Are you feeling overwhelmed by the threat of foreclosure? You're not alone; many homeowners face this daunting challenge and feel unsure of their options. In this article, we'll explore effective strategies and essential steps to take when it comes to defending your home against foreclosure. So, let's dive in and empower you with the knowledge you need to protect your home and rights!

Borrower's Information

Borrowers facing foreclosure often experience overwhelming stress and confusion due to legal complexities. A foreclosure defense notice formally communicates a borrower's intent to contest the foreclosure process initiated by lenders or banks, often due to missed mortgage payments. Essential details include the borrower's name, property address (including city and state), loan number, and the lender's name. In addition, crucial reference to applicable state laws, such as foreclosure timelines, notice periods, and possible defensive strategies (like loan modification or error disputes) can significantly impact the outcome. Understanding these components leads to a more effective defense against potential asset loss.

Loan Details

Providing a foreclosure defense notice requires careful attention to specific loan details. The mortgage loan number serves as a unique identifier, linking the property to the borrowing party. Principal balance represents the original borrowed amount minus any repayments, crucial for understanding the remaining liability. The interest rate (fixed or adjustable, typically around 3% to 6% in recent years) impacts monthly payments and total interest incurred over the loan's lifespan. The loan servicer accounts for the entity handling monthly payments and customer service, while the payment due dates illustrate the regularity and timing of obligations, often set on the first of each month. Loan origination date denotes when the mortgage contract was executed, affecting the time frame for legal actions. Additionally, property address specifies the location involved, providing a clear link between the loan and the physical asset. Understanding these details is essential for formulating a robust foreclosure defense strategy.

Legal Grounds for Defense

Foreclosure defense actions arise from a multitude of legal grounds, often varying by jurisdiction. Common defenses include allegations of procedural errors during the foreclosure process, such as failure to provide proper notice or lack of standing by the lender. In many cases, borrowers may assert that the lender did not follow state-specific guidelines outlined in laws such as the Real Estate Settlement Procedures Act (RESPA) or the Fair Debt Collection Practices Act (FDCPA). Additionally, claims of predatory lending practices, which often involve high-interest rates and misleading terms, can bolster a homeowner's argument against foreclosure. Other pertinent defenses might involve inaccuracies in the loan documentation or challenges related to the enforcement of a mortgage assignment. An understanding of local foreclosure laws and timelines, as seen in states like California with a non-judicial foreclosure process, can significantly impact the defense strategy employed.

Request for Documentation

Foreclosure defense involves legal processes that can protect homeowners from losing their properties. A key aspect is the request for documentation, which serves to gather essential information regarding the loan and the foreclosure actions taken by banks or mortgage companies. Homeowners, often facing financial difficulties, need to understand the terms of their mortgage agreements in depth, typically outlined in documents like the Promissory Note or Deed of Trust. This process might occur in courtrooms across different states, where legal protections vary, with cities like Miami, Florida, and Los Angeles, California experiencing high foreclosure rates. Documentation requests can lead to negotiations for loan modifications or potential settlements, emphasizing the need for precise and organized communication with lenders or servicers. Accurate records from the loan servicing company, payment history, and any correspondence related to the foreclosure can be crucial for building a strong defense against potential eviction.

Contact Information and Signature

Foreclosure defense strategies are critical for homeowners facing potential eviction, as they often involve legal measures to contest the validity of foreclosure proceedings. These strategies can include examining issues such as loan documentation, potential predatory lending practices, or improper notification of foreclosure. Homeowners should gather evidence, including mortgage statements, correspondence with lenders, and applicable state laws regarding foreclosure processes. Engaging with legal professionals who specialize in real estate law can provide invaluable assistance, ensuring that the homeowner's rights are protected throughout the legal process. Timely responses and adherence to any deadlines set by the court or lender are essential to mount an effective defense against foreclosure actions.

