Are you navigating the complexities of managing multiple loan accounts? It can often feel overwhelming, but staying organized is the key to effective financial management. In this article, we'll explore a helpful letter template you can use to update your lender on any changes or requests related to your loan accounts. So, if you're ready to streamline your communication and take control of your finances, read on for more insights!

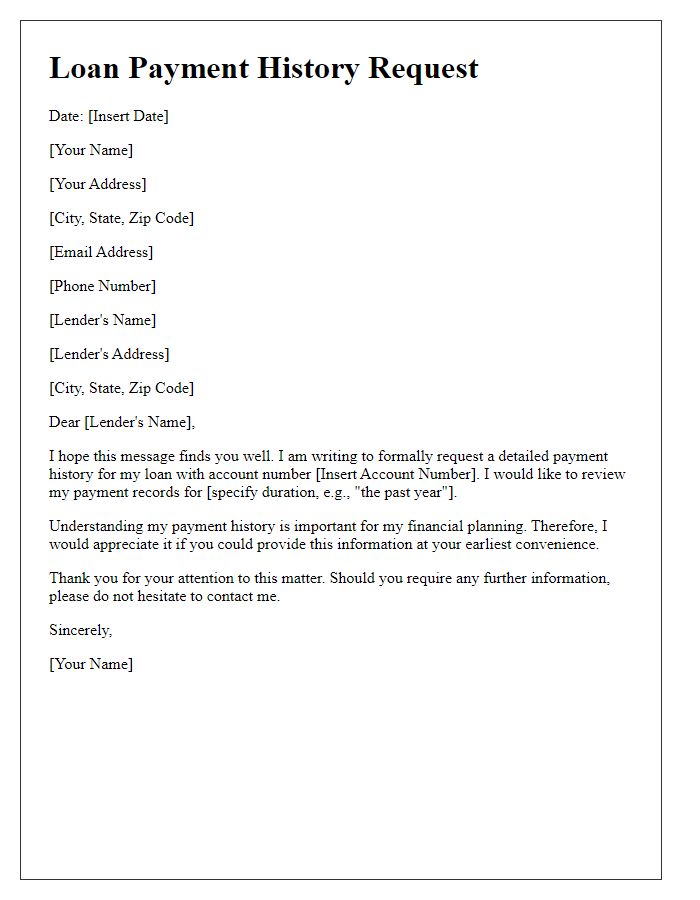

Borrower's Full Name and Contact Information

The comprehensive review of multiple loan accounts reveals critical updates for borrowers concerning their financial commitments. Borrower's Full Name represents an essential identification detail that links all loan agreements, including personal loans, mortgages, and auto loans. Accurate Contact Information ensures effective communication regarding loan status, changes in interest rates, or payment reminders. Additionally, tracking Loan Account Numbers aids in the precise management of each financial obligation, facilitating timely payments and preventing penalties. Understanding the terms such as Loan Amount, Interest Rate, and Loan Term enhances overall financial planning and transacts securely with lenders. Consistent review of these elements can significantly impact the borrower's credit score and overall financial health.

