Are you navigating the sometimes tricky waters of loan payment verification? Writing a clear and concise letter can make the difference in ensuring your financial documents are processed smoothly. It's essential to include all pertinent details, such as your account information and payment history, to avoid unnecessary delays. Dive into our article for a handy letter template that simplifies this process and ensures you're well-prepared!

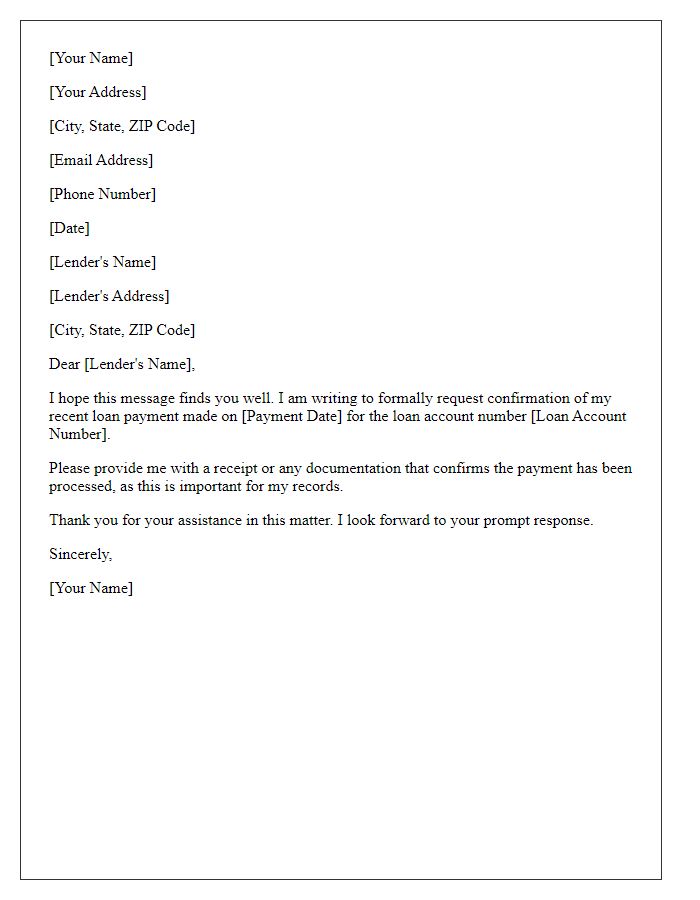

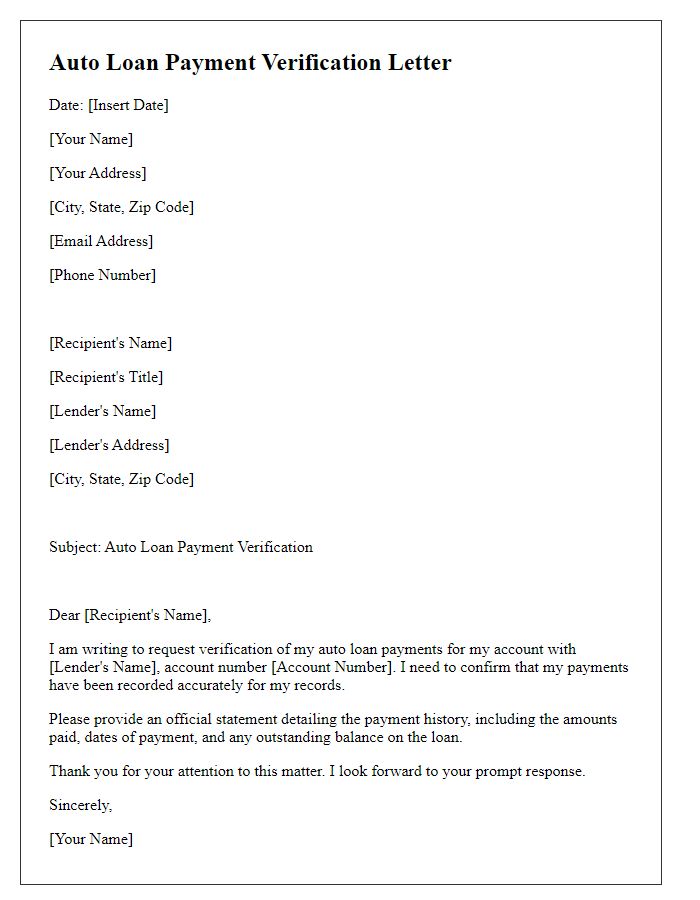

Borrower and Lender Information

The loan payment verification process requires detailed information from both the borrower and lender to ensure accurate record-keeping and compliance. The borrower's full name, address, and contact information, such as phone number and email address, must be clearly stated. Furthermore, the loan account number is essential for identifying the specific loan in question. On the lender's side, crucial details include the lender's name, address, and contact information, especially the representative handling the loan. It is also vital to include the loan amount, interest rate, loan term, and any specific payment schedule, such as monthly or bi-weekly, highlighting due dates and total payment history. This comprehensive data is essential for maintaining transparency and reliability throughout the loan repayment process.

