Hey there! If you're looking for clarity on your escrow account, you've come to the right place. Understanding these statements can be a bit tricky, but they're essential for keeping track of your finances and ensuring everything is in order. Ready to dive deeper and get all the insights you need? Let's explore the details together!

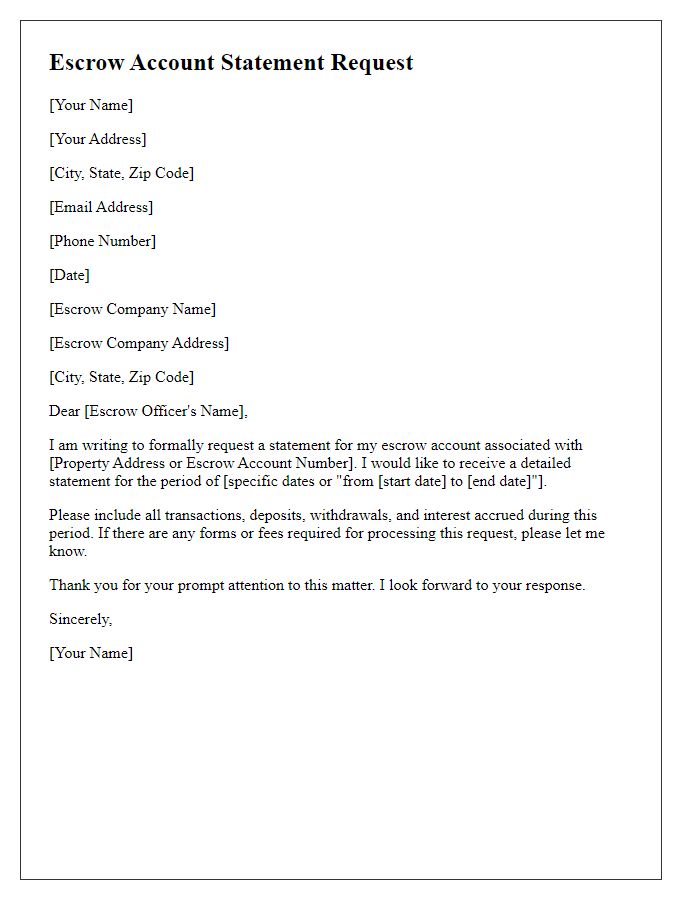

