Are you ready to navigate the important process of confirming your role as a loan guarantor? Understanding the ins and outs of this commitment can be a bit overwhelming, but it doesn't have to be. In this article, we'll break down what it means to be a loan guarantor, the responsibilities involved, and how to effectively communicate your confirmation in writing. So, let's dive in and make this journey a little easierâread on to discover all you need to know!

Loan details and terms

A loan guarantor confirmation involves a detailed overview of specific information regarding loan terms and conditions. The loan amount, for instance, could be $50,000 with an interest rate of 5% over a duration of 15 years. The repayment schedule may involve monthly installments, approximately $395, commencing within 30 days of loan disbursement. It is essential to note the guarantor's responsibilities, which may include covering missed payments and ensuring compliance with the loan agreement. Additionally, understanding the implications of collateral (such as a property or vehicle) tied to the loan might influence the guarantor's financial liabilities.

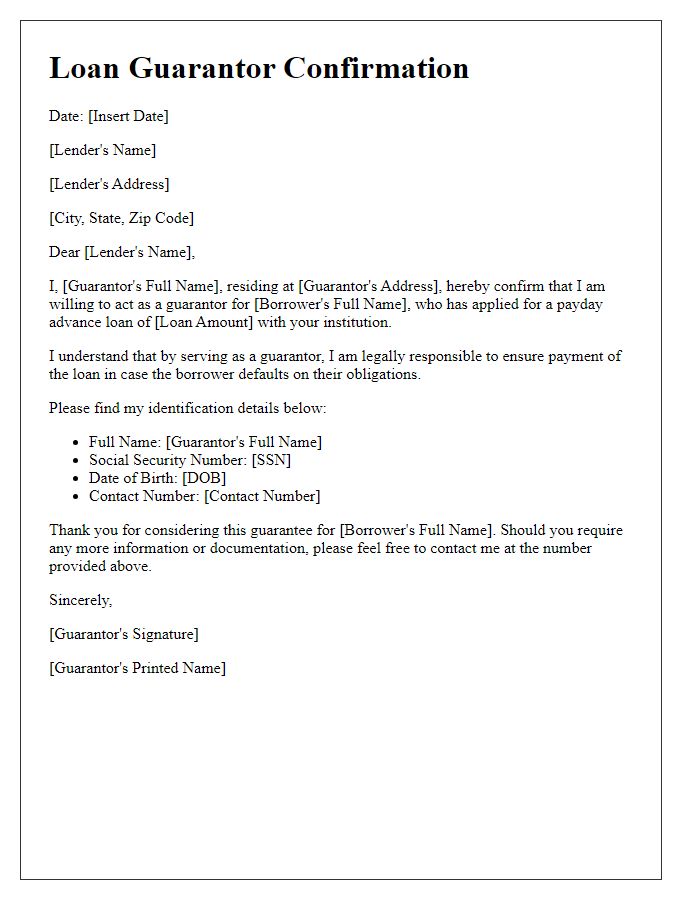

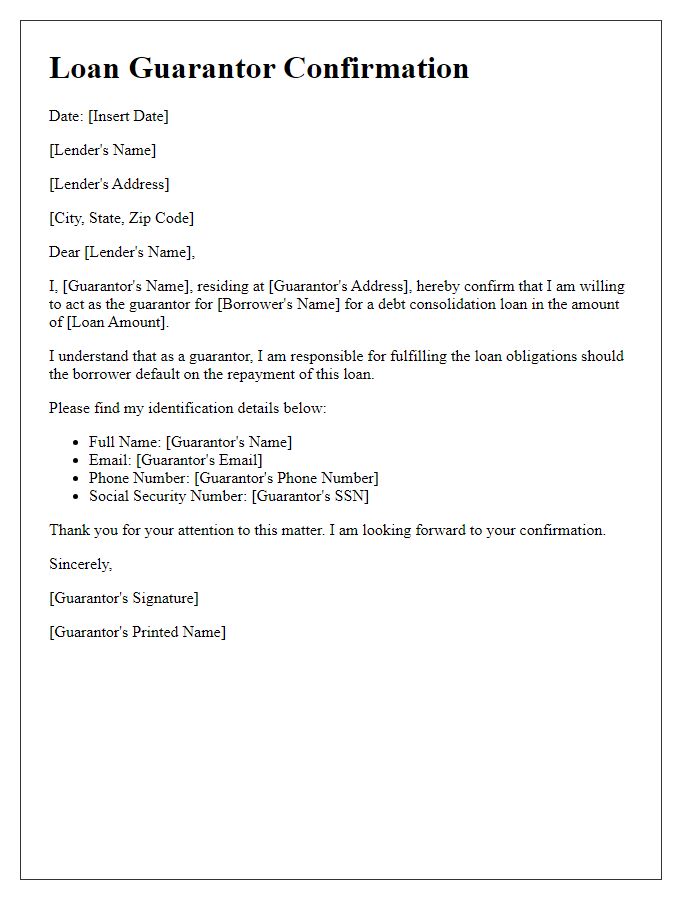

Guarantor's personal information

The loan guarantor confirmation is a crucial document used in financial transactions involving loans in which an individual, known as the guarantor, agrees to be responsible for the loan repayment if the primary borrower defaults. Personal information of the guarantor typically includes their full name, such as John Smith, residential address including street name, city, and zip code, date of birth providing age context, and Social Security number to verify identity. Additional details might encompass employment information specifying the employer's name and position held, along with annual income to assess financial stability. Contact information such as phone number and email address would also be important for any follow-ups regarding the loan application process.

Consent and agreement clause

