When navigating the complex waters of mergers and acquisitions, having a clear and effective strategy is essential. A well-crafted letter can set the tone for negotiations and foster a positive relationship between the involved parties. In this article, we'll explore key elements that should be included in your merger and acquisition letter templateâensuring that your message resonates and aligns with your goals. Join us as we delve deeper into crafting the perfect communication to elevate your M&A strategy!

Objective and Rationale

A merger and acquisition strategy aims to achieve significant growth and competitive advantage within the dynamic business landscape. The primary objectives include expanding market share by accessing new customer segments, enhancing operational efficiencies through economies of scale, and diversifying product offerings to mitigate risks. The rationale is to leverage synergies between organizations, such as combining resources, technology, and expertise to drive innovation and profitability. Companies can attain a stronger market position and scale by consolidating strengths and reducing redundancies in overlapping markets. Additionally, acquiring intellectual property or entering strategic partnerships can accelerate product development cycles and enhance customer value propositions. This strategic approach aligns with long-term vision and corporate goals for sustainable success in a rapidly evolving marketplace.

Key Stakeholders and Roles

The merger and acquisition strategy involves various key stakeholders, each playing a crucial role in ensuring successful integration. Company executives (C-suite) oversee strategic direction, while the finance team assesses asset valuation, identifying synergies and potential cost savings worth millions. Legal advisors navigate complex regulatory frameworks, ensuring compliance with antitrust laws and protecting intellectual property. Human resources facilitate talent retention, managing workforce transitions for thousands of employees affected by the merger. Lastly, communication teams craft internal and external messaging, maintaining stakeholder confidence throughout the process. Attention to these roles is vital for achieving anticipated growth and operational efficiencies in competitive markets.

Financial Considerations and Valuation

Financial considerations play a critical role in the merger and acquisition (M&A) strategy, focusing on valuation methods that determine a fair price for the target company. Common valuation approaches include Discounted Cash Flow (DCF) analysis, which forecasts future cash flows and discounts them to present value using an appropriate discount rate, often derived from the weighted average cost of capital (WACC). Comparable company analysis evaluates similar firms in the same industry, utilizing metrics such as Price-to-Earnings (P/E) and Enterprise Value-to-EBITDA ratios to establish a benchmark. Precedent transaction analysis examines past M&A deals within the sector, providing insights on market trends, multiples, and acquisition premiums. These financial metrics help identify synergies, assess risks, and outline potential returns on investment, ultimately guiding decision-makers in constructing a successful M&A strategy.

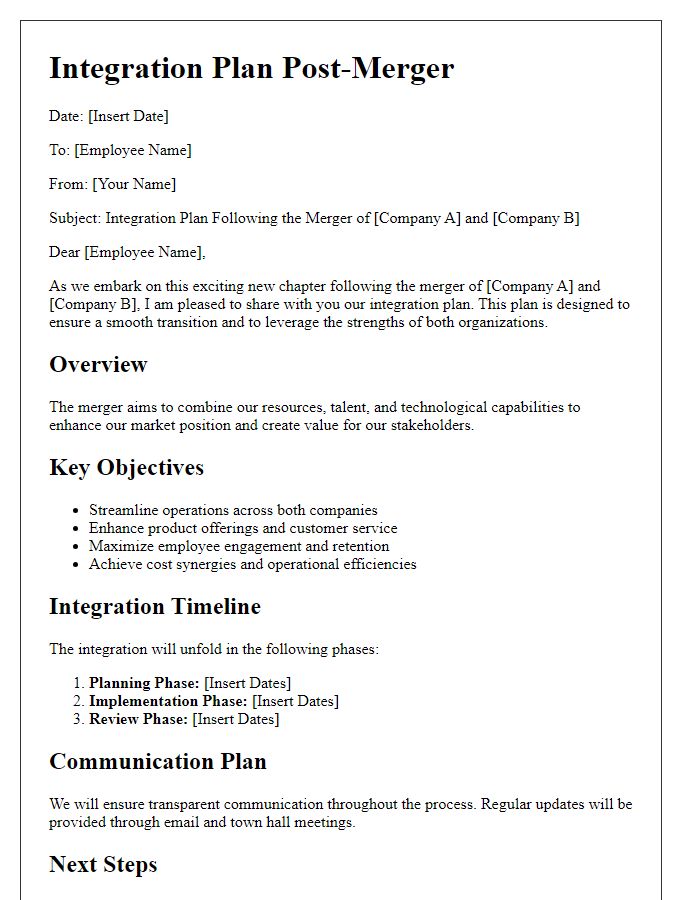

Integration Plan and Timeline

The Integration Plan for the merger between Company A and Company B outlines key objectives and actionable steps to ensure a smooth transition and synergy realization. Targeted completion date spans a twelve-month timeline, segmented into four main phases. Phase One focuses on the initial assessment (first three months), where cross-functional teams will evaluate operational overlaps and identify aligning corporate cultures to mitigate integration risks. Phase Two (months four to six) emphasizes aligning systems, including IT infrastructure and financial reporting, ensuring seamless communication across platforms. Phase Three, scheduled for months seven to nine, concentrates on employee integration programs, promoting a unified workforce through comprehensive training sessions and workshops aimed at enhancing collaborative efforts. Finally, Phase Four (months ten to twelve) involves performance evaluation metrics to assess integration success, which includes key performance indicators such as employee retention rates, customer satisfaction scores, and cost savings achieved through operational efficiencies. Each phase includes specific milestones to monitor progress and facilitate ongoing communication with stakeholders to keep them informed throughout the integration process.

Communication Strategy and Branding

Effective communication strategy and branding are crucial during merger and acquisition processes, ensuring a seamless transition for stakeholders from both organizations. Strategic messaging must address employees, shareholders, and customers, highlighting the merger's benefits. Transparency regarding changes, such as leadership restructuring or operational expansions, is essential to maintain trust. Aligning brand identities can enhance market perception; for instance, a unified logo should reflect the combined values and vision of the organizations. Utilizing both traditional media outlets and digital platforms (social media channels or company websites) ensures comprehensive outreach during integration phases. Moreover, internal communication should include regular updates through town hall meetings and newsletters to engage staff and foster a cohesive culture post-merger.

Comments