Hey there! If you're a landlord looking to streamline the payment process for your tenants, you've come to the right place. A well-crafted letter template can help ensure that your payment instructions are clear and easy to follow, making life simpler for both you and your tenants. Ready to learn how to create the perfect payment instruction letter? Let's dive in!

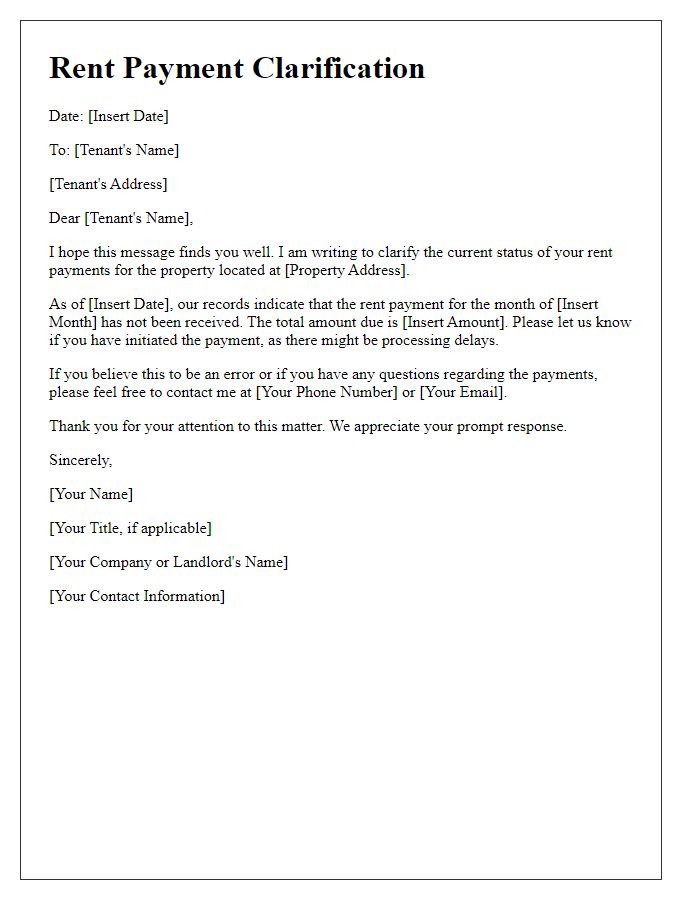

Clear Payment Instructions

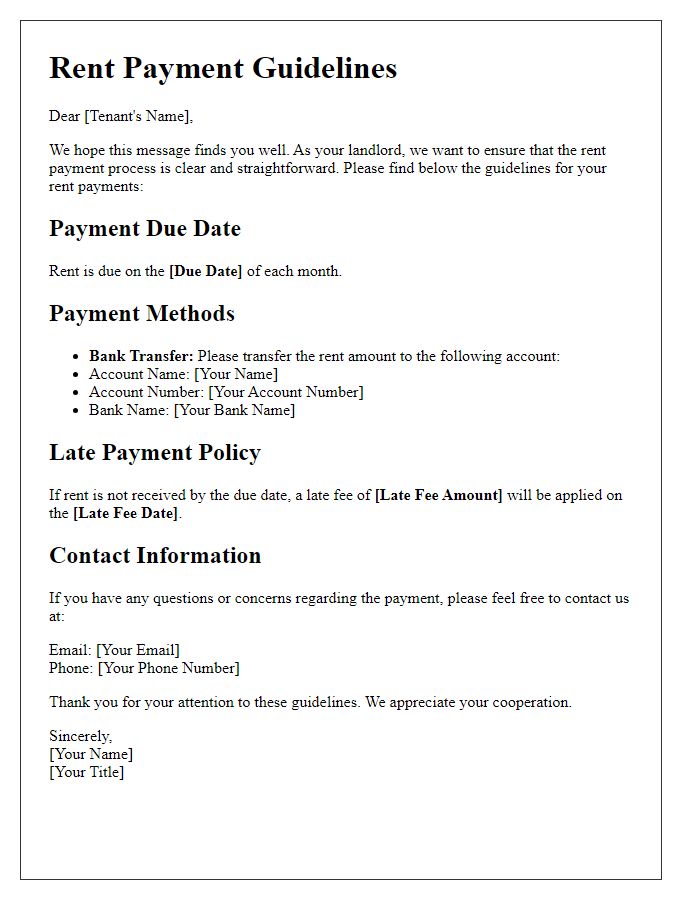

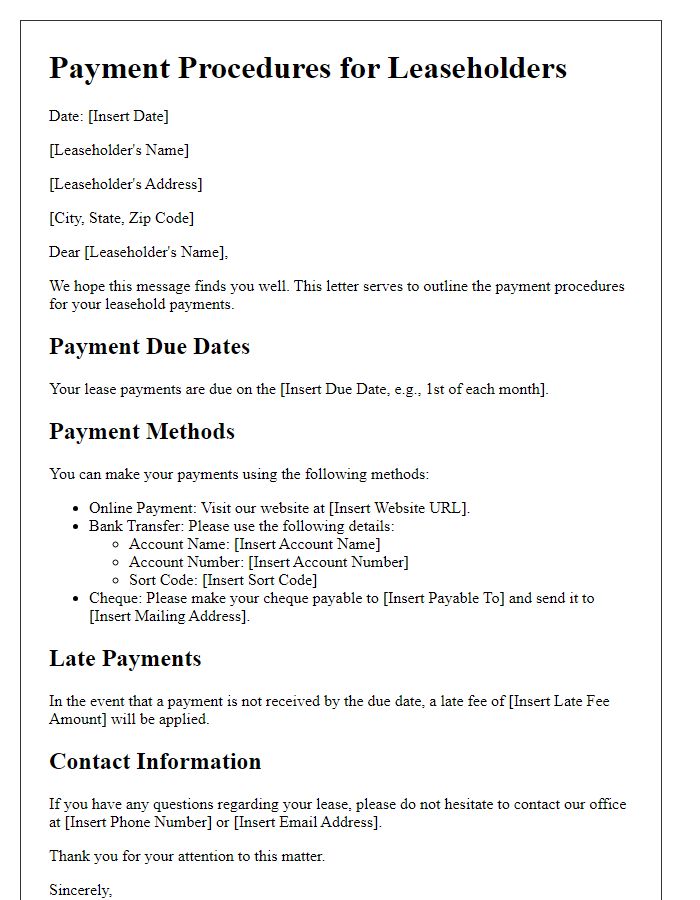

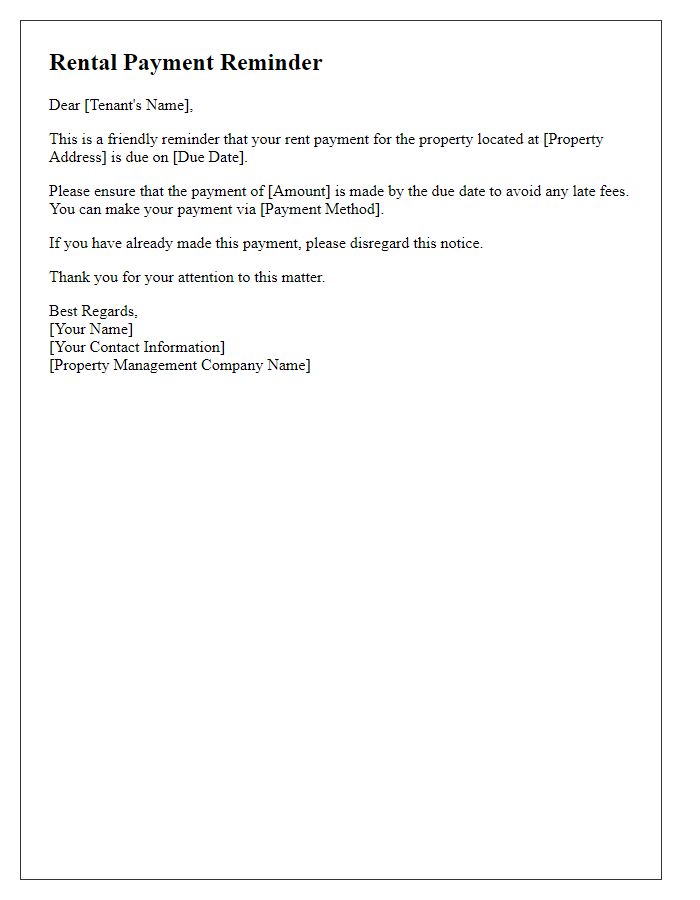

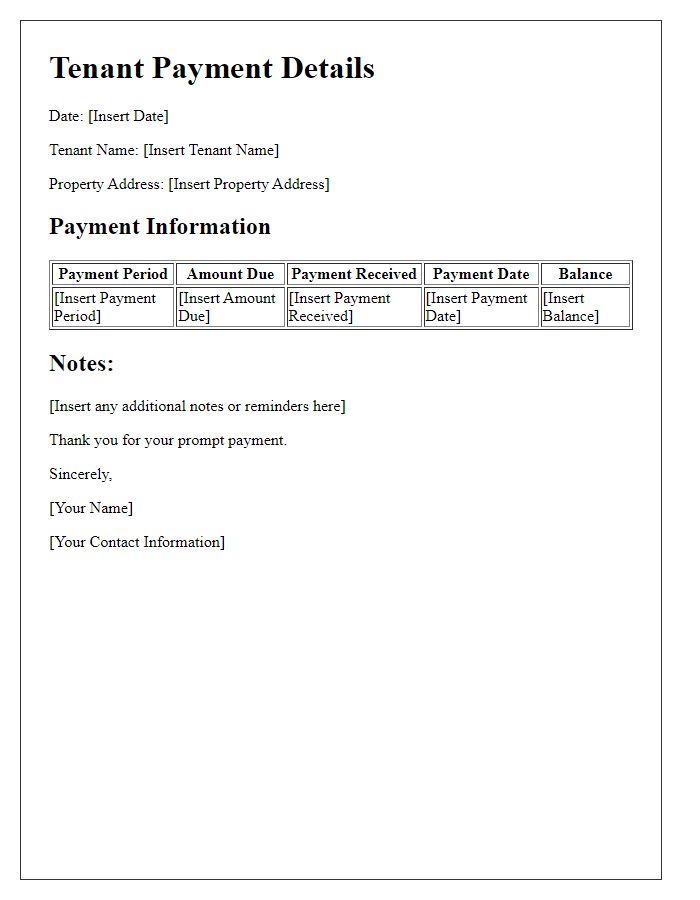

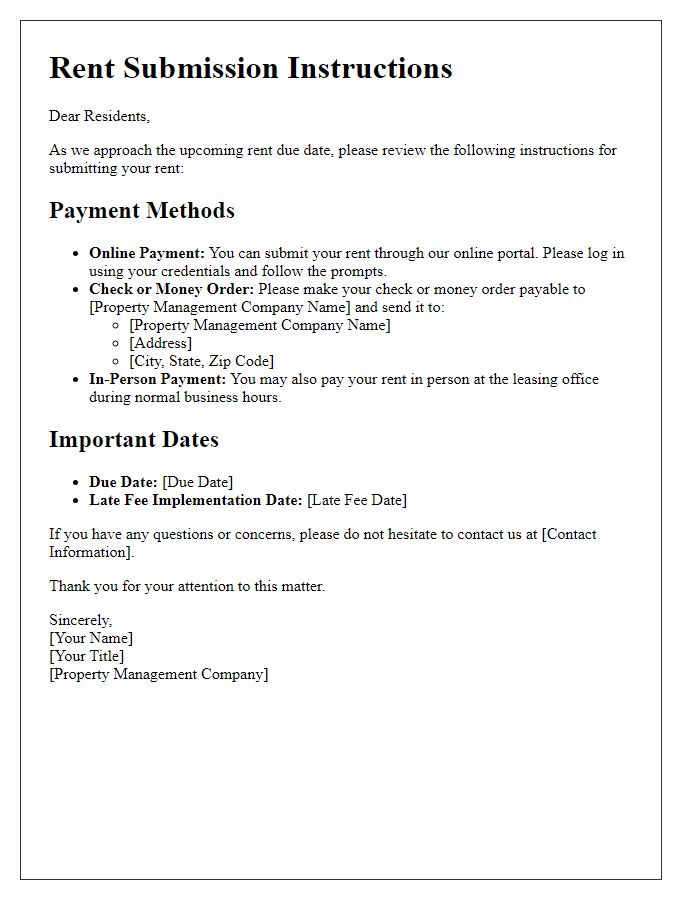

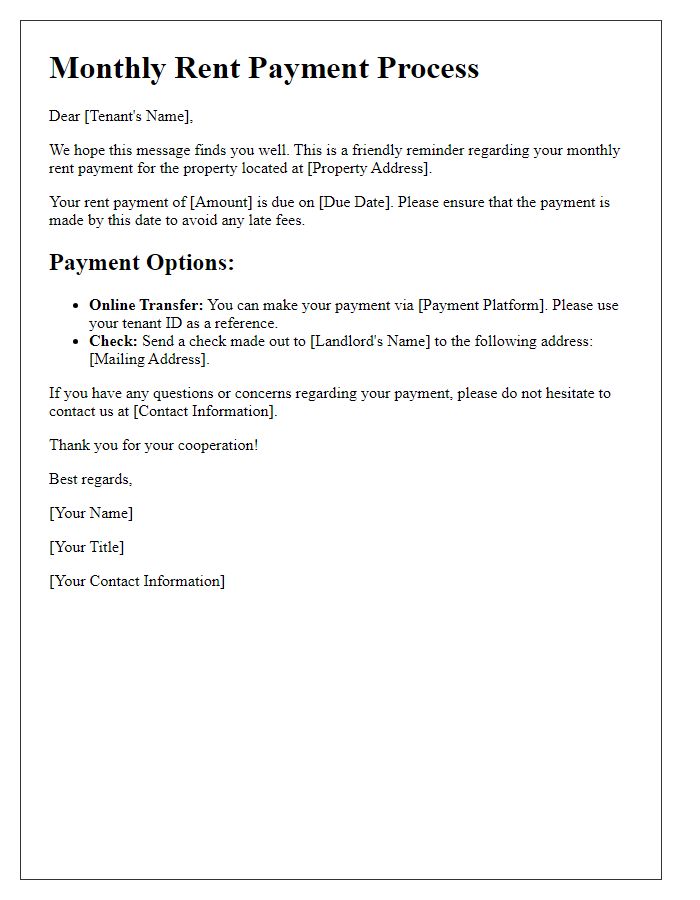

Timely rental payments are essential for ensuring smooth landlord-tenant relationships and maintaining property management efficiency. Clear payment instructions specify essential details such as the due date (usually the first of each month), acceptable payment methods (such as bank transfers, online payment portals, or checks), and relevant account information (like bank account numbers or payment service links). Proper instruction also includes any applicable late fees for overdue payments (often a percentage of the rent) and the grace period (commonly a few days after the due date). Regular communication helps avoid misunderstandings, fostering a positive living environment within properties managed by agencies or landlords.

