Are you feeling overwhelmed by the thought of repaying your personal loan? You're not alone; many people find themselves in similar situations, navigating the waters of financial commitments. Crafting a clear and concise letter for loan repayment can ease the process and foster better communication with your lender. Join me as we explore effective strategies for writing a personal loan repayment letter that gets results!

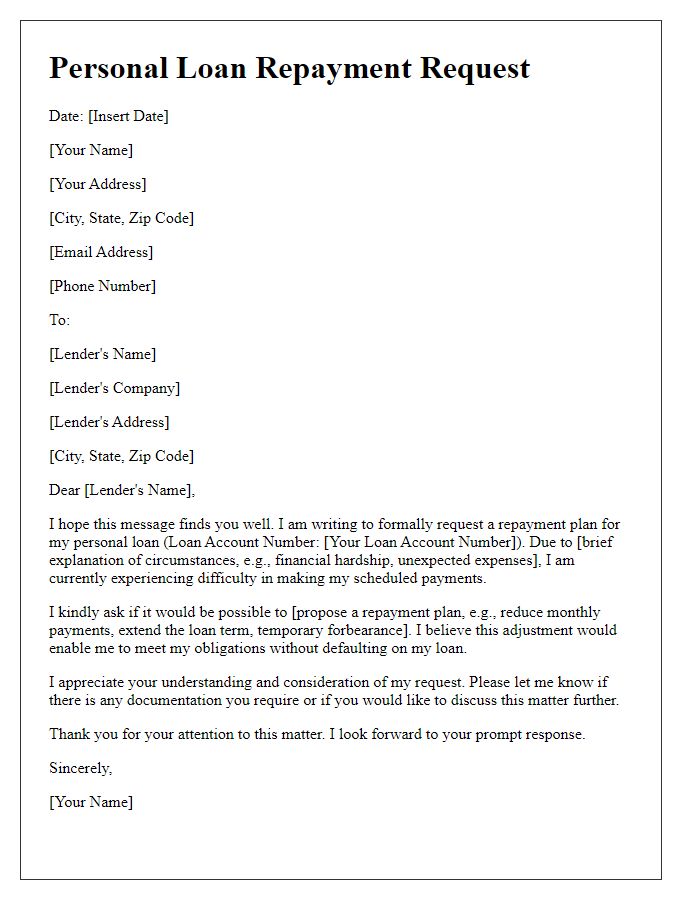

Borrower's Details

Borrower details are crucial in personal loan repayment processes. Full name often includes first name, middle initial, and last name to avoid any confusion. Contact information consists of phone numbers and email addresses to ensure timely communication regarding loan status. Residential address includes street number, street name, city, state, and zip code, providing a complete location for correspondence and records. Loan account number is unique to each borrower, distinguishing their specific loan terms and payment history. Date of loan disbursement is significant as it marks the beginning of the repayment schedule, while total loan amount specifies the principal sum borrowed. Monthly payment amount provides a clear expectation for future payments, aiding in budgeting. Lastly, payment due dates are critical as they establish the timeline for each repayment, preventing late fees and maintaining a positive credit score.

