Are you currently facing a tricky account reconciliation dispute and unsure how to articulate your concerns? Clearly communicating your discrepancies can make a significant difference in resolving issues swiftly. In this article, we'll guide you through an effective letter template that can help streamline your communication process. Join us as we dive deeper into crafting the perfect letter to address your concerns and ensure a smooth reconciliation experience!

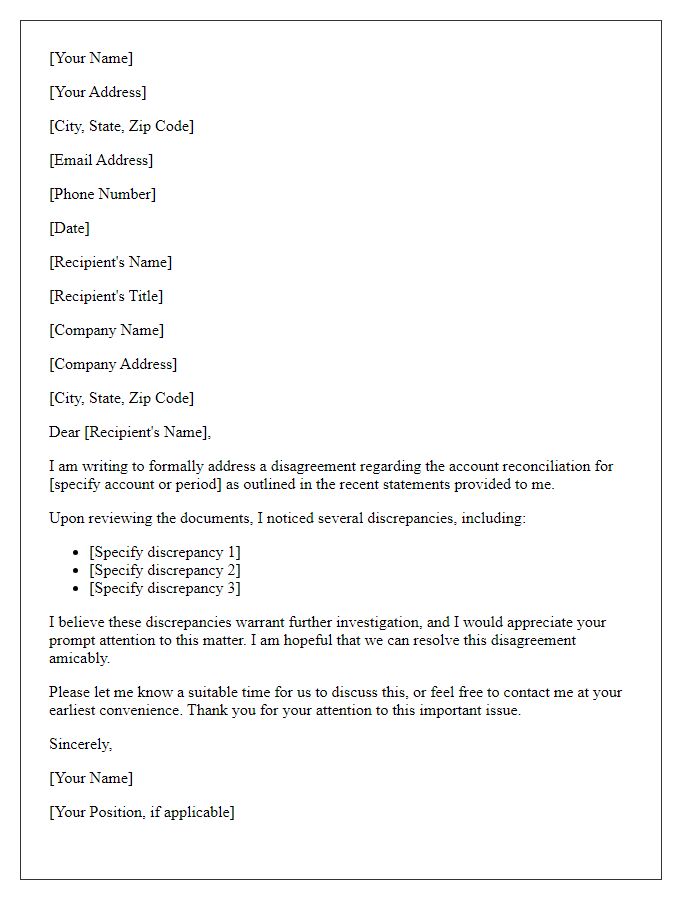

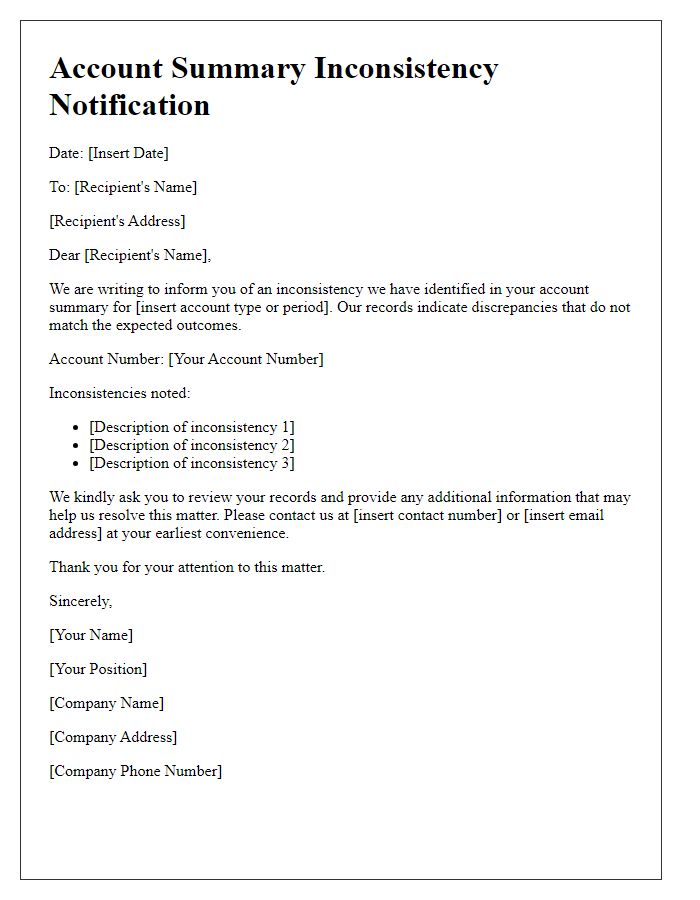

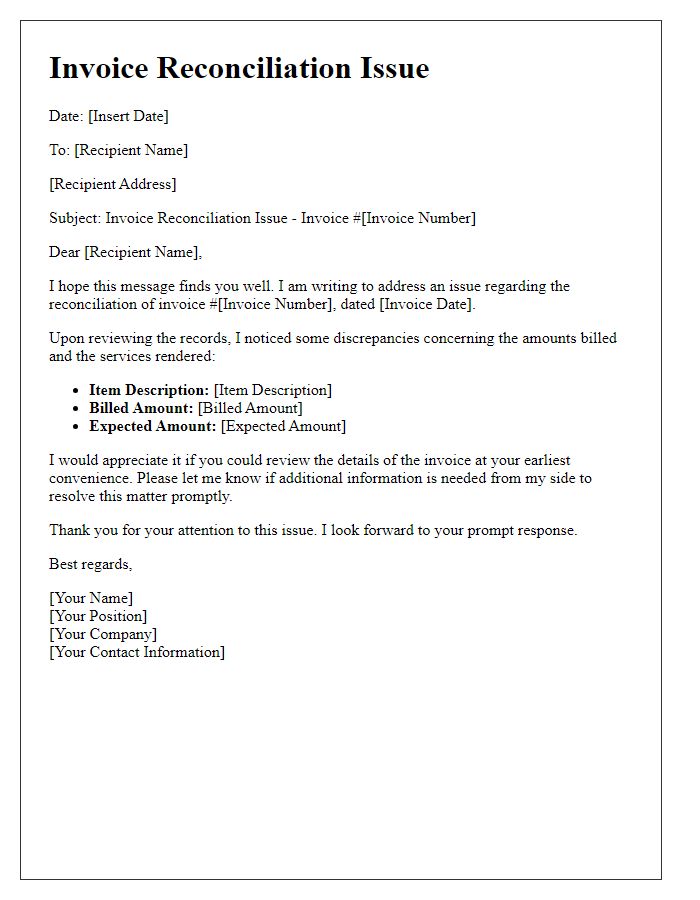

Clear identification of account details

Clear identification of account details is essential in account reconciliation disputes. Accurate account numbers, such as bank account numbers (IBAN or SWIFT codes), facilitate seamless communication. Specific dates related to transactions, such as discrepancies occurring between January 1, 2023, to March 31, 2023, should be highlighted. Clear labeling of disputed amounts, for instance, $1,250.00 as an erroneous charge, ensures transparency. Including relevant documentation, such as bank statements, invoices, or receipts, adds credibility to the claims. Statement descriptions, like "Service Charge" or "Transaction Fee," must be clearly noted for proper identification of discrepancies. Additionally, customer reference numbers enhance detail clarity during the reconciliation process.