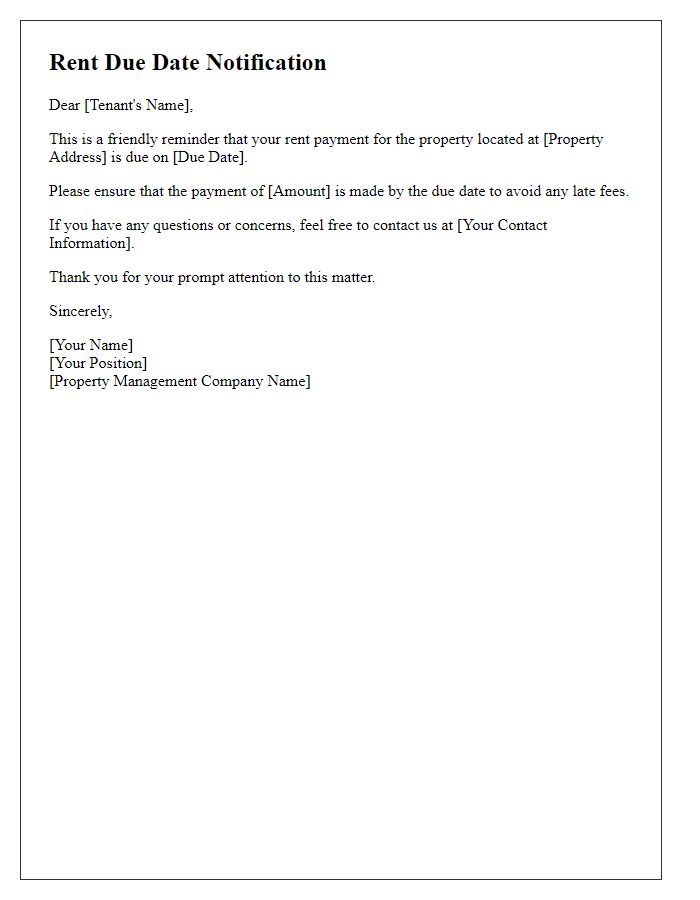

Payment Due Dates

Timely rent payments play a crucial role in maintaining a smooth landlord-tenant relationship. Many rental agreements specify exact due dates, often on the first of each month, which is critical for financial planning. Essential factors include payment methods such as bank transfers, checks, or online platforms like PayPal, which are commonly utilized for convenience. Tenants should note potential late fees, usually 5% of the monthly rent if payments are not received within a grace period of five days. Clear communication about these elements fosters reliability and accountability, ensuring that both parties understand the importance of adhering to the payment schedule.

