Are you eagerly waiting for the good news about your loan application? Getting a loan approval can be an exciting yet nerve-wracking experience, as it often means taking a significant step toward achieving your financial goals. In this article, we'll explore sample templates that can help you craft a professional and concise loan approval confirmation letter. So, let's dive in and ensure you have everything you need to communicate effectively!

Borrower's Details: Name, Address, Loan Account Number

Loan approval confirmation provides essential information about the borrower's details, including Name, Address, and Loan Account Number. The borrower's Name represents the individual or entity responsible for repaying the loan. Address refers to the residential or operational location associated with the borrower, critical for identification purposes. Loan Account Number is a unique identifier assigned to the specific loan, allowing tracking and management within the lending institution's financial systems. This information is vital in formal communications regarding the approval status and terms of the loan.

Loan Details: Loan Type, Amount, Interest Rate, Term Duration

Loan approval confirmation signifies a critical financial milestone for individuals or businesses seeking funding. Specifics of the loan generally include key elements such as Loan Type, which may vary from personal loans, mortgages, or business loans, reflecting the purpose of the financing. The Amount usually indicates the total funds requested, often ranging from a few thousand to millions of dollars, depending on the borrower's needs and creditworthiness. Interest Rate represents the percentage cost of borrowing, which can fluctuate based on market conditions or borrower qualifications, impacting overall repayment amounts. Term Duration defines the period over which the loan is to be repaid, commonly spanning from a few months to several decades, affecting monthly payment amounts and total interest paid over the life of the loan. Understanding these details is crucial for effective financial planning and management.

Repayment Schedule: Payment Due Dates, Payment Amounts

Loan approval confirmation details the terms of repayment, including structured schedules, specific due dates, and exact payment amounts. A repayment schedule outlines the timeline for loan payments, typically set monthly, starting from the first payment date, usually specified in the loan documentation. For example, a personal loan of $10,000 with a fixed interest rate of 5% per annum may require monthly payments of approximately $188.71 over a span of 60 months. This structured plan ensures timely payments, establishing a clear financial roadmap for borrowers. Detailed records of due dates, for instance, the 1st of each month, allow for better budgeting and financial planning. The consistent payment amount aids in reducing financial uncertainty.

Conditions and Terms: Any Specific Conditions, Legal Terms, Policies

Loan approval confirmation signifies a formal agreement between the lender and borrower, outlining specific conditions and terms that must be adhered to during the borrowing period. Key conditions might include the loan amount (e.g., $50,000), interest rate (typically ranging from 3% to 7%), repayment schedule (such as monthly installments for 5 years), and any associated fees like origination fees or late payment penalties. Legal terms may involve covenants that restrict certain actions (like selling assets or incurring additional debt without approval) and specify collateral requirements if applicable. Policies regarding default procedures and dispute resolution mechanisms are also important, detailing how grievances will be handled, often through arbitration or mediation in line with local laws. Understanding these details ensures informed decision-making throughout the loan process.

Contact Information: Customer Service, Loan Officer Details

Loan approval confirmation serves as an official notification to clients regarding the successful approval of their loan applications. Typically issued by financial institutions, this communication includes essential details such as the loan amount (e.g., $50,000), interest rate (such as 3.5%), repayment period (e.g., 15 years), and any applicable conditions or requirements. Key contact information, including the customer service helpline (e.g., 1-800-555-0199) and the loan officer's details (name, email, and direct phone number), facilitates further inquiries or clarifications. Additionally, understanding the implications of loan approval and guidelines surrounding disbursement procedures is crucial for the client's financial planning and management.