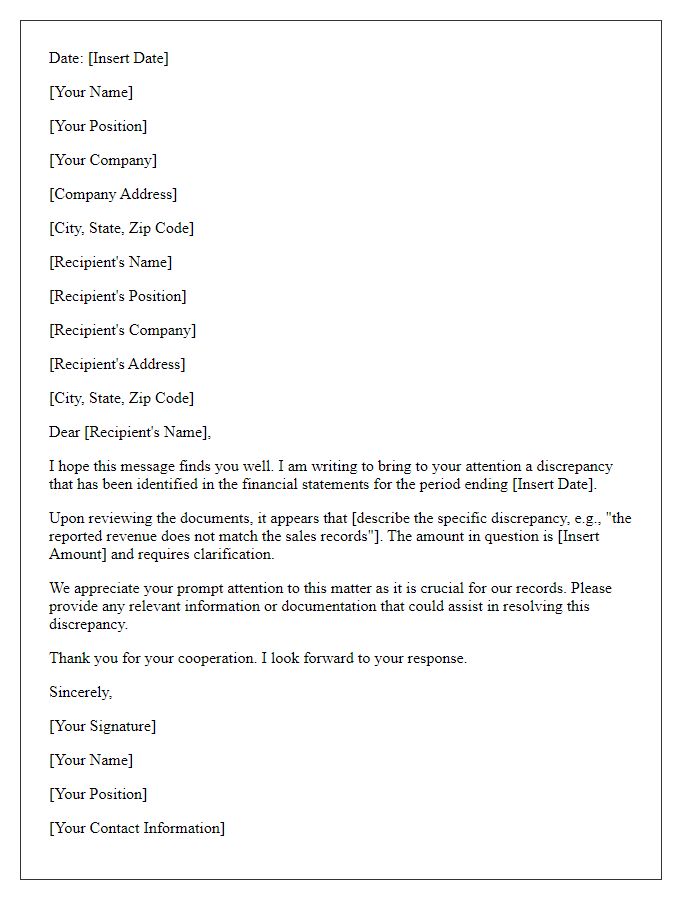

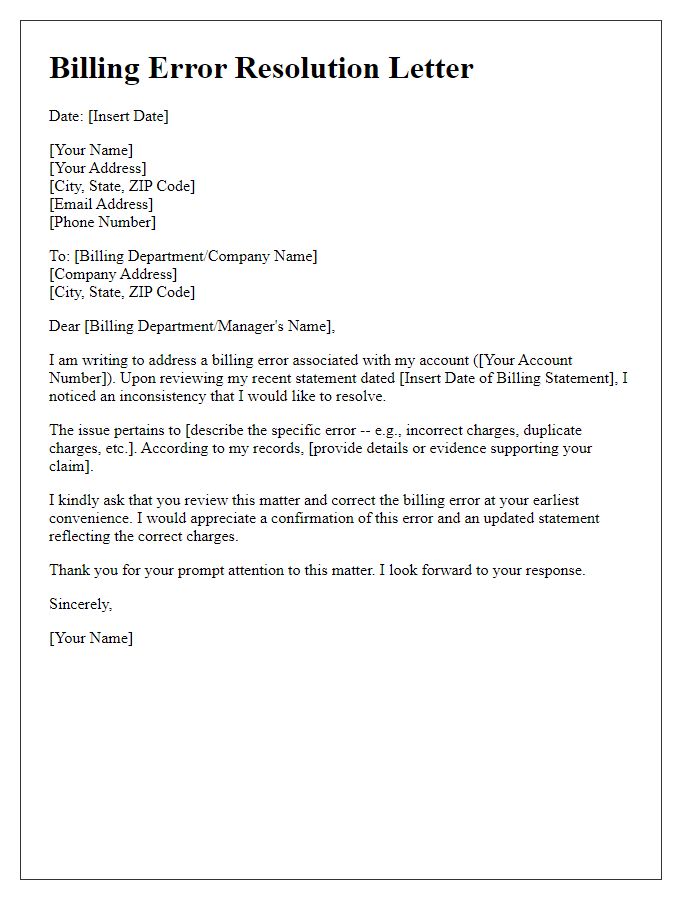

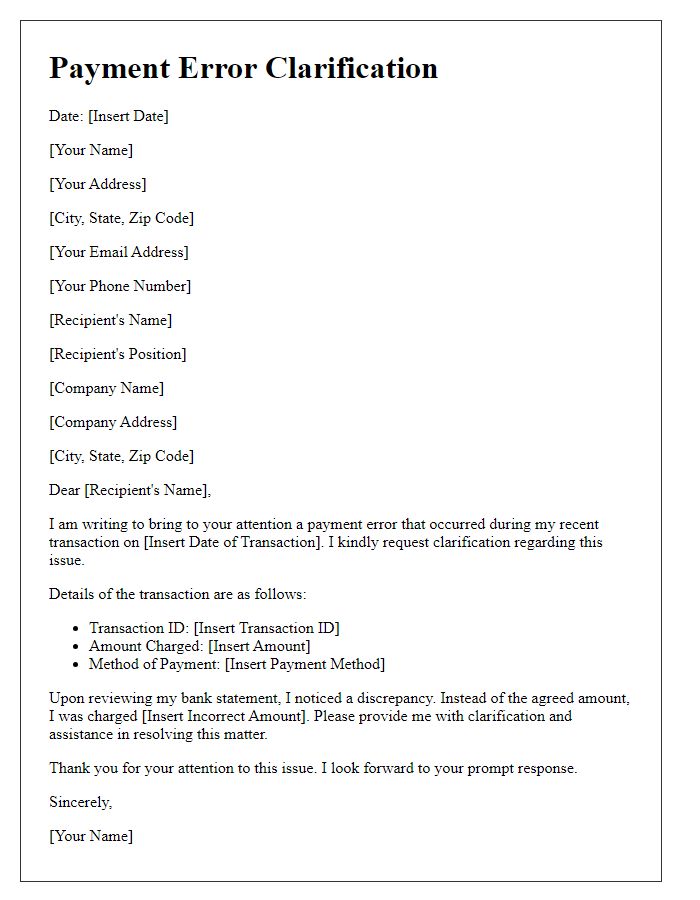

Statement of discrepancy or error

Account reconciliation disputes often arise from discrepancies between financial records. A statement of discrepancy may highlight issues such as incorrect transaction entries, miscalculations, or unauthorized charges. Identifying specific transactions, such as invoice numbers from January 2023 or a charge for $250 from a service provider, is crucial for clarity. Supporting documentation, including bank statements and receipts, should outline the timeline of events leading to the dispute. Establishing communication with relevant parties, such as accountants or financial institutions, within a defined timeframe (30 days is often standard) can facilitate the resolution process. Providing thorough details will strengthen the case for correcting the errors in the account.

