Are you awaiting the outcome of your loan underwriting assessment? It's a pivotal moment that can determine your financial future, and understanding the process is essential. Whether you're eager to buy a home, finance a new car, or consolidate debt, the loan underwriting decision can feel daunting. Join us as we explore the key factors that influence these assessments and what it means for your financial journey!

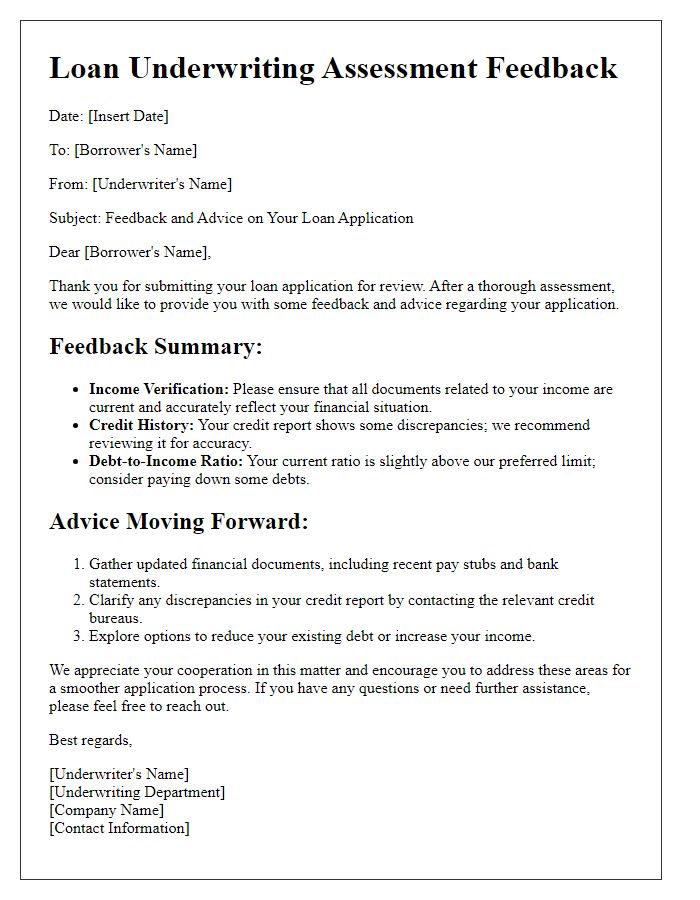

Personal and Financial Information

The loan underwriting assessment outcome relies on a comprehensive analysis of personal and financial information. This evaluation includes details such as credit score metrics, which typically range from 300 to 850, reflecting an individual's creditworthiness. Underwriters examine income verification from reliable sources like W-2 forms or recent pay stubs, ensuring consistency with stated figures. Additionally, debt-to-income (DTI) ratio calculations, ideally below 43%, gauge an applicant's financial stability and capacity to manage loan repayment. Assets, such as bank account balances and investment portfolio values, also play a pivotal role in assessing overall financial health. The evaluation process may involve specific events, like significant changes in employment history or recent large purchases, which could impact the perceived level of risk associated with the loan approval.

Loan Details and Terms

The underwriting assessment for the loan application has been completed, providing insight into the required Loan Details and Terms. The principal amount approved stands at $250,000, designated for the home purchase at 123 Maple Street, Springfield. The fixed interest rate is established at 4.5% per annum over a 30-year term, ensuring predictable monthly repayments of approximately $1,266. Additional pertinent information includes a 20% down payment, translating to $50,000, and necessary escrow for property taxes and insurance. The borrower's credit score, recorded at 720, signals a robust financial history, complementing a debt-to-income ratio calculated at 28%, demonstrating affordability. Moreover, the closing costs are estimated at $5,000, to be paid at the settlement scheduled for March 15, 2024.

