Are you tired of wrestling with mismatched account balances? Navigating the complexities of financial discrepancies can be a daunting task, and it's essential to ensure accuracy for peace of mind. In this article, we'll explore an effective letter template designed to facilitate the reconciliation process and clarify your account balance. Join us as we break down the steps and invite you to learn more about resolving those financial hiccups!

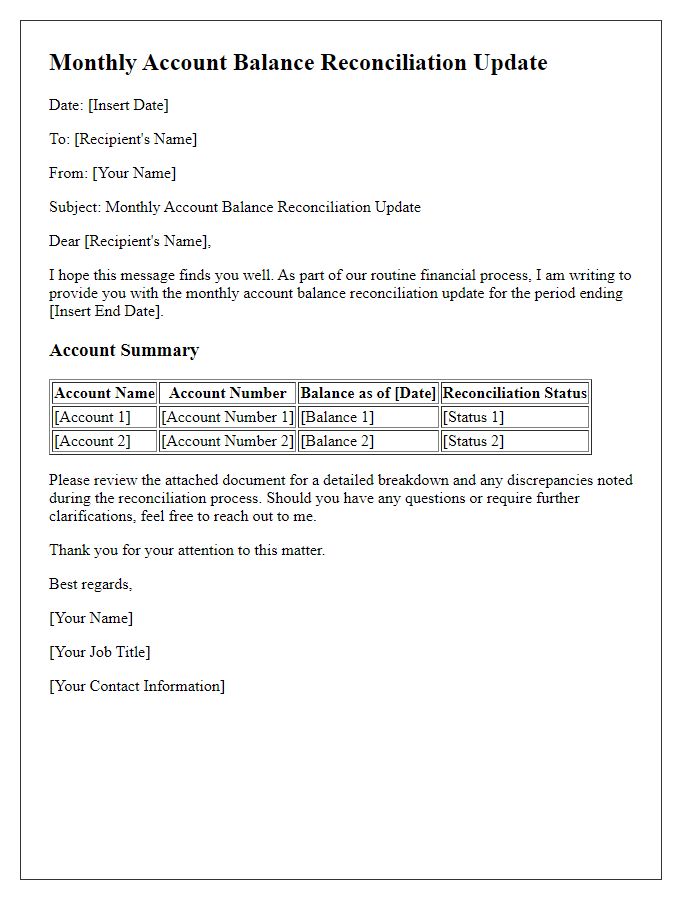

Account Details Section

The reconciliation of account balances requires a thorough examination of financial records to ensure accuracy and compliance. Important elements such as account number (a unique identifier for financial accounts), balance amount (the total funds available), and transaction history (a comprehensive list of all debits and credits) play crucial roles in this process. Additionally, discrepancies in figures may arise from timing differences in transactions or errors in data entry. The inclusion of bank statements (documents issued by financial institutions detailing account activity) can provide further clarity during the reconciliation process, facilitating the identification and correction of any inconsistencies in financial reporting. Understanding these components is essential for maintaining accurate financial management and ensuring integrity across financial statements.

