Are you considering dissolving a partnership and unsure about how to create a formal agreement? Navigating the complexities of partnership dissolution can be challenging, but having a clear, comprehensive letter template can simplify the process. This template will guide you in outlining the terms and conditions of the dissolution, ensuring all parties are on the same page. Keep reading to explore essential elements that should be included in your partnership dissolution agreement!

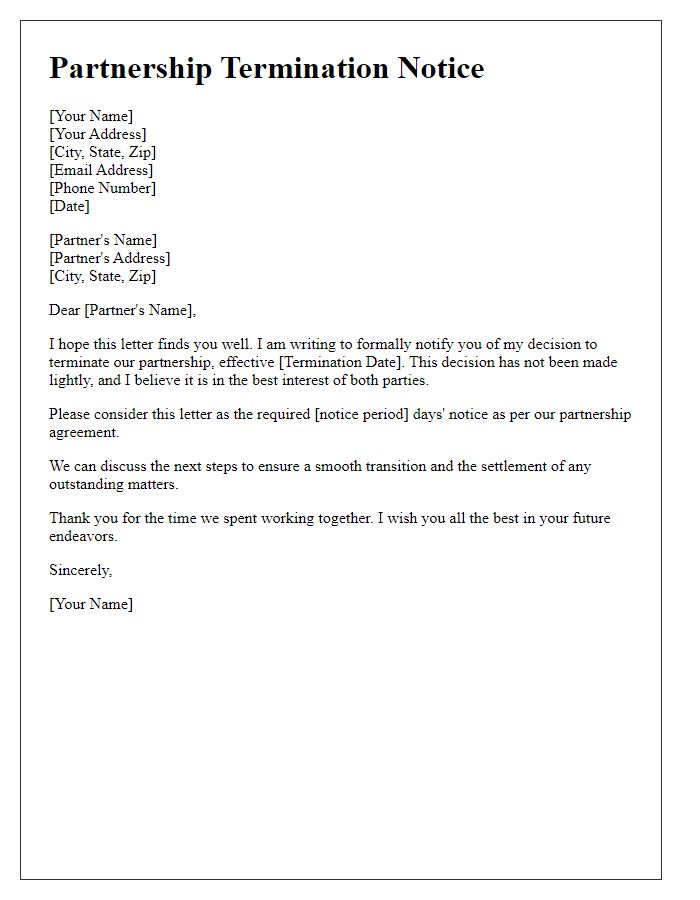

Identification of Parties

The partnership dissolution agreement identifies the parties involved in the partnership, specifically noting the legal names and addresses of the entities. For instance, John Doe, residing at 123 Main Street, Springfield, is one party, while Jane Smith, residing at 456 Elm Street, Springfield, represents the other party. Both parties voluntarily entered into the partnership established on January 15, 2020, under the name "Springfield Innovations." This document serves as a formal acknowledgment of the termination of business activities conducted under this partnership, and it includes details regarding the distribution of assets and liabilities as of the effective dissolution date.