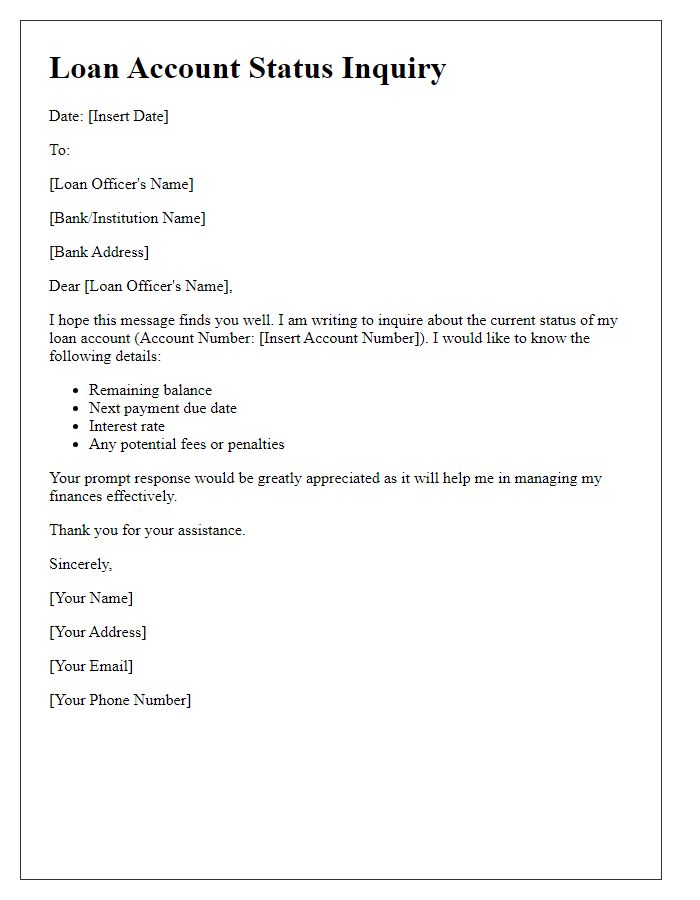

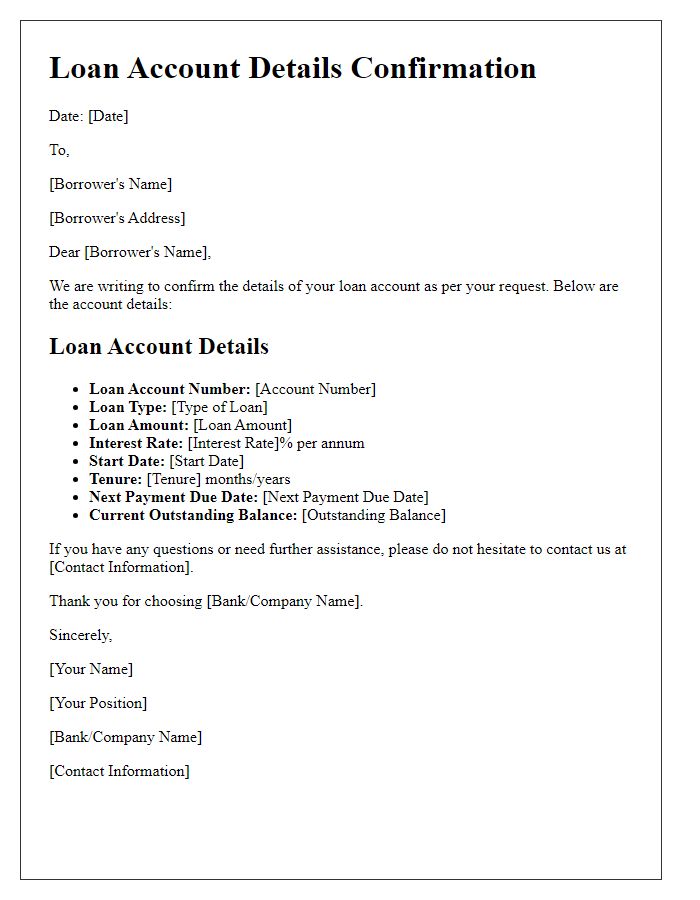

Financial Institution's Name and Address

Financial institutions often provide detailed loan account updates to their customers, particularly regarding outstanding balances, interest rates, and repayment schedules. Customers may have multiple types of loans, such as personal loans, auto loans, or mortgages. Each loan account typically has unique identifiers, including account numbers and terms of agreements. For example, the mortgage account may have a fixed interest rate of 3.5% over a 30-year term, while a personal loan may have an interest rate of 5.0% with a term of 5 years. Comprehensive updates can also include payment history, including the last payment date, total payments made, and remaining balances for each loan. Regular contact helps customers stay informed about their financial commitments and obligations with the institution, ultimately fostering a better relationship between the lender and borrower.

