Are you considering a hybrid vehicle to save on fuel and reduce your carbon footprint? Navigating the world of financing can feel overwhelming, but it doesn't have to be. This article will walk you through a comprehensive letter template that simplifies the process of applying for a hybrid vehicle purchase loan. So, buckle up and read on to discover how to secure your eco-friendly ride with ease!

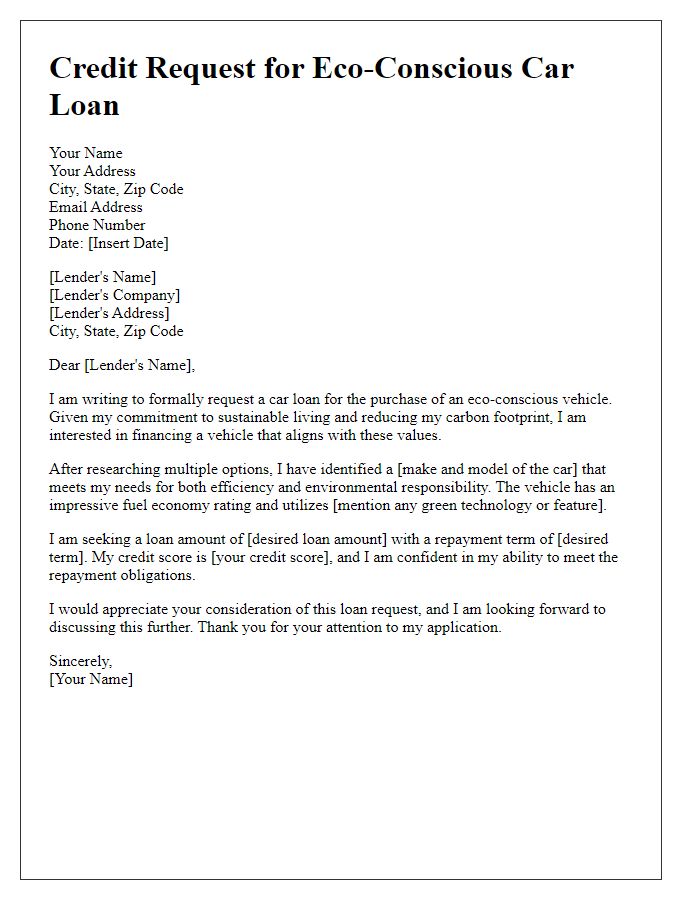

Borrower Information

Borrower information is crucial when applying for a hybrid vehicle purchase loan. This includes personal details such as full name, residential address, and contact number for communication purposes. Additionally, financial information is essential; this includes annual income, employment status, and credit score, which can significantly impact loan approval and interest rates. It is also important to provide information about the hybrid vehicle, like the make, model, year, and VIN (Vehicle Identification Number), as this will help assess the value and eligibility of the loan. Understanding these details allows lenders to evaluate the borrower's financial standing and the viability of the loan application in a competitive automotive market.

Vehicle Details

The purchase of a hybrid vehicle, characterized by its dual powertrain combining an internal combustion engine and an electric motor, represents a sustainable choice in modern transportation. Popular models, such as the Toyota Prius or the Honda Insight, typically deliver impressive fuel efficiency ratings of over 50 miles per gallon (MPG). When considering the specifics of financing, potential buyers should note the vehicle identification number (VIN), which uniquely identifies the car, and the total cost, often averaging between $25,000 and $35,000 for new hybrids. Additionally, understanding the available state and federal incentives, such as tax credits ranging from $2,500 to $7,500, can significantly impact the overall financial commitment.

