Are you a small business owner looking to navigate the often confusing waters of tax exemptions? Understanding the nuances can be challenging, but securing the right exemptions can significantly benefit your bottom line. In this article, we'll break down the process and provide you with a comprehensive letter template to help you apply for tax exemptions effectively. So, let's dive in and explore how you can streamline your application process!

Business Identification Information

Business identification information includes critical details that establish the legal and operational identity of a small business within the tax system. The business name, such as "Green Leaf Organic Grocers," must be precise and consistent with registration documents. The Employer Identification Number (EIN), a unique number assigned by the Internal Revenue Service (IRS), enables accurate tax tracking and reporting. The business address, which may be a physical location like "123 Market Street, Springfield," indicates the operational area and may affect local tax obligations. The owner's name, such as "Jane Doe," represents the individual legally responsible for the business, while contact information, including phone numbers and email addresses, is essential for correspondence with tax authorities. Including these details accurately can facilitate the tax exemption process for qualified small businesses.

Statement of Purpose

A small business tax exemption allows qualifying enterprises to reduce their tax burden, fostering growth and sustainability. To apply, businesses must provide a clear statement that outlines purpose, objectives, and eligibility criteria. For instance, a local bakery in Ohio may emphasize its commitment to supporting the community by sourcing ingredients from nearby farms and creating jobs for local residents. Assessors review the application based on factors such as revenue thresholds, number of employees, and community impact. Successful applicants can allocate savings toward expansion efforts, enhancing services, and investing in additional resources that bolster the local economy.

Detailed Description of Business Activities

A small business specializing in eco-friendly home products operates in the heart of Austin, Texas, founded in 2020. The enterprise focuses on sustainable goods such as reusable kitchen items, biodegradable cleaning supplies, and organic personal care products, targeting environmentally conscious consumers. Estimated annual revenue reaches $250,000, driven by a growing clientele seeking to reduce their carbon footprint. The business engages in community initiatives, including local farmers' markets and eco-awareness events, promoting sustainable living. Collaborations with local artisans and producers enhance product diversity while supporting the local economy. Future plans include expanding the product line to include zero-waste personal care options and hosting workshops on sustainable practices, emphasizing continuous community engagement.

Justification and Eligibility Criteria

Small business tax exemption serves as a vital financial relief mechanism for emerging enterprises, typically defined as those with fewer than 500 employees. Eligibility criteria often include meeting revenue thresholds, such as annual gross receipts below $1 million. Justification for tax exemption hinges on factors such as stimulating local economies, promoting job growth, and fostering innovation. Additionally, businesses located in economically disadvantaged areas can qualify for special exemptions, bolstering community development initiatives. Documentation requirements frequently encompass financial statements, tax returns, and proof of operations. Understanding and navigating these criteria can significantly impact small business sustainability and growth potential.

