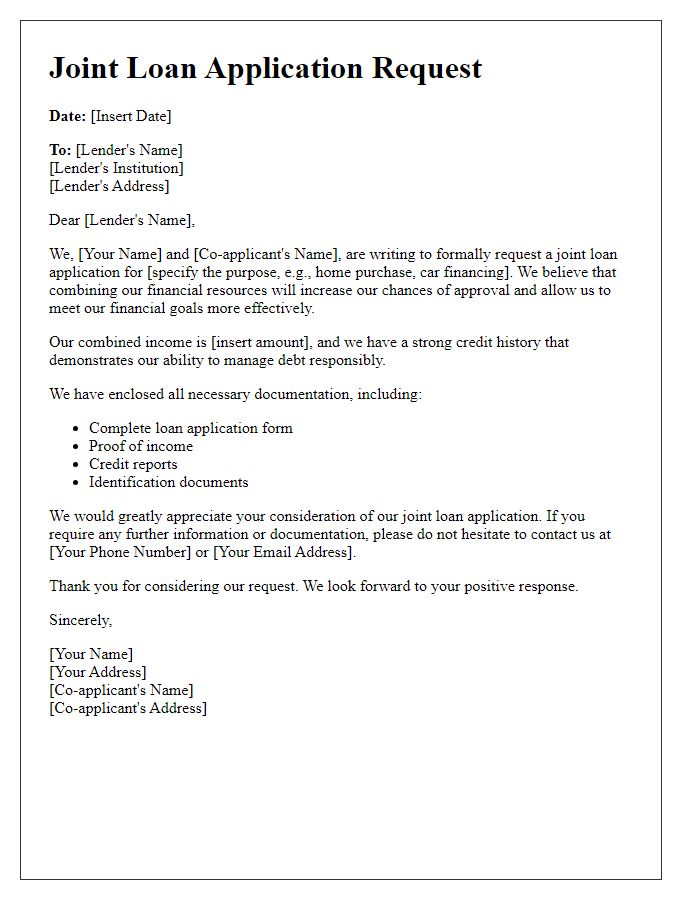

Are you considering applying for a joint loan but unsure where to start? Crafting the perfect letter to accompany your application is crucial, as it lays the foundation for a smooth process. In this article, we'll guide you through essential details to include, ensuring your application stands out to lenders. So, let's dive in and explore the best strategies to make your joint loan application shine!