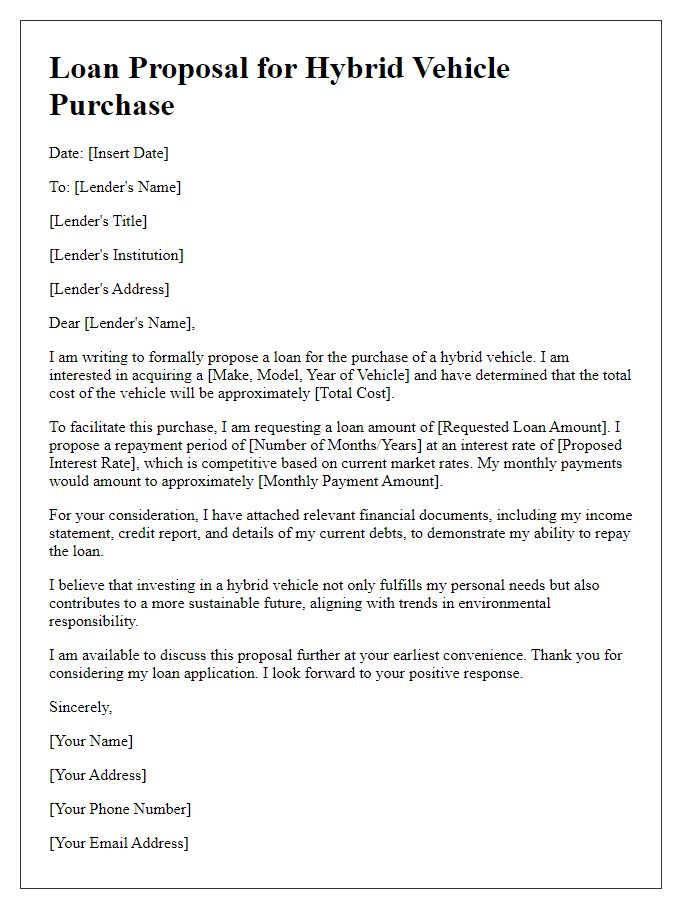

Loan Amount and Terms

A hybrid vehicle purchase loan often varies in loan amount and terms based on several factors. Typical loan amounts for hybrids range from $20,000 to $50,000, accommodating various models such as the Toyota Prius and Honda Insight. Loan terms usually span 36 to 72 months, providing buyers flexibility in repayment. Interest rates tend to fall between 3% and 7%, depending on credit score and lender policies. Additionally, incentives such as federal tax credits (up to $7,500 for eligible hybrid purchases) and local rebates may influence overall costs. Understanding these financial elements can facilitate informed purchasing decisions for prospective hybrid vehicle owners.

