Are you thinking about navigating the sometimes tricky waters of securing a mortgage? As a mortgage broker, I'm here to simplify the process for you and help you find the best options tailored to your financial situation. With expert insights and personalized service, we can turn what often feels overwhelming into a seamless experience. So, let's dive deeper into how we can work together to achieve your homeownership dreams!

Client Information

Client engagement with a mortgage broker involves essential details that streamline the loan process. Clients should provide personal information, including full names, addresses, and social security numbers, which are critical for identity verification. Financial details, such as annual income figures ($50,000 or more for standard loans), employment status, and savings account balances, are necessary to assess lending eligibility. Property information, including the desired location (e.g., Los Angeles, California) and the type of property (single-family home, condominium, etc.), helps in identifying suitable mortgage options. Credit scores, pivotal in determining loan terms (e.g., scores above 700 often qualify for better interest rates), must also be disclosed. Additional requirements may include documentation such as tax returns from the last two years and bank statements, which enhance the accuracy of the financial assessment.

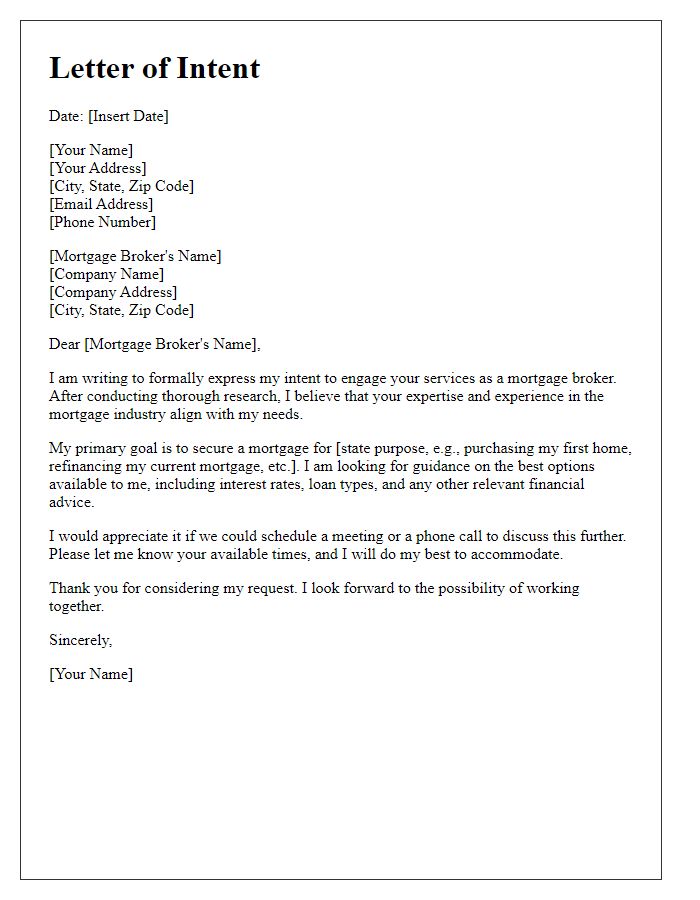

Broker Details

A mortgage broker engagement involves specific details crucial for establishing a professional relationship. The broker's name should be prominently displayed, such as "John Doe, Senior Mortgage Advisor," providing clear identification. The business address, including city and state, such as "1234 Finance Ave, Suite 100, San Diego, CA," ensures accurate correspondence. Contact information should include a direct phone number, like "(555) 123-4567," and an email address, such as "johndoe@mortgagebrokers.com," facilitating prompt communication. The broker's licensing number, essential for compliance, should be referenced, providing assurance of their credentials. Additional details may include the broker's experience, highlighting years in the industry (e.g., "over 10 years of experience"), areas of expertise, and notable achievements to establish credibility and build trust with the client.

