Have you ever faced the frustration of an address discrepancy on your mortgage documents? It can be a headache when the details don't match up, causing unnecessary delays and confusion. Luckily, addressing this issue is simpler than you might think, and getting it resolved promptly can help you avoid future complications. Join me as we explore how to effectively navigate this process and ensure your mortgage records are accurateâread on to find out more!

Correct address details.

Address discrepancies in mortgage documents can lead to significant issues, including delays in processing and potential legal complications. For example, a borrower in California (specific state regulations may apply) may have their property address mistakenly recorded as 123 Main Street instead of the correct 321 Main Street. The implications of such a mistake could include difficulties in title transfer and challenges in property tax assessments, potentially affecting the loan approval process. It is essential to ensure that all official documents reflect the accurate address to avoid complications with entities like the county assessor's office or mortgage service providers. Timely rectification ensures the integrity of legal records associated with real estate transactions.

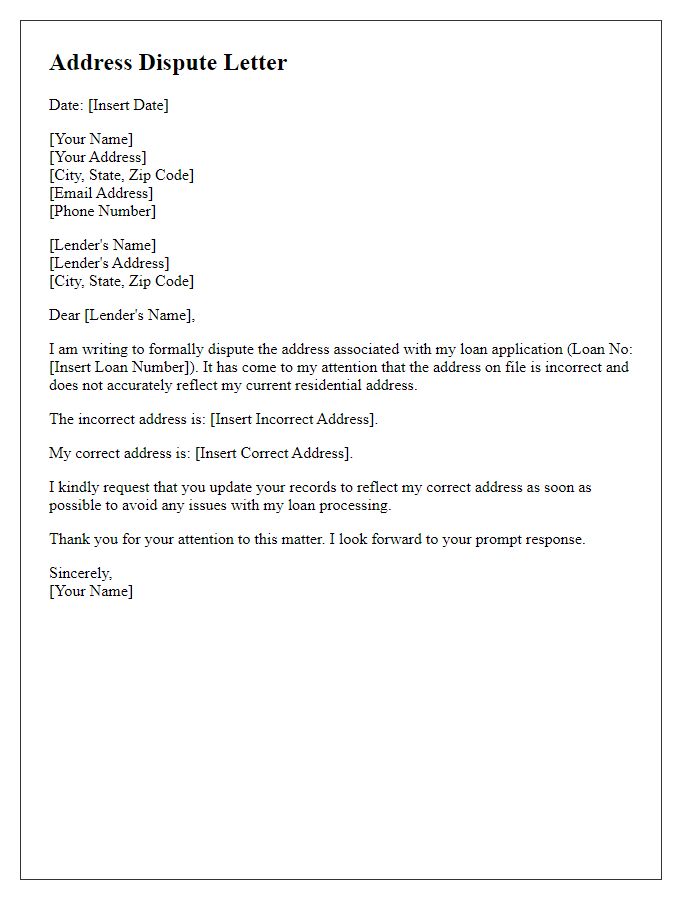

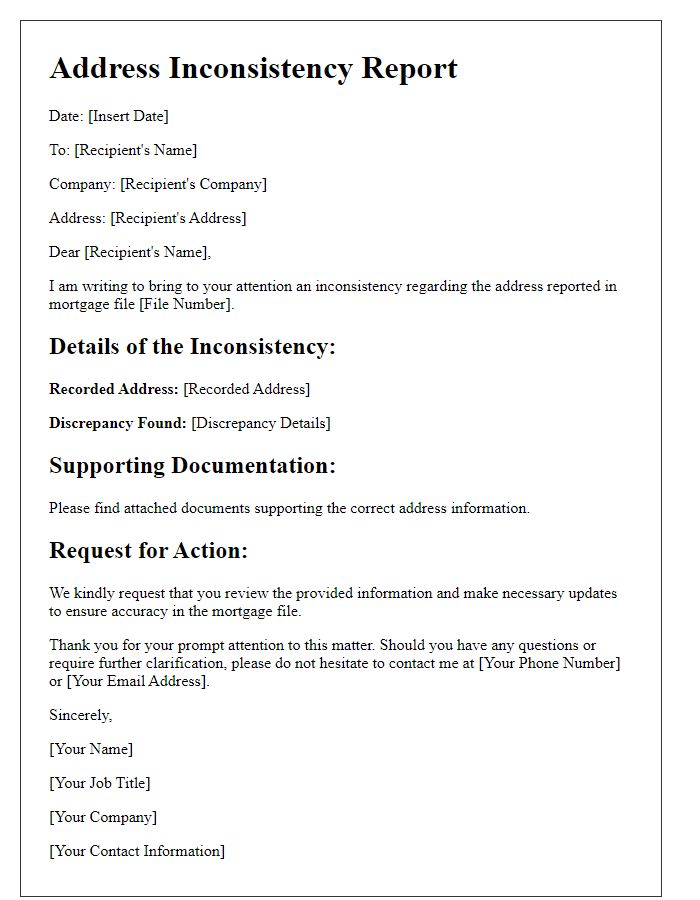

Explanation of discrepancy.

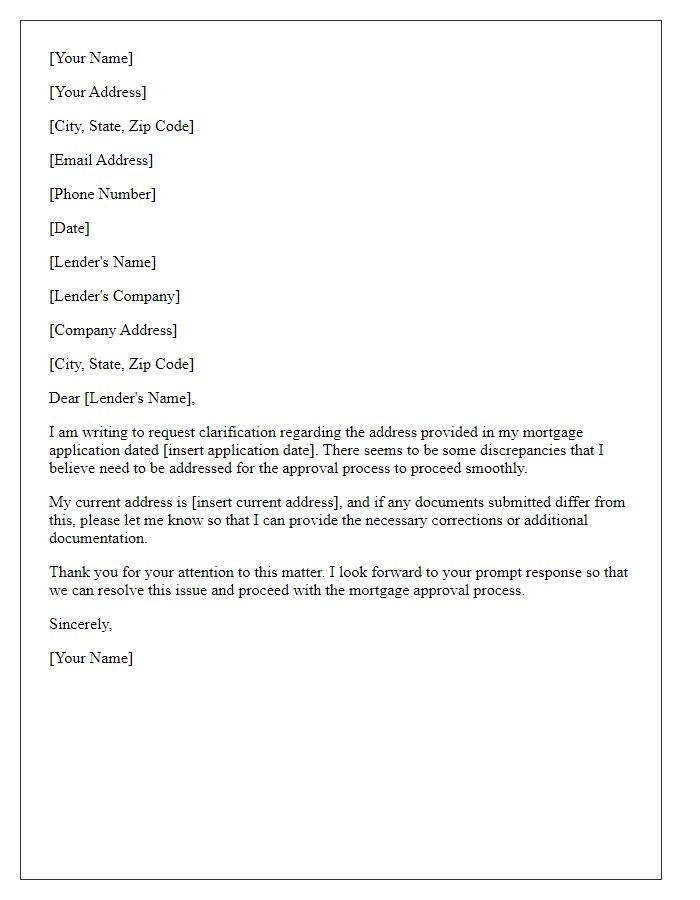

An address discrepancy in mortgage documentation can lead to significant complications during the approval process. Missing or incorrect information, such as improper formatting of the street address (including directional indicators like North or South), can create confusion with the property identification. Discrepancies may also arise from variations in recorded addresses between county records and loan applications, impacting title searches and insurance details. Furthermore, address inaccuracies can result in delays in closing dates, affecting both the buyer's and lender's timelines. It is crucial to address these inconsistencies promptly to ensure smooth processing and avoid possible legal implications relating to property ownership.

Supporting documentation.

Address discrepancies can significantly impact mortgage applications, especially regarding loan approval. Important documents such as utility bills, bank statements, or government-issued identification (showing the correct address) can clarify any inconsistencies. Providing evidence of residence through signed leases or property tax statements (garnering credibility from local authorities) may also help. Correcting discrepancies promptly is essential for avoiding delays in the mortgage process. Submitting these supporting documents ensures that lenders have accurate information, facilitating smoother transactions and minimizing potential issues during underwriting.

