In today's fast-paced world, it's crucial to stay informed about the terms of your agreements, especially when it comes to collateral. Understanding the implications of collateral repossession can save you from unexpected surprises and financial strain. Whether you're facing challenges in meeting payment obligations or simply wanting to clarify your rights, being proactive is essential. Join me as we explore the intricacies of collateral repossession warnings and what you can do to navigate them effectively!

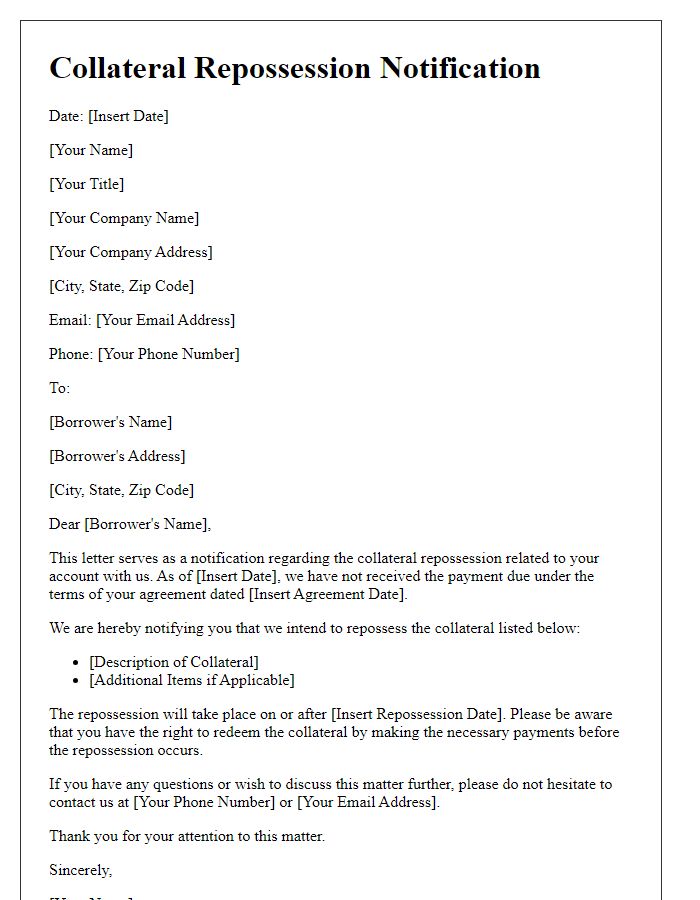

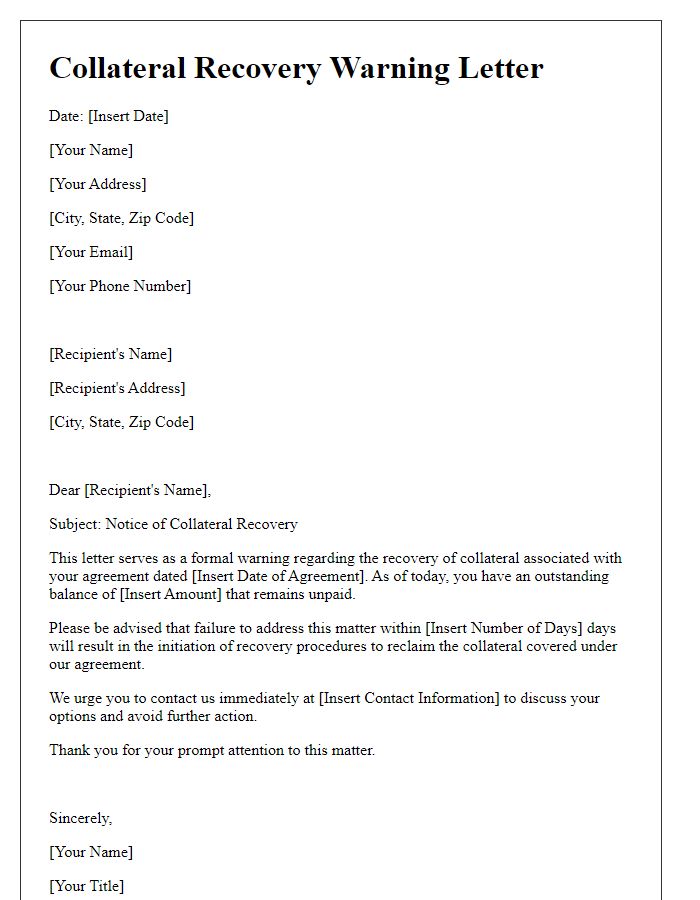

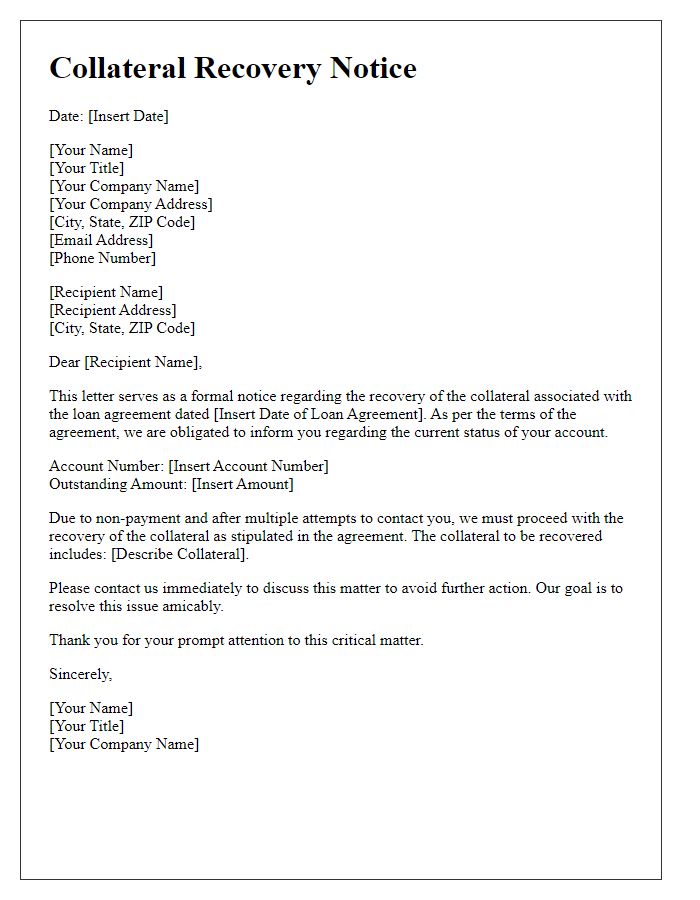

Sender's Contact Information

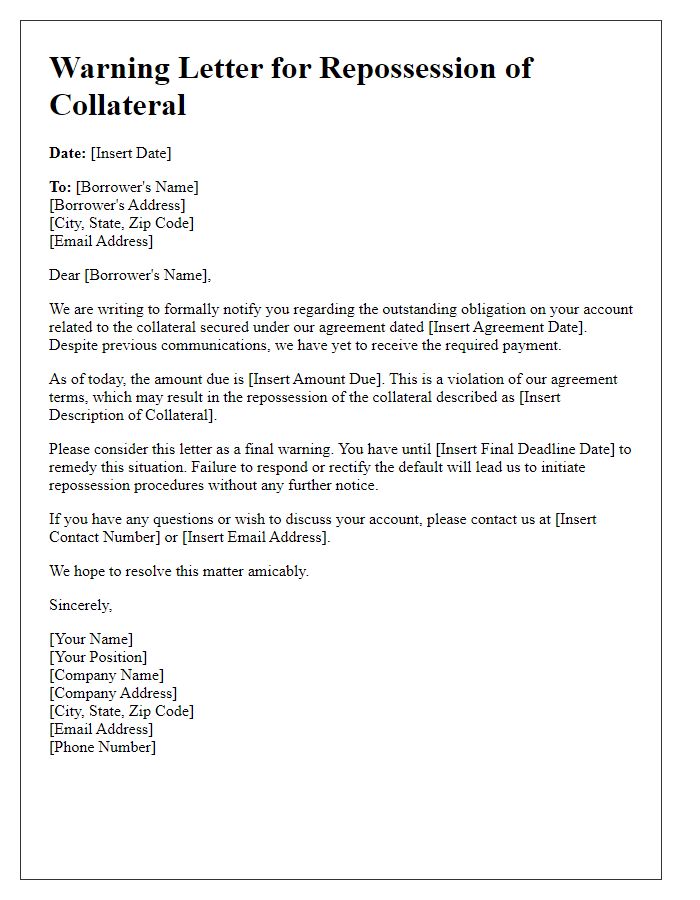

Collateral repossession can occur when a borrower defaults on a loan, typically involving valuable assets such as vehicles or real estate. This process often involves legal agreements and varies by state, influencing the timing and execution of repossession. Notification may include specific deadlines for payment, such as 30 days from the date of the letter, as well as any applicable fees or charges incurred. It is crucial for borrowers to understand their rights under the Uniform Commercial Code, which governs secured transactions in business financing across the United States. Communication from the lender must also adhere to local regulations to ensure compliance and validity of the repossession action.