Creditworthiness and Risk Assessment

Loan underwriting assessments play a crucial role in evaluating creditworthiness and risk for borrowers seeking financial assistance from institutions like banks. Factors such as a credit score (usually ranging from 300 to 850), which reflects an individual's payment history and debt levels, are carefully reviewed. Employment history, ideally with at least two years of stable income, also contributes to the assessment process. The debt-to-income ratio (DTI), ideally below 36%, indicates the financial burden on the borrower. Additionally, collateral value in the case of secured loans, such as property or vehicles, significantly affects risk outcomes. Lastly, delinquencies, bankruptcies, or foreclosure events in the past five to seven years can severely impact overall approval rates and terms offered by lenders.

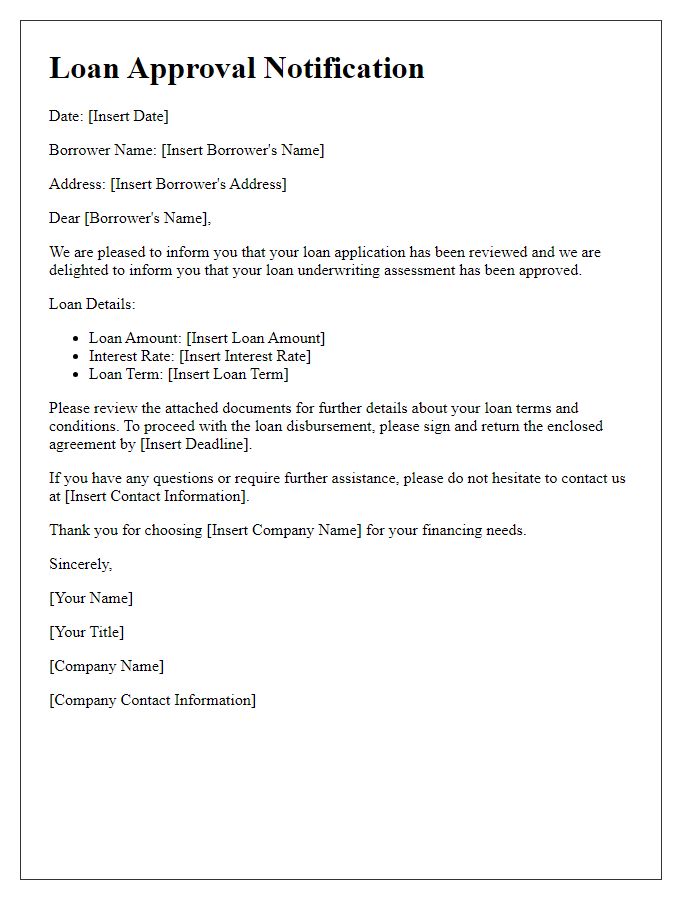

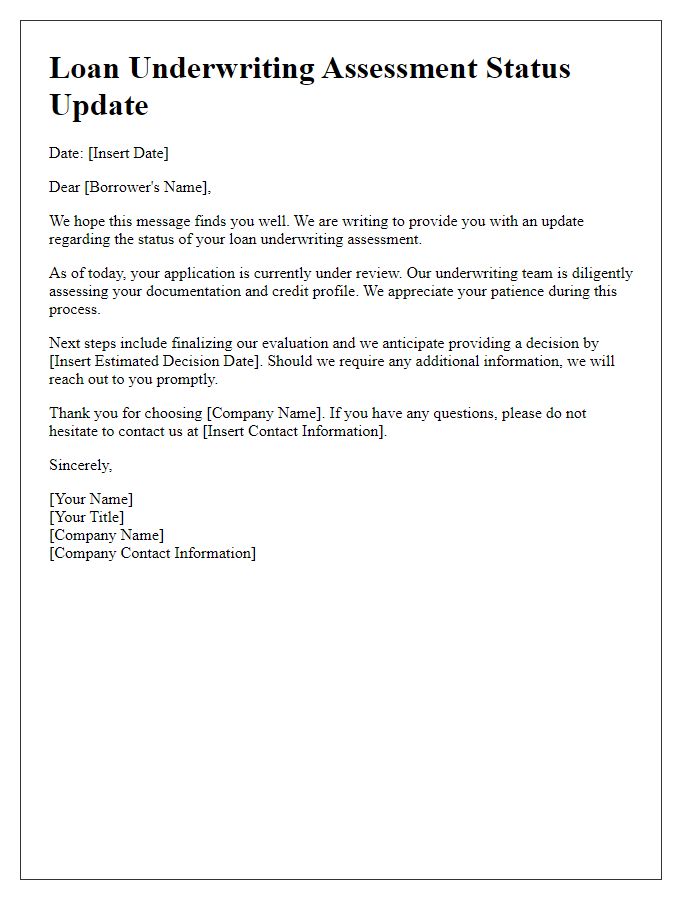

Approval Status and Rationale

The loan underwriting assessment results indicate an approval status for the mortgage application submitted on September 15, 2023, at the downtown branch of ABC Bank in Springfield. Key ratios such as the debt-to-income ratio of 35% and a credit score of 720 were crucial in this decision. The