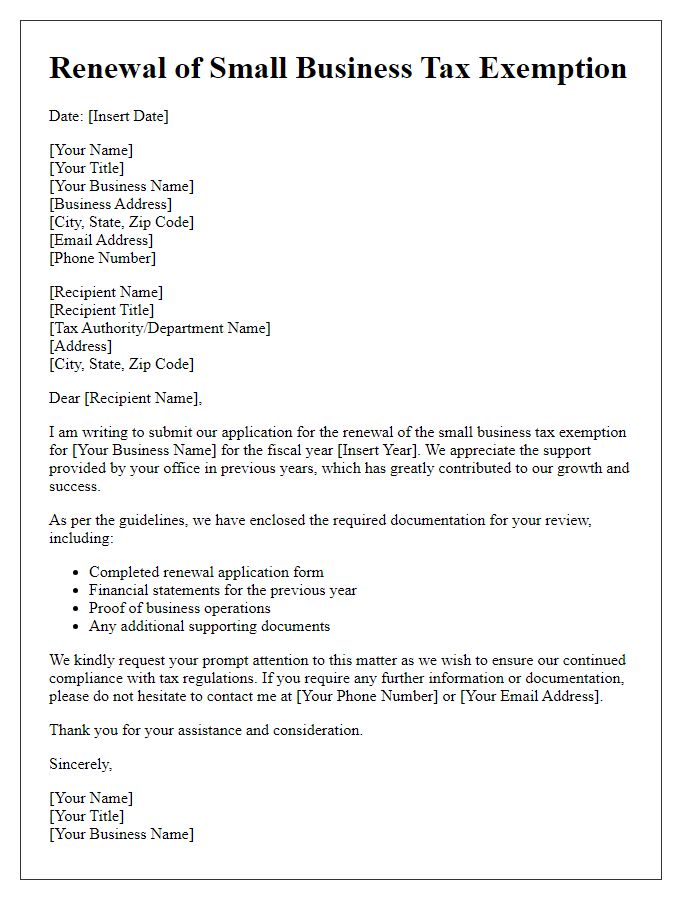

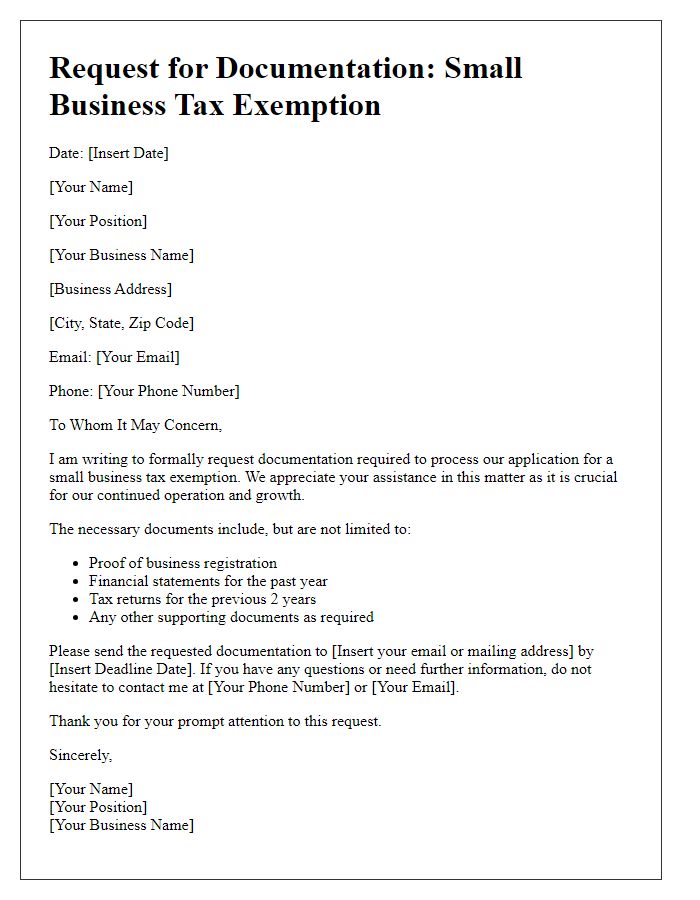

Supporting Documentation

A comprehensive set of supporting documentation for small business tax exemption should include essential elements such as financial statements, income tax returns, and a business license, which validate the legitimacy of the enterprise. Specifics like a profit and loss statement for the last fiscal year, detailing revenues (for example, $200,000) and expenses (approximately $150,000), provide insight into the business's economic health. Additionally, a document outlining the purpose of the tax exemption, indicating alignment with local regulations, strengthens the application. Supporting evidence of employee count, such as payroll records showing a workforce of ten, underscores the contributions to the local economy. Moreover, industry-related certifications (like a Small Business Administration (SBA) certificate) can further substantiate eligibility for the exemption.

