Navigating the complexities of real estate foreclosure can be daunting, but you don't have to face it alone. Understanding your rights and options is crucial in defending your property and securing your financial future. With the right strategies and guidance, you can effectively challenge foreclosure actions and explore alternatives that work for you. Ready to learn how to protect your home? Let's dive deeper into the steps you can take to advocate for yourself and your property.

Accurate borrower information

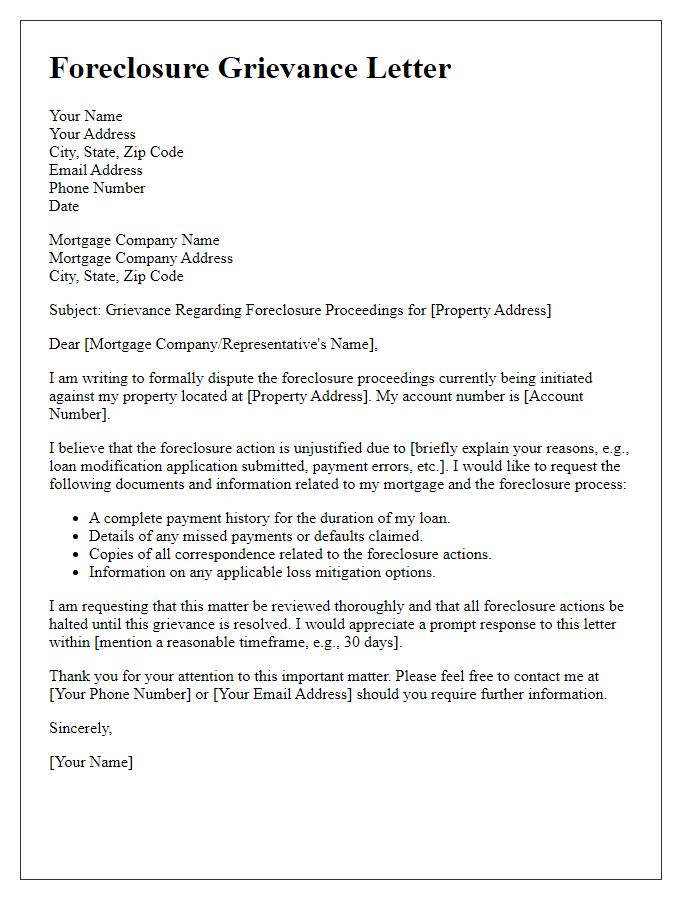

Accurate borrower information is crucial in real estate foreclosure defense. Borrower details (such as full name, social security number, and address) establish identity and ownership. Documentation should include the original mortgage agreement (date, terms, and lender details) to verify loan legitimacy. Communication records with the lender (phone calls, emails, or letters) also play a vital role, indicating attempts to resolve issues and demonstrating borrower intent. Ensuring accurate information can highlight discrepancies in the foreclosure process, such as missing documents or procedural errors, potentially invalidating the foreclosure action against the property, which may be located in jurisdictions like the state of California or Florida, known for their specific foreclosure laws.