applicant's stable income history from employment at XYZ Corporation, which spans over five years, and a current annual salary of $75,000 contributed positively to the assessment. Additional assets, including a savings account balance of $20,000, provided further financial security. The loan amount approved is $150,000, intended for the purchase of a residential property located at 123 Maple Street, Springfield, ensuring alignment with the bank's lending criteria and risk parameters.

Contact Information for Inquiries

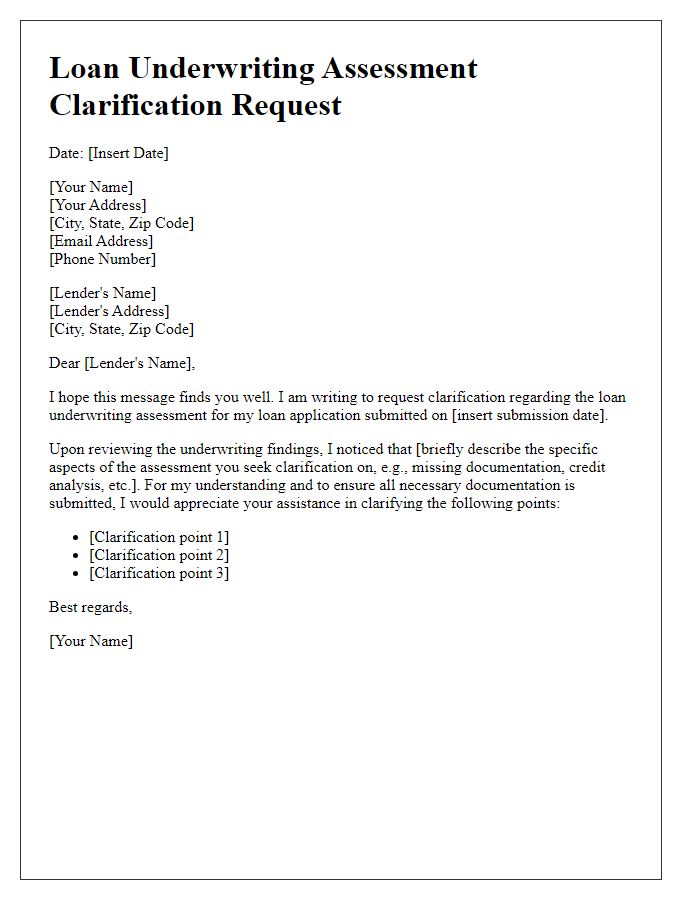

Loan underwriting assessment outcomes vary based on factors like credit scores, income verification, and property appraisal values. Borrowers may seek clarification on decisions regarding their loans from the underwriting team. Contact information typically includes a dedicated email address (e.g., underwriting@financialinstitution.com) and a phone number for direct inquiries, ensuring efficient communication. Addressing inquiries promptly can foster transparency and trust in the lending process. Additionally, a physical mailing address for formal correspondence may be provided, often located within a financial institution's headquarters, such as the address listed in regulatory filings.