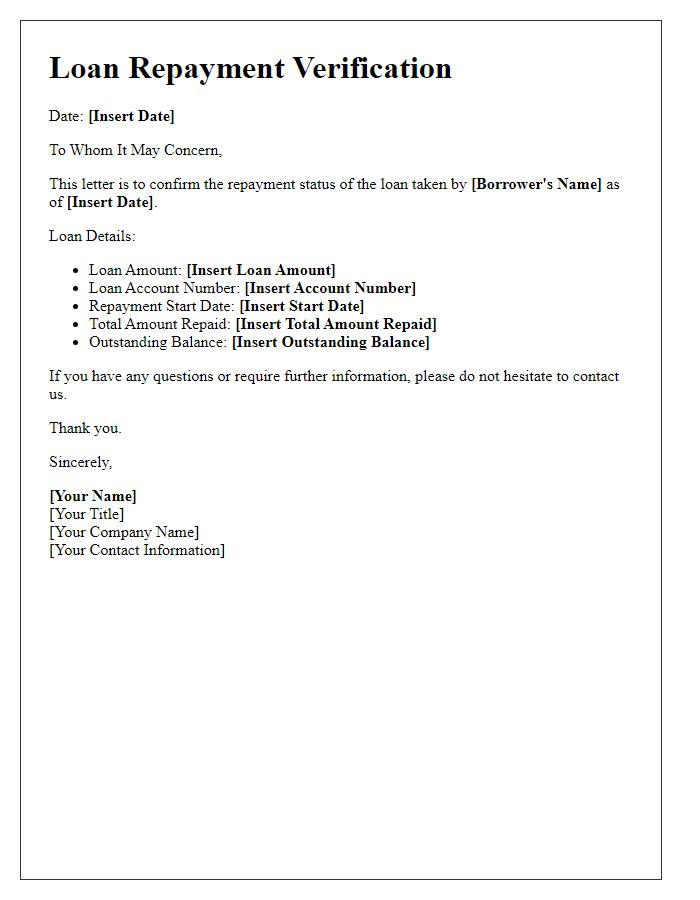

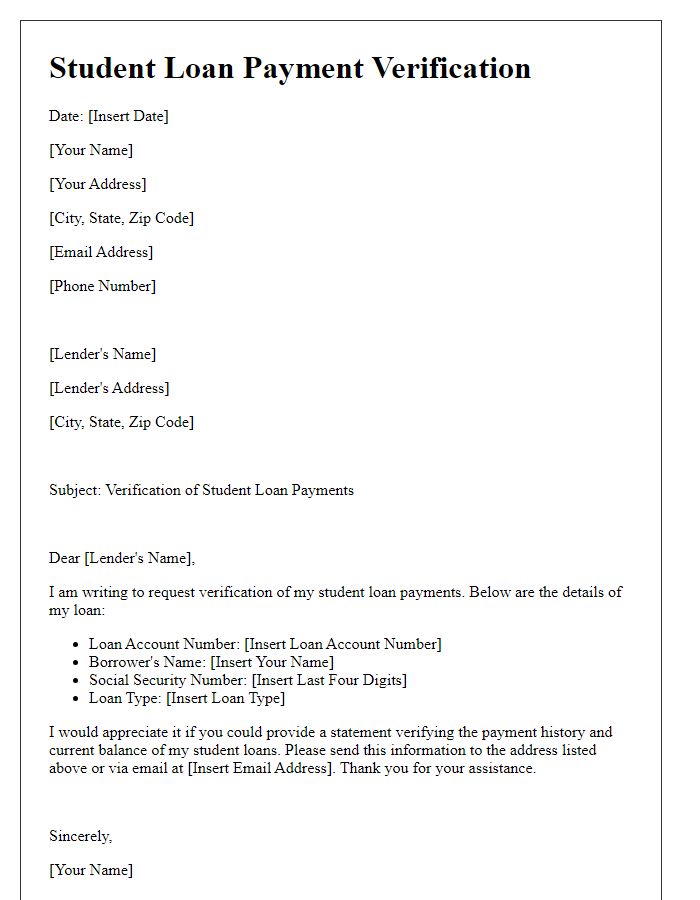

Loan Account Details

Loan account details include essential information such as the loan account number, which serves as a unique identifier, borrower name linked to the account, and outstanding balance reflecting the remaining amount owed. Interest rate percentage impacts the monthly payments, and payment due date specifies when the next installment is required. Payment history records previous payments made, showcasing punctuality or delays, while type of loan categorizes the account, such as personal, auto, or mortgage loan. Verification of these details is crucial for both lenders and borrowers to maintain accurate records and ensure timely payments.

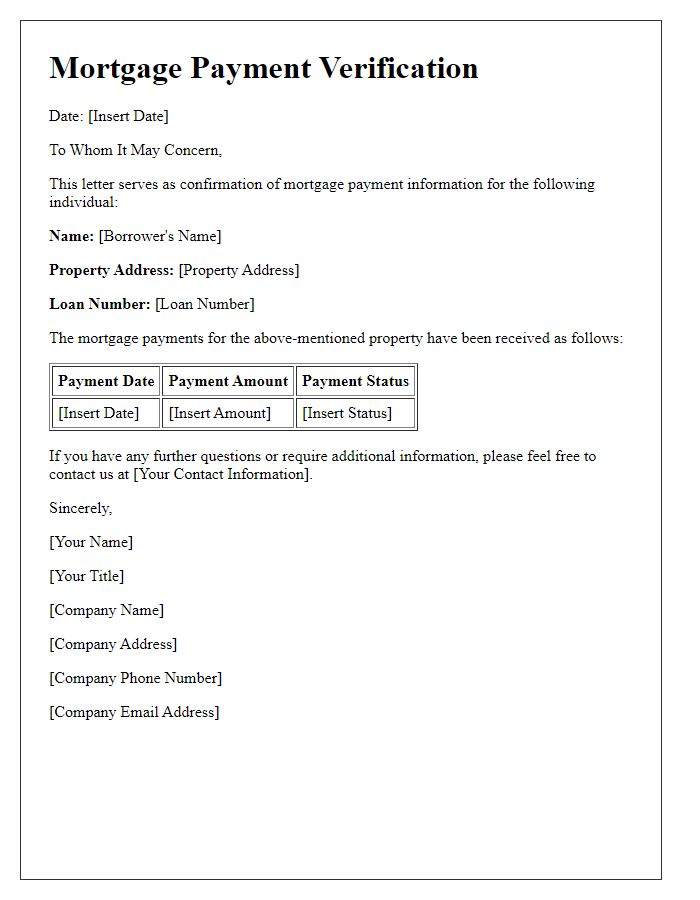

Payment History and Amount

Payment history records are crucial for verifying loan repayments, providing a comprehensive overview of the transaction timeline. A typical payment history includes specific details such as the loan account number, borrower information, and outstanding balances. Notable dates, such as the initiation date of the loan and subsequent due dates, contribute to a clear picture of borrower compliance. Each payment entry typically shows amounts paid, payment methods (check, electronic transfer), and any applicable late fees. Loan terms defined in the original agreement, including interest rates and payment frequency (monthly, bi-weekly), further contextualize the payment history, allowing lenders and borrowers to assess overall financial health and adherence to the repayment schedule. Financial institutions often utilize these records for credit reporting or assessment of future loan eligibility.

