Are you in need of a quick cash loan but unsure how to apply? Crafting the right letter can make all the difference in streamlining your application process. In this article, we'll explore a simple yet effective letter template that will help you present your case clearly and professionally. Stick around to discover tips and tricks on turning your loan application into a success!

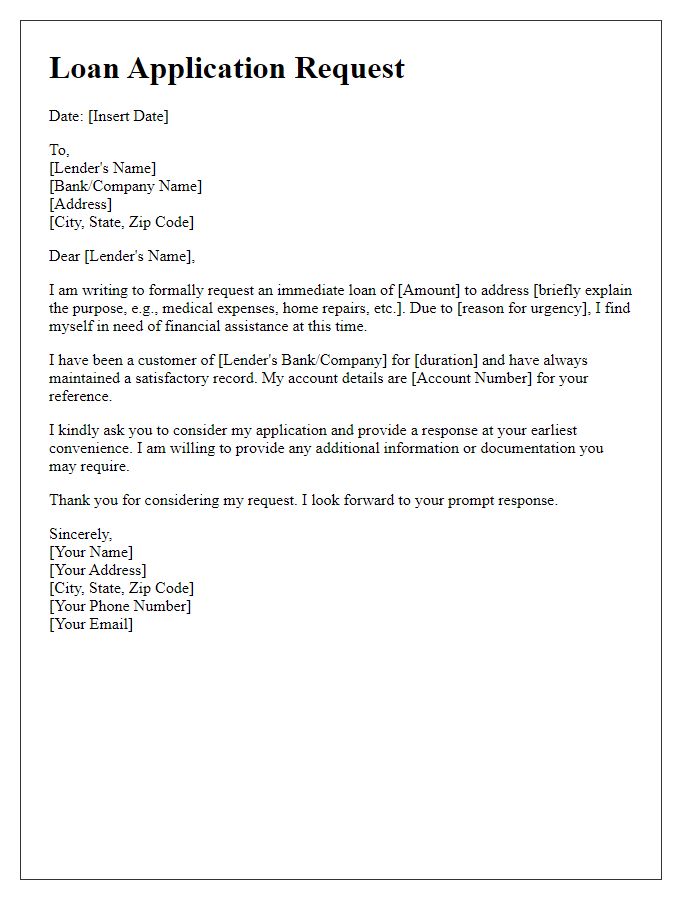

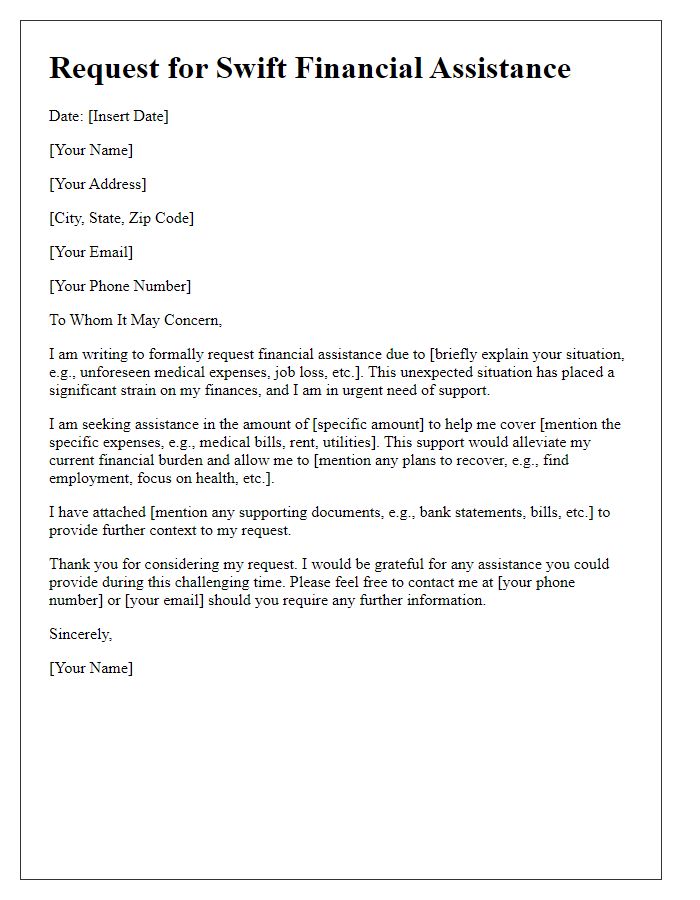

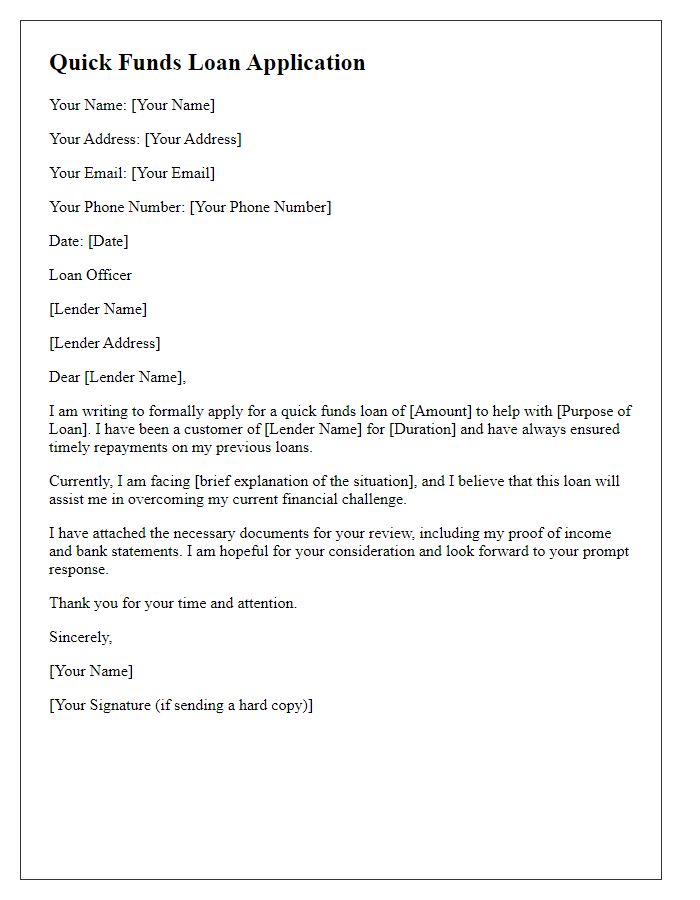

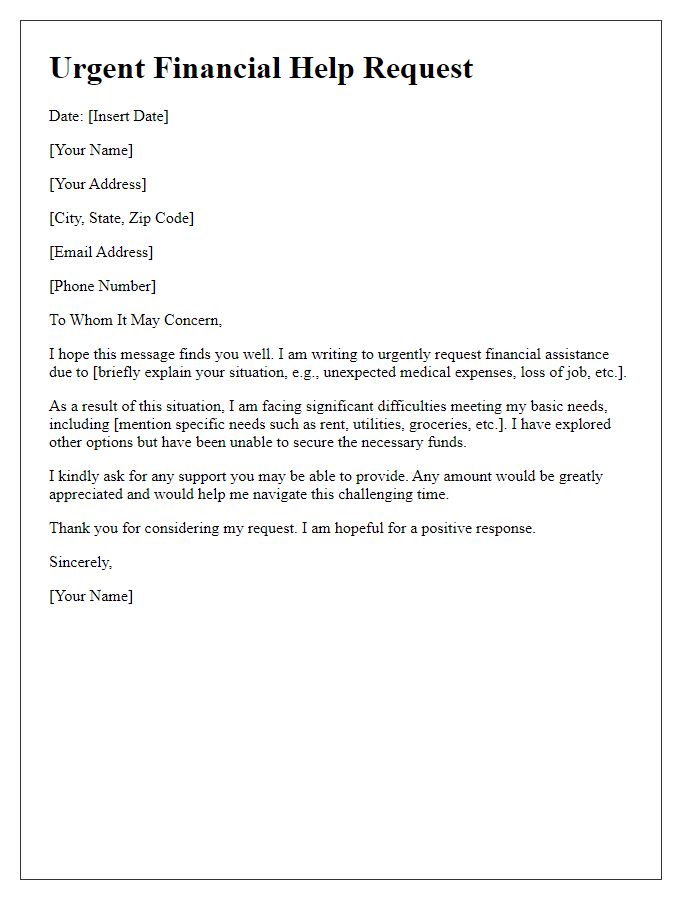

Applicant's Personal Information

Quick cash loans serve as a valuable financial solution for individuals facing unforeseen expenses or urgent financial needs, such as medical