A loan guarantor confirmation serves as a vital assurance for lenders regarding the borrower's ability to meet their financial obligations. This document outlines the terms of the guarantee, specifying that the guarantor agrees to assume the responsibility for the loan repayment should the borrower default. This clause often includes the loan amount, interest rate, repayment schedule details, and the specific conditions under which the guarantor's responsibility is triggered. It is imperative that the guarantor is aware of their legal obligation to cover the debt, which could lead to significant financial consequences should the borrower fail to pay. The document usually requires signatures from both the lender and guarantor, in addition to being notarized for authenticity.

Legal and financial obligations

A loan guarantor confirmation is a crucial document detailing the legal and financial obligations of a guarantor in a loan agreement, such as those pertaining to personal loans, mortgages, or business financing. The guarantor, often a family member or close friend, agrees to take on responsibility for the loan if the primary borrower defaults. This agreement typically outlines specific terms, including the loan amount, interest rate, repayment period, and consequences of default, which can include lien on personal assets or legal action. The confirmation formalizes the guarantor's commitment, ensuring they understand their potential financial liability, which can vary significantly based on the total loan, default rates in the lending institution, and the borrower's credit history. Legal implications may also arise in cases of foreclosure or bankruptcy, necessitating detailed analysis of the guarantor's obligations under applicable laws and regulations.

Contact information for communication

A loan guarantor confirmation is essential in the process of securing financial assistance, particularly for individuals with limited credit history. The confirmation typically includes the guarantor's name, their contact information such as phone number and email address, and the relationship to the borrower. Important details about the loan itself, including the amount, interest rate, and payment terms, should also be noted. This confirmation serves as a legal acknowledgment of the guarantor's commitment to cover loan payments in case the borrower defaults. Clear communication channels facilitate the process, allowing lenders to quickly reach the guarantor for any necessary clarifications or confirmations throughout the loan period.

