Are you considering leaving a meaningful mark on the world even after you're gone? A legacy donation can provide incredible support to causes that resonate with your values, ensuring your impact lives on. In this article, we'll explore how you can navigate the simple yet profound process of legacy giving. Join us on this journey to discover how your generosity can create lasting changeâread more to find out how!

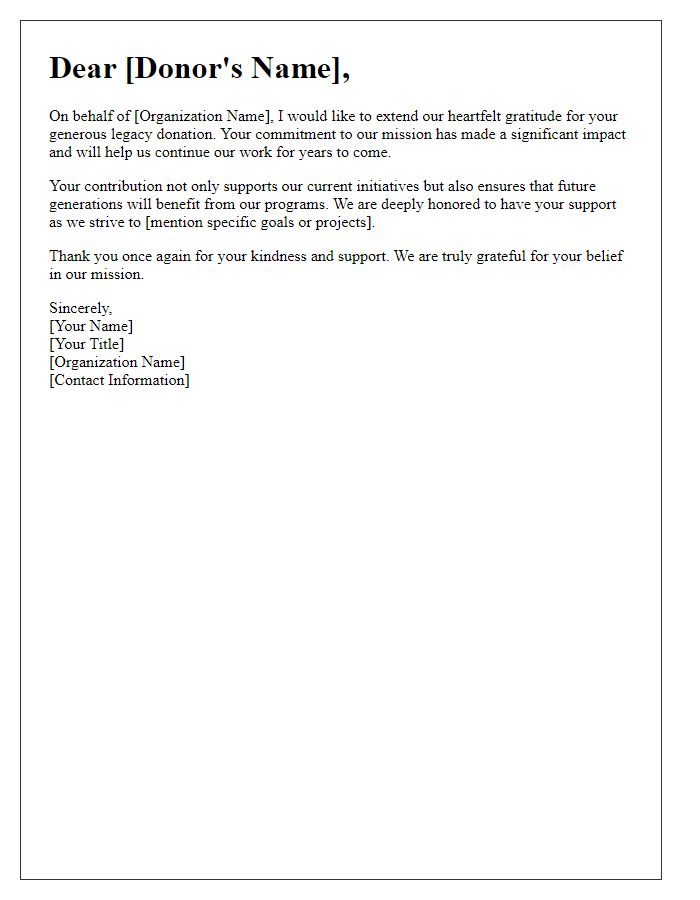

Donor's Intent and Purpose

Legacy donations often serve to support vital causes and create long-lasting impact on communities. They allow donors to express their philanthropic intent, often directed toward areas such as education, healthcare, or environmental conservation. These contributions can establish scholarship funds, support medical research initiatives, or preserve natural habitats, demonstrating a deep commitment to fostering positive change. Organizations typically use legacy gifts to enhance their endowment funds, ensuring financial stability for future generations of beneficiaries. Noteworthy figures in philanthropy, like Andrew Carnegie, have exemplified this practice by dedicating substantial portions of their wealth to societal advancements, thus inspiring others to consider their own legacies.

