learn more about managing your debts and finding relief, keep reading!

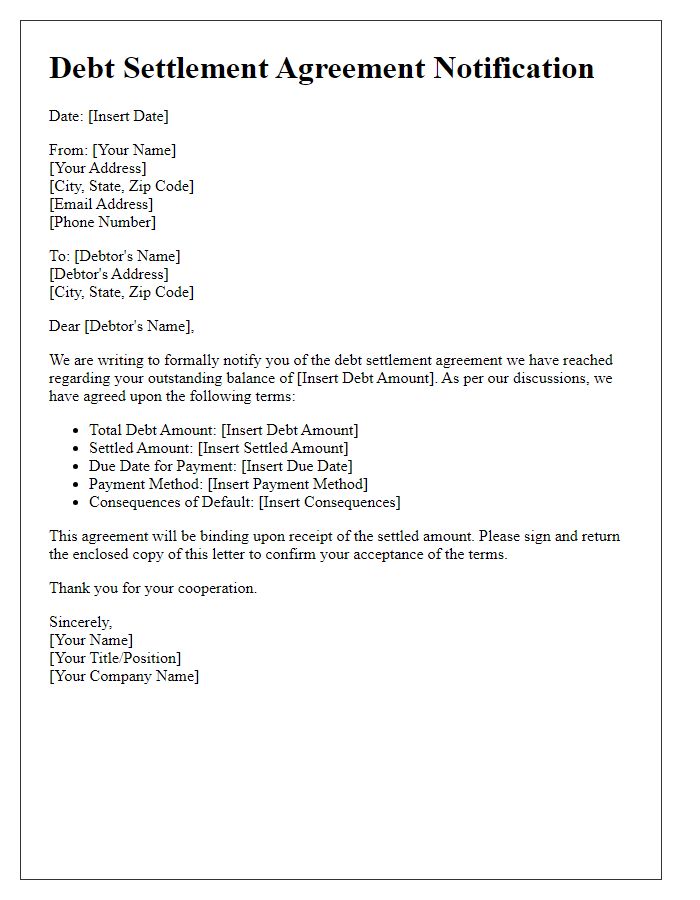

Creditor Information

Creditor information is crucial in a debt settlement notice as it outlines the entity owed money. This may include the name of the creditor, such as ABC Financial Services, the account number, and contact details like phone number and mailing address. For example, the creditor's mailing address could be 123 Main Street, Suite 400, Los Angeles, CA 90001. The importance of including a clear creditor name ensures clear communication of whom the debtor is addressing in the settlement negotiations. Furthermore, details on the original amount owed, such as $5,000, alongside identification of any relevant contracts or agreements related to the debt, can help establish the context of the settlement. Accurate and complete creditor information significantly streamlines the negotiation process, providing transparency and facilitating more effective dialogue regarding acceptable terms for debt reduction or cancellation.

