Hey there! If you're looking to secure a bridging loan, understanding the approval details can be a game changer for your financial journey. These short-term loan solutions can help you bridge the gap between buying a new property and selling your current one. Curious about the ins and outs of the approval process and what you need to prepare? Read on to discover everything you need to know!

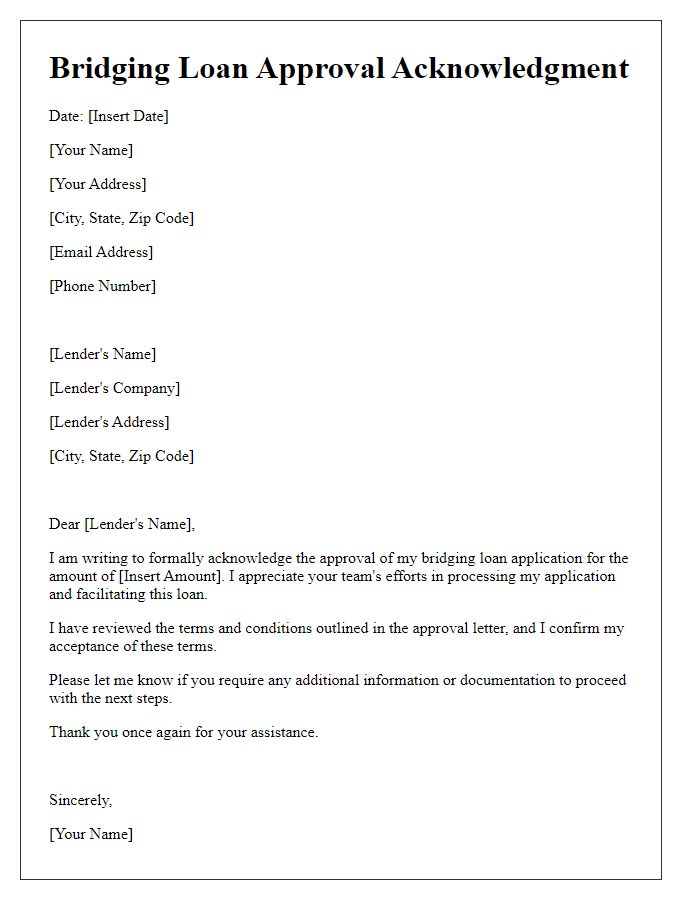

Borrower's full name and contact information

A bridging loan is a short-term financing solution that assists property buyers in acquiring new real estate while waiting for their existing property to sell. Borrowers typically need to provide details such as their full name, contact information, and any relevant personal financial information. The approval process usually requires a thorough assessment of the borrower's creditworthiness and the value of the collateral property involved. Bridging loans, often utilized in real estate transactions, can have interest rates ranging from 0.3% to 2% per month, depending on market conditions and lender criteria. Loan terms typically range from a few months up to 18 months, making them a flexible option for short-term financing needs.

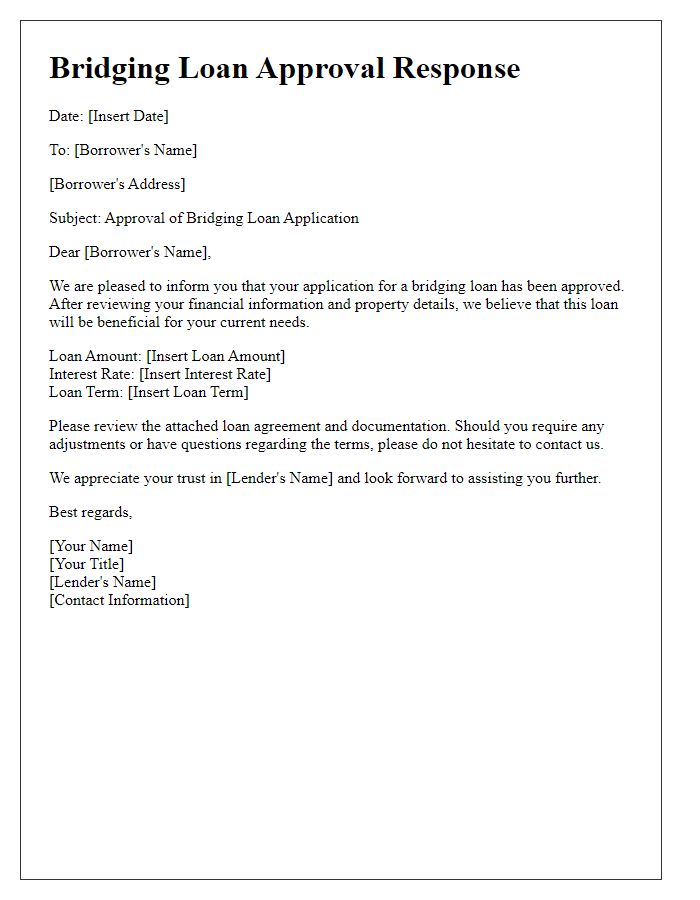

Loan amount and interest rate

Bridging loans, often utilized in real estate transactions, typically range from PS50,000 to PS1 million, depending on the lender's policies and the borrower's creditworthiness. Interest rates for bridging loans can vary significantly, usually between 0.4% to 2% per month, influenced by the loan term and the risk profile of the asset. Approval details may include the loan's duration, which usually spans from a few weeks up to 12 months, making it vital for borrowers to demonstrate a clear exit strategy, such as property resale or long-term financing, to satisfy lender requirements.

Terms and conditions of the loan

Bridging loans serve as short-term financial solutions for individuals or businesses seeking immediate capital to bridge gaps in financing, particularly during property transactions. The loan amount typically ranges from PS25,000 to PS10 million, depending on the lender's criteria and the value of the collateral. Interest rates can vary significantly, often between 0.5% and 2% per month, based on risk assessment and loan duration, which usually spans 1 to 12 months. Lenders may require a down payment of 25% to 40% of the property's value, with properties held as security, commonly residential or commercial real estate, located in high-demand areas. Additional fees may apply, including arrangement fees, valuation fees, and legal costs, adding further financial considerations. Repayment terms are often flexible, with options for full repayment at the end of the loan term or partial repayments available depending on the lender's policy. It's crucial for borrowers to fully understand the implications of the bridging loan's terms and conditions, including default penalties, before proceeding with the agreement.

Repayment schedule and due dates

Bridging loans provide short-term financing solutions for property transactions, where borrowers may need interim funding to secure a new property before selling an existing one. These loans typically come with specific repayment schedules, often due in a period of 6-12 months. The repayment structure may involve interest-only payments during the loan term, allowing flexibility for borrowers to manage cash flow. Important due dates include installment payments due on the first of each month, ensuring timely management of finances, with the final balloon payment covering the principal amount owed at loan maturity. Understanding these critical aspects permits borrowers to navigate their financial commitments effectively.

Lender's contact information and signature line

The details of bridging loans are crucial for property transactions, particularly in real estate markets such as the United Kingdom. A bridging loan is a short-term financing option often used for purchasing properties before securing a permanent mortgage, typically lasting from a few weeks to a couple of years. Key features of bridging loans include high interest rates (often ranging from 0.4% to 1.5% per month), quick access to funds, and typically less stringent credit requirements compared to traditional mortgage loans. Notably, lenders such as high-street banks, niche lenders, and peer-to-peer lending platforms offer these loans to both residential and commercial buyers. Understanding the costs and terms, alongside lender-specific contact information, ensures borrowers navigate the borrowing process effectively. Additionally, a signed agreement emphasizes commitment to the lending terms and borrower responsibilities.

Comments