Loan Account Details (Account Numbers and Balances)

Loan account management requires regular updates to maintain accurate financial records. Each loan account, such as home loans or personal loans, possesses unique identifiers, namely Account Numbers, which help track individual liabilities. The outstanding Balances associated with these accounts reflect the amount owed, crucial for budgeting and financial planning. Regular updates on these balances ensure that borrowers remain aware of their financial positions, assisting in timely repayments and avoiding penalties. Accurate record-keeping facilitates effective communication with lenders, ensuring a smooth borrowing experience and maintaining a good credit score.

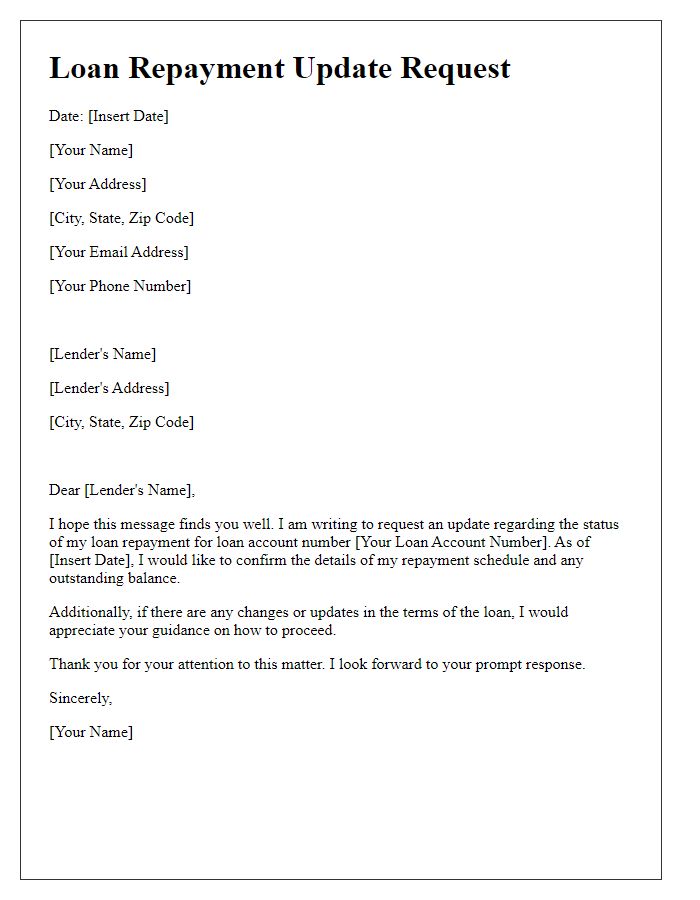

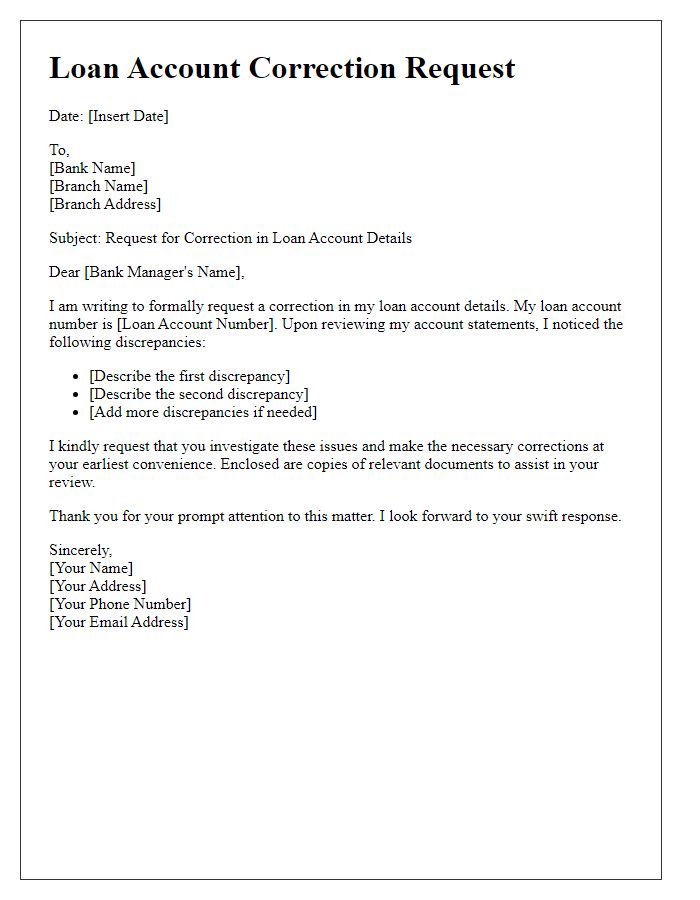

Requested Update or Change Specification

The recent update regarding multiple loan accounts highlights the importance of monitoring financial commitments. Loan accounts, particularly those related to personal finance, auto loans, or mortgages, often require accurate information to maintain optimal management. For instance, if an individual holds three distinct loan accounts with varying interest rates (ranging from 3.5% to 6.7%), it's crucial to record any changes such as payment schedules, outstanding