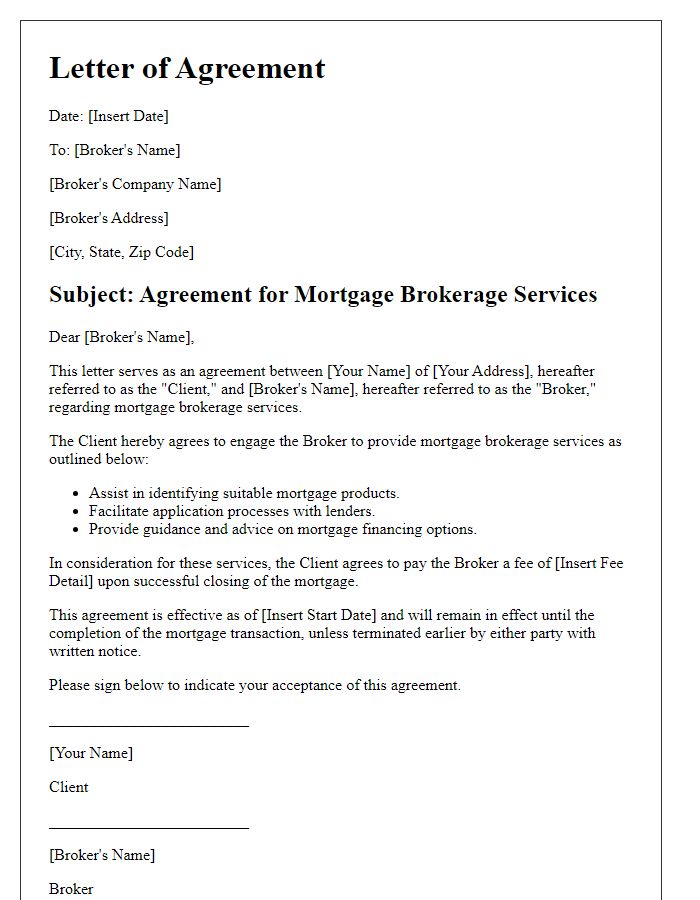

Services Provided

Engaging a mortgage broker offers a range of specialized services to streamline the home financing process. Mortgage brokers provide personalized advice tailored to individual financial situations, assessing credit scores and income levels. They have access to a variety of lenders, including major banks and credit unions, allowing for a broader selection of mortgage products such as fixed-rate mortgages, adjustable-rate mortgages, and first-time homebuyer programs. Brokers assist clients in gathering necessary documentation, like pay stubs and tax returns, ensuring compliance with lending requirements. They also facilitate communication between clients and lenders, negotiating terms and rates to secure favorable conditions. Market insights, including interest rate trends and housing market conditions in specific areas like New York City or Los Angeles can be invaluable. Additionally, brokers offer guidance throughout the entire mortgage process, from pre-approval to closing, ensuring a smoother transaction experience.

Fees and Charges

Engaging a mortgage broker often involves understanding various fees and charges that may be incurred during the mortgage process. Typical fees can include application fees, which range from $300 to $1,500 depending on the complexity of the loan, and appraisal fees averaging between $300 and $700 for property valuation. Other possible charges are credit report fees, usually around $30 to $100, as well as broker fees that can amount to 1% to 2% of the loan amount, depending on the broker's terms. Additional costs might also arise from title search and insurance fees, estimated at $1,000 to $2,500, necessary to ensure clear property ownership. Understanding these fees is crucial for homeowners in cities like New York or Los Angeles, where the competitive housing market can significantly influence overall expenses.

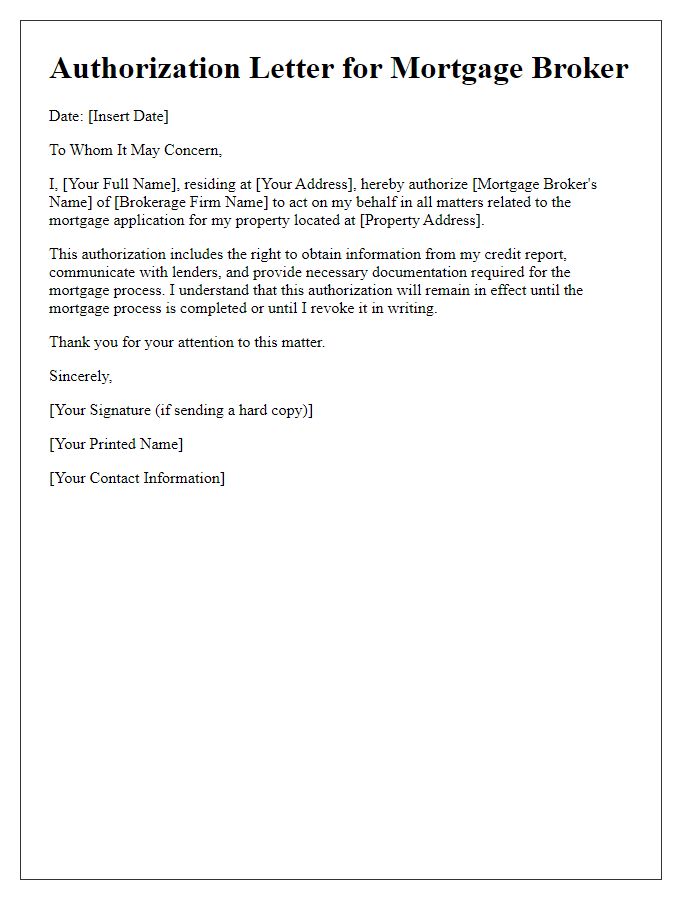

Confidentiality Agreement

Confidentiality agreements are crucial in mortgage broker engagements, protecting sensitive information shared during the loan application process. For example, proprietary financial data like income levels, debt ratios, and credit scores may be disclosed, necessitating a robust confidentiality agreement. The agreement should explicitly outline the types of information considered confidential, including personal identification details (like Social Security Numbers) and property valuations. Additionally, it should stipulate the obligations of the mortgage broker, which may include safeguarding this information from unauthorized access and limiting its use to the specific purposes of facilitating the mortgage application. Effective confidentiality agreements also require clear definitions of the duration of confidentiality and the consequences for breaches, ideally tailored to foster trust between clients and brokers throughout the engagement process.

Comments