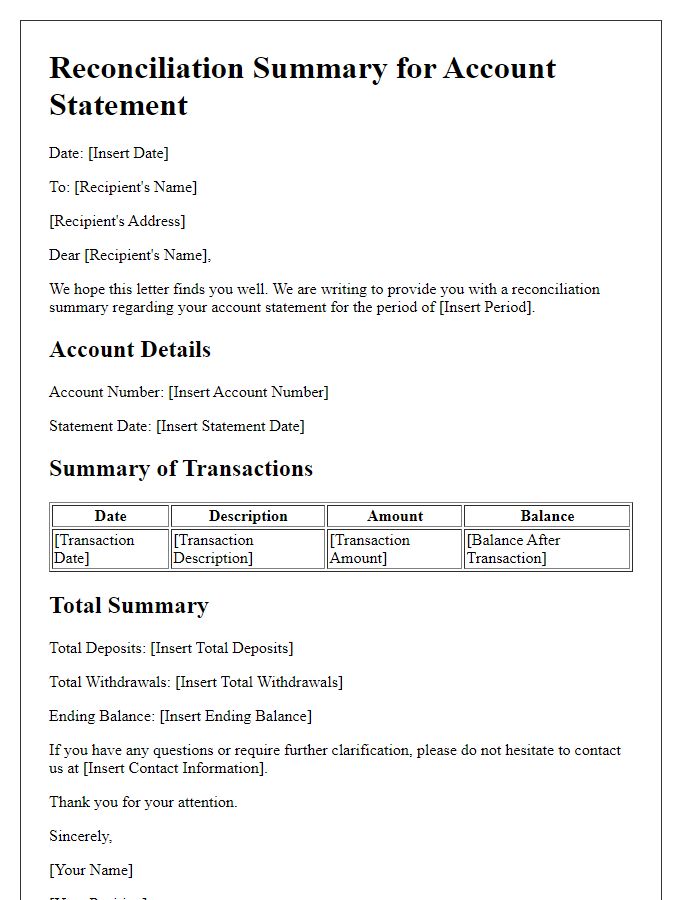

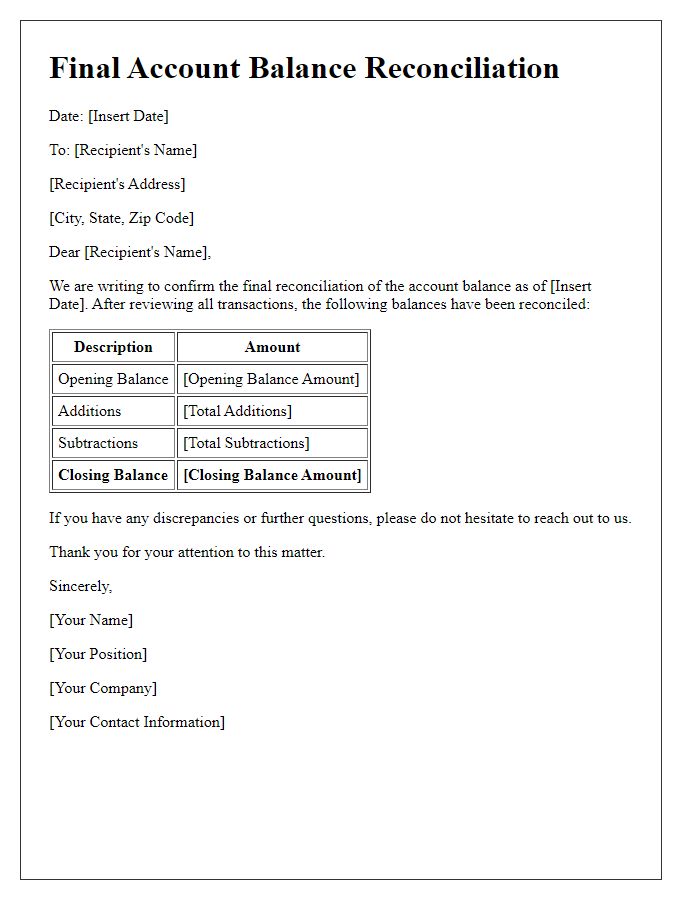

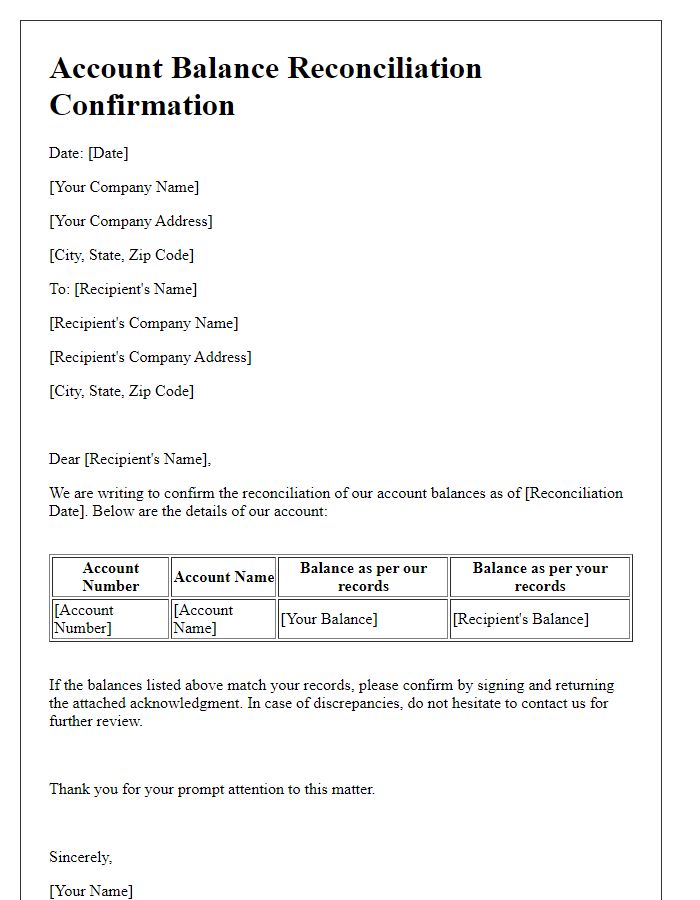

Statement of Charges and Credits

The process of reconciling an account balance involves creating a detailed statement of charges and credits to ensure both parties (such as individuals and businesses) agree on their financial transaction records. This statement typically includes various entries such as invoices, payments made, and any adjustments or corrections, all accompanied by their corresponding amounts. For instance, if a business owes $500 for services rendered in September 2023, this charge should be clearly documented, along with any payments applied, such as a $300 payment received in October 2023. In addition, discrepancies can arise from late fees or interest charges, which must be highlighted for clarity. Each entry's date and description provide context and facilitate efficient dispute resolution, ensuring transparency and mutual understanding of the financial status.