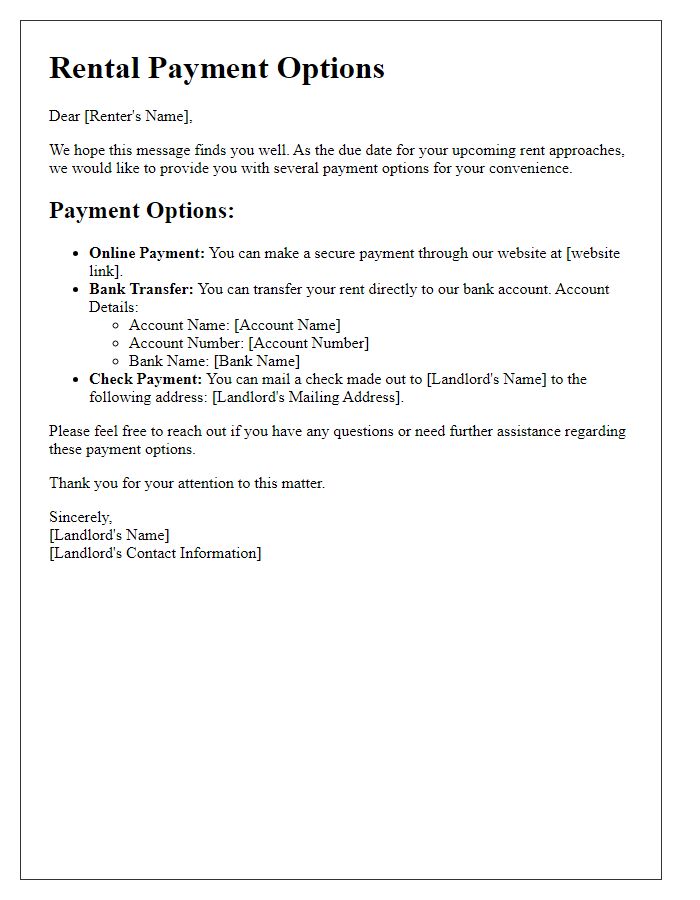

Accepted Payment Methods

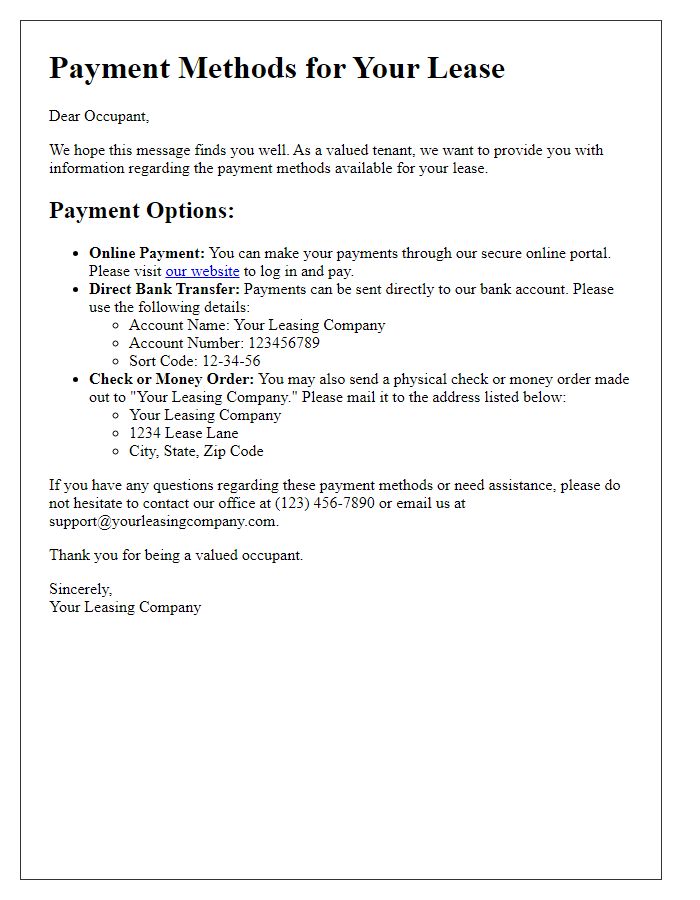

Accepted payment methods for tenants include various options to ensure convenience and security. Electronic bank transfers offer instant processing and require tenants to provide bank account details, which include routing numbers (for domestic payments) and account numbers. Online payment platforms, such as PayPal and Venmo, enable seamless transactions with minimal fees; however, both parties must create accounts for use. Direct debit services allow automatic monthly deductions, fostering timely payments but require authorization from the tenant. Credit and debit card payments provide flexibility, although some landlords may charge processing fees for card transactions. Additionally, physical methods like checks or money orders remain valid, but these require more time for processing and physical delivery to the landlord's specified address, ensuring security during transit.

Contact Information for Queries

In commercial lease agreements, tenant payment instructions are crucial in maintaining a smooth financial transaction between landlord and tenant. The contact information should include the primary contact person's name, phone number, and email address, providing tenants with a direct line for queries regarding rent, payment methods, and due dates. For example, a landlord might designate their property management team, such as ABC Property Management, located in New York City, with a phone number (555) 123-4567 and an email address info@abcpm.com. Clear communication through these channels ensures prompt resolution of any issues and contributes to a positive landlord-tenant relationship. Additionally, it's important to specify office hours for queries, ideally Monday to Friday from 9 AM to 5 PM, to establish expectations for response times.

Late Payment Penalties

Late payment penalties serve as an important mechanism in rental agreements, ensuring tenants adhere to payment schedules. For instance, in many jurisdictions, landlords impose fees after a grace period of five days post-due date, often a percentage of total rent due (commonly 5% to 10%). Such penalties can escalate quickly; some landlords might enforce additional fees for subsequent late payments, increasing tenant obligations. Regular communication regarding payment expectations and penalties reinforces responsibility. Clear communication regarding local laws, such as the Fair Housing Act in the United States, is essential to maintain compliance and prevent disputes, ensuring a transparent landlord-tenant relationship.

Comments