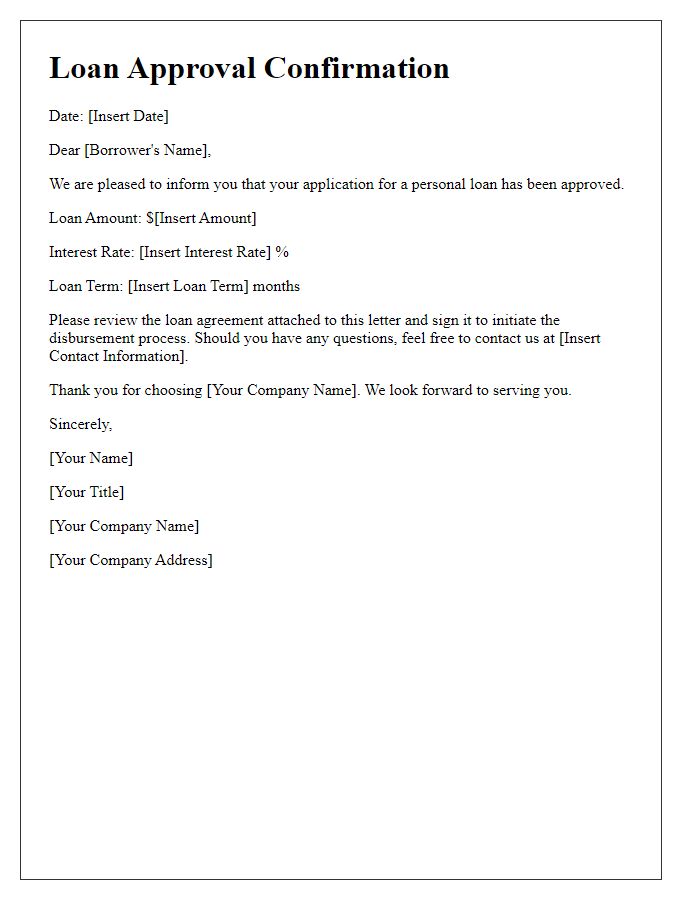

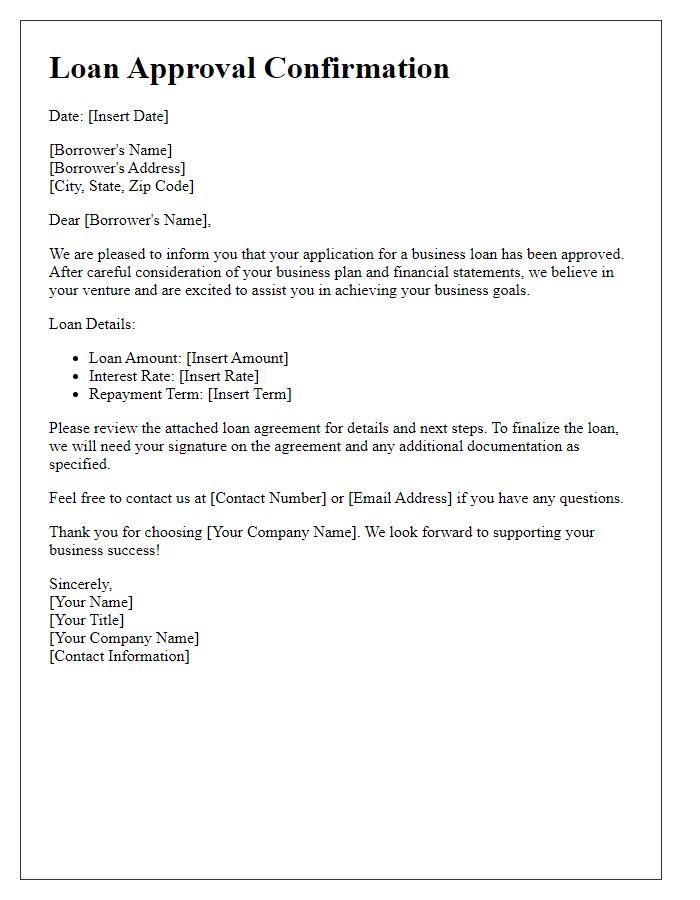

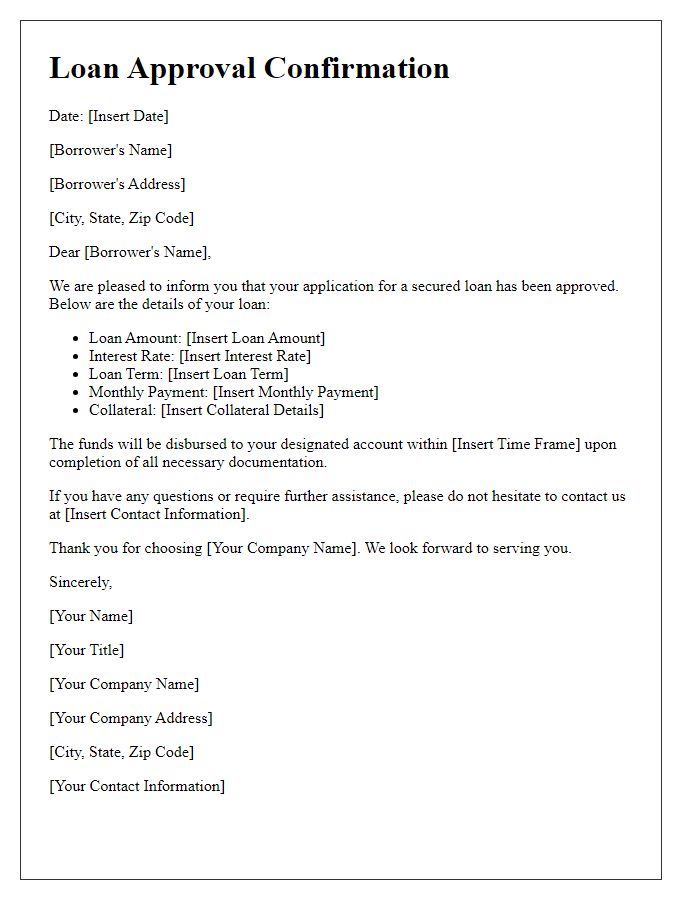

