Are you navigating the complex world of foreclosure sales and wondering how to confirm the process? Understanding the nuances of foreclosure sales is essential for both buyers and sellers, as it ensures transparency and accountability. In this article, we'll explore a helpful letter template that can guide you through confirming a foreclosure sale, offering you clarity and peace of mind. Ready to dive in and learn how to make this process smoother? Keep reading!

Borrower's information

Foreclosure sales occur when borrowers default on mortgage payments, leading to legal proceedings that result in the sale of the property. The confirmation of a foreclosure sale involves essential information about the borrower, such as their full name, which provides identification; the property address, typically including the street number, street name, city, and zip code; and the loan number associated with the mortgage, which helps in tracking the account. Additionally, the confirmation document may include the date of the sale, which is crucial for legal records, and the outcomes related to the total amount bid during the auction, thus reflecting the financial implications for both the borrower and lender. This formal verification process is vital in the judicial system to ensure proper procedure during property repossession.

Property details

Foreclosure sales occur when a property (real estate asset) is repossessed due to loan default. For example, a residential property located at 123 Maple Street, Anytown, with a mortgage loan default occurring over a 90-day period can lead to such a sale. The property's assessed value is currently $250,000, with the foreclosure process initiated on March 15, 2023, following non-payment of $3,000. The auction date is set for April 30, 2023, at the Anytown Courthouse, with bidders required to present a certified check for a minimum bid, along with documentation verifying their identity. Winning bidders must finalize the transaction within 30 days of the auction while assuming all liabilities associated with the property, including unpaid taxes or liens.

Sale confirmation date and time

The foreclosure sale confirmation takes place on October 15, 2023, at 10:00 AM, located at the City Courthouse, 1500 Main Street, Springfield. This event marks the finalization of the property auction process, following multiple notices and legal proceedings under the state's foreclosure laws. Interested parties must arrive promptly to ensure their participation in the confirmation of bids and to verify ownership transfer details. Documentation required includes proof of identification and any necessary financial statements.

Legal references and obligations

Foreclosure sales occur when lenders repossess properties due to borrower defaults. In the United States, laws guiding these processes vary by state, impacting sale procedures, notification requirements, and borrower rights. Legal references often include the Fair Debt Collection Practices Act (FDCPA) and state-specific statutes like the Uniform Commercial Code (UCC). Foreclosure notice stipulates that borrowers must be informed at least 30 days prior to the auction date. The confirmation of sale typically requires filing documentation with the court, including a summary of the sale, auctioneer's report, and final bid amounts, ensuring compliance with local regulations. Each jurisdiction mandates specific obligations for lenders during the foreclosure process, including maintaining clear records and providing an opportunity for borrowers to contest, if applicable.

Contact information for queries

Foreclosure sales often create confusion for property owners dealing with assets at risk of loss. Accurate contact information plays a crucial role in addressing inquiries efficiently. Buyers at these auctions may seek clarification on property details, bidding procedures, or payment methods. In the realm of foreclosure, knowing the right contacts can uncover critical insights. For example, the local foreclosure auction office typically provides information on sale dates and criteria. Additionally, legal representatives specializing in property law can offer guidance on rights and obligations. Prospective buyers may also benefit from reaching out to real estate agents familiar with foreclosure processes, as they can help navigate the complexities of these transactions. When dealing with foreclosure sales, prompt and direct communication through verified contact channels can significantly ease the process.