Clear explanation of circumstances

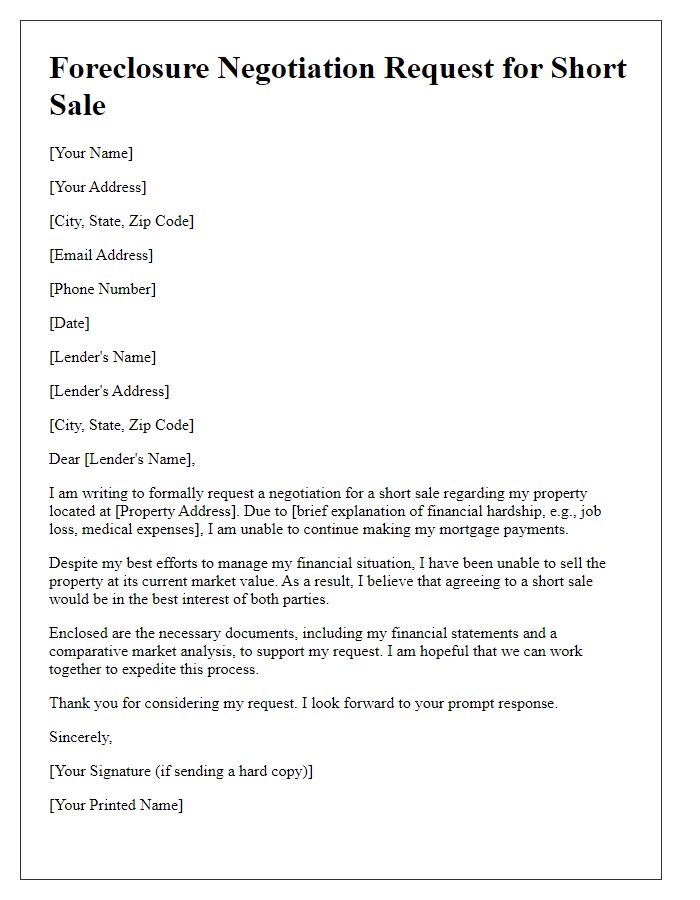

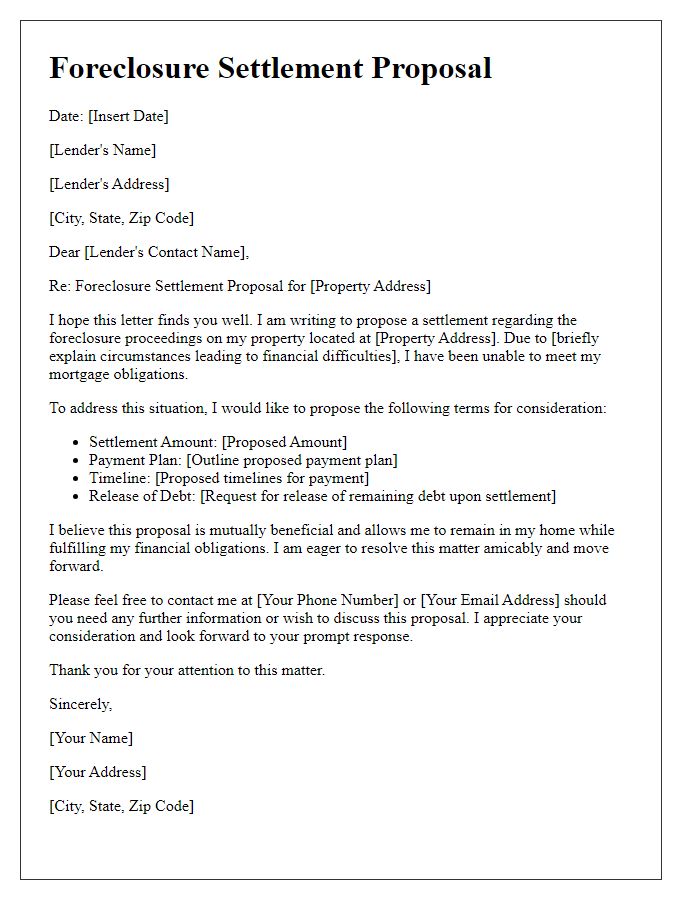

Home foreclosure occurs when property owners fail to meet mortgage obligations, leading lenders to initiate legal proceedings to reclaim residential properties. Factors contributing to these financial struggles may include loss of employment, medical emergencies, or divorce, often resulting in significant financial strain. Notably, the U.S. had over 300,000 foreclosure filings in 2022, highlighting the widespread impact of this crisis. Affected homeowners facing foreclosure proceedings in regions such as California or Florida may seek legal representation to negotiate alternatives like loan modifications or short sales instead of losing their homes. Navigating the complexities of foreclosure defense requires careful examination of loan documents, adherence to state-specific regulations, and timely action to safeguard property rights and maintain housing stability.