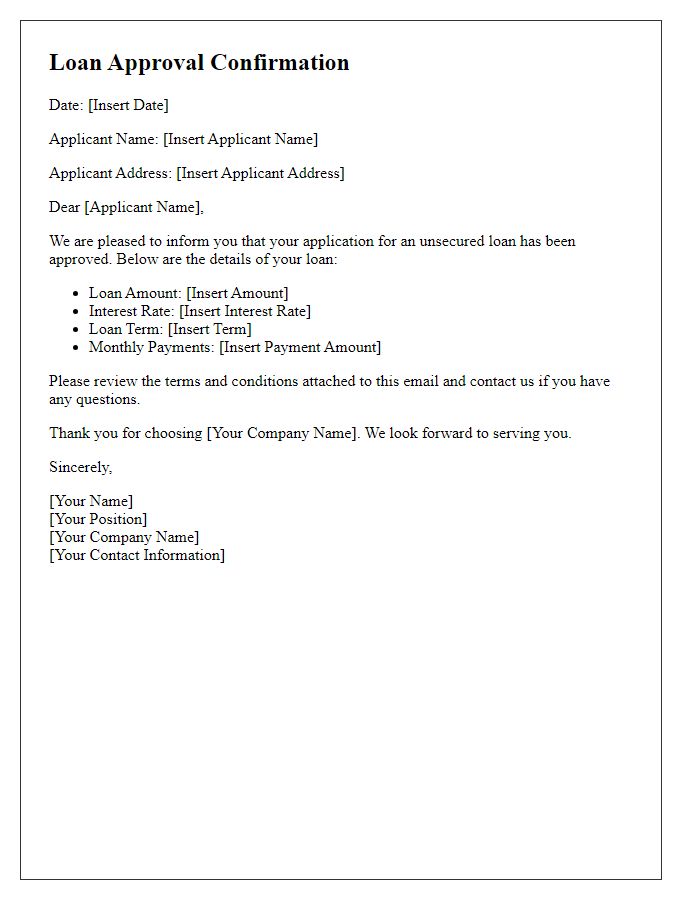

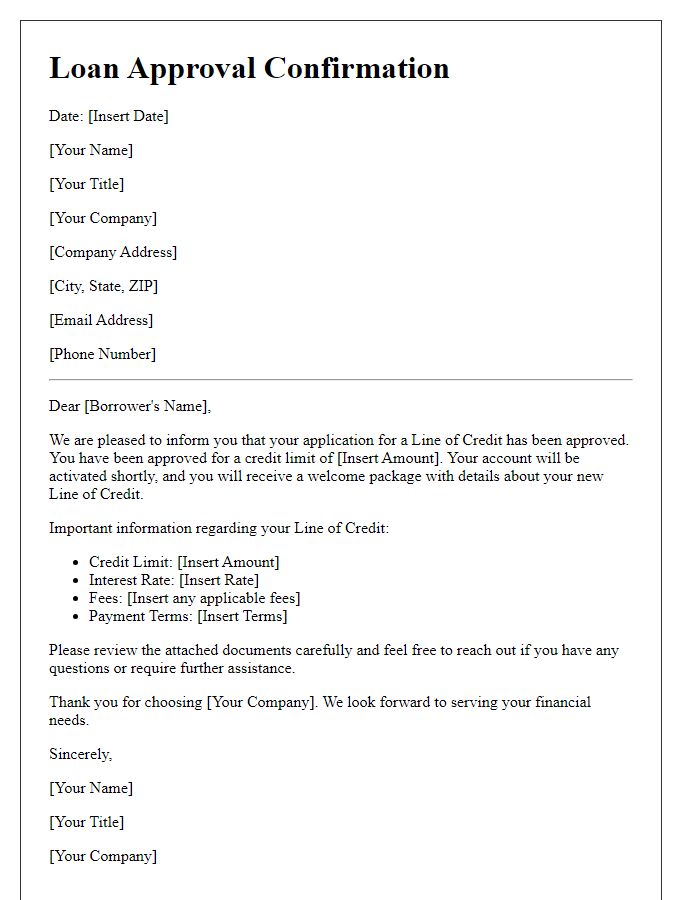

Letter Template For Loan Approval Confirmation Samples