Contact information.

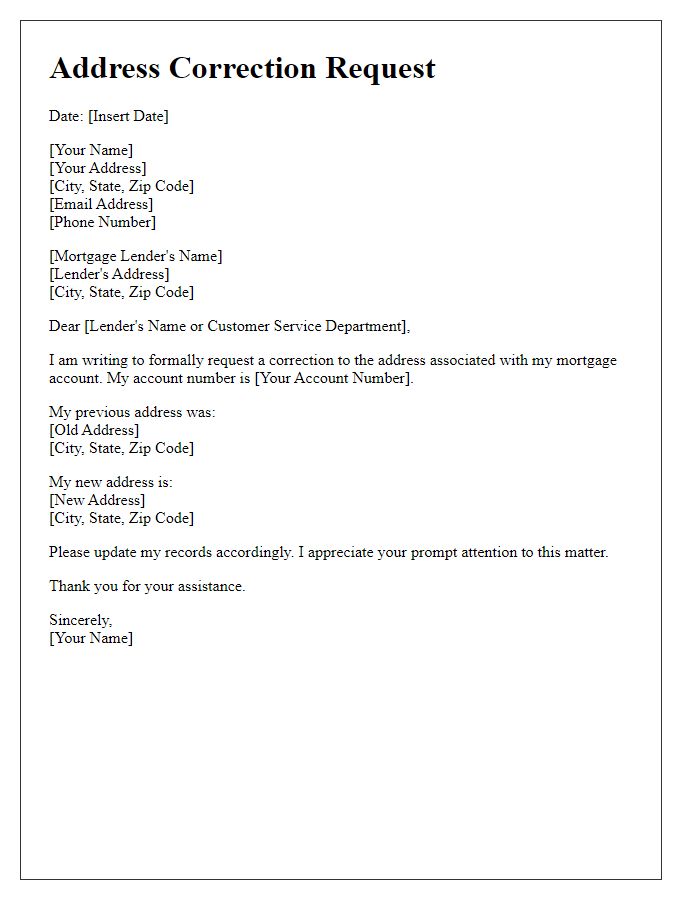

Address discrepancies can lead to significant issues in mortgage processing, impacting the timely approval of loans, housing transactions, or refinancing. Essential contact information, including the borrower's full name, primary residence address, email address, and phone number, should be clearly stated to facilitate quick communication with the lender. Accurate documentation reflecting the correct address, such as government-issued IDs, utility bills, or lease agreements, must be provided to rectify any inconsistencies. Timely resolution of address discrepancies ensures that all relevant mortgage documentation aligns, preventing delays in the underwriting process and ensuring compliance with federal regulations surrounding real estate transactions.

Request for acknowledgment.

Homeowners experiencing an address discrepancy on their mortgage documents may encounter issues during the loan processing phase. Misalignment of property details, such as the street number (e.g., 1234 Main Street), can lead to complications, including delays or incorrect assessments. Financial institutions, like banks or mortgage lenders, rely on accurate information to ensure compliance and proper documentation. It's essential for homeowners to formally request acknowledgment from the mortgage servicer, providing clear evidence of the correct address and any supporting documentation, such as tax statements or insurance information. This proactive approach can help clarify misunderstandings and facilitate a smoother mortgage experience.