Recipient's Details

Collateral repossession warnings serve as formal notifications to borrowers regarding the potential recovery of secured assets due to non-compliance with repayment terms. These letters typically include key details, such as the recipient's name, address, and account number, ensuring clarity about the borrower's identity and obligations. Furthermore, the warning outlines the specific collateral involved, which could range from vehicles to property, detailing the repercussions of continued default. Legal references to the lending agreement and applicable laws underline the seriousness of the situation, providing context on the lender's rights. Including a deadline for action often compels prompt responses from the recipient, emphasizing the urgency and importance of addressing the matter at hand.

Reference to Original Agreement

Collateral repossession warning refers to the formal notification regarding the reclaiming of assets utilized as security for a loan or credit agreement. This process usually occurs when the borrower defaults on their payment obligations as outlined in the original agreement established between parties, often including terms such as interest rates and payment schedules. For example, in the United States, the Uniform Commercial Code (UCC) regulates the repossession process, requiring lenders to follow specific procedures to notify borrowers, generally involving a grace period or chance to rectify the default. Various states impose extra regulations or protections, ensuring that the repossession does not occur unjustly, solidifying the legal framework surrounding this significant financial issue.

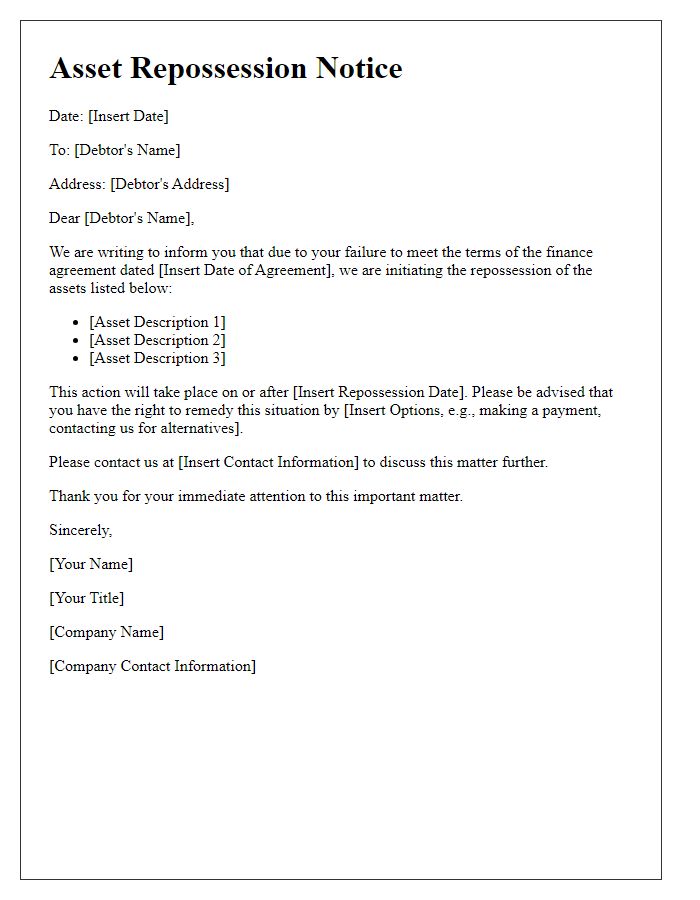

Detailed Description of Collateral

In the event of default, the collateral subject to repossession includes a 2018 Ford F-150 XLT, painted in a metallic blue finish, equipped with a 3.5-liter V6 EcoBoost engine, boasting 375 horsepower and a towing capacity of 13,200 pounds. The vehicle features an odometer reading of approximately 45,000 miles, with premium alloy wheels and a Ford Tough bed liner. Additionally, the collateral includes a set of original factory-installed electronics, consisting of a SYNC infotainment system, Bluetooth connectivity, and a rear-view camera. The title for the vehicle is recorded in [State Name], and all necessary registration documents are retained on file. The repossession process will follow applicable laws, ensuring compliance with regulations outlined in the Uniform Commercial Code (UCC).

Consequences and Next Steps

Collateral repossession occurs when a borrower defaults on a secured loan, typically involving items such as vehicles or equipment serving as guarantee against the debt. Lenders may initiate repossession after missed payments, often following a standard grace period. Legal actions, such as court orders or notifications under local laws, may precede repossession. The borrower faces consequences, including potential negative impacts on credit scores (FICO scores dropping significantly), securing future loans, and incurring additional fees. Next steps involve communication with the lender, discussing repayment options or restructuring agreements to avoid repossession. Seeking legal advice might also be advisable to understand rights and obligations during this process.

Comments