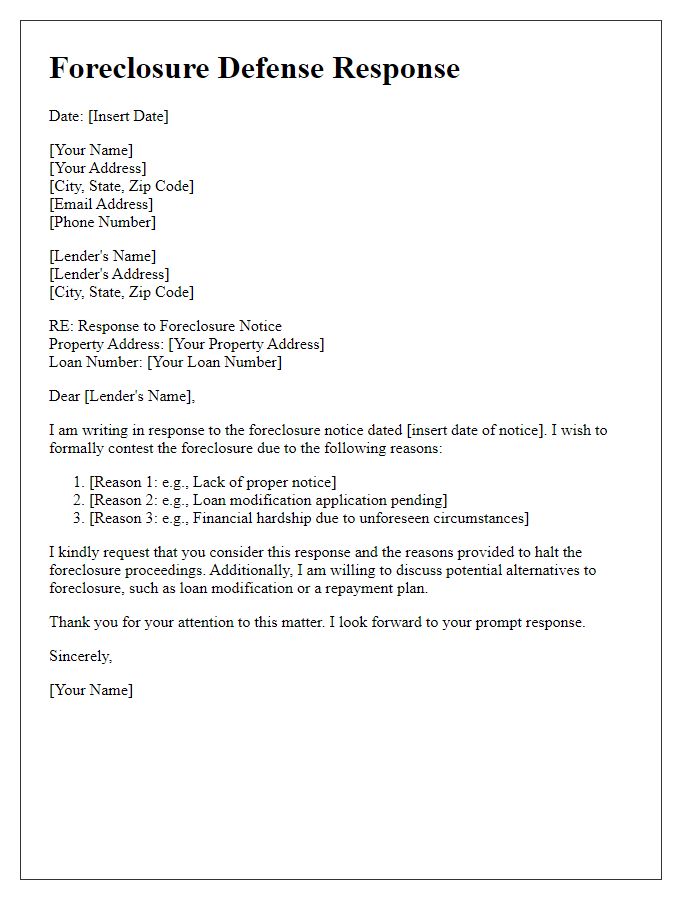

Potential legal defenses

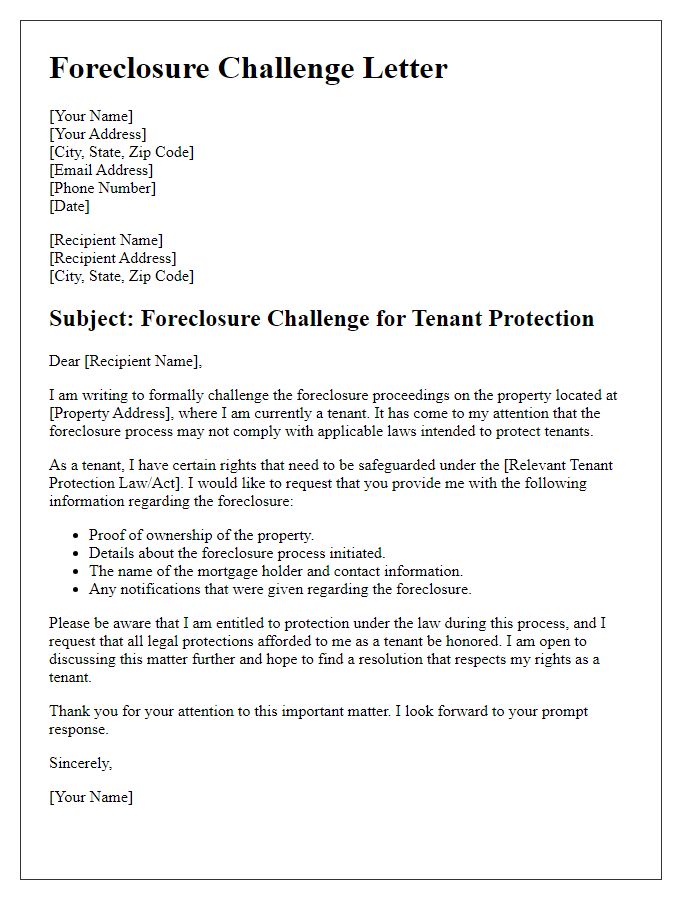

Property owners facing foreclosure may explore various potential legal defenses to protect their interests. Common defenses include improper notice, where lenders fail to provide the required notifications per state law, leading to possible wrongful foreclosure claims. Another salient defense is the assertion of predatory lending practices, which may involve deceptive loan terms or excessive fees. The statute of limitations can also play a critical role, as lenders must initiate foreclosure within a specific timeframe, typically ranging from three to fifteen years, depending on the jurisdiction. Additionally, borrowers can challenge the standing of the lender, questioning whether the entity pursuing foreclosure has the legal right to do so, particularly if the loan has been sold or transferred multiple times. Moreover, evidence of loan modification agreements or servicer errors, manifesting as inadequate processing or failure to honor payment modifications, can strengthen a homeowner's case. Engaging with professionals specializing in foreclosure defense can provide homeowners the best chance of navigating these complexities successfully.

