Are you navigating the complexities of corporate loan restructuring? You're not alone; many businesses find themselves in need of a financial facelift due to changing market conditions. With the right approach and expert guidance, you can effectively revamp your loan terms to better suit your current financial landscape. Let's delve deeper into the essential details of corporate loan restructuring and how it can benefit your business moving forward!

Borrower's Information

Corporate loan restructuring is crucial for businesses facing financial challenges. Essential details include the borrower's information, such as the company's registered name, a legal entity number, and Tax Identification Number (TIN) linked to the jurisdiction of operation (typically the United States or the European Union). Company address must specify the street, city, state, and postal code, providing clarity on the physical location. Financial metrics like total assets (in USD), outstanding debt (in millions), and annual revenue need to be outlined, highlighting the organization's fiscal health. Additionally, key contacts should be listed, including the Chief Financial Officer and legal advisors, ensuring clear communication channels throughout the restructuring process.

Loan Details

Loan details play a crucial role in the corporate loan restructuring process, providing essential information regarding the specific terms of the financial obligation. Typically, this includes the principal amount, which may range into millions of dollars, the current interest rate, often varying between 3% to 10%, the loan maturity date, which can span anywhere from 1 to 30 years, and the payment schedule that outlines monthly or quarterly payments. Additionally, collateral details, such as property or inventory pledged to secure the loan, are essential to assess potential risks. Financial ratios, including debt-to-equity ratios, guide the restructuring strategy, while credit ratings from agencies like Moody's or Standard & Poor's offer insights into the organization's financial health. Understanding these components ensures a successful negotiation, balancing lender expectations against the corporate borrower's capacity to repay post-restructuring.