Letter Template For Address Discrepancy On Mortgage Samples

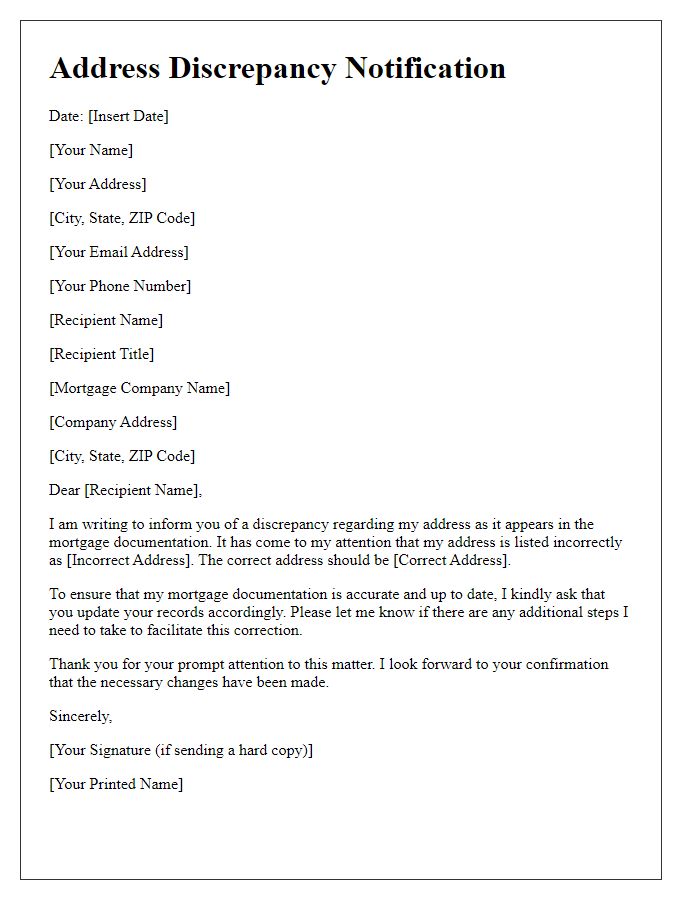

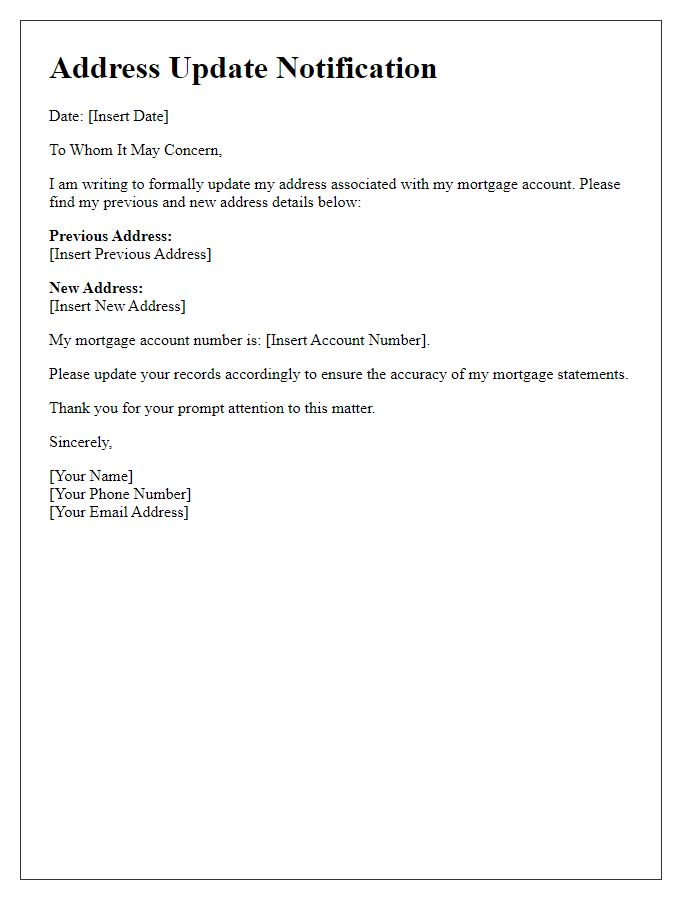