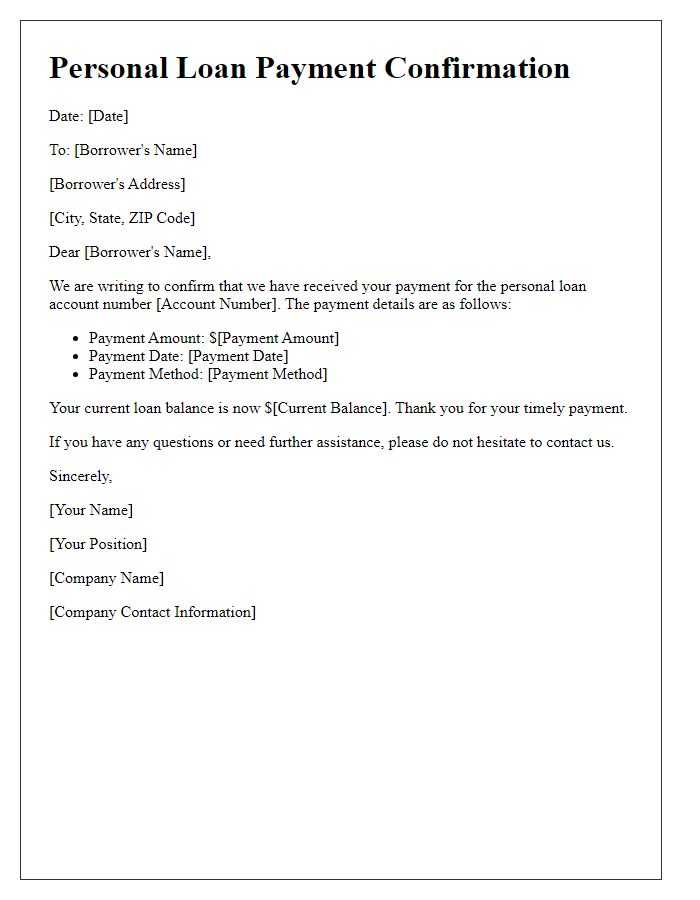

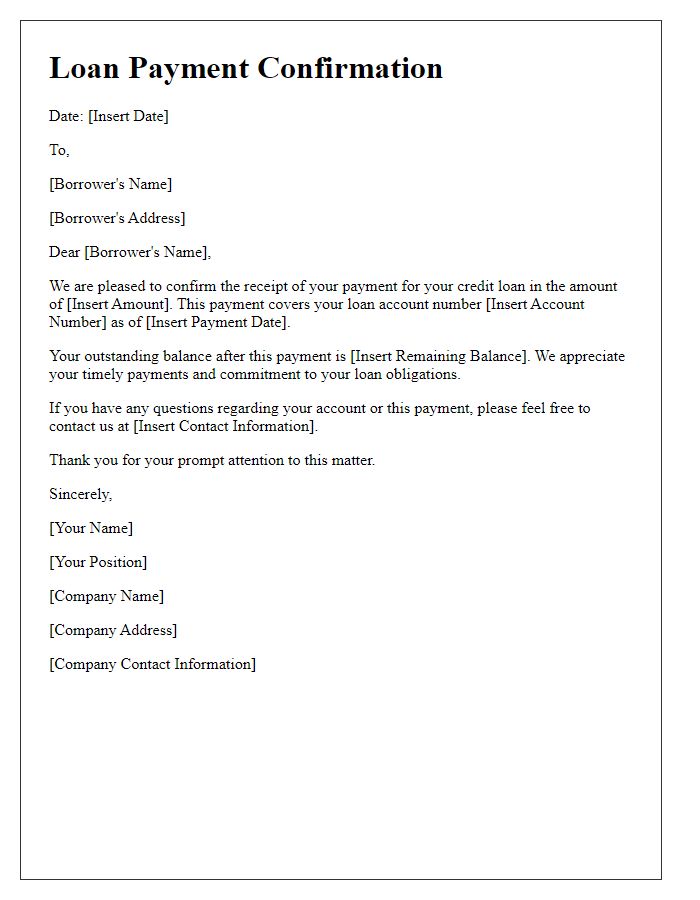

Verification by Financial Institution

Loan payment verification is a crucial process undertaken by financial institutions, such as banks or credit unions, to confirm that borrowers meet their repayment obligations. This verification typically involves documentation such as payment history (often spanning several months or years), loan agreements, and the borrower's credit report reflecting the payment habits. Key documents for this verification may include bank statements, payment receipts, and loan statements, which detail the amounts paid, dates of each payment, and remaining balance. Financial institutions utilize this information to assess the borrower's financial stability and creditworthiness, often calculating metrics like the debt-to-income ratio or payment-to-income ratio to ensure responsible