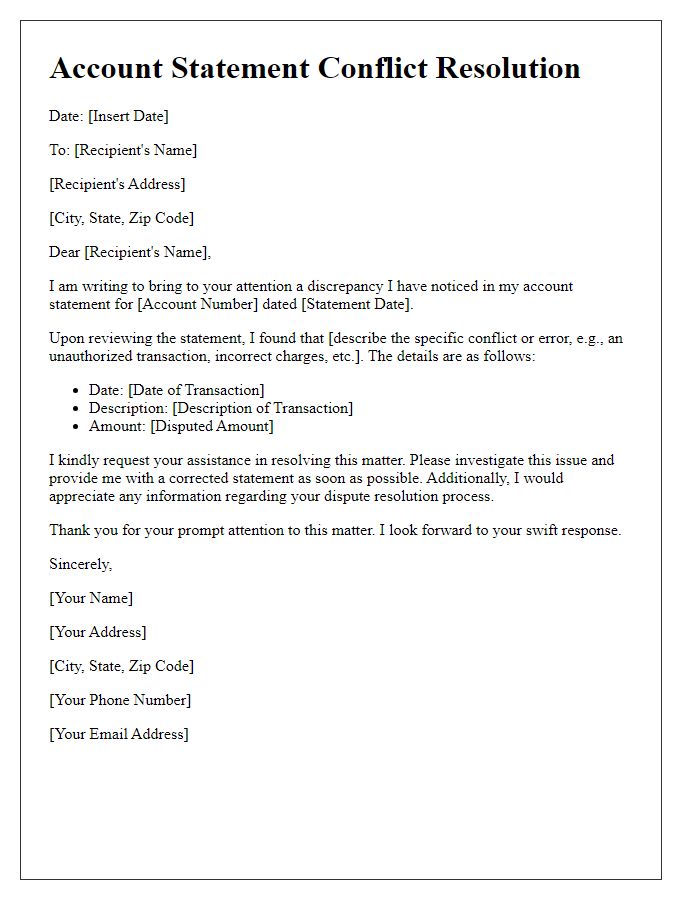

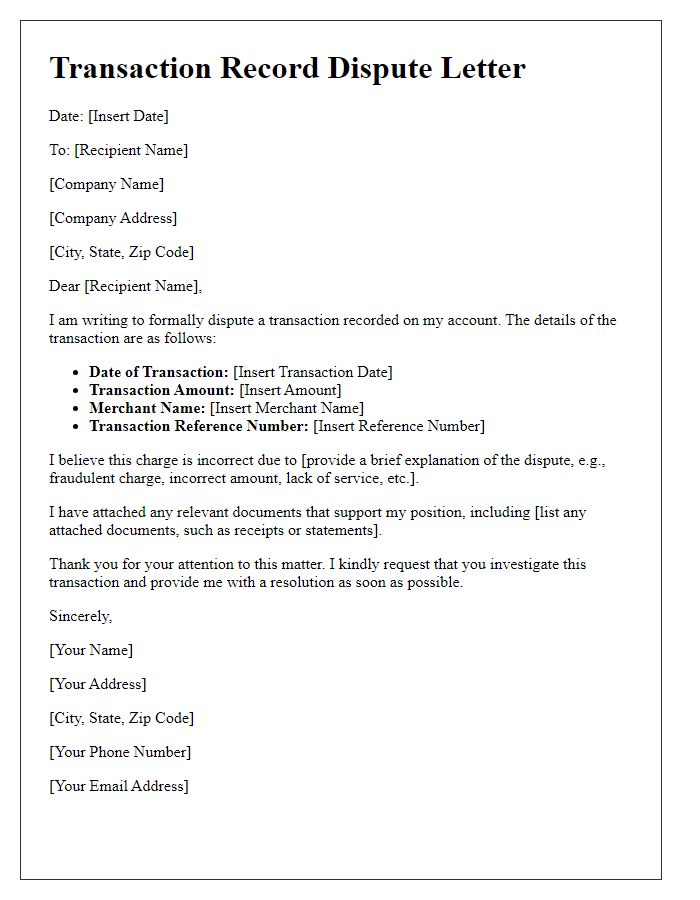

Supporting documents and evidence

Account reconciliation disputes can arise due to discrepancies between account statements and recorded transactions. Supporting documents, such as bank statements, invoices, receipts, and transaction reports, serve as crucial evidence to substantiate claims. The examination of these documents, dated within the current fiscal year (e.g., January 2023 to December 2023), helps to clarify errors or misunderstandings related to amounts credited or debited. Additionally, maintaining a detailed log of communication with financial institutions, including phone call records and email correspondence, strengthens the case for resolution. The ultimate goal is to achieve accurate financial records and restore trustworthiness in accounting practices.