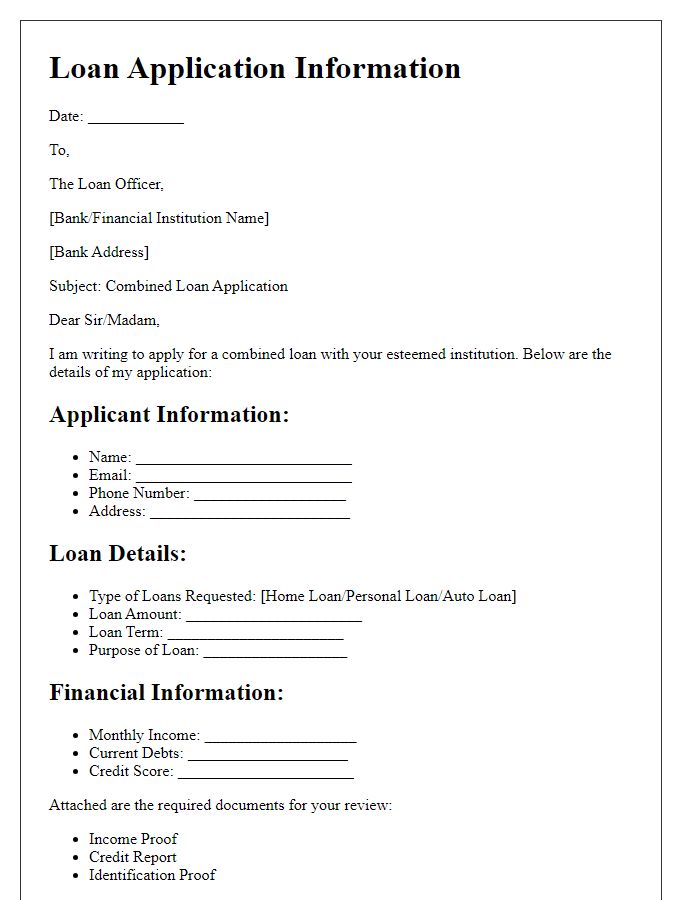

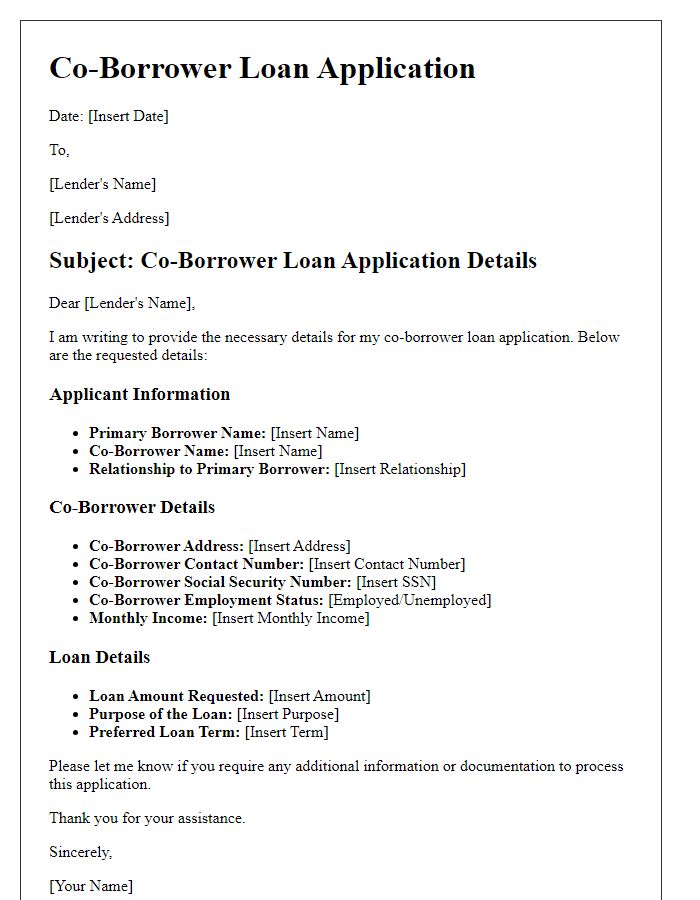

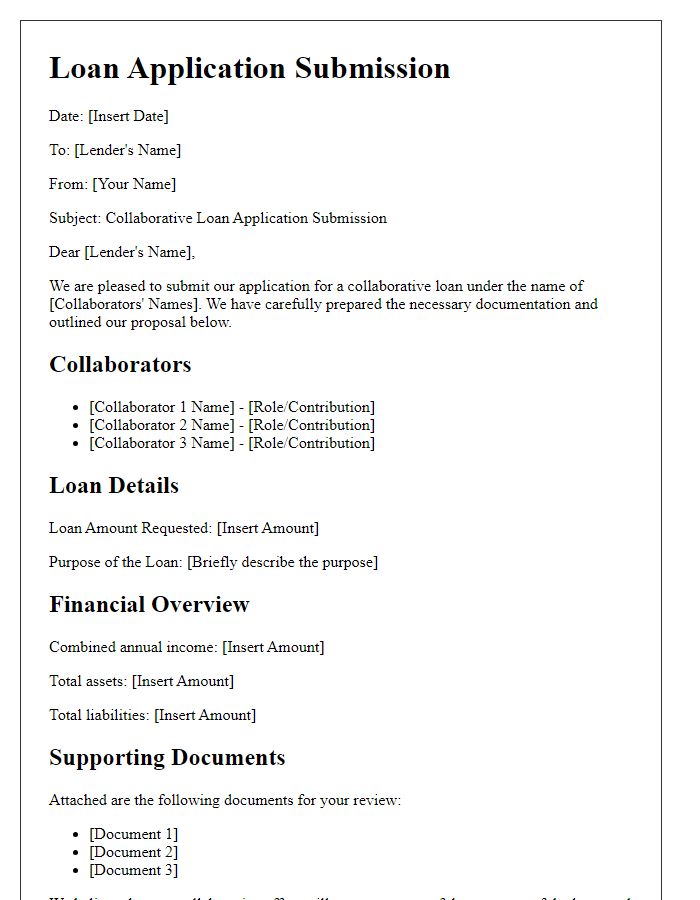

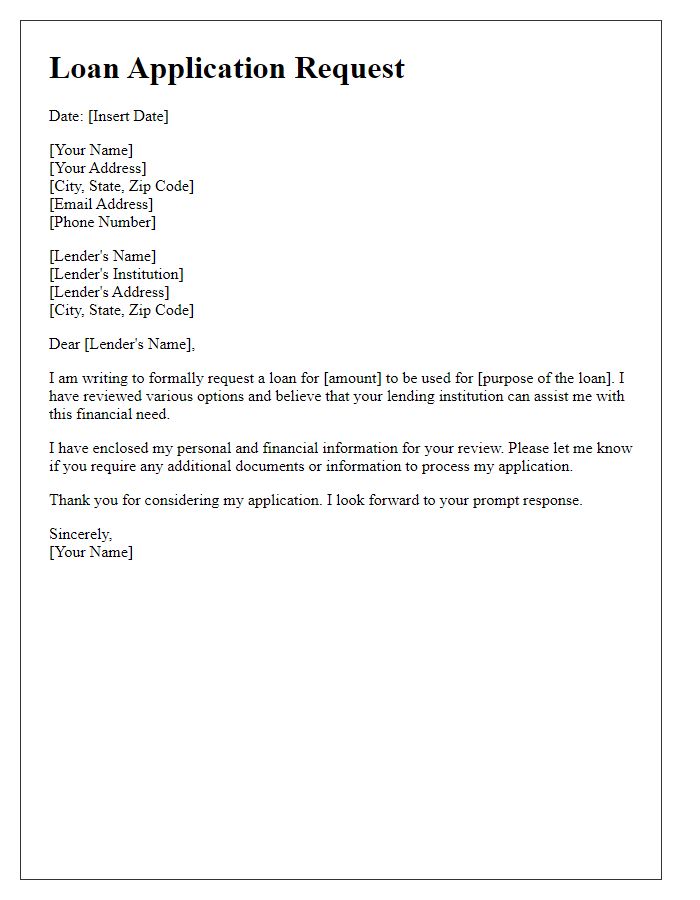

Applicant Information

The joint loan application process requires comprehensive applicant information to streamline the evaluation. Each individual must provide personal details such as full names, Social Security numbers, and dates of birth for identity verification. Address history, including current residence and previous addresses over the last five years, is essential for assessing stability. Employment information should include job titles, employers' names, employment durations, and monthly incomes to demonstrate financial reliability. Additionally, both applicants must disclose any existing debts, financial obligations, and credit scores to evaluate creditworthiness accurately. This thorough submission ensures the lending institution can make informed decisions regarding the loan approval.