bills, home repairs, or emergency travel. Personal information of the applicant, including full name, date of birth, and social security number, plays a crucial role in the application process. Income details, such as monthly salary and employer information, are essential for assessing the applicant's ability to repay the loan. Additionally, contact information, including phone number and email address, ensures efficient communication throughout the loan approval process. Accurate documentation of these details streamlines verification, expediting the overall application timeline, often ranging from a few hours to a couple of days, depending on the lender's policies.

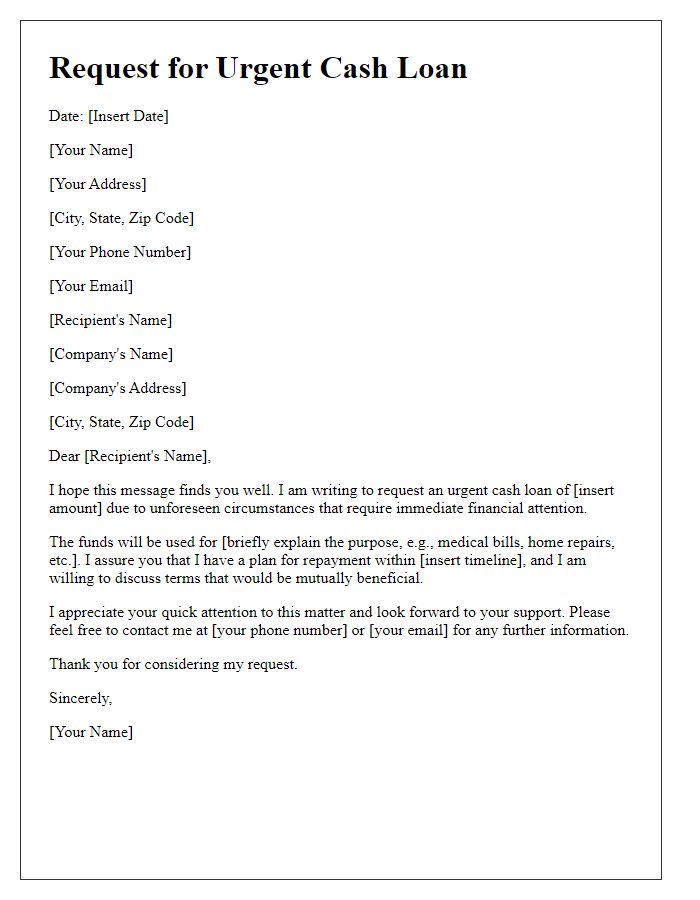

Loan Amount and Purpose

Individuals seeking financial assistance often require quick cash loans to address urgent expenses, such as medical bills or home repairs. Common loan amounts range from $1,000 to $10,000, depending on the lender's policies and the borrower's income level. These loans can be utilized for various purposes, including unexpected medical emergencies (averaging $1,500), car repairs (costing around $800), or even consolidating credit card debt (with average balances of $5,500). Borrowers should clearly outline the intended use of the funds, as this can influence approval rates. Understanding local regulations surrounding interest rates and repayment terms is also essential to avoid falling into a cycle of debt.