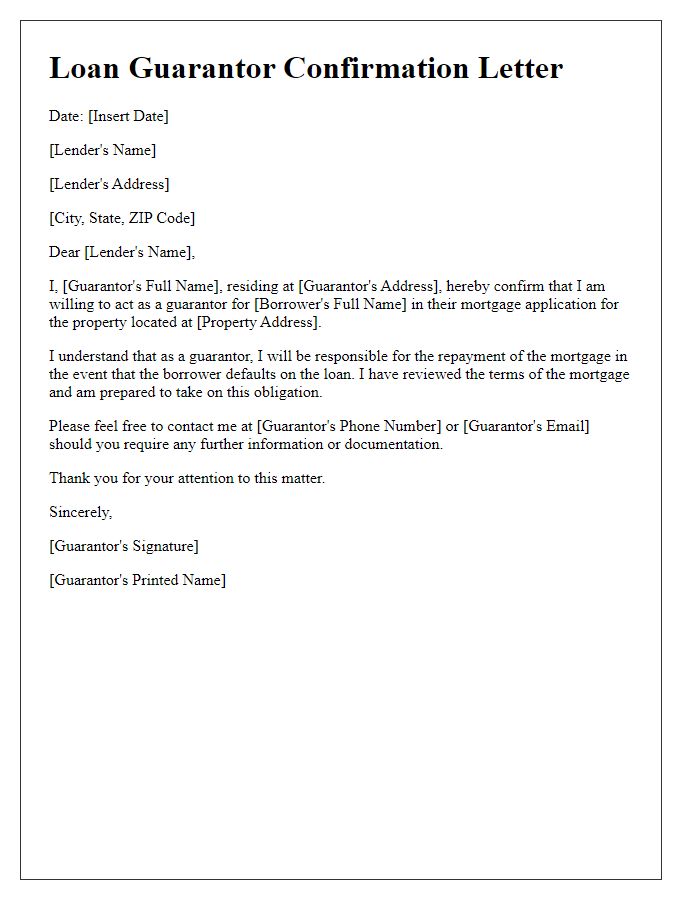

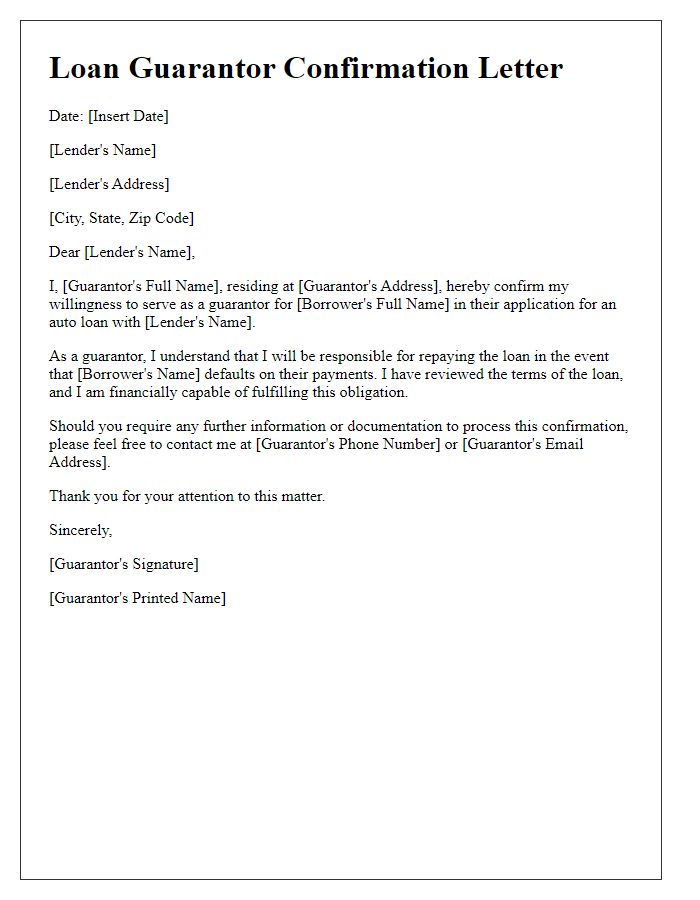

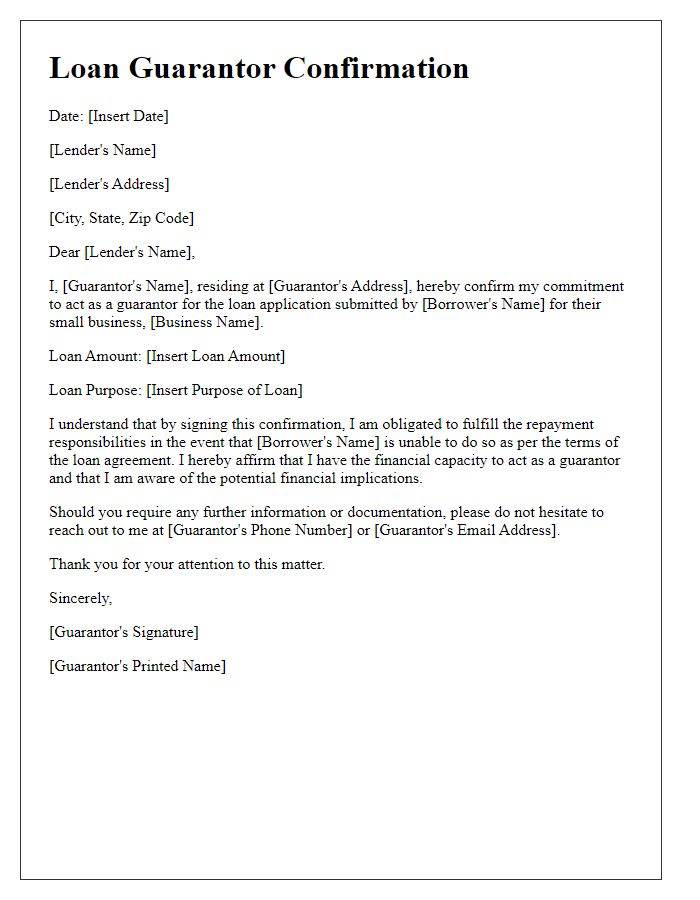

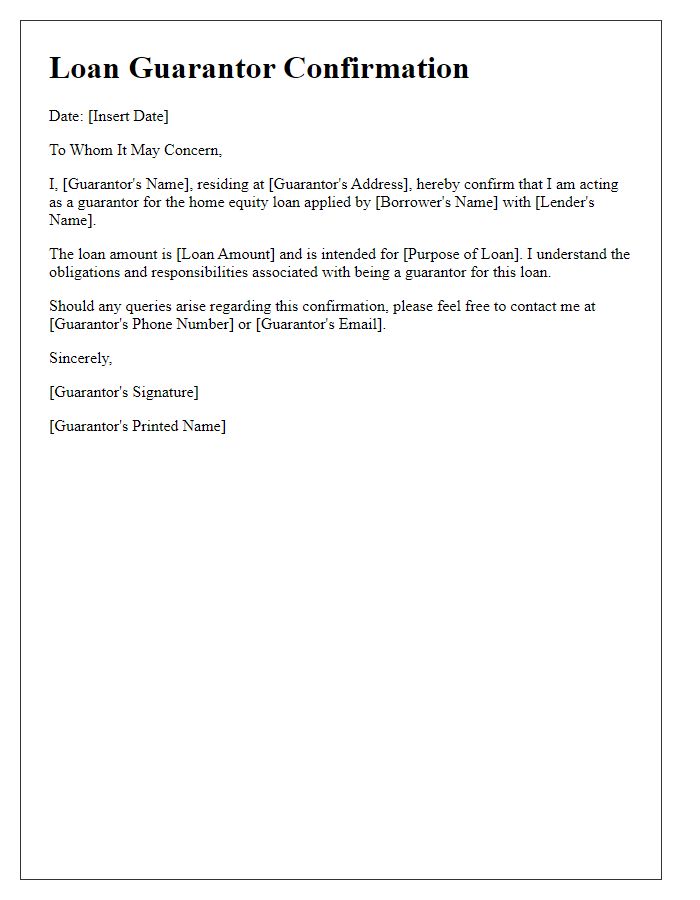