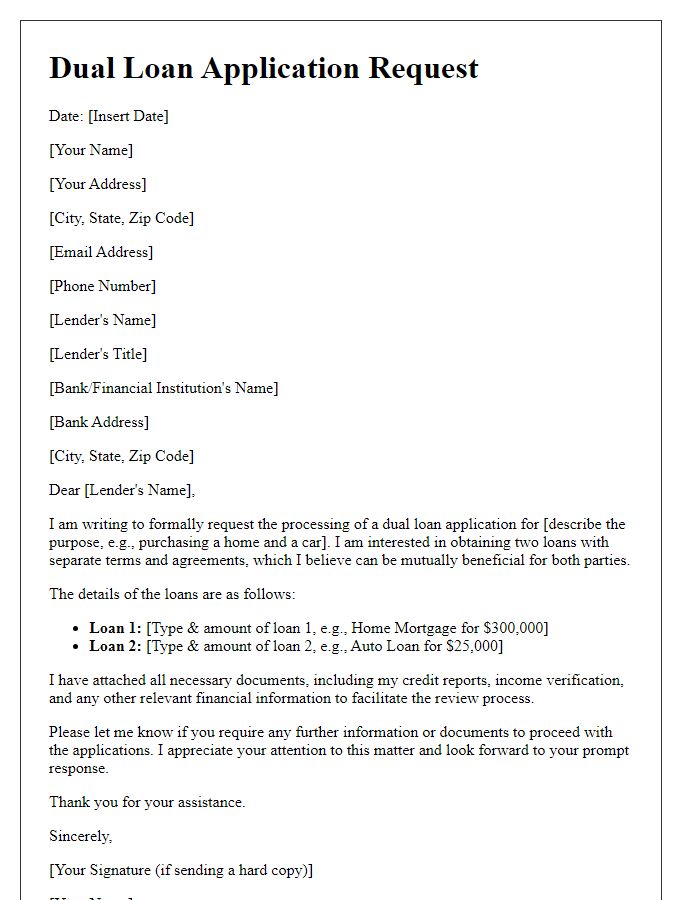

Loan Purpose and Amount

In securing a joint loan, applicants typically specify the loan purpose, which could range from purchasing a home, such as a single-family residence valued at $300,000, to consolidating debt with an amount of $20,000. Clarity in the intended use of funds ensures lenders understand the financial objectives. For instance, home renovation projects may warrant a loan of $50,000 to finance kitchen upgrades and roof repairs, while education expenses might require a $30,000 borrowing to cover tuition fees for a four-year degree at a prestigious university. Loan amounts must align with both parties' financial profiles, ensuring they meet lender criteria for income and creditworthiness, often represented by credit scores above 700.

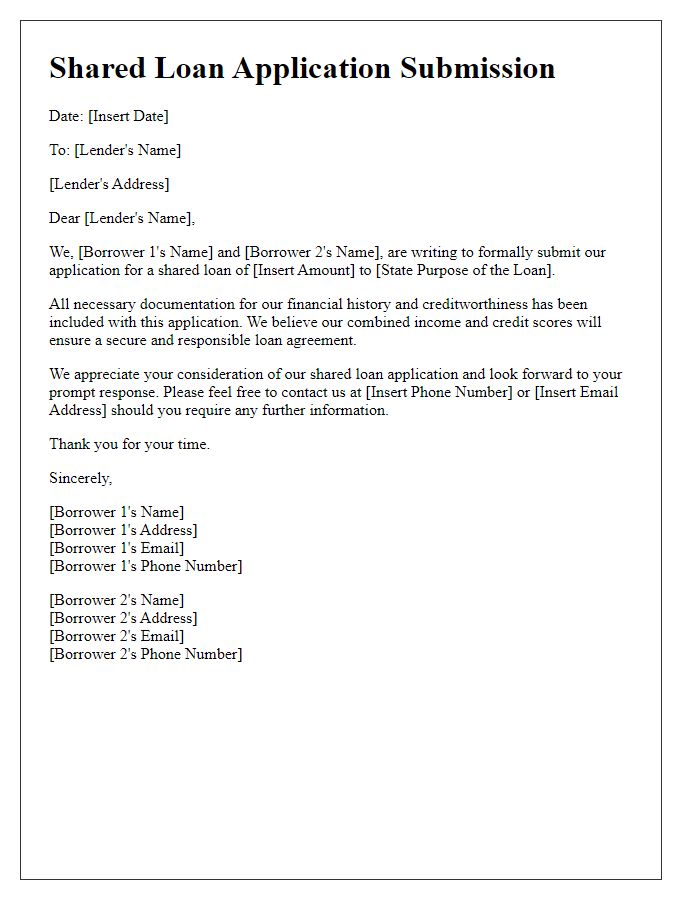

Repayment Terms

Repayment terms for joint loan applications typically involve specific conditions outlining the amount, frequency, and duration of payments. Monthly installments usually occur on a predetermined date, aligning with the loan amount, which could range from $5,000 to $500,000 for personal or mortgage loans. Interest rates, which can vary based on credit scores and the lender, generally fall between 3% and 7%. The repayment period often spans from three to thirty years, depending on the loan type and lender's policies. Default consequences include potential foreclosure on property, significantly impacting credit scores, usually lowering them by 100-300 points. All co-borrowers share responsibility for repayment, ensuring clear communication about financial obligations and maintaining timely payments.