Letter Template For Foreclosure Sale Confirmation Samples

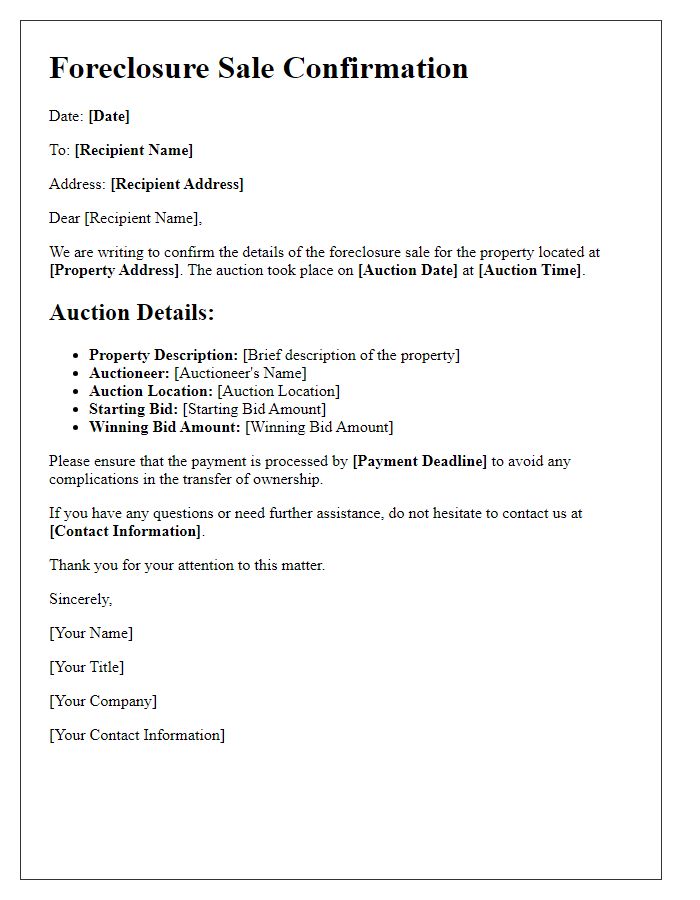

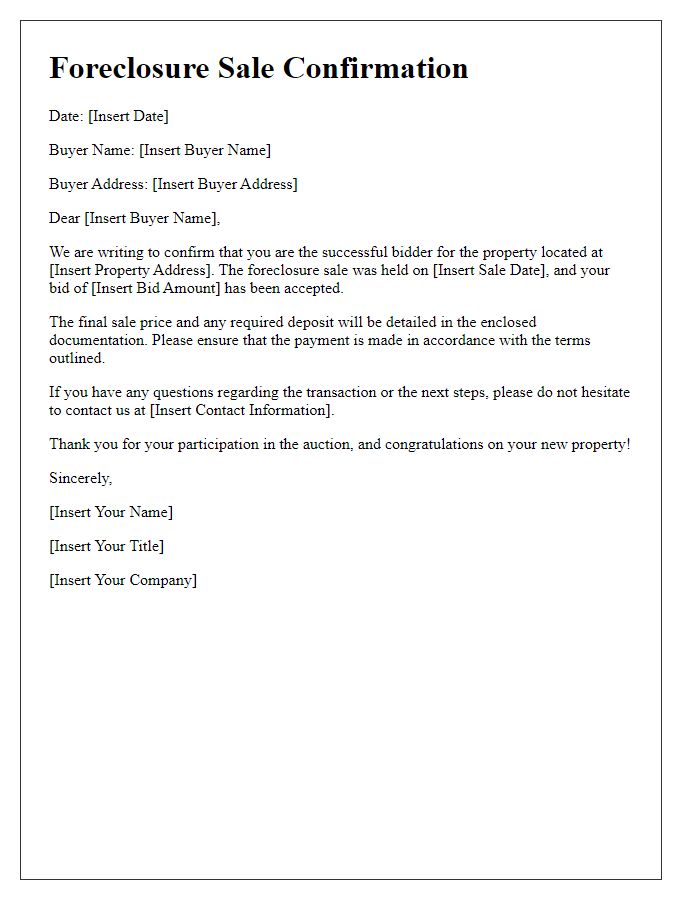

Letter template of foreclosure sale