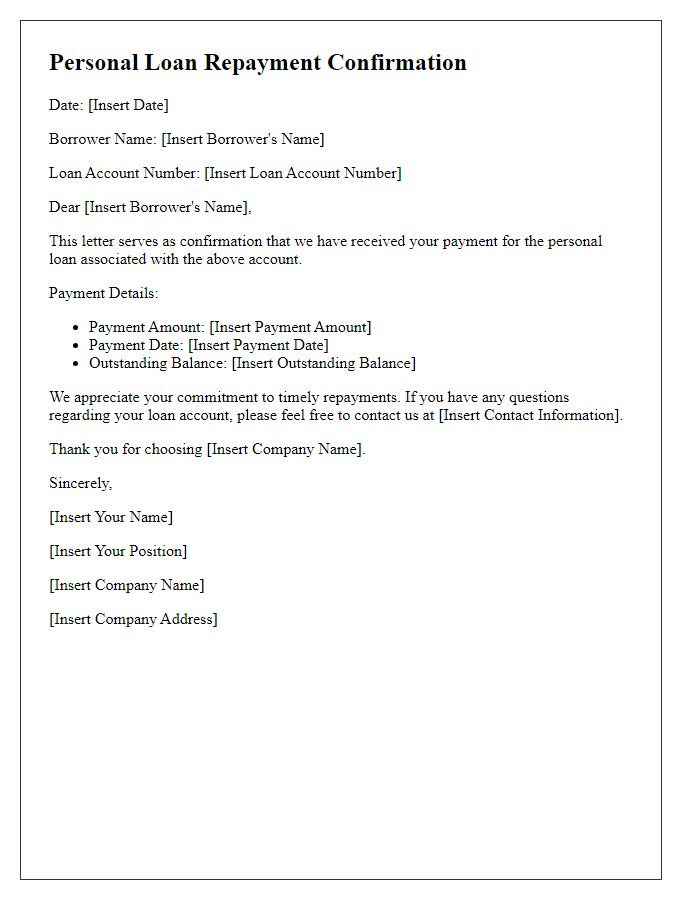

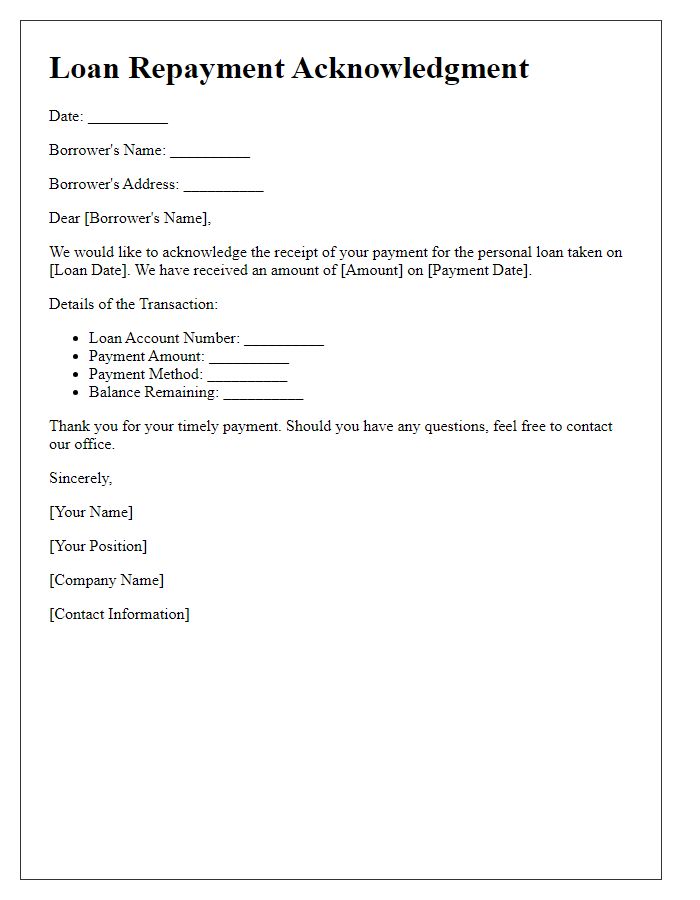

Loan Account Information

The Loan Account Information for personal loans typically includes details about the original loan amount, interest rate, repayment term, and outstanding balance. For instance, a common personal loan amount might be $10,000 with a 10% annual interest rate over a five-year term. Each month, the borrower might have a repayment obligation, roughly $212, including principal and interest. This information is crucial for maintaining awareness of repayment schedules and assessing any potential late fees after the loan's due date, which could negatively impact the borrower's credit score, recorded at agencies like Experian, Equifax, and TransUnion. Successful management of these loans is essential for long-term financial health.