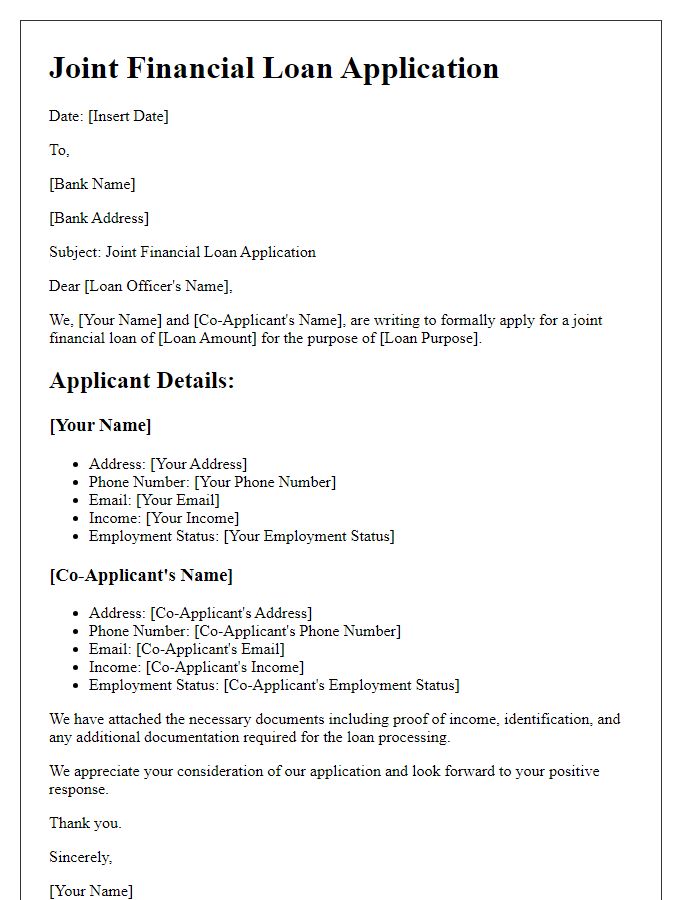

Financial Background

The financial background of a joint loan application involves several crucial elements that collectively determine eligibility and loan approval likelihood. Joint applicants typically include two or more individuals, often spouses or partners, combining their financial profiles for improved borrowing power. Key factors such as individual credit scores (ranges from 300 to 850), income levels (median household income in the USA reported at $70,784 in 2021), employment stability (over two years in the same role is often preferred), and existing debt-to-income ratios (ideally below 36%) play significant roles in assessing affordability. Furthermore, the history of financial transactions, including savings accounts (FDIC-insured institutions), investment portfolios (stocks, bonds), and any previous loan payment history, contributes to the overall financial picture. Financial institutions also analyze joint assets, including real estate property values (with Zillow reporting a median home price of $321,500 in 2021) and vehicles, to gauge total net worth, thereby influencing the loan conditions such as interest rates and repayment terms based on the perceived risk profile of the joint applicants.