confirmation including auction details

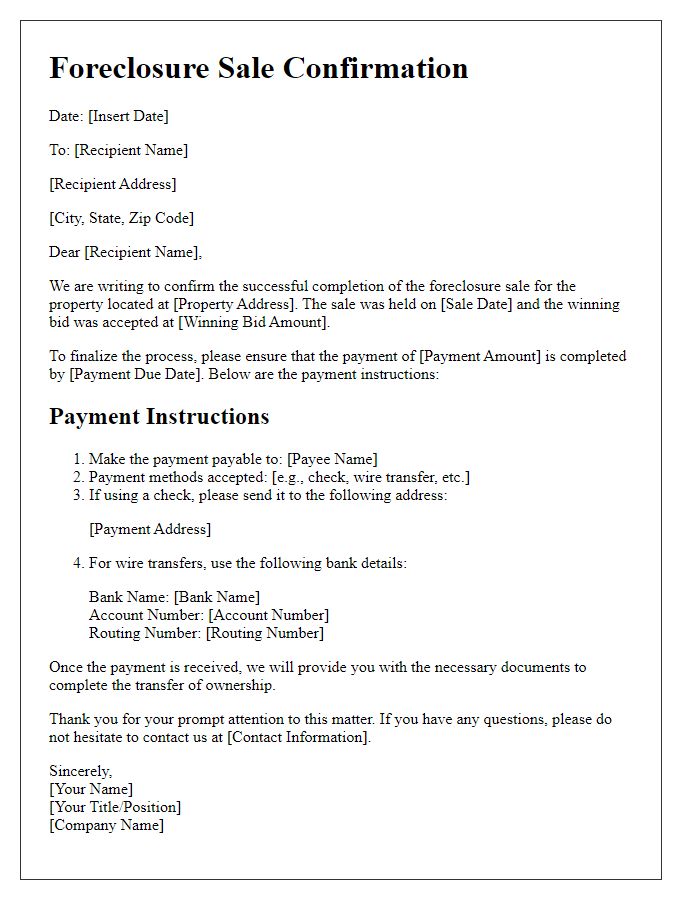

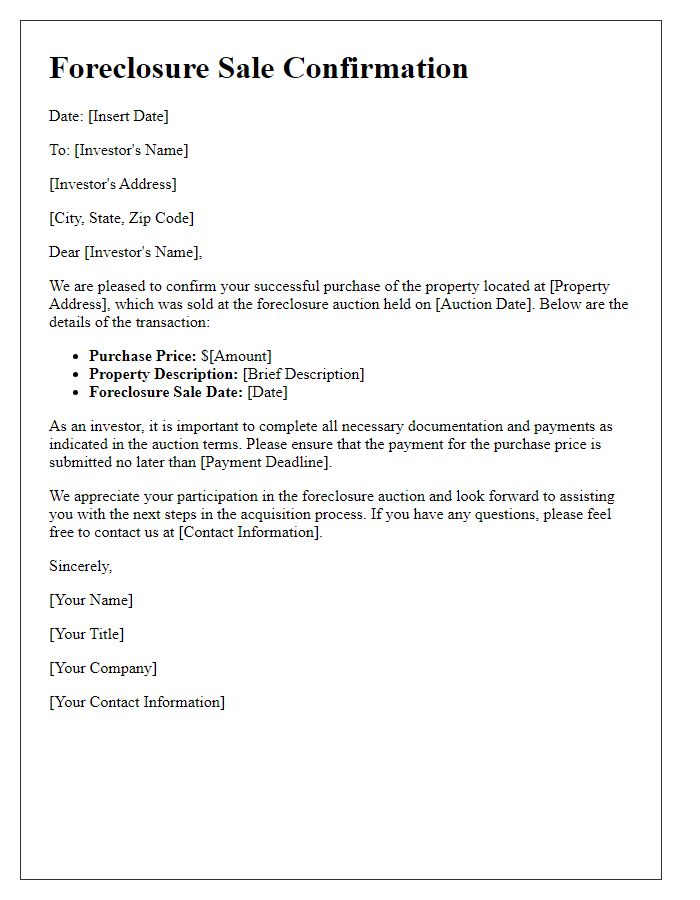

Letter template of foreclosure sale confirmation with payment instructions