balances, or modifications in terms of agreements. Specific requests for updates might include changes in payment methods, adjustments to due dates, or clarifications regarding fees. Maintaining precise records of these updates is essential for ensuring financial stability and avoiding late payment penalties or negative credit report impacts.

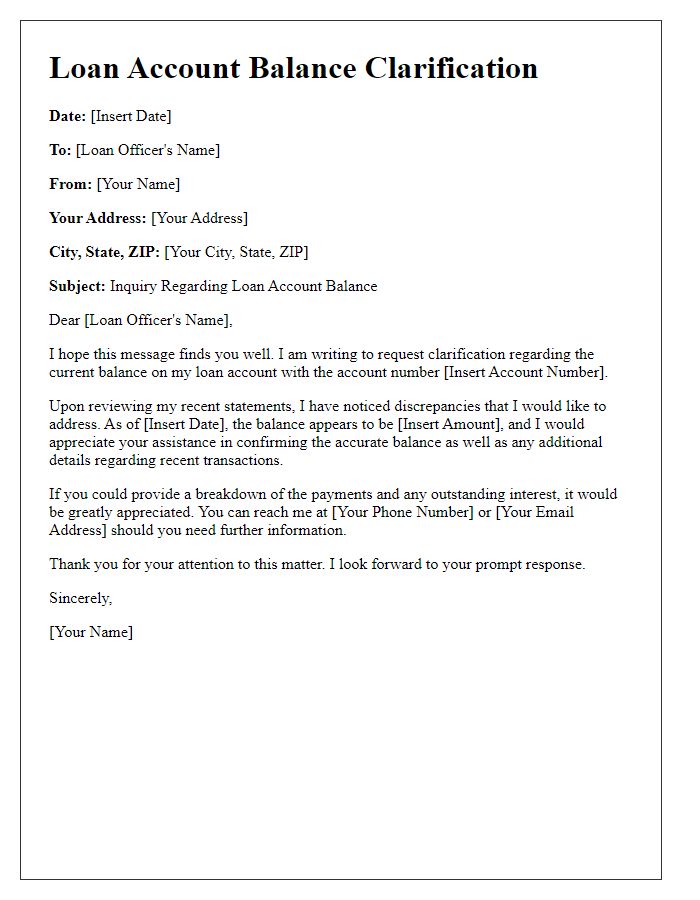

Signature and Date

The process of managing multiple loan accounts can often become cumbersome, particularly when seeking updates on outstanding balances, interest rates, or payment schedules. For instance, borrowers may hold various loans such as personal loans, auto loans, and mortgages, each with distinct terms and conditions dictated by financial institutions like Bank of America or Wells Fargo. Regular updates on loan accounts are critical for maintaining financial health and ensuring timely repayments. This may involve reviewing account statements, which usually reflect recent transactions, current balances, and any applicable fees. In instances requiring formal communication with lenders, clear signatures (often necessitating handwritten validation) and dates are essential for documentation purposes. This process exemplifies the importance of organized financial management amidst diverse lending arrangements.

Comments