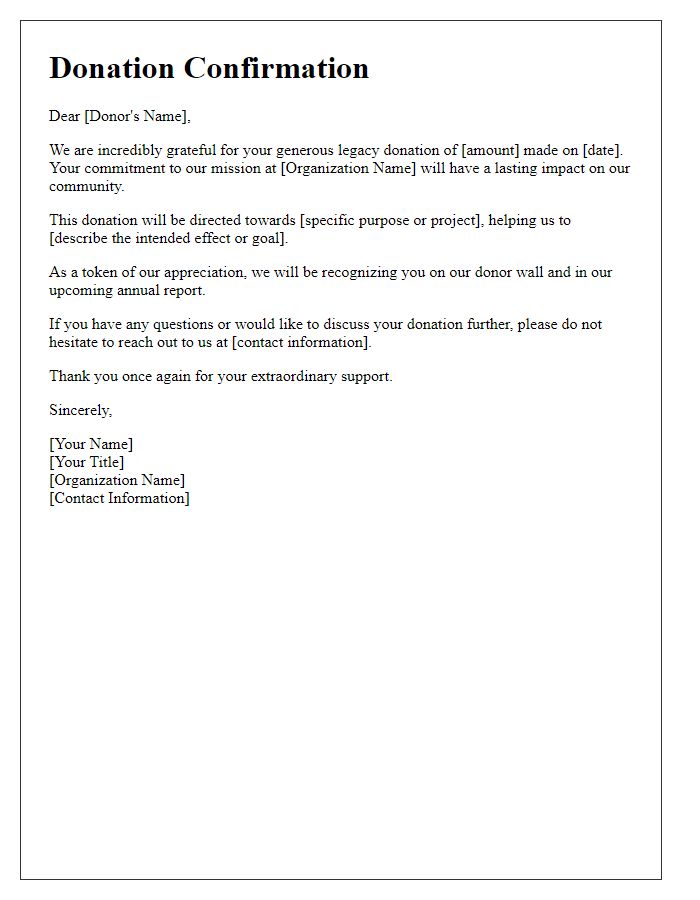

Beneficiary Information

Legacy donations play a significant role in supporting charitable organizations and their missions. Detailed beneficiary information is essential for understanding how these donations impact specific causes, ensuring funds directly support initiatives like education, healthcare, and environmental conservation. Key data includes the beneficiary organization's name, such as the Red Cross or United Way, their registration number (e.g., 123-456-789), mission statement that outlines goals and objectives, and the specific programs that will benefit from the donation, such as disaster relief efforts or youth development programs. Additionally, understanding geographical areas served, annual budget allocation for funded programs, and testimonials from beneficiaries can provide insight into the legacy donation's lasting impact.

Legal and Financial Details

Legacy donations play a crucial role in the sustainability of nonprofit organizations, providing essential support for long-term goals and initiatives. Legal considerations include understanding the requirements for bequests, such as documentation of the donor's intent and the designation of specific assets, like real estate or financial accounts. Financial details encompass the potential tax implications for both the donor's estate and the organization receiving the donation. Different forms of legacy gifts, such as charitable remainder trusts or donor-advised funds, can influence the overall financial strategy of the donor. In addition, reviewing the organization's status, such as 501(c)(3) designation in the United States, is important for ensuring compliance with tax laws and regulations.

Tax Implications and Benefits

Legacy donations provide significant opportunities for philanthropic impact while also offering potential tax benefits for donors. Charitable contributions to qualified organizations, as defined by the Internal Revenue Service (IRS), allow individuals to deduct a portion of their taxable income, reducing overall tax liability. For estate planning, bequeathing assets such as real estate, stocks, or cash can confer additional tax advantages. For instance, when a donor leaves property to a charity, it may escape estate taxes, thus potentially increasing the net value of the estate for heirs while still achieving charitable goals. It is critical for donors to consult with tax advisors and estate planning professionals to maximize benefits, ensuring compliance with regulations and optimizing philanthropic impact during one's lifetime and beyond.

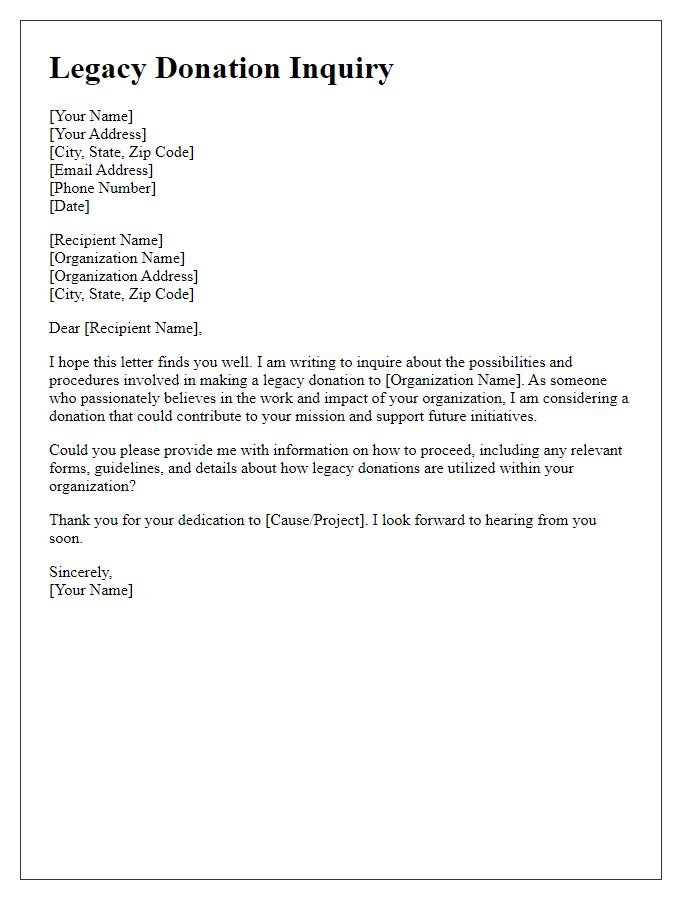

Contact Information for Inquiries and Assistance

Legacy donations, often referred to as planned gifts, play a crucial role in supporting charitable organizations. Interested individuals can seek assistance by contacting dedicated representatives via phone or email. Many nonprofits provide comprehensive information on their legacy donation programs, which can vary greatly depending on the organization's mission, size, and jurisdiction. It is recommended to reach out to specific contacts listed on official websites or printed materials associated with campaigns, ensuring personalized guidance tailored to donor preferences and financial intentions. Additionally, local offices may offer in-person consultation for those desiring face-to-face discussions regarding their giving options.

Comments