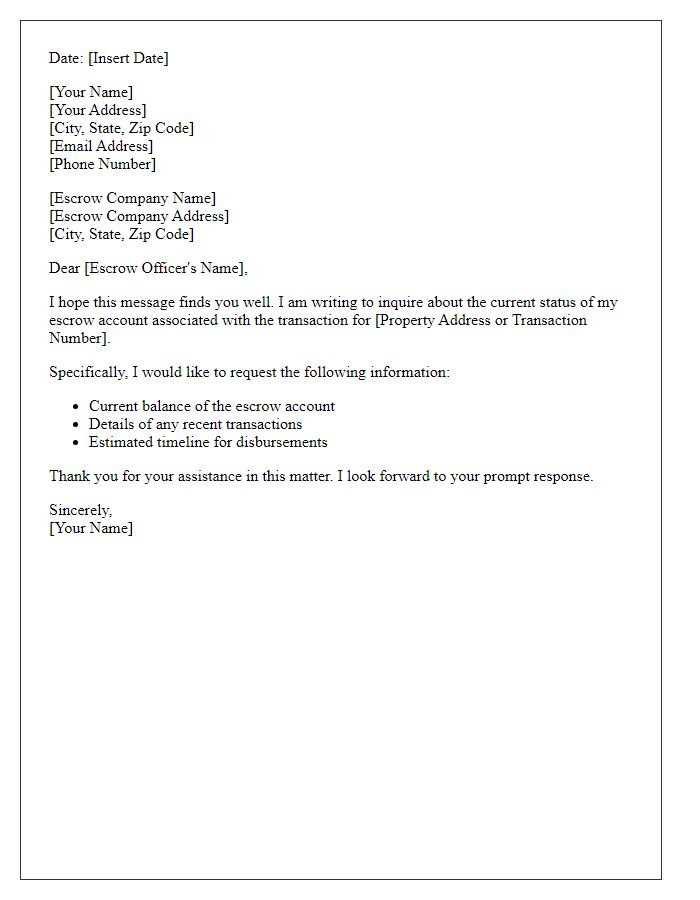

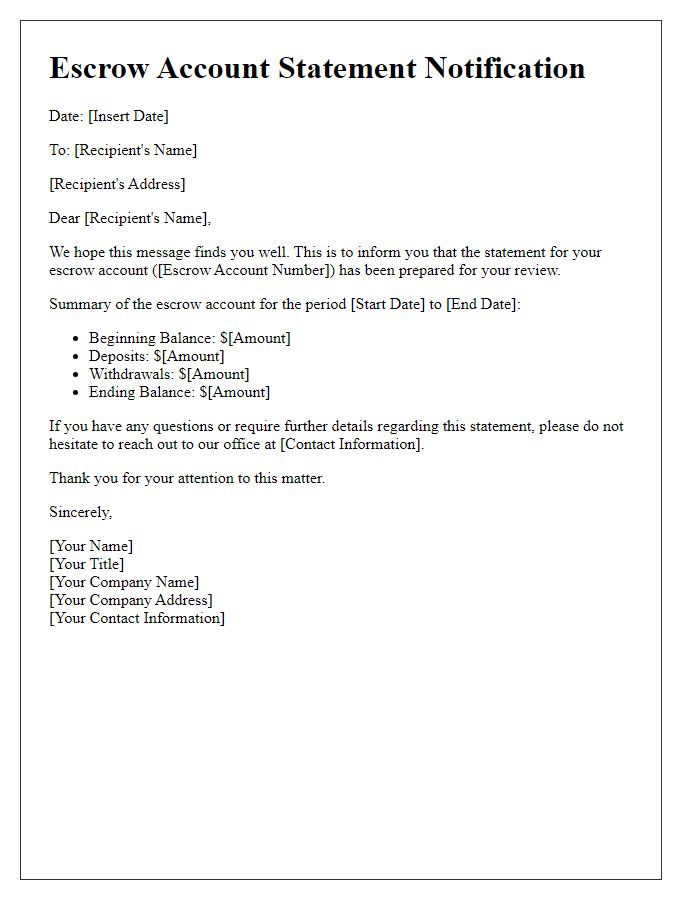

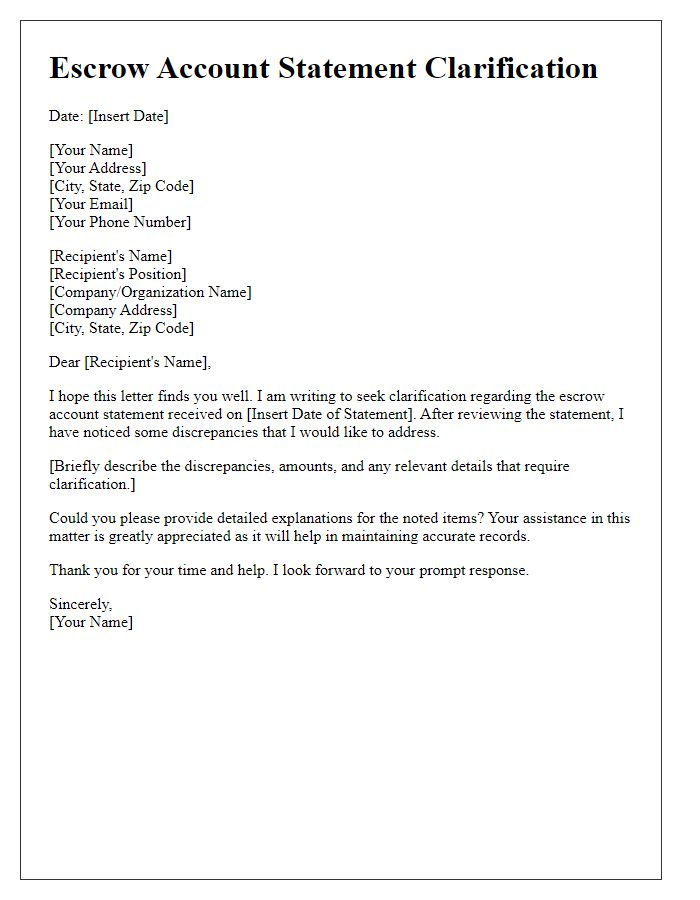

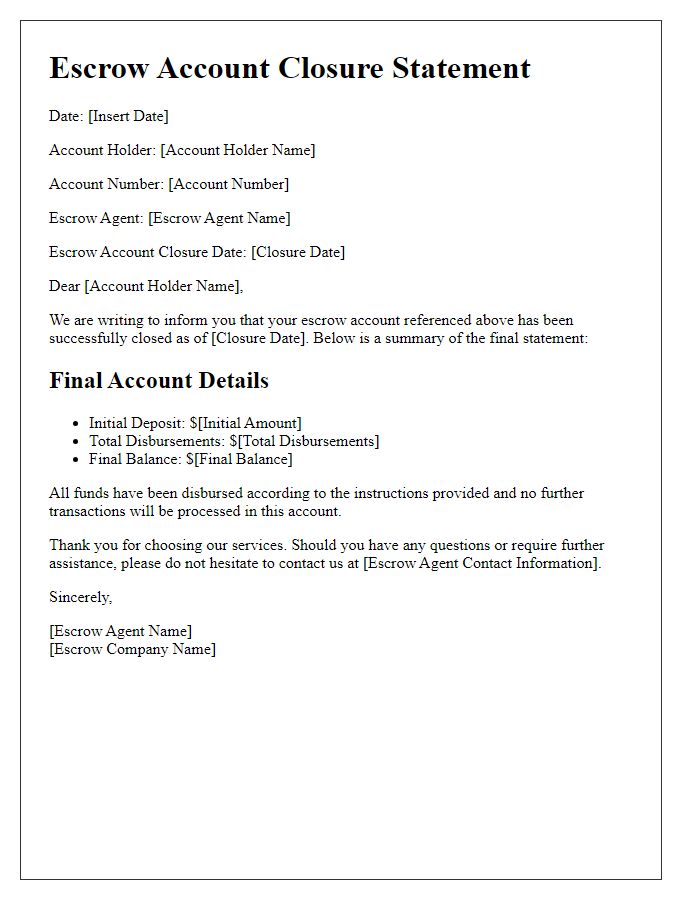

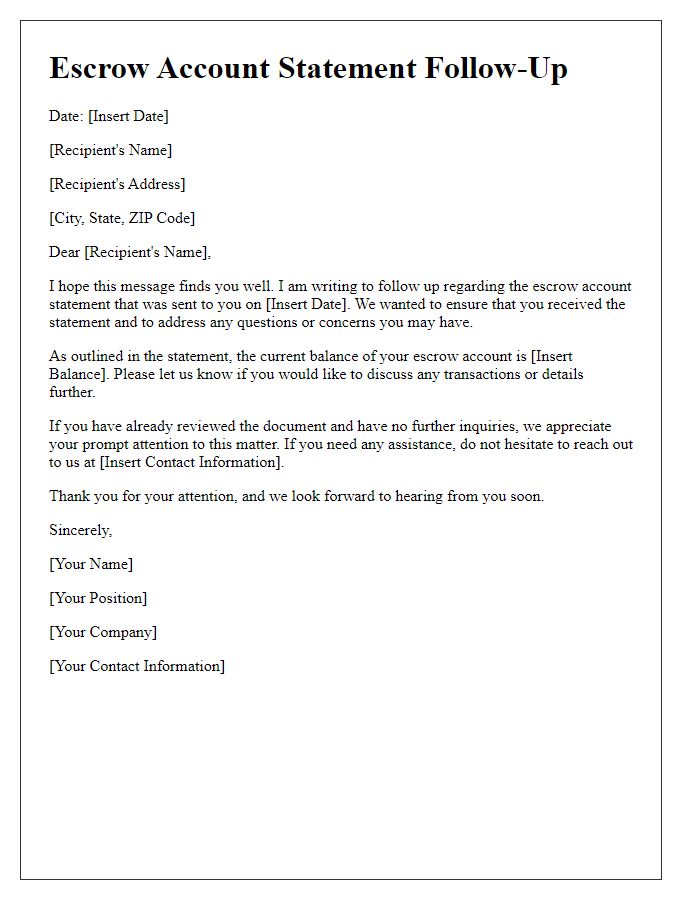

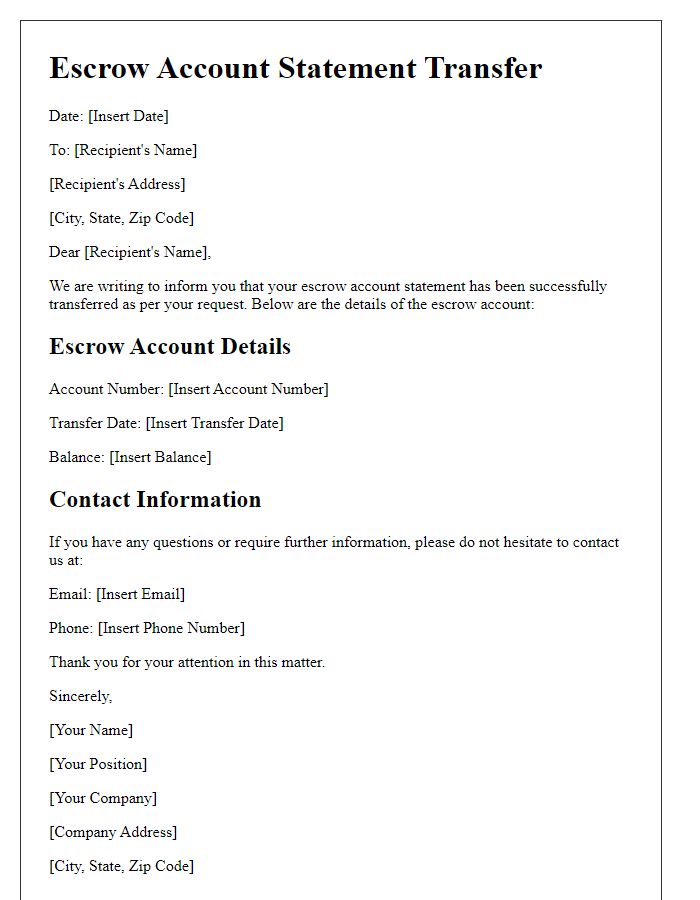

Salutation and Contact Information

Escrow accounts serve as neutral financial arrangements, often utilized in real estate transactions, ensuring that funds are securely held until contractual obligations are fulfilled. These accounts may involve large sums, such as down payments (typically ranging from 3% to 20% of the property value), and are managed by escrow agents, who oversee the distribution of funds, pertinent documents, and provide ongoing updates. Regular statements detail balances, disbursements, and any accrued interest, ensuring all parties involved have clear insight into financial status. It is crucial for stakeholders, including buyers, sellers, and real estate agents, to monitor these updates during the duration of the escrow period--often lasting 30 to 60 days--maintaining transparency and trust throughout the transaction process.