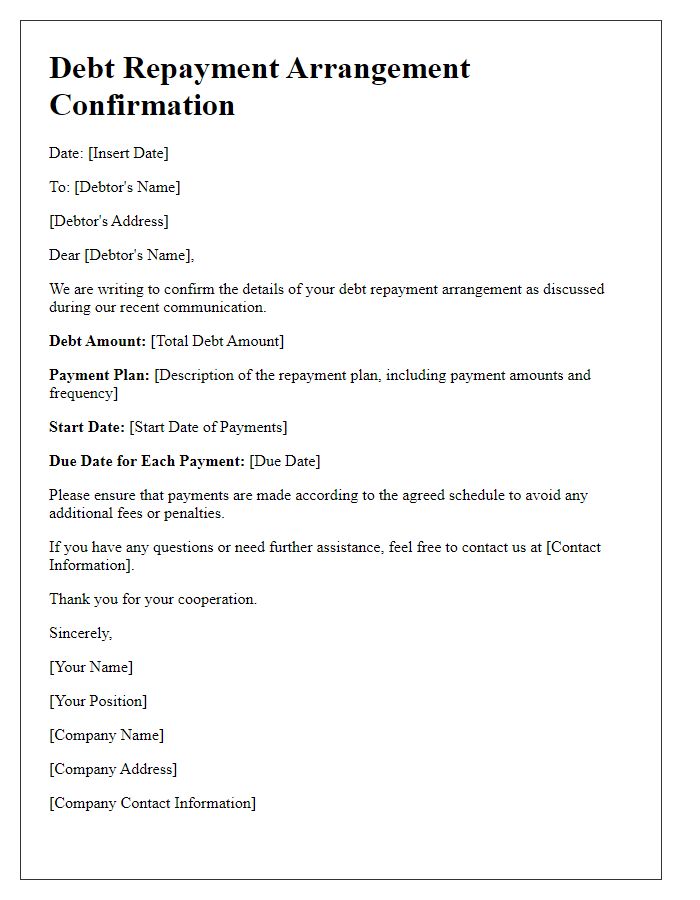

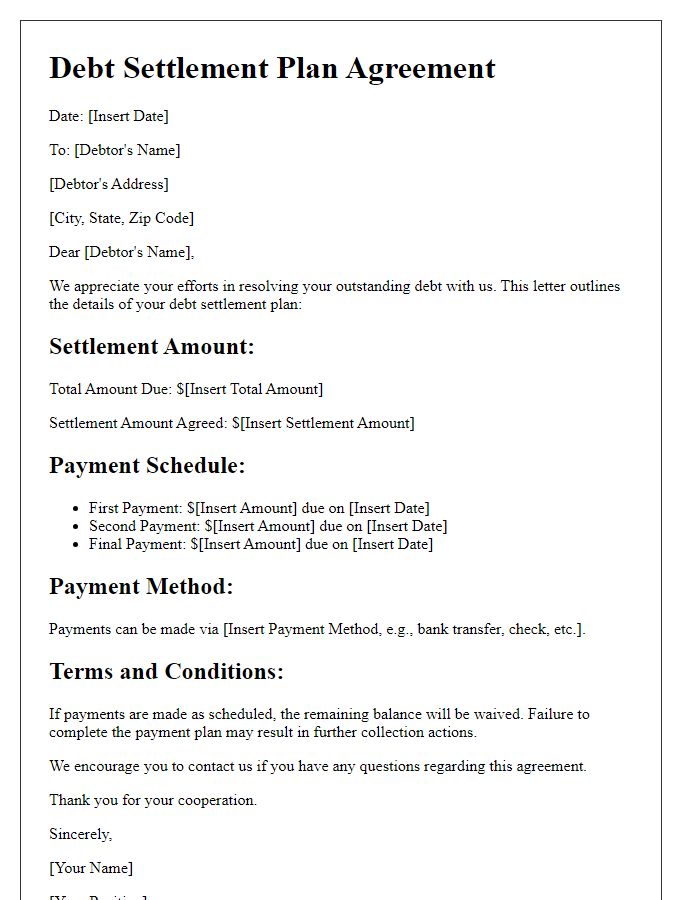

Debtor Information

Debt settlement notices serve as crucial communications between creditors and those who owe money, ensuring clarity in financial obligations. Essential elements in this notice include the debtor's full name, providing a direct link to the financial account in question. Address details, typically including street address, city, state, and ZIP code, help validate the debtor's identity and ensure that correspondence reaches the correct individual. Additionally, account numbers associated with the debt are vital for precise identification, as they distinguish one debtor's obligations from another's, often pinpointing the amount owed, which can significantly impact settlement negotiations. Lastly, the notice should incorporate date fields to establish timelines for payments, communications, and any proposed settlement agreements, as well as contact information for further inquiries or discussions regarding the debt.