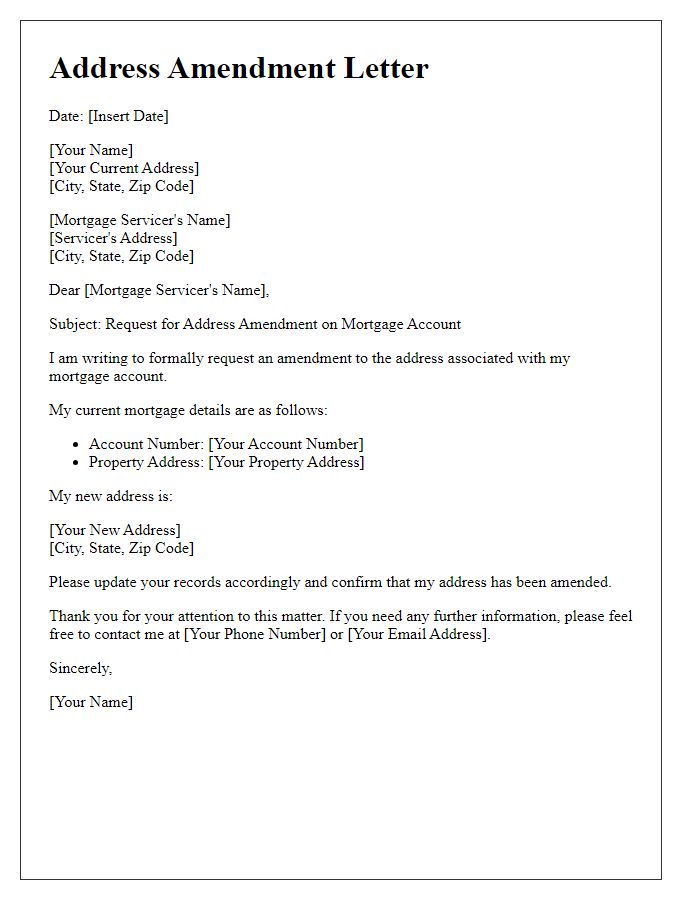

Letter template of address discrepancy notification for mortgage documentation.