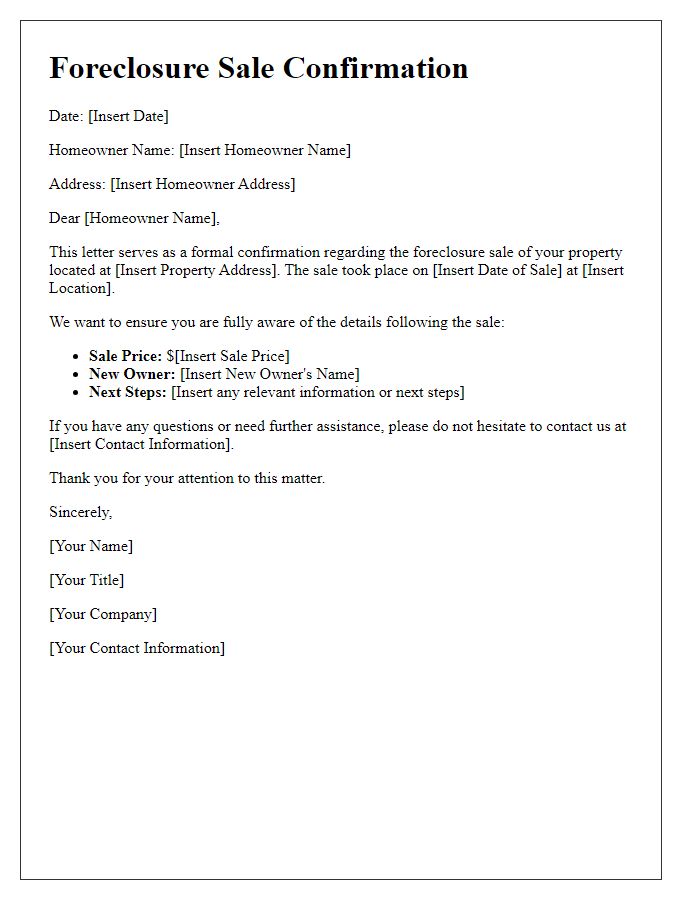

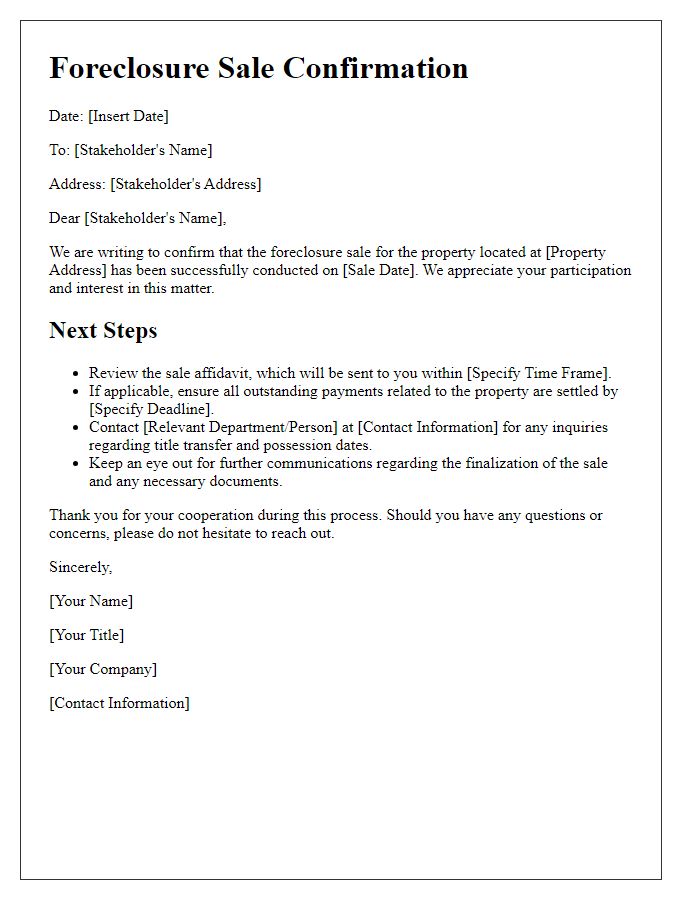

Letter template of foreclosure sale confirmation for distressed homeowners

Comments