Letter Template For Loan Guarantor Confirmation Samples

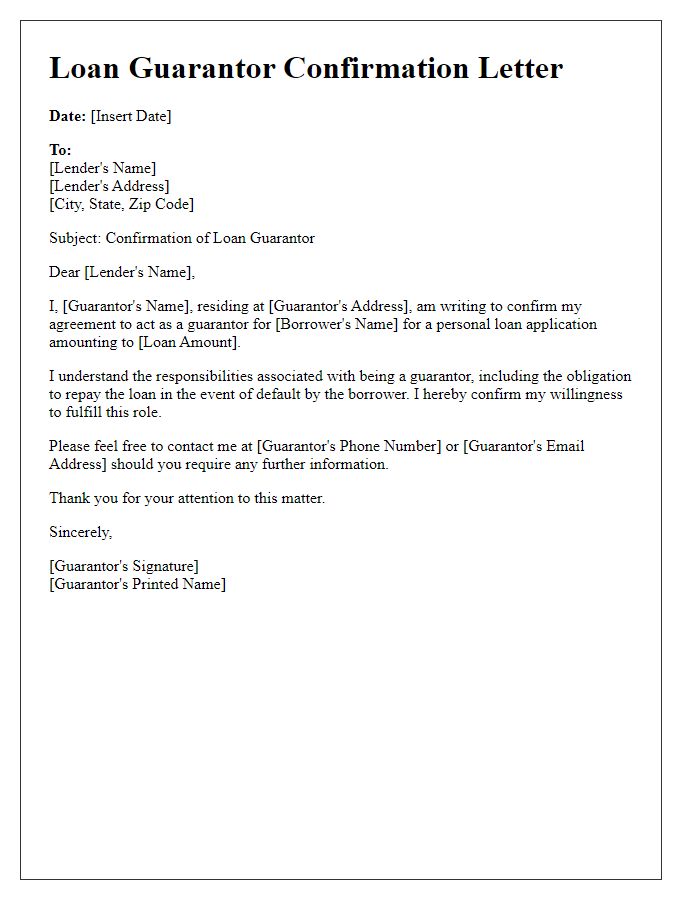

Letter template of loan guarantor confirmation for personal loan application.