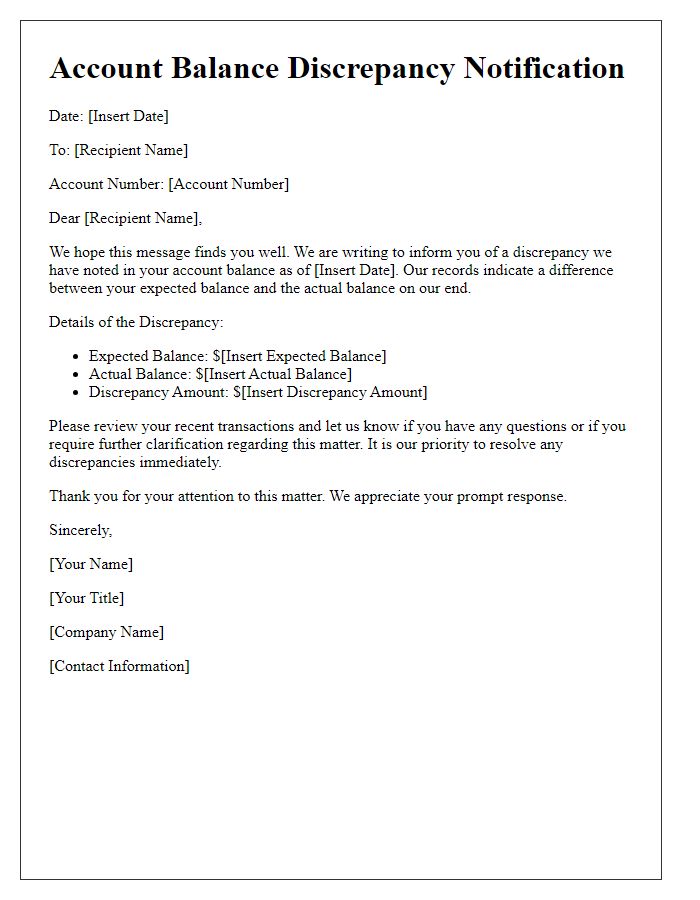

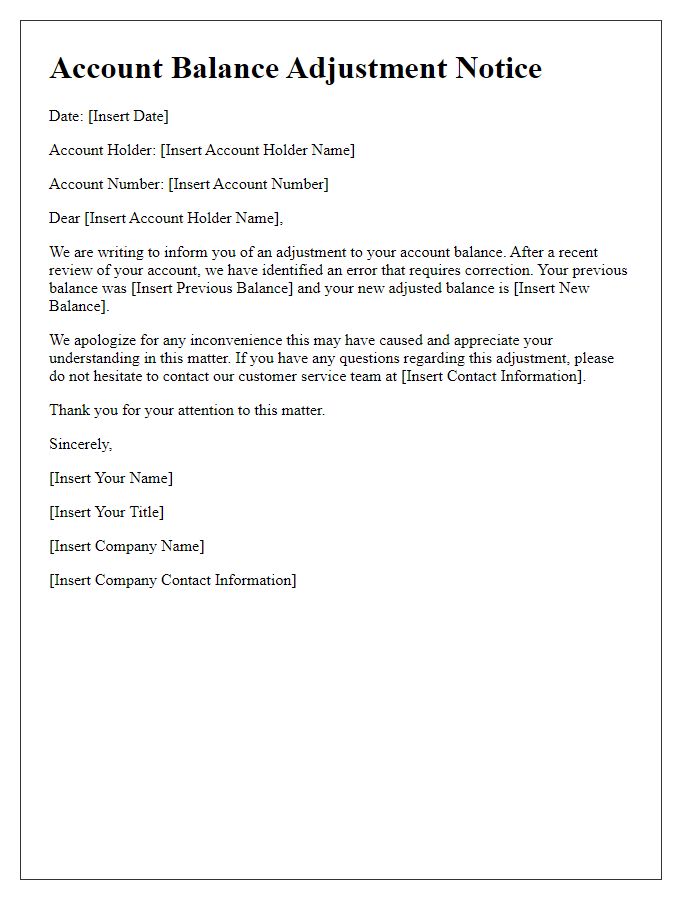

Discrepancy Explanation

A reconciliation of account balance is essential in financial management to ensure accuracy in financial records and identify discrepancies, often stemming from factors like timing differences, data entry errors, or unrecorded transactions. This process typically involves examining transactions across multiple statements, such as bank accounts and accounting ledgers, often leading to differences in reported amounts. For example, a minor discrepancy of $250 might arise between a business's cash flow statement and its bank statement due to outstanding checks not yet cleared, or errors such as duplicate entries. Addressing these discrepancies requires a detailed methodical approach, including careful verification of entries and communication with relevant stakeholders, often within a specified period (30 days) to maintain financial transparency and integrity.

Supporting Documentation

The reconciliation of account balances involves meticulous examination of financial records to ensure accuracy. Documentation can include bank statements from financial institutions like JPMorgan Chase and transaction records from accounting software such as QuickBooks. Anomalies, such as discrepancies between the general ledger and bank statements (often highlighted by amounts