lending practices. Accurate verification protects both the institution and borrower from undue risks, fostering transparent communication and trust in the borrowing process.

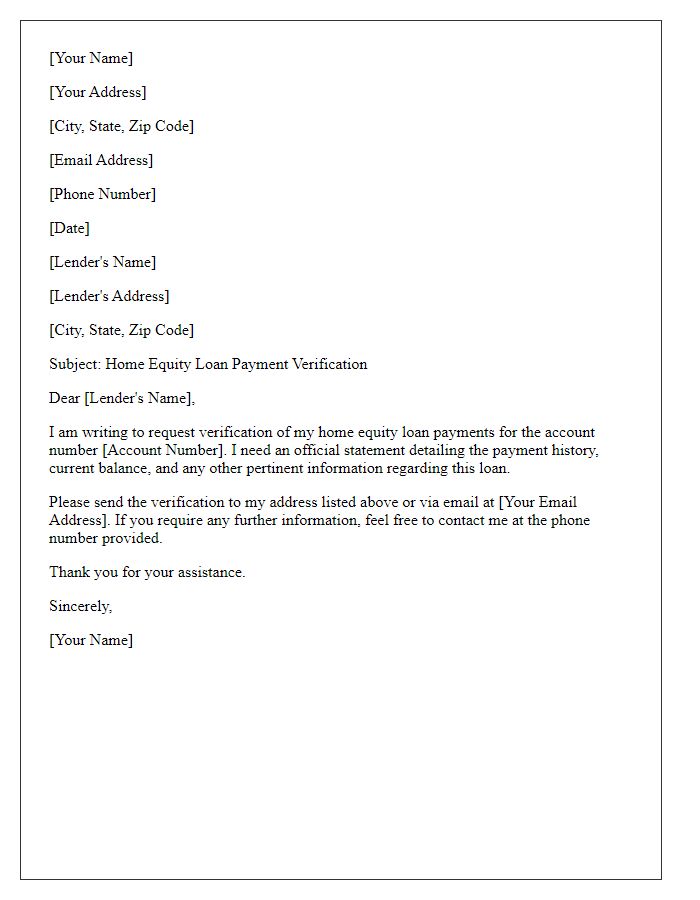

Contact Details for Queries

Loan payment verification often requires a clear communication channel for any inquiries or issues. Please ensure to include complete contact details, including the phone number (such as +1-800-555-0199), email address (like support@loanprovider.com), and physical address (for example, 123 Finance Street, Financial City, State, Zip Code) associated with the loan institution. These details facilitate prompt assistance and streamline the verification process for borrowers seeking clarity on their loan accounts. Regular updates regarding payment status and account details can enhance borrower confidence and ensure accountability.

Comments