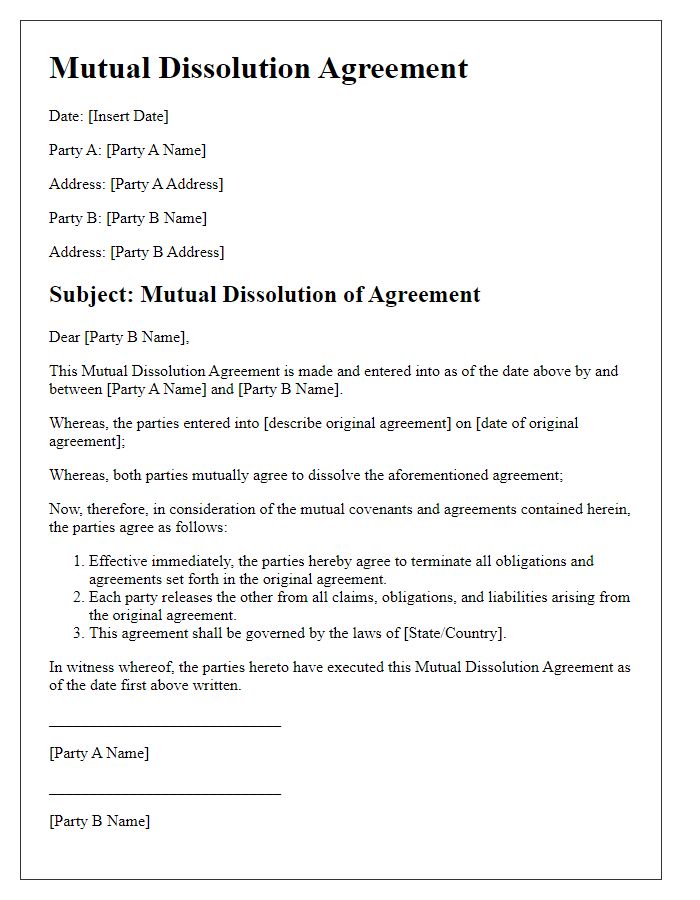

Purpose of Dissolution

In the context of partnership dissolution, the purpose of the dissolution refers to the formal termination of the business partnership agreement established under the Partnership Act of [specific year]. This process may arise from various circumstances such as mutual agreement between partners, changes in the business environment, or the fulfillment of specific business objectives. The dissolution intends to ensure an orderly wind-up of business affairs, including the settlement of outstanding debts, distribution of remaining assets, and address the allocation of liabilities among partners. Legal documents will be prepared reflecting the intent to dissolve, filing necessary paperwork with the Secretary of State or appropriate regulatory body in [specific state] to formalize the cessation of the partnership's legal status. It is critical to follow all stipulated procedures to prevent potential disputes or liabilities post-dissolution.