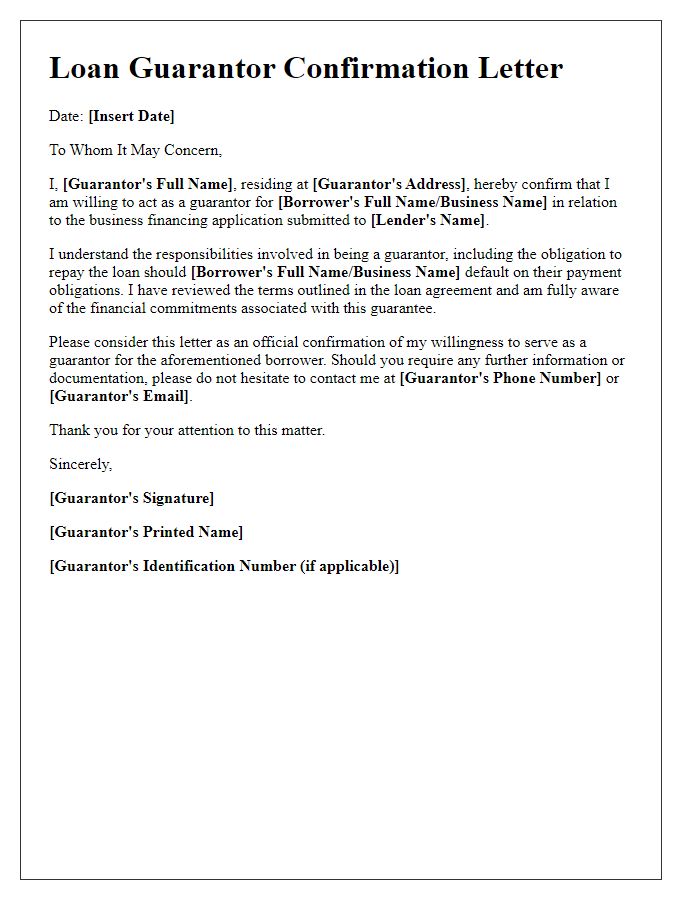

Letter template of loan guarantor confirmation for business financing approval.

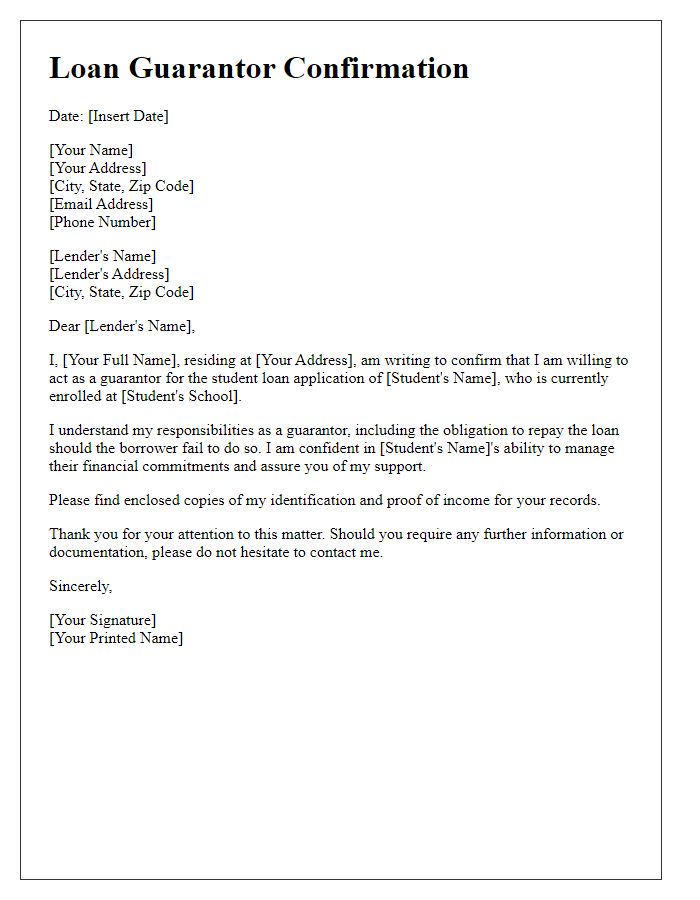

Letter template of loan guarantor confirmation for student loan support.

Letter template of loan guarantor confirmation for mortgage application.

Letter template of loan guarantor confirmation for credit card issuance.

Comments