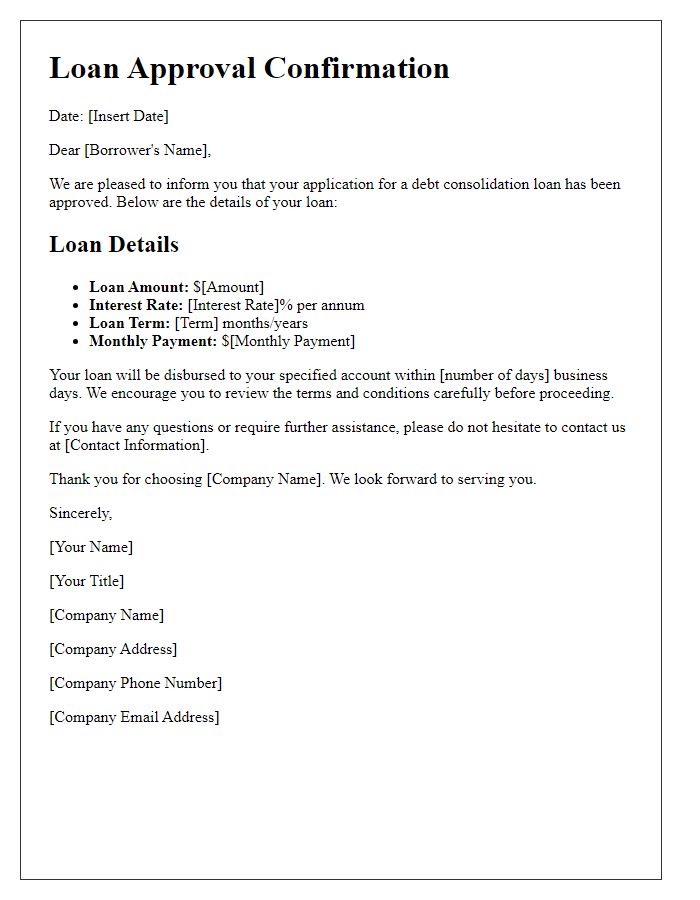

Letter template of loan approval confirmation for debt consolidation loans

Comments