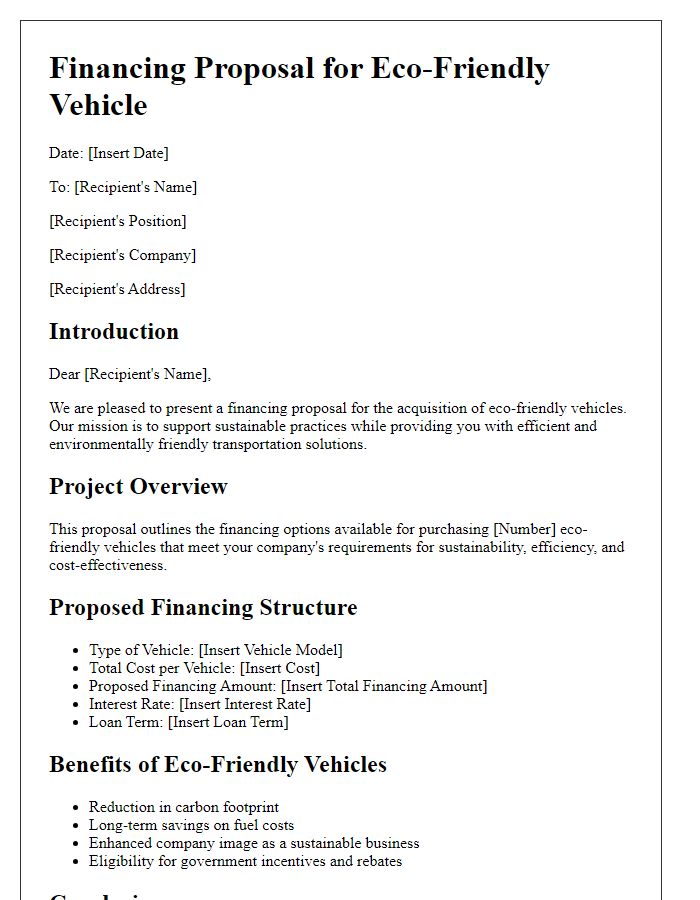

Environmental Benefits

Hybrid vehicles, such as the Toyota Prius and Honda Insight, offer significant environmental benefits by reducing carbon emissions. The dual engine system, combining a gasoline engine with an electric motor, allows for improved fuel efficiency, often exceeding 50 miles per gallon. This efficiency translates to lower greenhouse gas emissions, significantly less than traditional vehicles that average around 22 miles per gallon. By driving a hybrid, individuals can contribute to cleaner air in urban areas, where pollution levels are often higher. Furthermore, regenerative braking technology in hybrids captures energy during braking, enhancing energy efficiency and contributing to reduced reliance on fossil fuels. These environmental advancements align with global efforts to combat climate change and promote sustainable transportation alternatives.

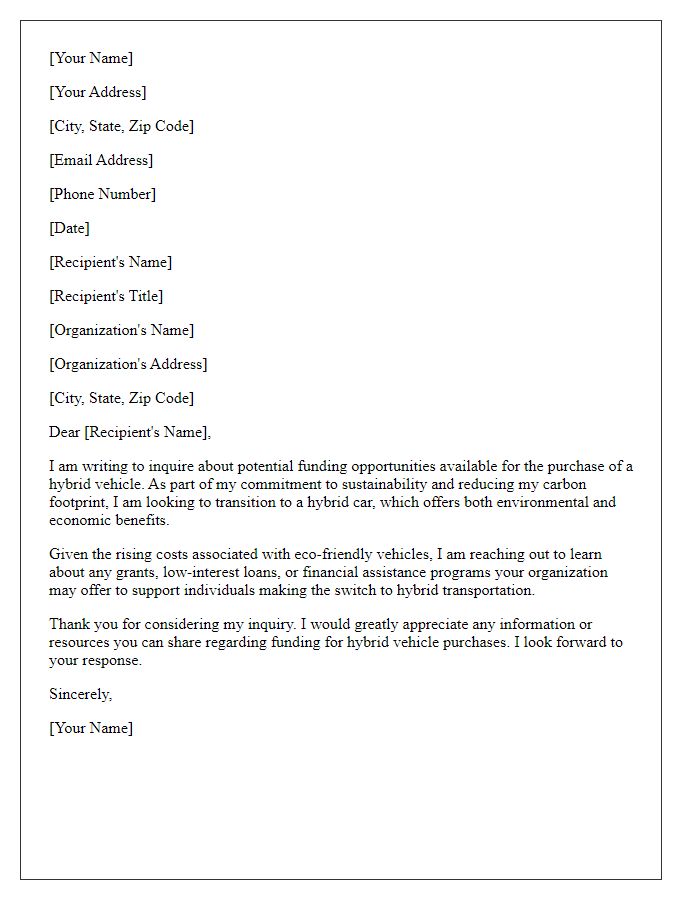

Financial Compatibility

Hybrid vehicle purchase loans offer financially compatible solutions for environmentally conscious buyers. These loans typically feature competitive interest rates ranging from 3% to 6% depending on credit score and lender policies. Loan amounts can vary significantly, often ranging between $20,000 and $50,000, accommodating various hybrid models such as the Toyota Prius or Honda Insight. Loan terms generally span 36 to 72 months, influencing monthly payments and total interest paid over the life of the loan. Many lenders also provide incentives for zero-emission vehicles, which could lower the overall cost. Applying for these loans usually involves assessing income, existing debt, and credit history to ensure financial compatibility.

Comments