Are you considering a Home Equity Line of Credit (HELOC) but feeling overwhelmed by the interest rate options available? You're not aloneânavigating the world of HELOCs can be a bit tricky, especially when it comes to understanding how different rates can impact your financial goals. This article will break down various interest rates, helping you make an informed decision that suits your needs. So, let's dive in and discover the best HELOC interest rates for you!

Loan amount and terms

When evaluating Home Equity Lines of Credit (HELOC), borrowers must consider several key factors, including interest rates, loan amounts, and terms. Typical loan amounts range from $10,000 to $500,000, depending upon the home's market value and the equity available. Interest rates for HELOCs usually vary between 3.5% to 7.5%, and these rates can be either variable or fixed. Terms typically extend between 5 to 30 years, with an initial draw period of 5 to 10 years, followed by a repayment period often lasting 10 to 20 years. Understanding these variables can significantly impact the overall cost and sustainability of the HELOC over time. Additionally, fees may apply, such as appraisal fees, closing costs, and annual fees, which can influence the total expense associated with the loan.

Interest rate and APR

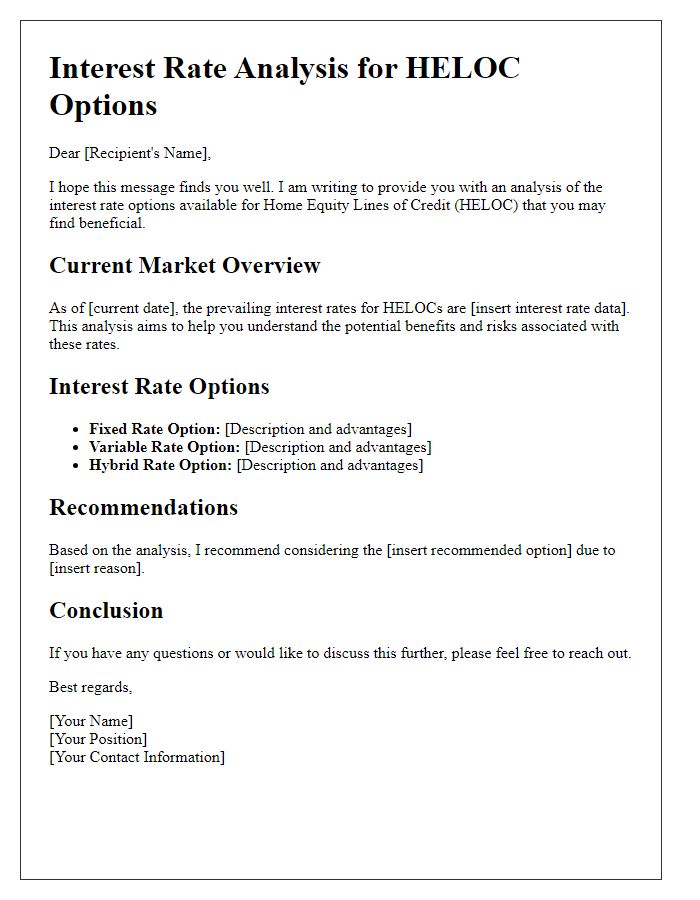

When comparing Home Equity Line of Credit (HELOC) offerings, consider interest rates (the cost of borrowing expressed as a percentage) and Annual Percentage Rate (APR, which includes interest and additional fees). Typical interest rates for HELOCs can range from 3% to 7%, influenced by factors such as the lender's policies and the borrower's credit profile. Understanding the difference between a variable interest rate and a fixed interest rate is crucial; variable rates can change based on market conditions, whereas fixed rates remain constant throughout the loan period. Additionally, the APR provides a more comprehensive picture, accounting for associated costs like closing fees and maintenance charges, which may vary significantly between lenders. Evaluating both the interest rate and APR enables borrowers to make informed decisions and choose the most cost-effective HELOC option tailored to their financial needs.

Fees and closing costs

Home Equity Lines of Credit (HELOC) offer homeowners a flexible borrowing option using their property's equity. When comparing HELOC interest rates, it's essential to consider fees and closing costs that can impact the overall cost. Typical fees include origination fees, ranging from 0% to 2% of the line amount, and appraisal fees, which can range from $300 to $700 depending on the property location and size. Lender requirements may also include attorney fees or title insurance charges, often totaling $500 to $1,500. Closing costs, such as credit report fees (approximately $20 to $50) and recording fees (ranging from $50 to $100), should be factored into the calculation of the overall expense. Analyzing these costs alongside interest rates can significantly affect the borrowing decision for a HELOC.

Repayment flexibility and options

Home Equity Lines of Credit (HELOC) provide borrowers with a flexible borrowing option, allowing access to funds based on home equity. Unlike traditional loans, HELOCs typically operate on variable interest rates, which can vary significantly among lenders. This variability (often ranging from 3% to 8% annually) impacts repayment schedules and overall cost. Key features include interest-only repayment periods that can last up to ten years, followed by a fixed repayment period where principal and interest must be paid. Borrowers may choose to make interest-only payments initially, which may aid cash flow management. However, this option could lead to larger payments later when transitioning to the principal repayment phase. Understanding these repayment terms and interest rate structures is crucial when comparing different HELOC offers, ensuring the selected option aligns with financial goals and budgeting capabilities.