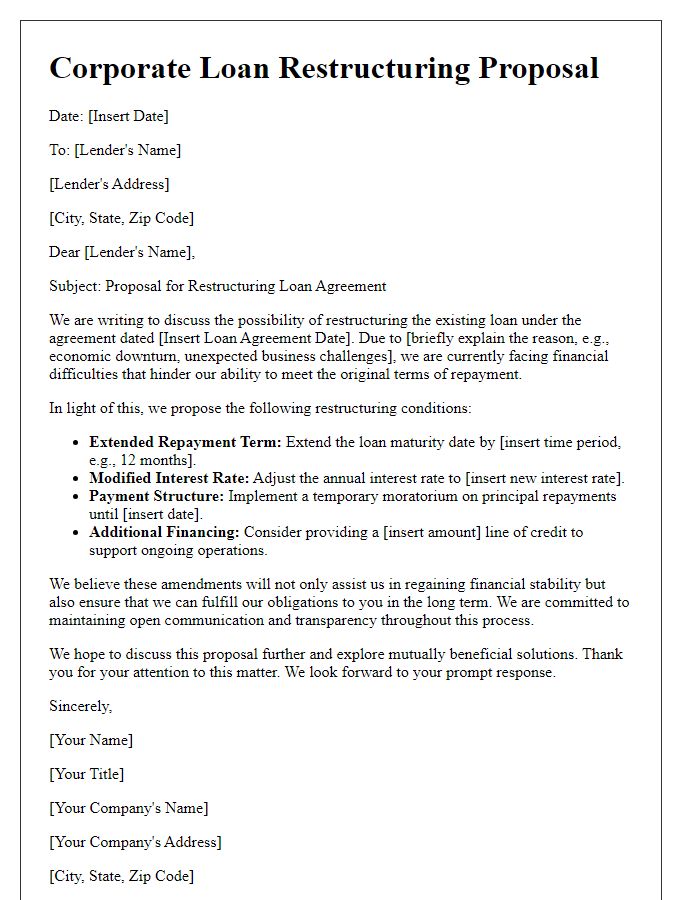

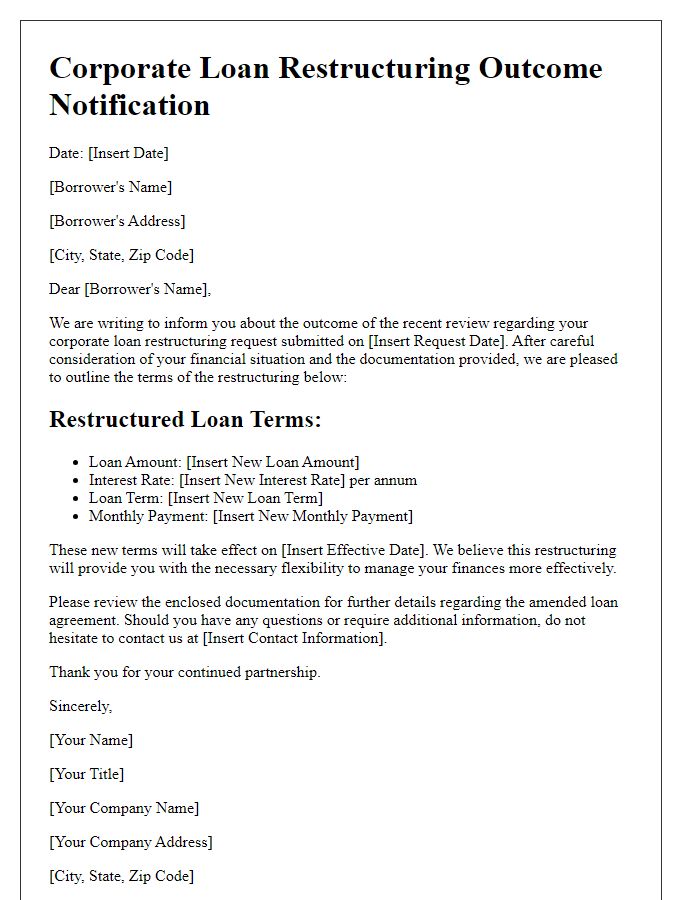

Restructuring Terms

Corporate loan restructuring often involves various terms that can influence financial stability. In many cases, restructuring includes adjustments to interest rates, potentially lowering them from original rates, aiming to ease the borrower's payment obligations. Loan maturity dates may be extended, allowing for a longer repayment period, often ranging from two to five additional years, providing relief to struggling companies. Additionally, principal repayment schedules might be revised, permitting deferred payments or reduced amounts, which can alleviate cash flow pressures. Lenders may require revised covenants, altering financial performance measures to ensure viability while maintaining oversight. Furthermore, other options like a temporary interest-only payment phase can be introduced, aiding businesses in managing liquidity. Successful restructuring negotiations typically occur within a framework of transparency and mutual agreement between stakeholders, aiming for a sustainable path forward for the corporation involved.

Financial Justification

Corporate loan restructuring involves strategic adjustments to existing debt agreements, aimed at improving financial stability and operational efficiency for struggling companies. Financial justification for such restructuring often requires detailed analysis of current obligations, including outstanding principal amounts, interest rates, and repayment schedules. Lenders, such as banks or credit unions, assess the company's cash flow projections, typically over a three to five-year period, taking into account factors like revenue forecasts and expense management. An important aspect is the company's debt-to-equity ratio, which should fall within industry standards, ideally below 2:1 for manufacturing sectors. Additionally, economic indicators, including market trends and applicable interest rate changes from central banks like the Federal Reserve, influence restructuring negotiations. Clear communication of potential business growth, supported by data from market analysis reports, ensures lenders understand the necessity of restructuring, securing better terms, possibly reducing interest rates by 1-3% or extending repayment periods.

Authorization and Signatures

Corporate loan restructuring involves a detailed revision of the terms associated with financial obligations. Authorization signifies approval from key stakeholders in the organization, such as the Chief Financial Officer (CFO) and Board of Directors. Signatures from these individuals are crucial as they represent commitment to new terms, which may include altered interest rates, extended repayment periods, or adjusted principal amounts. For instance, a corporate loan might transition from a fixed interest rate of 5% to a variable rate, dependent on market conditions, based on negotiations in restructuring. Documentation should reflect all amendments and ensure legal compliance, maintaining transparency to lenders and stakeholders throughout this process.

Comments