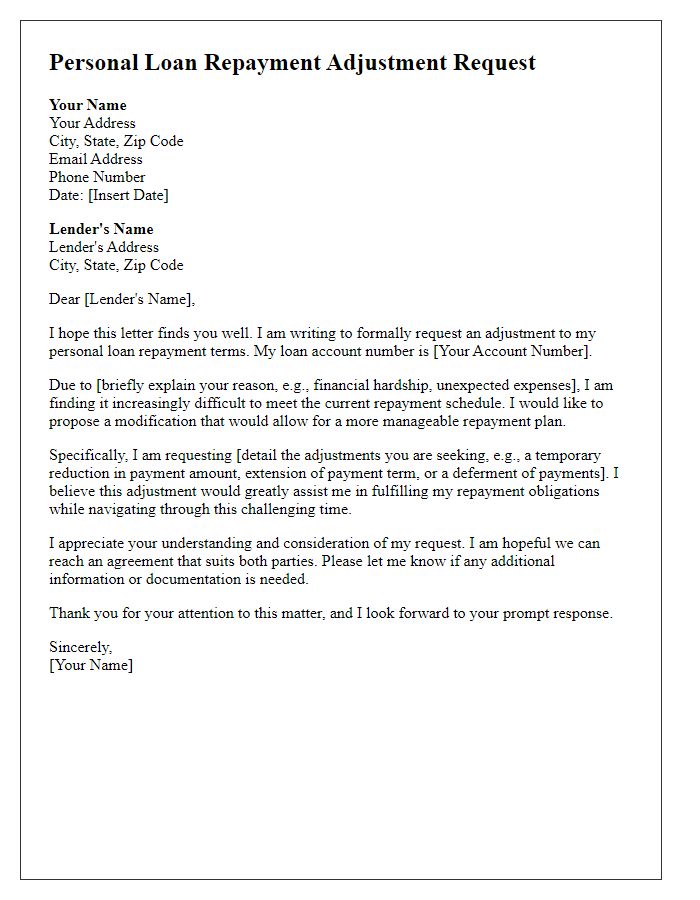

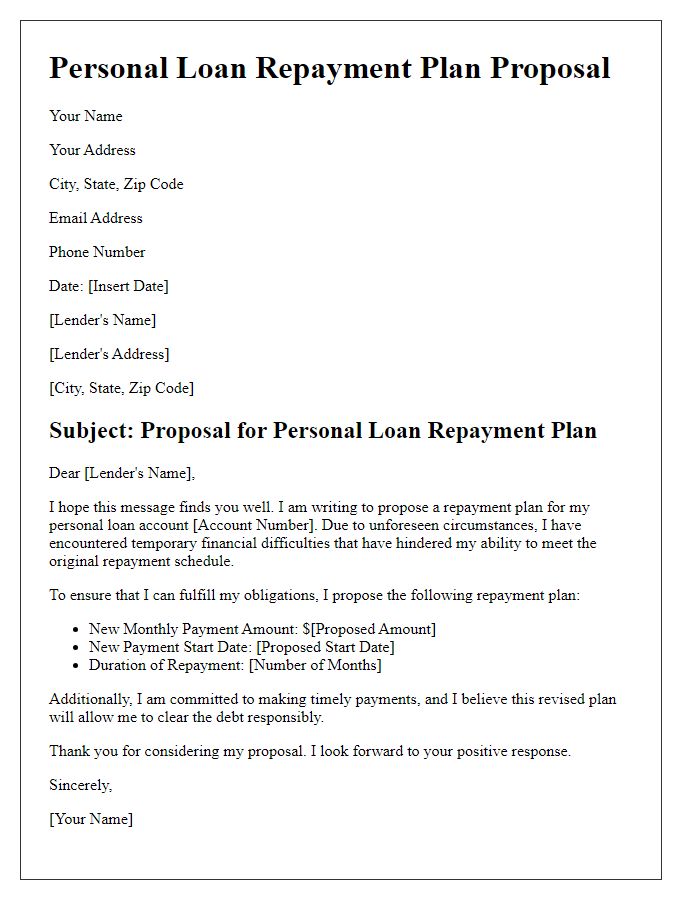

Repayment Plan

A personal loan repayment plan outlines the timeline and amounts required to repay borrowed funds effectively. Key components of this plan include total loan amount, for example, $10,000, interest rate, potentially 5% annually, and repayment duration of 5 years (60 months). Monthly payments might amount to approximately $188, ensuring manageable budgets for borrowers. Additional considerations include loan originators, such as banks or credit unions, and their specific repayment terms, often determining flexibility with early repayment options without penalties. Furthermore, tracking progress against allocated milestones can enhance financial discipline and assist in maintaining positive credit history metrics.

Payment Method

Personal loan repayment options include various methods suitable for different financial situations. Borrowers can utilize automatic bank transfers, ensuring timely payments directly from checking or savings accounts to loan servicers. Online payment platforms provide flexibility, allowing users to settle their dues securely via credit or debit cards. Mobile banking apps can facilitate quick transactions, often providing reminders for upcoming payments. Additionally, in-person payments at designated financial institutions can cater to those who prefer direct interactions. Understanding each method's fees, processing times, and convenience can greatly assist in managing loan repayments effectively.

Contact Information for Queries

Personal loan repayment processes often require clear communication with lending institutions to address any concerns. Financial institutions, such as banks and credit unions, typically provide contact information for queries related to payment schedules, outstanding balances, or changes in repayment plans. Phone numbers may vary by department, often established for customer service or loan servicing inquiries, available during business hours (e.g., 9 AM to 5 PM on weekdays). Email addresses, commonly formatted with the bank's domain, serve as an alternative for written inquiries. Additionally, many institutions offer secure online portals, allowing borrowers to access their accounts, view payment history, or initiate direct communication with loan advisors. Ensuring accurate and readily accessible contact information facilitates efficient resolution of payment issues.

Comments