Lender reputation and customer service

When evaluating Home Equity Line of Credit (HELOC) options, lender reputation plays a significant role in decision-making. Established institutions such as Bank of America (founded in 1904) and Wells Fargo (founded in 1852) are known for their reliability and consumer trust, reflected in various industry awards. Customer service quality, including responsiveness and support accessibility, is crucial. Online platforms like LendingTree provide user reviews and ratings that highlight customer experiences. Additionally, regulatory bodies such as the Consumer Financial Protection Bureau (CFPB) monitor complaints, offering insights into lender practices. Comparing different providers on these attributes ensures informed choices when selecting a HELOC.

Letter Template For Heloc Interest Rate Comparison Samples

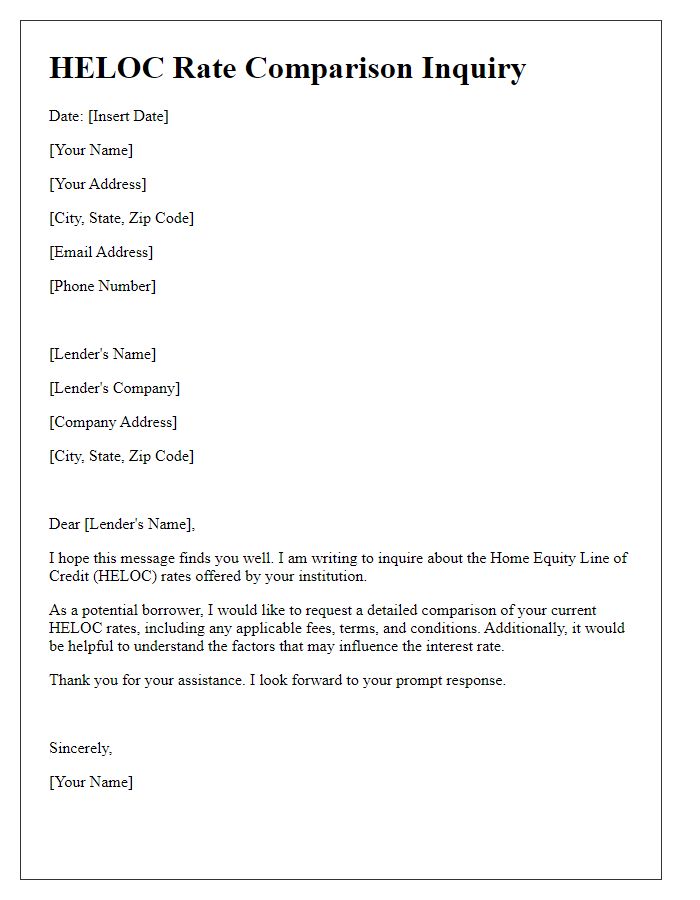

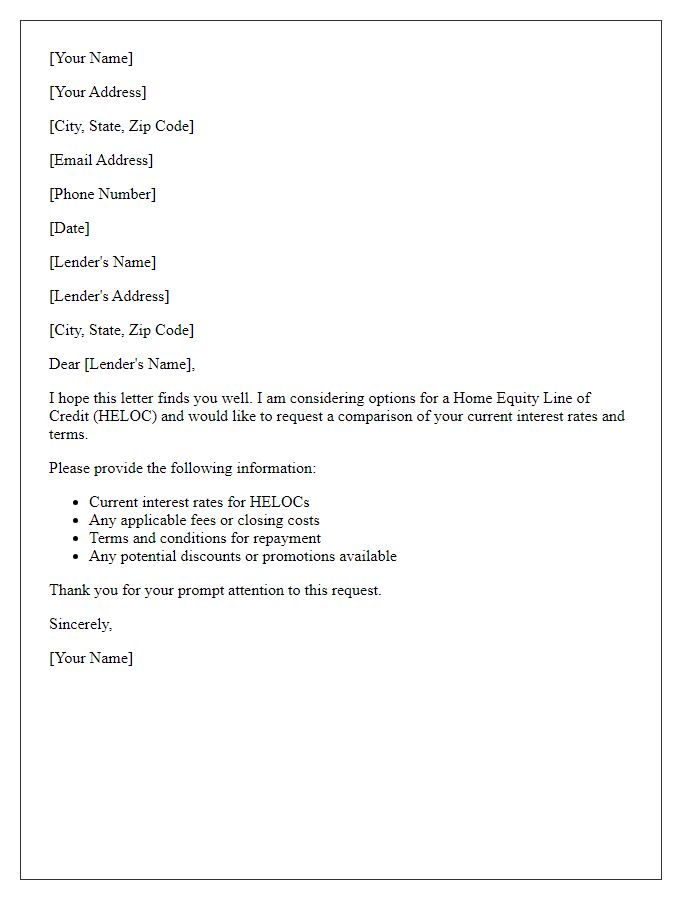

Letter template of HELOC Interest Rate Request to Multiple Financial Institutions

Comments