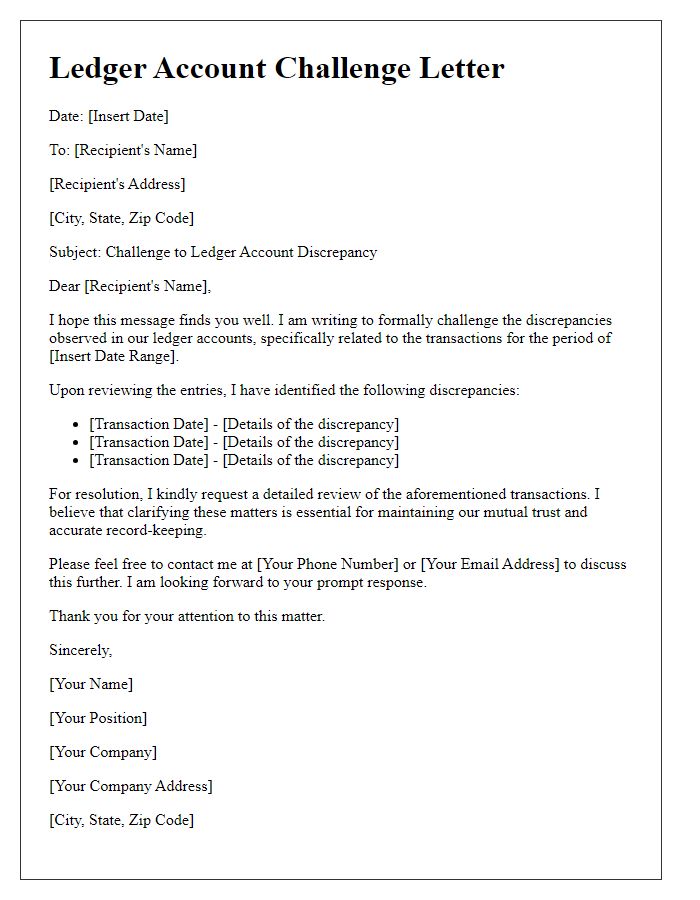

Request for specific corrective action

Inaccurate account reconciliation can lead to significant discrepancies in financial records, impacting both personal and business finances. Detailed review of transaction statements, such as monthly bank statements or credit card statements, may reveal inconsistencies between recorded expenses and actual charges. For instance, a missing deposit of $1,250 on the March 2023 bank statement can create a deficit in the reconciliation process, leading to erroneous balance assessments. It's essential to provide specific corrective actions, such as adjusting entries reflecting accurate transactions, to ensure financial clarity. Implementing corrective measures promptly will improve financial accuracy and maintain trust with stakeholders, particularly in events like quarterly financial reporting or annual audits.

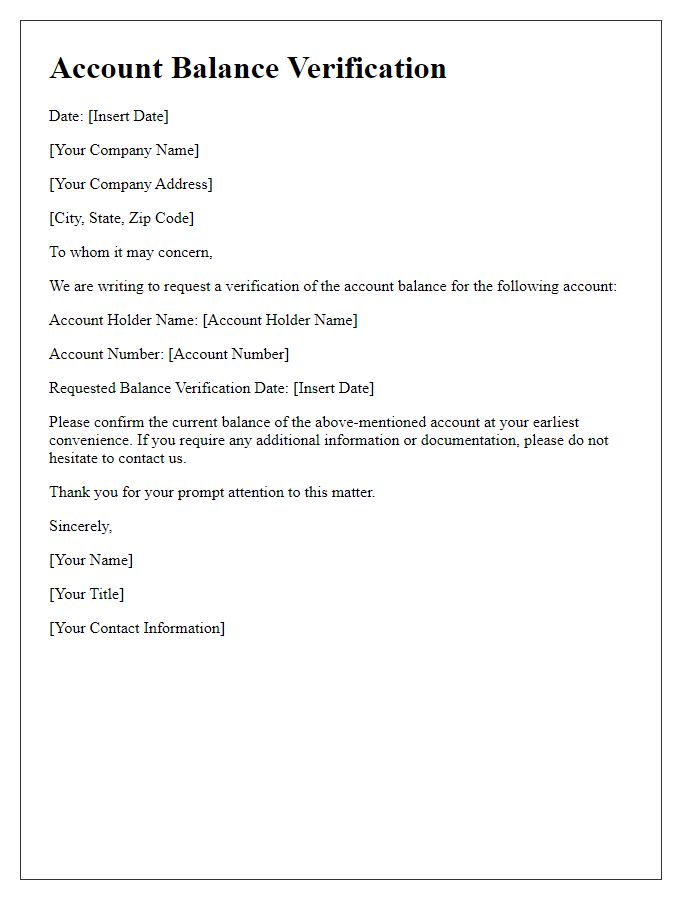

Contact information for further communication

In the realm of account reconciliation disputes, having clear contact information is vital for effective communication. Primary contacts typically include the account manager, who oversees the financial details, and the compliance officer, ensuring adherence to regulations. The specific email address, such as reconciliation@company.com, allows for direct correspondence. Additionally, a dedicated phone line, such as (123) 456-7890, facilitates immediate discussions regarding discrepancies. Finally, providing a physical address for formal documentation, like 123 Finance St., Suite 100, Accounting City, XY 45678, ensures all parties can send or receive pertinent paperwork swiftly.

Comments