Letter Template For Loan Underwriting Assessment Outcome Samples

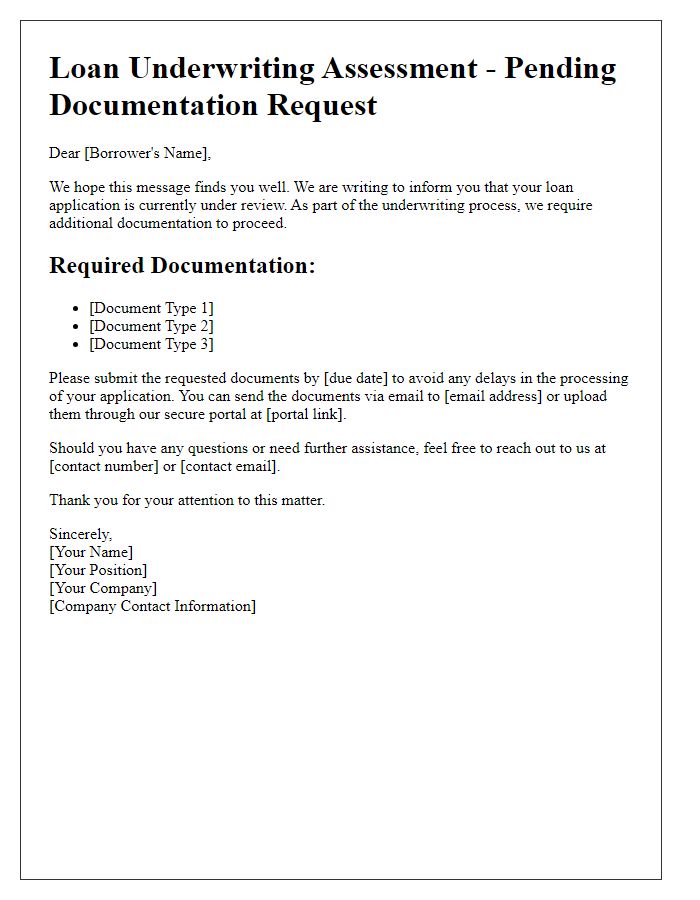

Letter template of loan underwriting assessment pending documentation request

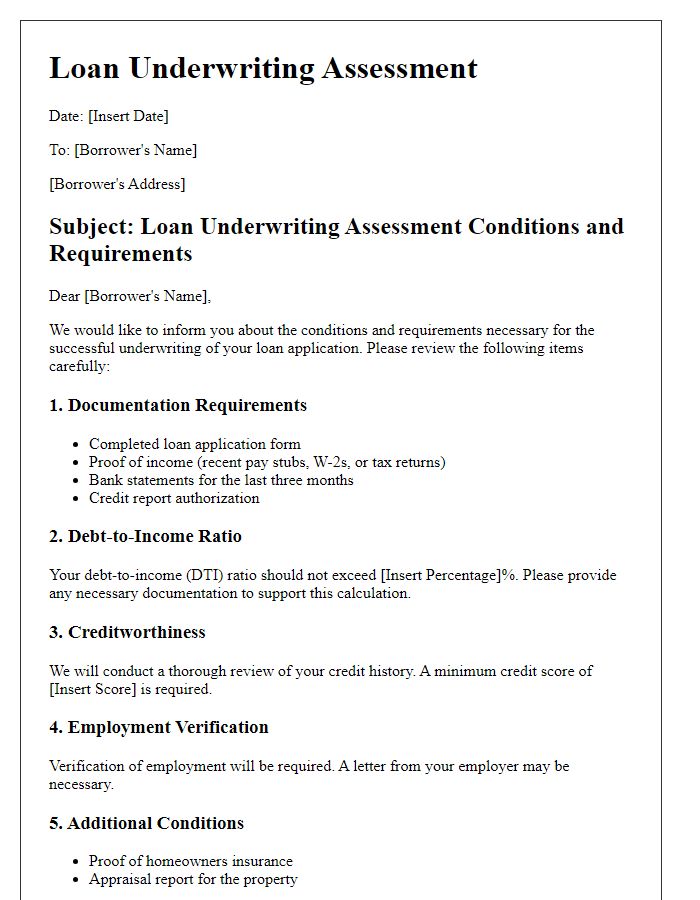

Letter template of loan underwriting assessment conditions and requirements

Comments