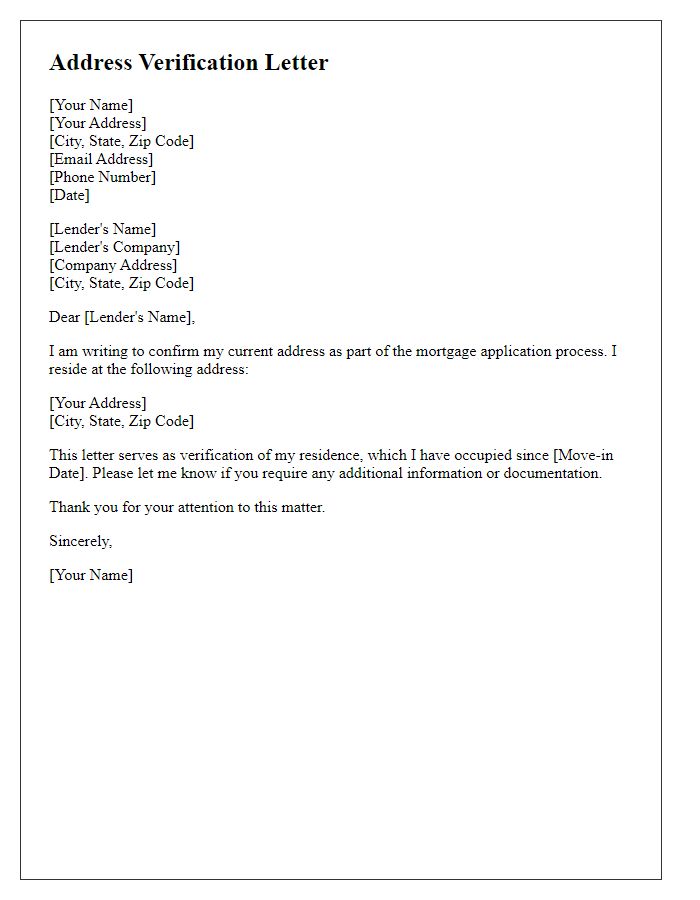

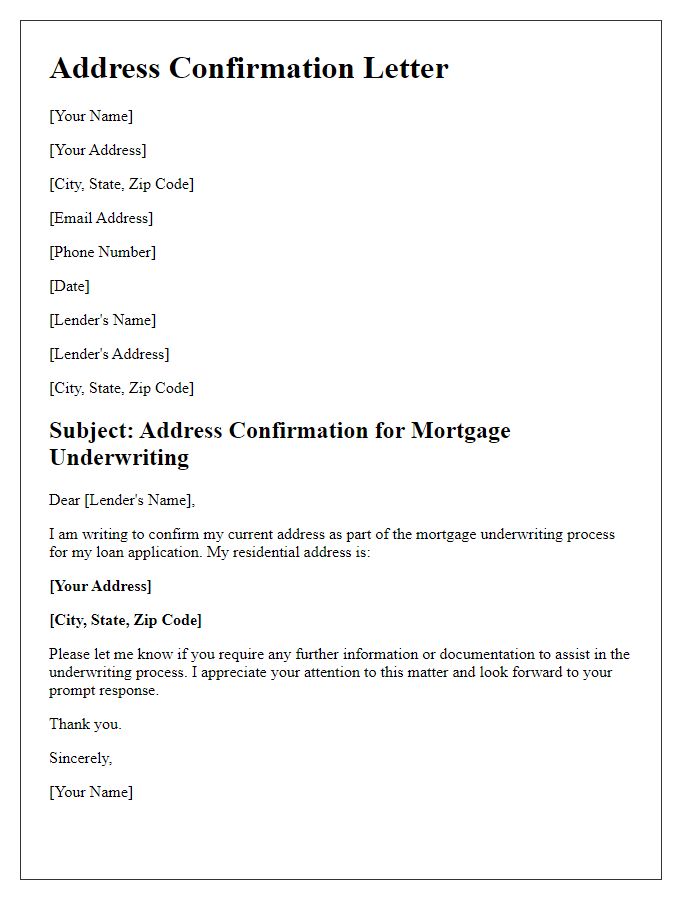

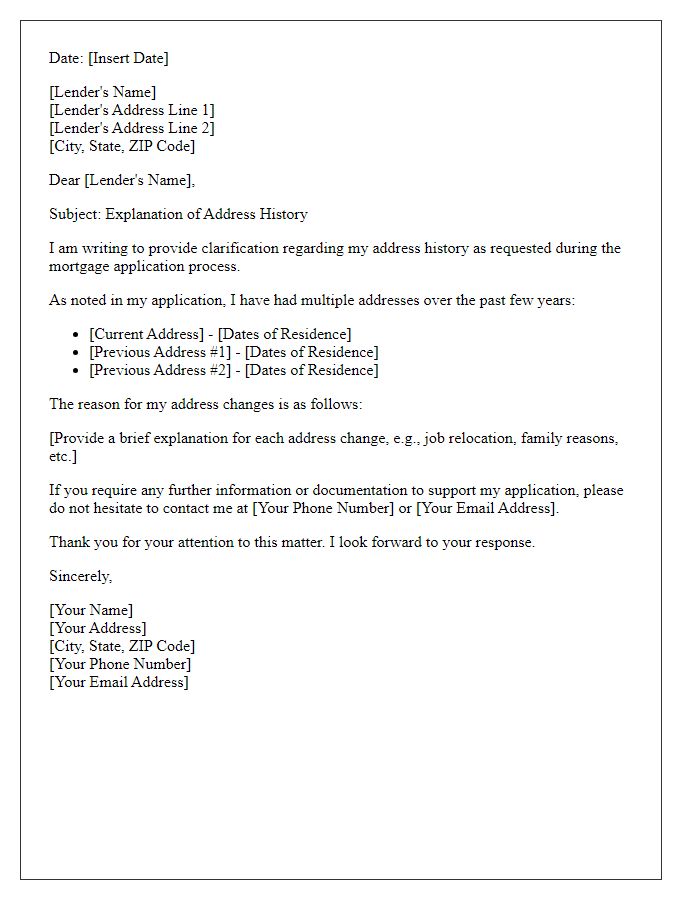

Letter template of address verification for mortgage application process.

Comments