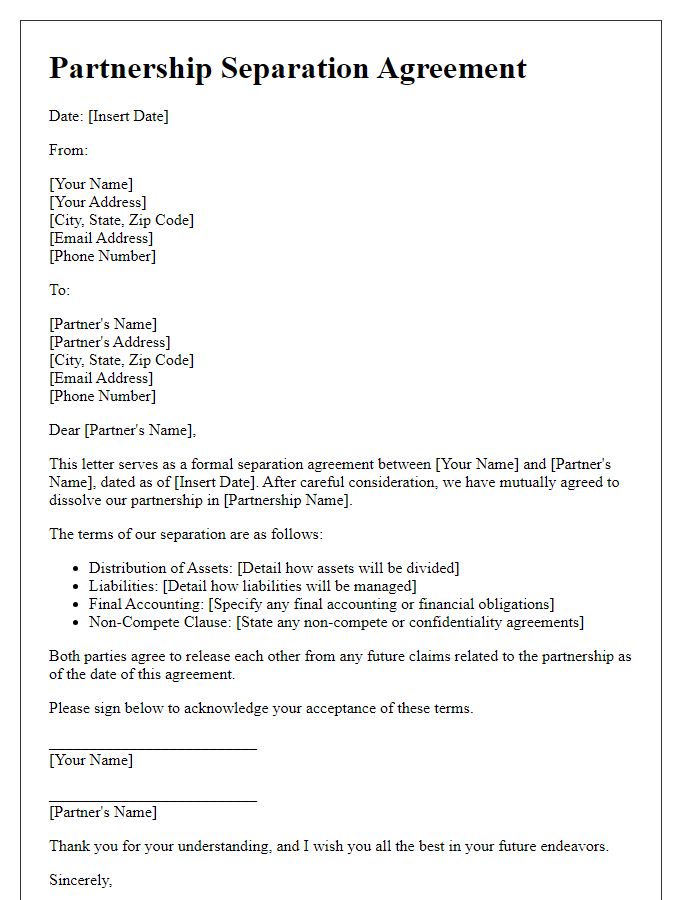

Detailed Asset Division

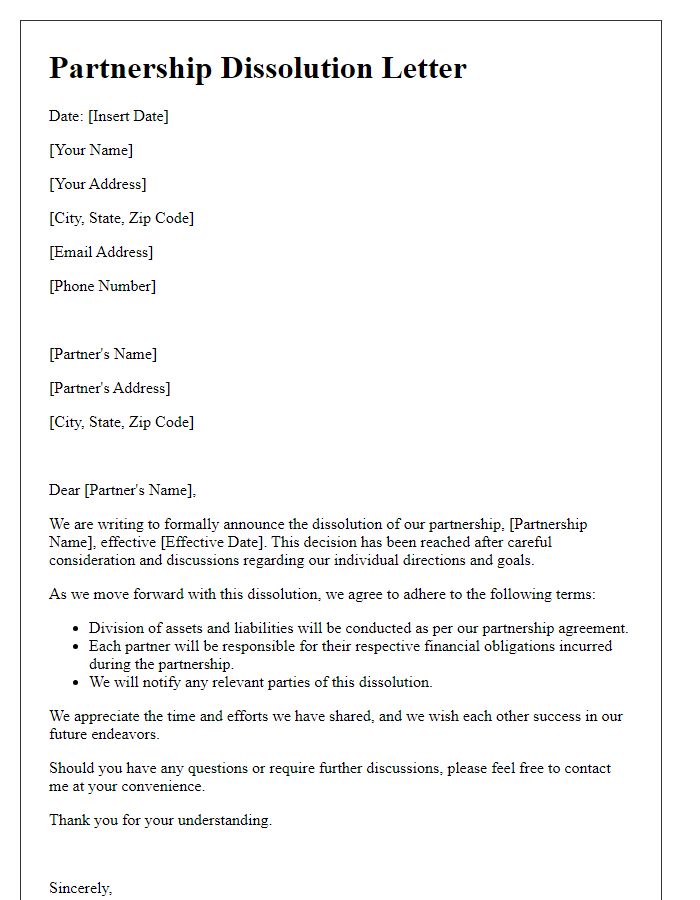

A partnership dissolution agreement outlines the process of ending a business relationship and the distribution of assets among partners. Clear communication regarding asset division is critical. Specific assets such as real estate properties (identified by addresses, market values, and appraisal dates), equipment (detailed lists of machinery, tools, or vehicles with serial numbers), and intellectual property (patents, trademarks, and copyrights with registration numbers) must be documented. Financial assets including bank accounts (account numbers, institution names), stocks (names and identification numbers) and expenses (receipts and invoices) require comprehensive evaluation to ensure equitable distribution. Outstanding debts and liabilities (loan agreements and creditor details) should be addressed to prevent future conflicts. Legal intervention may be necessary for unresolved disagreements, potentially involving mediation or arbitration. A concluding section may outline future obligations for each partner, ensuring compliance and clarity post-dissolution.

Liability and Debt Allocation

A partnership dissolution agreement outlines the responsibilities and obligations of each partner when dissolving a business entity. Clear documentation addresses liability (legal responsibility for debts and obligations) and debt allocation (distribution of financial obligations among partners). For instance, in a partnership dissolving in San Francisco, California, on October 1, 2023, partners may stipulate that Partner A assumes a 60% liability for a $100,000 loan from ABC Bank, while Partner B bears 40% of that debt. Additionally, any outstanding obligations such as payroll and vendor payments must be detailed, ensuring transparency and fairness. Final asset distribution, including shared equipment and real estate valued at $250,000, should also be included to prevent future disputes.

Confidentiality Clause

A partnership dissolution agreement requires a confidentiality clause to protect sensitive information. This clause prohibits the disclosure of proprietary business information, trade secrets, and financial data regarding the partnership. The parties involved must agree to maintain confidentiality for a specified duration, often ranging from one to five years post-dissolution. Any breach of this clause could lead to legal repercussions, emphasizing the importance of trust in the dissolution process. Additionally, this clause serves to safeguard client lists, operational methods, and marketing strategies, which could potentially harm the former partnership's interests if leaked. The value of maintaining confidentiality during this sensitive transition reflects the professional relationships built over time.

Comments