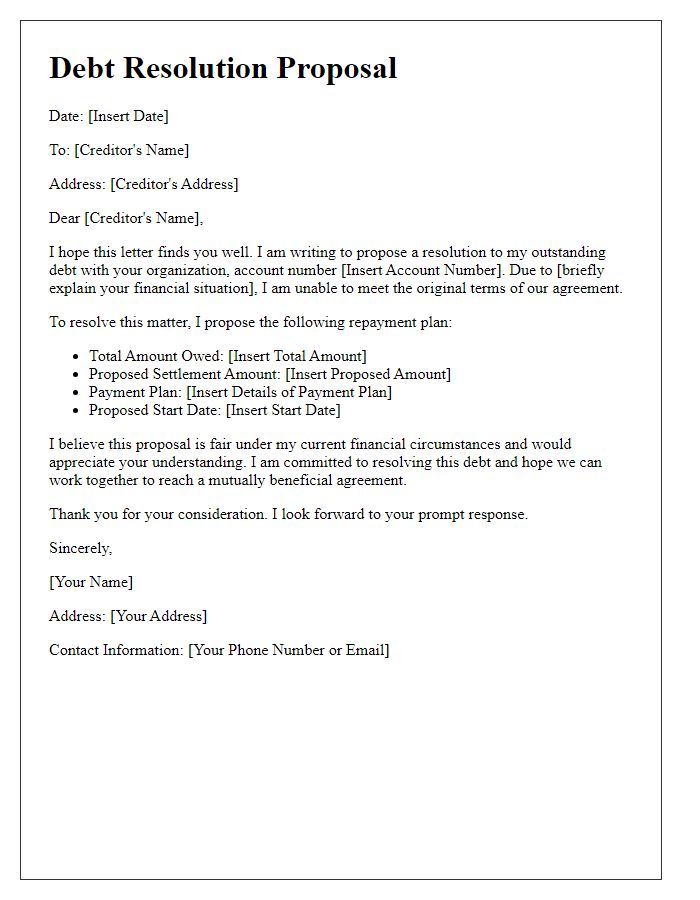

Outstanding Debt Amount

Outstanding debts, such as unpaid credit card balances or personal loans, can significantly impact an individual's financial stability. A debt settlement notice typically details the total outstanding amount, which may range from hundreds to thousands of dollars, depending on factors like principal, interest rates, and time overdue. Key entities involved include creditors, who may be banks or financial institutions, and debtors, typically individuals or businesses facing financial difficulties. Timely communication about debt settlements can prevent further complications, such as court actions or collection agency involvement, preserving credit ratings and promoting a more manageable repayment strategy.