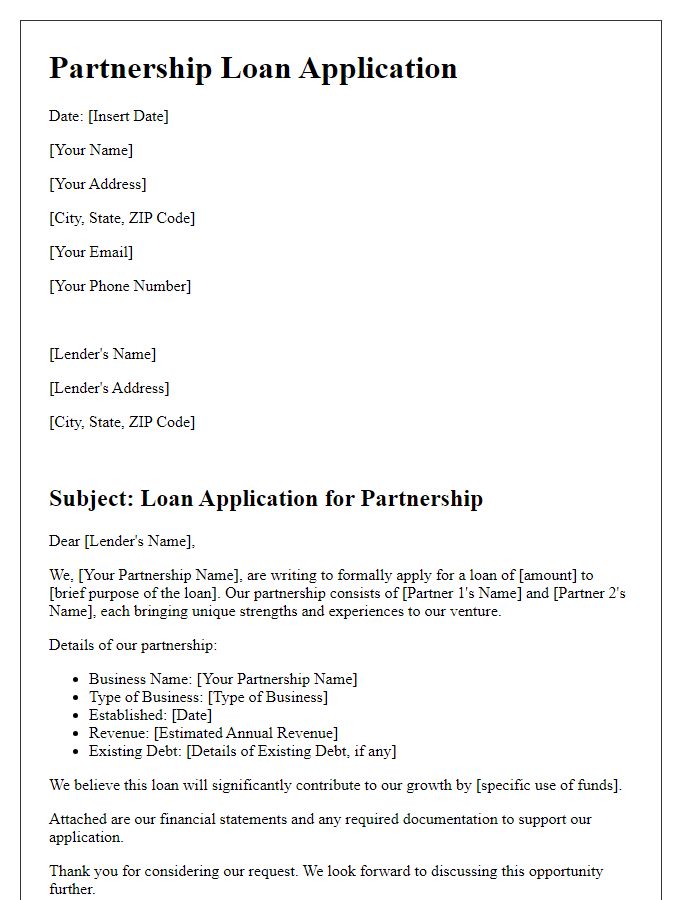

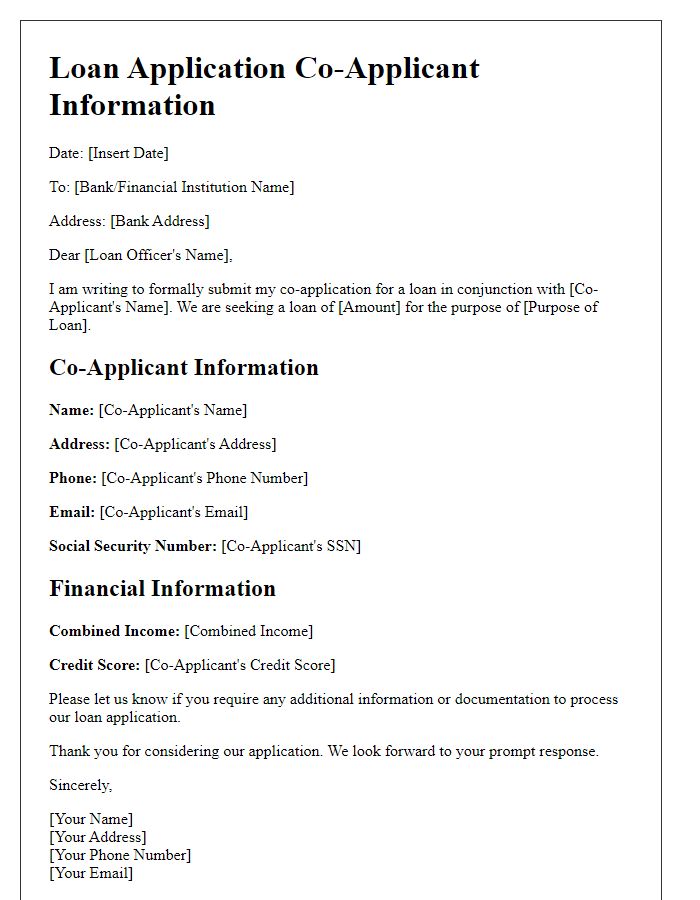

Co-applicant Details

A joint loan application typically includes essential information about both primary and co-applicants to assess creditworthiness for financial institutions, such as banks. Co-applicant details encompass full name (legal name as per identity documents), relationship to the primary applicant (e.g., spouse, business partner), date of birth (to determine age and eligibility), and Social Security Number (for credit checks). Additional information includes residential address (current living situation), employment status (current job role and employer details), annual income (to evaluate borrowing capacity), and any existing debts (loans or credit obligations already held). This comprehensive overview assists lenders in making informed decisions regarding the joint loan application, impacting interest rates and approval chances.

Comments