over $100), require thorough investigation. Supporting documents may also comprise invoices, receipts, and payment confirmations, especially for high-value transactions exceeding $500. Collating this information is essential for identifying outstanding checks or deposits in transit, ensuring that every transaction, from the previous month's records to the current balance, is accurately accounted for. Ultimately, this meticulous process aids in maintaining financial integrity for businesses or personal finances.

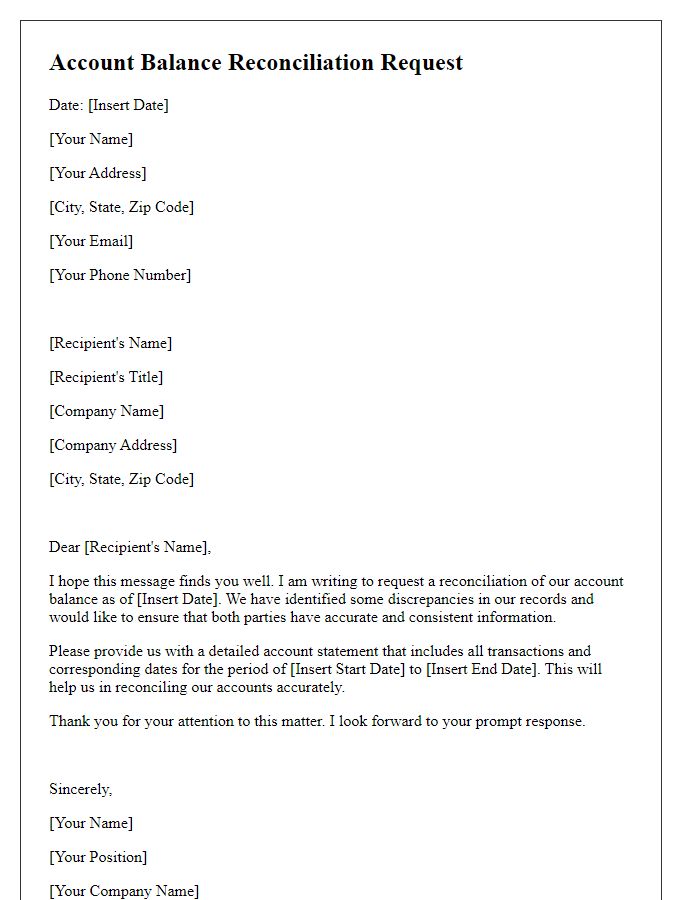

Contact Information for Resolution

Contacting financial institutions regarding reconciliation of account balances requires clear communication. Customers should gather relevant details, including account number (unique identifier for bank accounts), statement dates (specific periods for which balances are being reviewed), and discrepancies (detailed list of inconsistencies). It's vital to include personal information such as name, phone number (point of contact for follow-up), and email address (for written documentation). Additionally, referencing transaction history (detailed record of past transactions) can expedite the resolution process. Providing clear documentation, such as bank statements and receipts (proof of transactions), can enhance the chances of swift resolution when discrepancies arise.

Comments