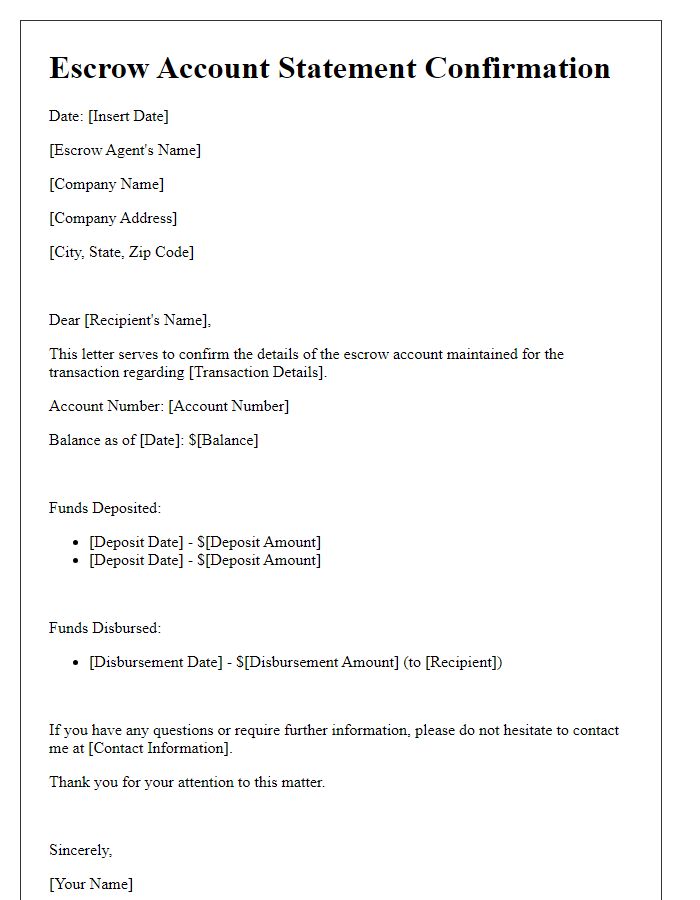

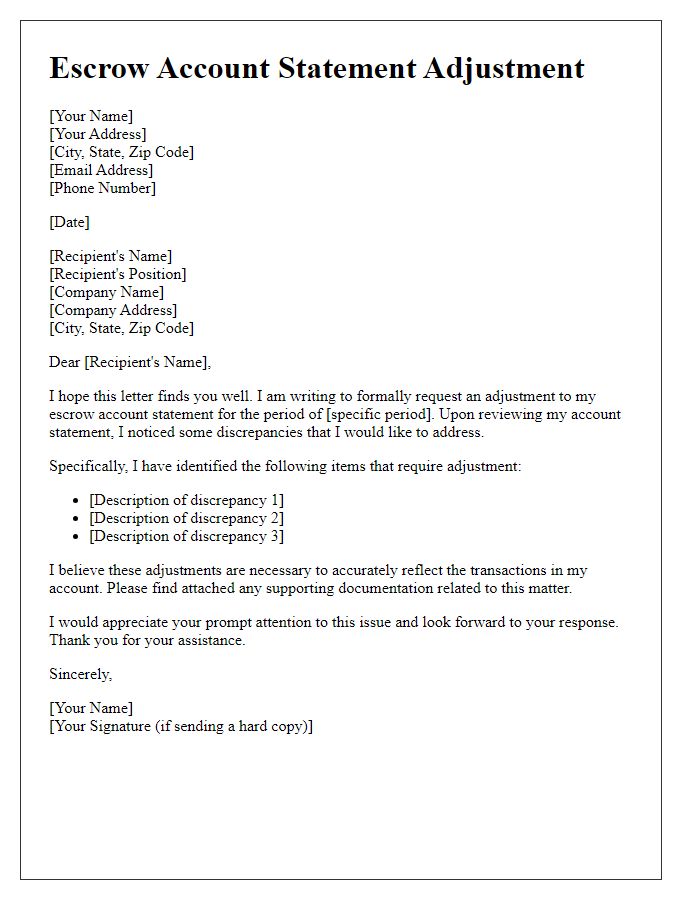

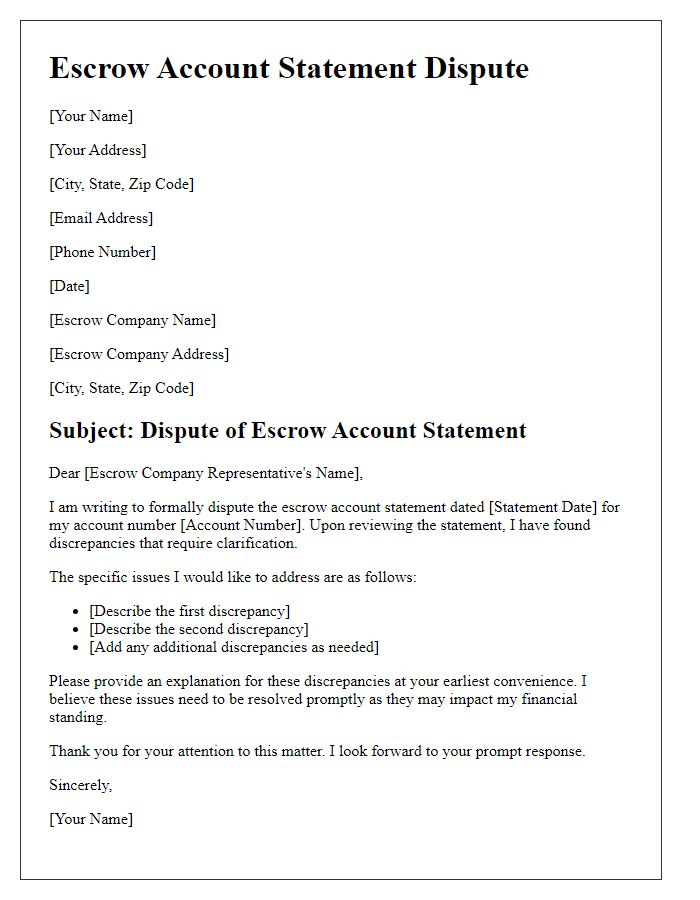

Account and Transaction Details

Escrow account statements provide crucial financial updates for managed funds, typically held in a third-party account during real estate transactions or legal agreements. Each statement should include essential account details such as the account holder's name, account number, and the institution managing the escrow account. Transaction details encompass the date, description, and amounts for deposits and withdrawals, with some transactions possibly linked to specific properties or agreements, such as real estate closings involving significant sums, often ranging from thousands to millions of dollars. Additionally, the closing balance at the end of the statement period must be recorded, ensuring all parties maintain a clear understanding of the funds' flow during the transaction process.

Statement Date and Period

An escrow account statement provides crucial financial information regarding transactions held in a trust until conditions are met. The statement date, such as October 1, 2023, marks the day the statement is created, reflecting the current account balance and transaction history. The statement period represents the timeframe, for example, July 1, 2023, to September 30, 2023, during which activities such as deposits, withdrawals, and disbursements occur. Understanding these details ensures transparency for all parties involved in the escrow agreement, often pertinent in real estate transactions, insurance claims, or business deals, emphasizing the importance of tracking funds accurately.

Summary of Deposits and Withdrawals

An escrow account statement update provides a detailed overview of financial transactions, essential for transparency and accurate record-keeping. The summary includes total deposits, which may consist of earnest money, insurance premiums (such as home insurance), or property taxes, often collected during significant real estate transactions (like home buying). Withdrawals reflect amounts disbursed for specific services or payments, including legal fees related to the escrow process or settlement costs. The account is typically held at a financial institution in locations such as California or Florida, where escrow services are commonly utilized. Regularly updating this statement is crucial to ensure all parties are informed regarding the balance and any changes, fostering trust and clarity throughout the transaction period.

Closing Balance and Signature

The closing balance of the escrow account, typically maintained in a secure financial institution, can reflect the final amount held for transactions, such as real estate purchases. A detailed statement may show various line items, including deposits, withdrawals, fees imposed during the escrow period, and interest accrued on the balance. The final figure, represented as the closing balance, is crucial for all parties involved in the escrow agreement. To validate the statement, a signature of the escrow officer, often a licensed professional regulated by state laws, is required. This signature signifies the accuracy of the account information and compliance with relevant escrow regulations, ensuring the accountability and integrity of the financial transaction process.

Comments