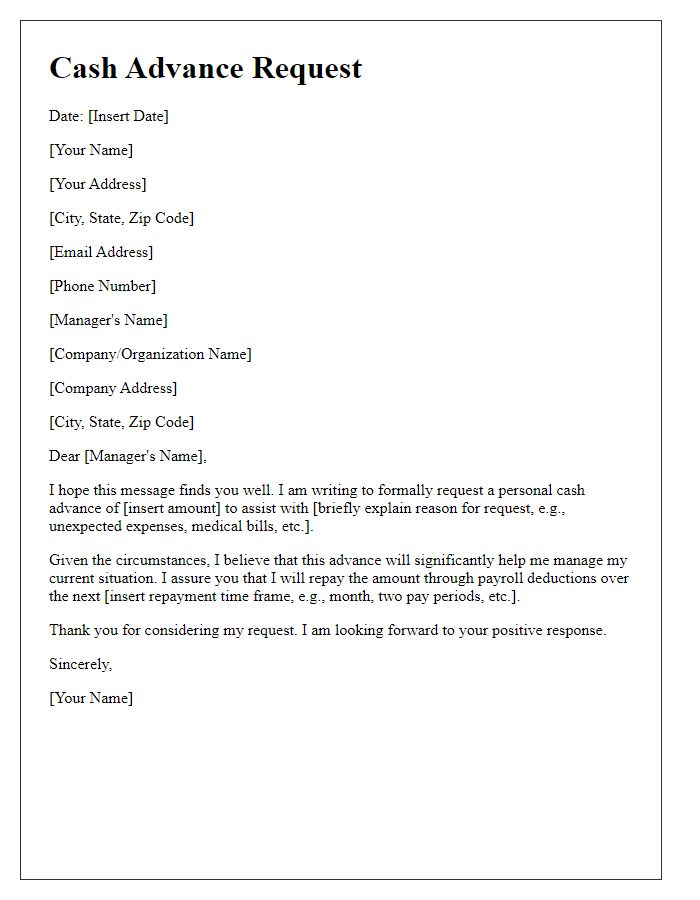

Employment and Income Details

For quick cash loan applications, employment and income details play a crucial role in determining eligibility. Applicants typically provide information about current employment status, including job title and employer name, as well as duration of employment (months or years). Monthly or annual income should be clearly stated, often supplemented by recent pay stubs or tax returns for verification. Additional information, such as secondary income sources from freelance work or investments, may enhance the application's strength. Lenders often require proof of stability, such as a consistent employment history with minimal gaps or changes, which reassures them of the applicant's ability to repay the loan.

Repayment Plan and Terms

When applying for a quick cash loan, it's essential to outline a clear repayment plan and terms. Loan amounts can vary, typically ranging from $500 to $5,000. Borrowers often face interest rates that can reach up to 36%. Repayment durations usually span from 2 to 24 months, depending on the lender's policies. It's crucial to specify the scheduled payments, such as bi-weekly or monthly installments, ensuring that the total repayment amount is clearly defined. For instance, if borrowing $1,000 at a 20% APR, the total repayment could tally up to approximately $1,200 over the course of one year. Additionally, late payment fees may apply, which can increase the overall debt significantly. Understanding these terms helps foster transparency and allows for better financial planning throughout the loan period.

Contact Information and References

When applying for a quick cash loan, essential details include personal contact information such as full name, address (street, city, state, zip code), phone number (home, mobile), and email address. Furthermore, providing references enhances credibility; typically includes at least two individuals who can vouch for your reliability. Common reference details consist of names, relationships (friend, colleague), and contact numbers. Ensuring accuracy in this information is crucial for expediting the loan approval process, enabling the lender to verify applicant identity and reliability efficiently.

Comments