Have you ever found yourself anxiously waiting for a payment that seems to be taking its sweet time? It can be frustrating and confusing, especially when you need clarity on the status of your funds. In this article, we'll explore the best approaches to inquire about your payment status, ensuring you get the answers you need without any unnecessary hassle. So, let's dive in and discover how to effectively communicate your concernsâkeep reading!

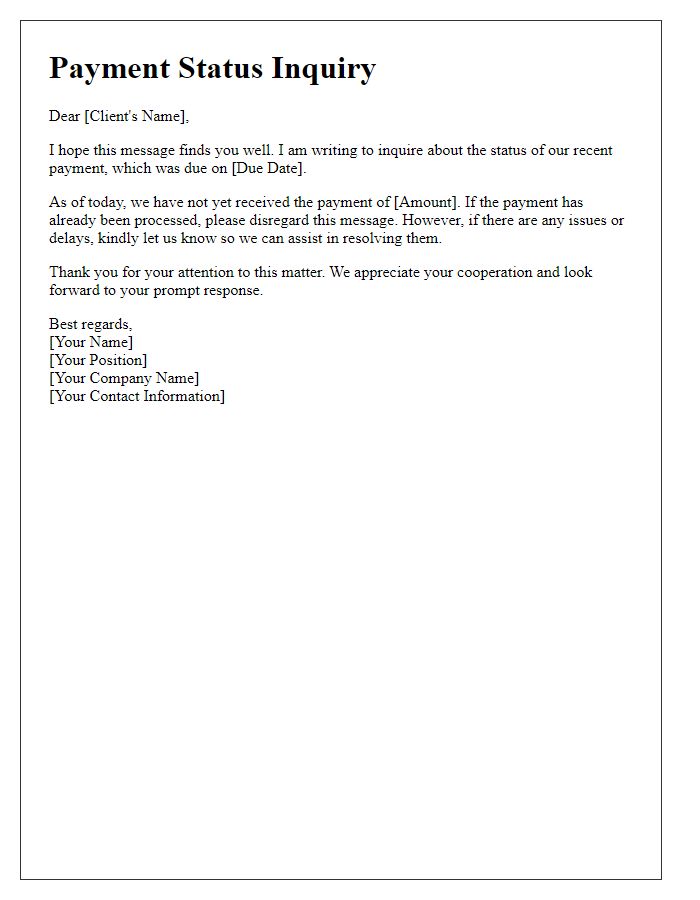

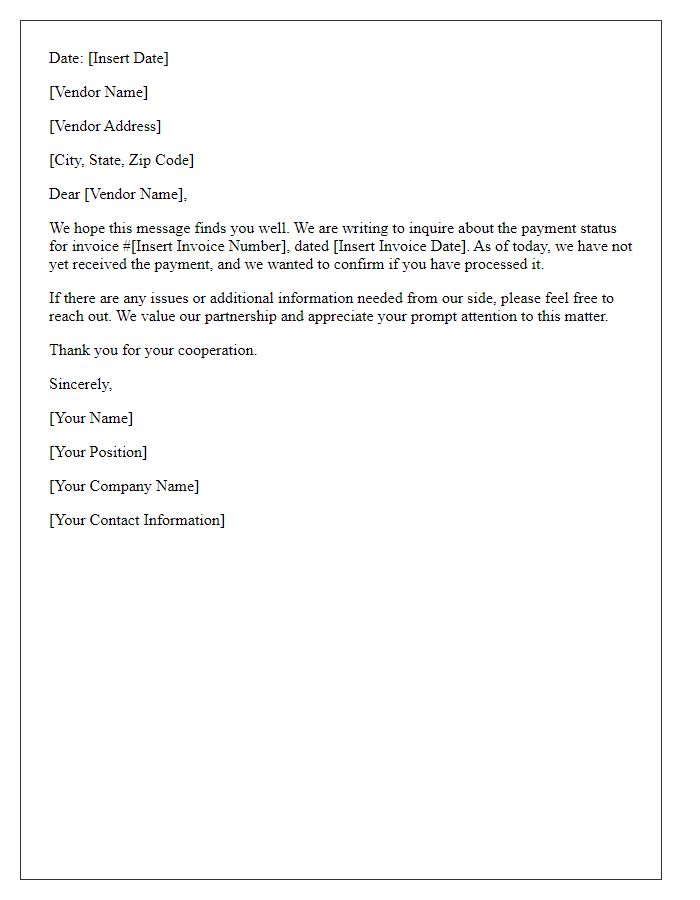

Polite and professional tone

A significant delay in the payment status can create challenges for both parties in any business transaction. For example, outstanding invoices often affect cash flow (a critical aspect of managing operations) and may require follow-up actions. The payment terms defined in contracts outline specific timelines for settlement, typically ranging from 30 to 90 days post-invoice issuance. Proactive communication, such as sending reminders via email or phone, is crucial to ensuring payments are processed on time. Using invoice management software can also streamline tracking, allowing better visibility into payment statuses and enhancing relationships with clients. Implementing these practices can result in improved financial stability for both businesses involved in the transaction.

Clear and concise language

The payment status for Invoice #12345, issued on October 1, 2023, is currently overdue, with a due date of October 15, 2023. As of today, October 20, 2023, the outstanding amount remains $1,000. Failure to process the payment has led to a temporary suspension of services. To avoid additional late fees (typically 1.5% per month), please address this matter promptly. Contact accounts receivable at accounts@yourcompany.com for further assistance or clarification.

Include payment details (amount, date, method)

The recent payment of $1,250 was successfully processed on October 15, 2023, using a bank transfer method from Account Number 123456789. The transaction reference for this payment is TRX789456. Receipt confirmation has been sent via email to enhance transparency in record-keeping. Please refer to this information for any further inquiries regarding this payment status.

Offer assistance or further clarification

Payment status inquiries often arise in business transactions, including services from companies like PayPal or Stripe. Clients may request updates regarding payments made for invoices, often referencing specific dates like October 5, 2023. Companies usually provide a detailed response regarding transaction timelines, such as processing times ranging from 3 to 5 business days. Key factors influencing payment status include bank processing times, payment methods utilized (credit cards versus bank transfers), and the amount involved. Additionally, customer service contacts may be provided for direct assistance and clarification on complex cases.

Contact information for follow-up

Inquiries regarding payment status often require clear and accessible contact information for effective follow-up. Providing a dedicated email address, such as payments@companyname.com, enables direct communication with the finance department. Including a phone number, like +1-800-555-0199, allows for immediate assistance. Furthermore, listing the business hours, for instance, Monday to Friday from 9 AM to 5 PM EST, ensures that clients know the best times to reach out. Additionally, including a reference number tied to the payment can expedite the inquiry process, helping representatives locate specific transaction details more efficiently.

Comments