Are you noticing a steady climb in prices across various sectors lately? This upward pricing trend can feel daunting, but understanding its implications is key to navigating these changes efficiently. From household essentials to luxury goods, price adjustments are affecting our daily lives in more ways than one. Join me as we delve deeper into this topic and explore practical strategies to adaptâread on for valuable insights!

Clear Objective Statement

In recent months, an upward pricing trend has been observed across various sectors, notably in commodities like oil and food. For instance, Brent crude oil prices surged to approximately $95 per barrel, reflecting a significant increase due to geopolitical tensions and supply chain disruptions. This trend impacts consumer behavior significantly, with inflation rates reaching a 40-year high in many economies, such as the United States at 8.3%. The housing market also showcases price elevation, with median home prices in urban areas, like San Francisco, exceeding $1.5 million. Understanding this pricing trend is crucial for businesses to adjust strategies effectively, allowing them to navigate economic shifts and maintain competitiveness in an evolving marketplace.

Justification and Reasons

Due to an increase in raw material costs, companies face challenges in maintaining profitability. Global supply chain disruptions, influenced by factors such as the COVID-19 pandemic and geopolitical tensions, have resulted in heightened prices for essential resources like aluminum and steel. Additionally, inflation rates, hovering around 3.7% in October 2023 according to the U.S. Bureau of Labor Statistics, have pressured manufacturing costs, impacting operational budgets. Furthermore, labor shortages in key sectors have spurred wage increases, compounding expenses. These economic pressures necessitate an upward adjustment in pricing strategies to ensure sustainability and continued service quality in a fluctuating market.

Impact on Stakeholders

The upward pricing trend in essential commodities, notably food and fuel, has profound implications for various stakeholders. Consumers, facing rising costs, experience diminished purchasing power, leading to potential shifts in spending habits and lifestyle adjustments, particularly among low-income families. Businesses, especially small and medium enterprises (SMEs) that rely on these commodities, grapple with increased operational expenses, squeezing profit margins and possibly resulting in price hikes that could alienate customers. Investors may react to inflationary pressures, affecting market dynamics and stock valuations of sectors heavily influenced by commodity pricing. Additionally, policymakers must address these trends, considering measures such as subsidies or price controls to stabilize the market and protect vulnerable populations, balancing economic health with social welfare. Non-profit organizations may also find increased demand for their services as more individuals and families seek assistance amid rising living costs.

Reassurance and Mitigation Strategies

In recent months, the upward pricing trend in essential commodities, such as crude oil and agricultural products, has significantly impacted consumer behavior and business operations across various sectors. Prices for crude oil have surged to nearly $90 per barrel, while grains like wheat and corn have experienced an increase of over 25% since the beginning of the year due to supply chain disruptions and adverse weather conditions affecting production levels. Companies are implementing mitigation strategies, such as diversifying supply sources and optimizing inventory management, to address these challenges. Additionally, businesses are enhancing communication with consumers, providing transparency about pricing changes and the reasons behind them, thereby fostering trust and reassurance in a volatile economic landscape.

Call to Action or Follow-up Instructions

The recent upward pricing trend observed in commodity markets has significantly impacted various sectors, including agriculture, energy, and manufacturing. For example, the price of crude oil has surged by 30% in the last six months, reaching levels not seen since early 2020. Agricultural products like wheat and corn have also seen increases, with wheat prices climbing to $8.50 per bushel due to supply chain disruptions and adverse weather conditions. Businesses must respond proactively to these price fluctuations by reviewing their procurement strategies and considering future contracts to mitigate potential losses. Moreover, sectors reliant on imported materials should develop contingency plans to cope with anticipated further price hikes. Stakeholders are encouraged to participate in upcoming strategy sessions scheduled for early November in New York City to address these challenges effectively and explore collaborative solutions.

Letter Template For Upwards Pricing Trend Samples

Letter template of adjustments for rising costs communicated to customers

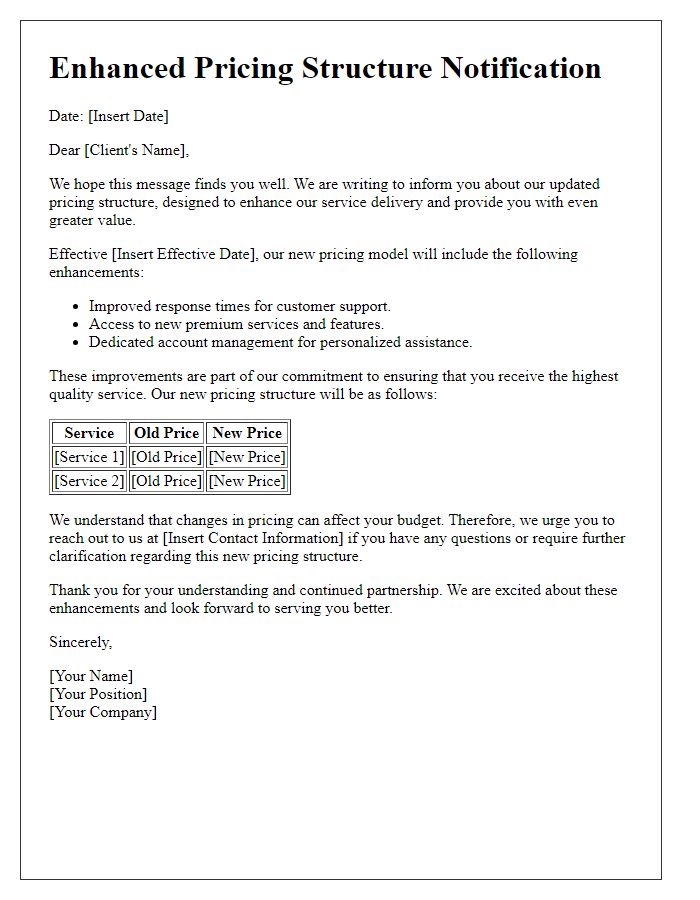

Letter template of enhanced pricing structure for better service delivery

Comments