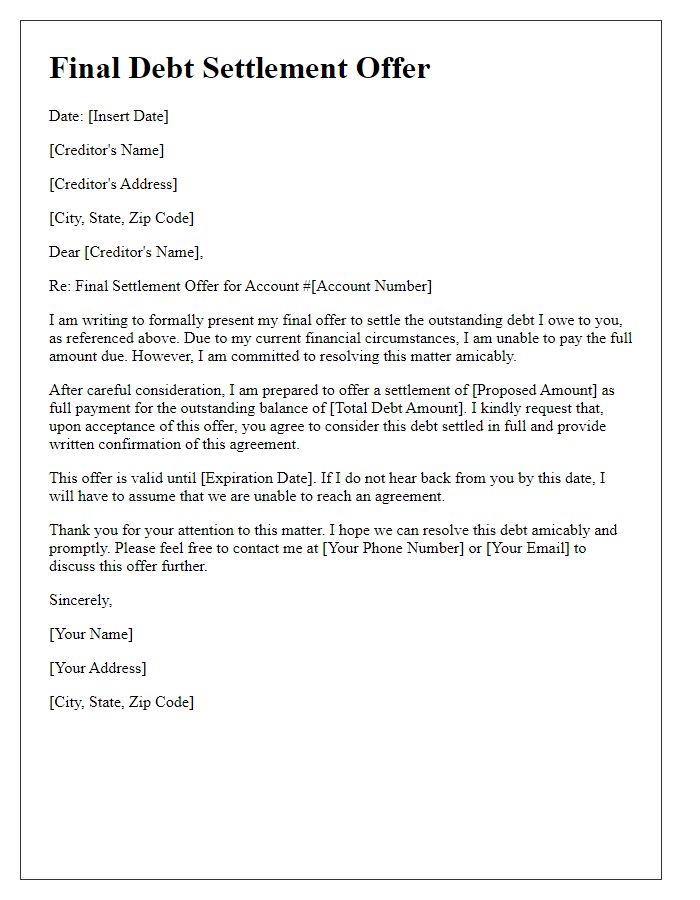

Settlement Offer Details

Debt settlement notices outline crucial details regarding repayment agreements between creditors and debtors. Settlement offers typically include the total debt amount, specific terms of the proposed settlement, and deadlines for acceptance. For example, a creditor may propose a settlement of $5,000 on a $15,000 debt, requiring payment within 30 days. The notice should also mention potential impacts on credit scores, typically dropping by 100-150 points due to the settlement arrangement being reported as settled for less than owed. It's important to document all correspondence and any adjustments to payment plans, as many settlement agreements stipulate that failure to comply may result in reversion to the original debt terms. Including financial disclosures such as monthly income (e.g., $3,500) can support eligibility for the proposed settlement.

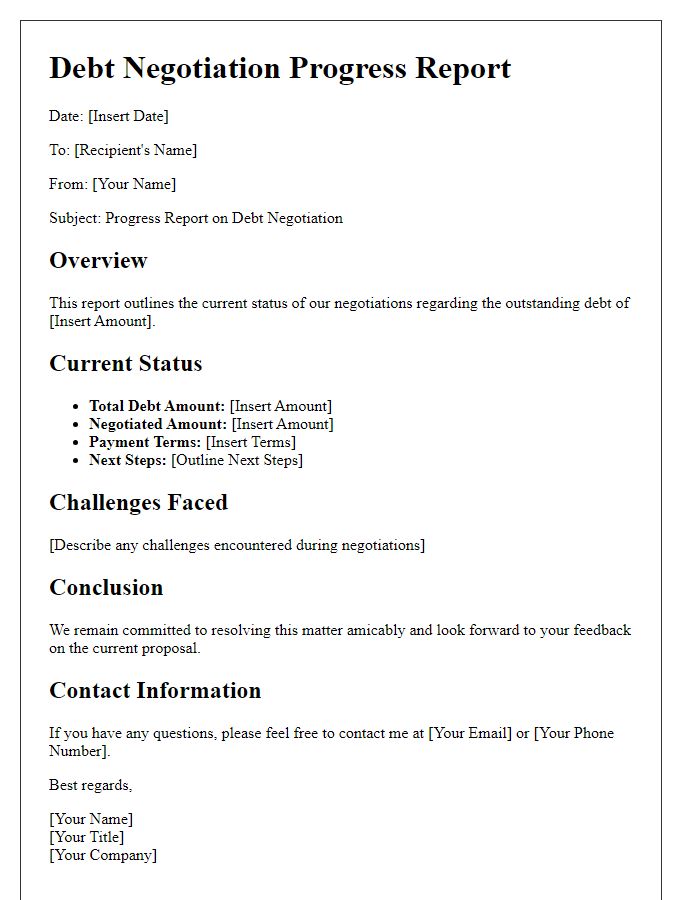

Deadline for Response

Debt settlement notices require clear communication regarding deadlines and obligations. This document serves to inform the debtor about the outstanding amount (specific figure) owed, the settlement offer (a percentage of the total debt), and the critical deadline for response (usually a specified date, such as 30 days from receipt of the notice). Failure to respond by this date may result in further actions, including collections or legal consequences. Such notices often mention applicable laws (like the Fair Debt Collection Practices Act) and include contact details for negotiations or inquiries, ensuring the debtor has multiple avenues to seek clarification. Clarity and professionalism are crucial for maintaining an amicable resolution process.

Comments