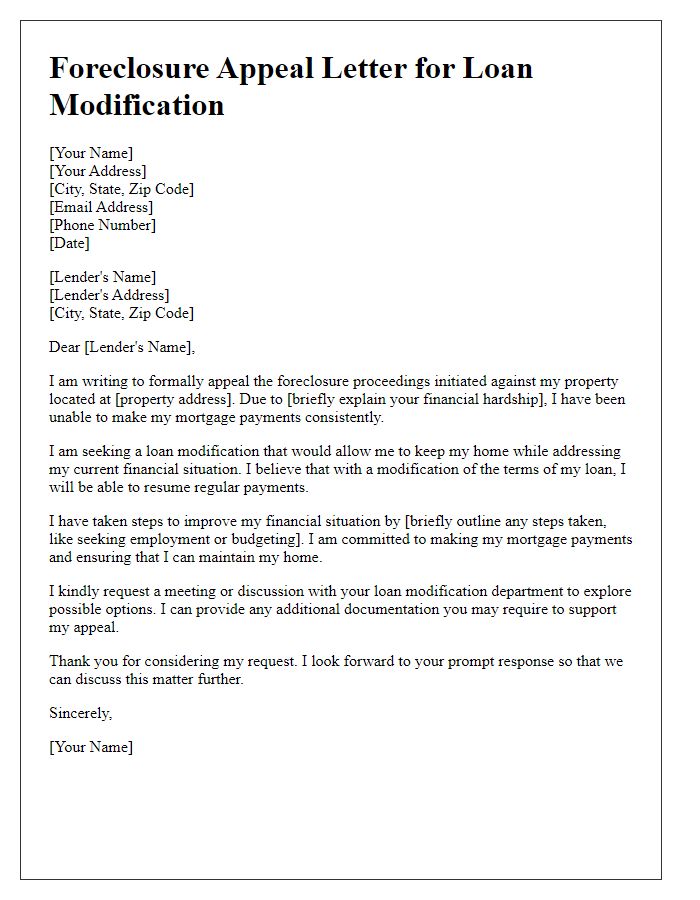

Request for loan modification

In regions experiencing financial hardship, homeowners facing foreclosure may seek a loan modification to adjust their mortgage terms. The Loan Modification request should outline the homeowner's current financial situation, including specific details such as monthly income ($4,500) and expenses ($3,000), indicating difficulty meeting existing mortgage obligations, usually ranging from $1,200 to $2,000 per month. Highlighting hardships such as loss of employment at local businesses or medical emergencies can further illustrate the need for assistance. Including the current property details, such as location (e.g., 123 Maple Street, Springfield, IL) and the original loan amount ($250,000), can lend weight to the case. Additionally, referencing past payment history (indicating a generally positive track record) can demonstrate a willingness to maintain homeownership. The request should clearly articulate the desired modification terms, such as a reduction in monthly payments, extension of the loan period to lower the monthly obligation, or a potential interest rate adjustment. Emphasizing the desire to maintain the property as a family home can help convey the emotional significance of the request. Providing supporting documentation, such as recent pay stubs, bank statements, and a detailed hardship letter, strengthens the case, highlighting the urgency and necessity of the loan modification amid ongoing financial difficulties.

Contact information for follow-up

Real estate foreclosure defense involves legal strategies to combat the foreclosure process initiated by lenders. Homeowners facing foreclosure can gather essential documents such as their mortgage agreement and proof of income, which are critical for building a defense. Courts typically require a response within 20 to 30 days of receiving a foreclosure notice. Engaging a qualified attorney experienced in real estate law can provide guidance tailored to local laws and regulations. Key entities like the U.S. Department of Housing and Urban Development (HUD) may offer resources for homeowners seeking assistance. Maintaining accurate contact information ensures important follow-ups regarding court hearings and mediation sessions are timely and efficient, aiding in the defense against foreclosure proceedings.

Letter Template For Real Estate Foreclosure Defense Samples

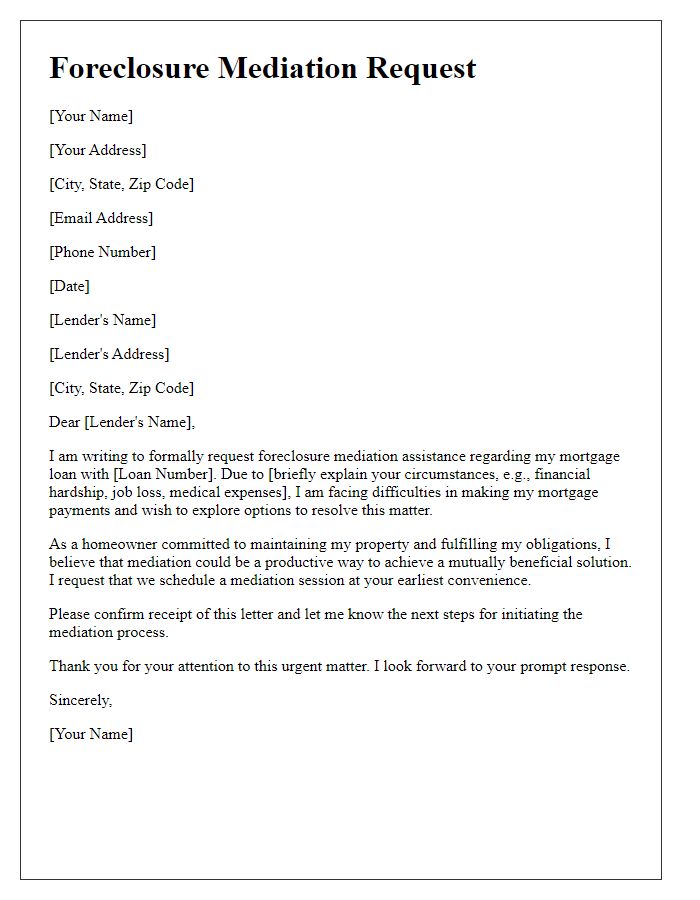

Letter template of foreclosure mediation request for homeowner assistance

Comments