Letter Template For Foreclosure Defense Notice Samples

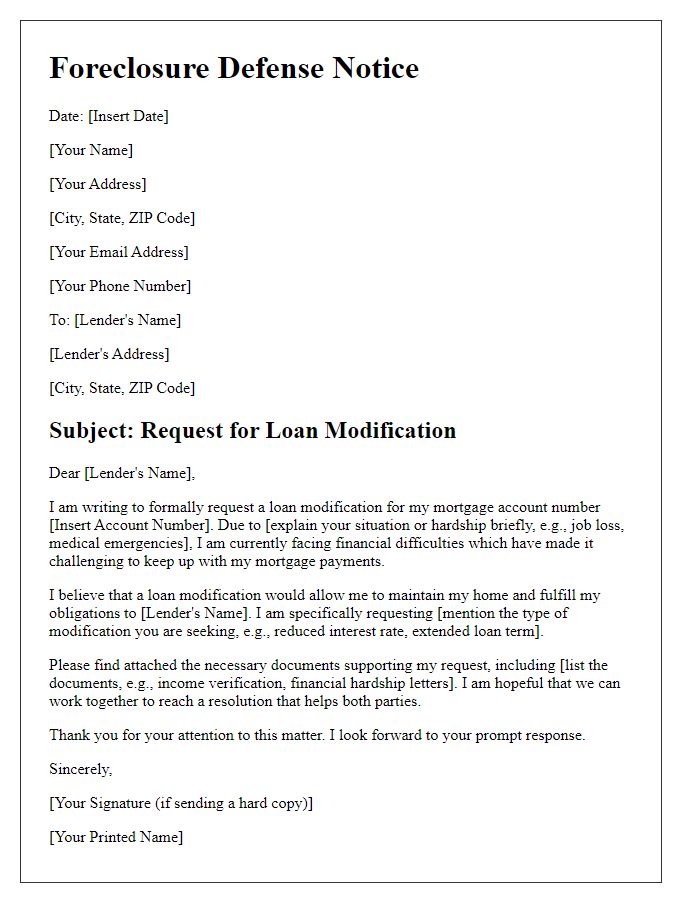

Letter template of foreclosure defense notice for loan modification request

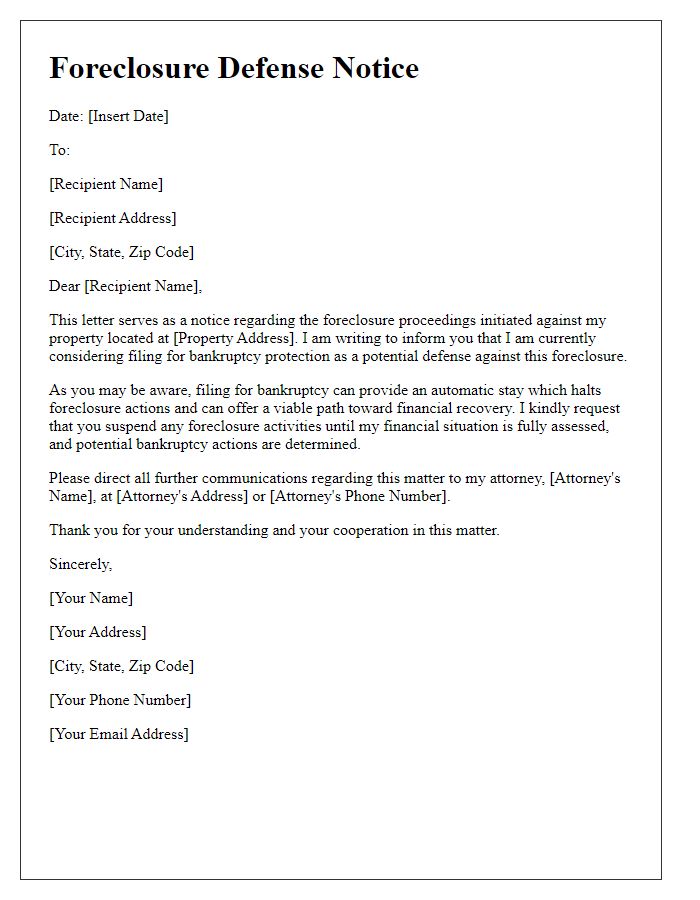

Letter template of foreclosure defense notice for bankruptcy considerations

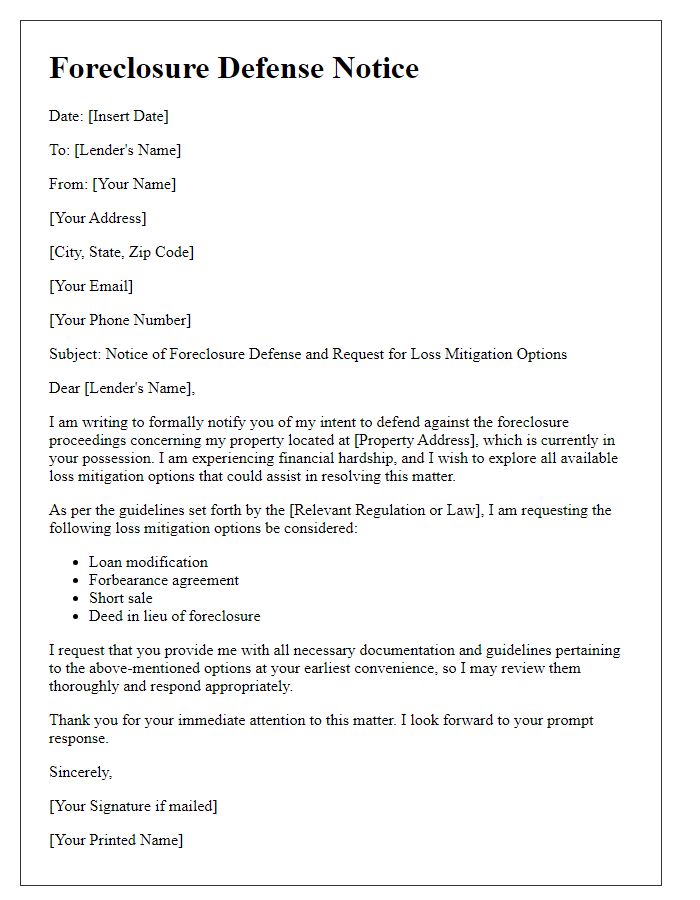

Letter template of foreclosure defense notice for loss mitigation options

Comments