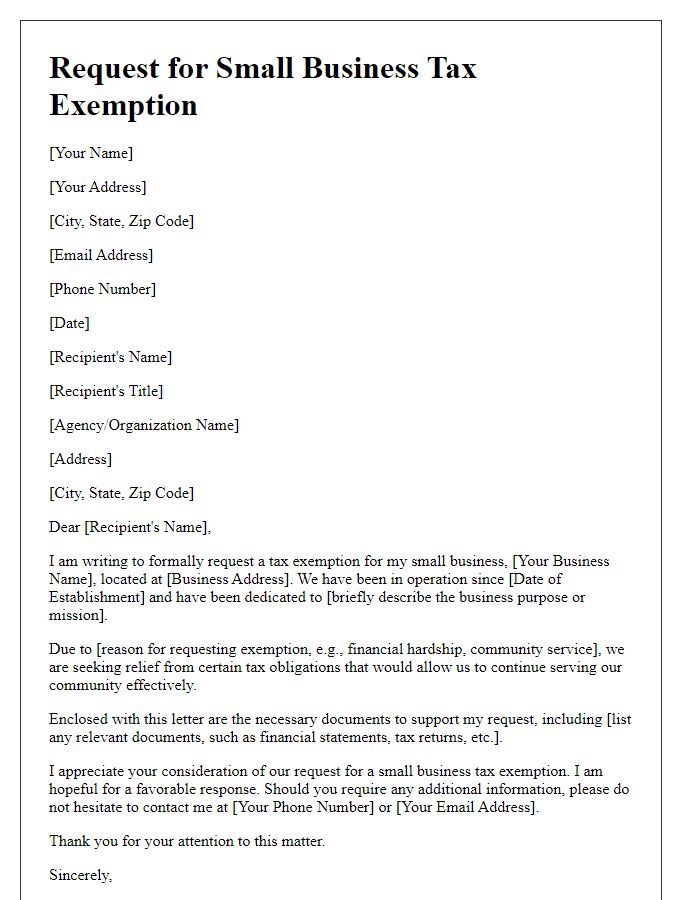

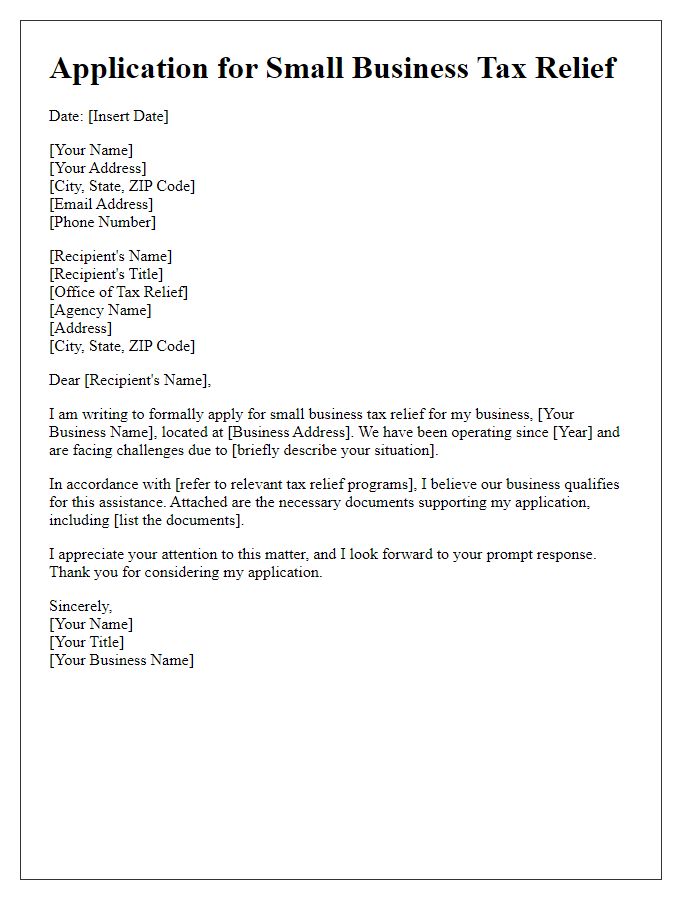

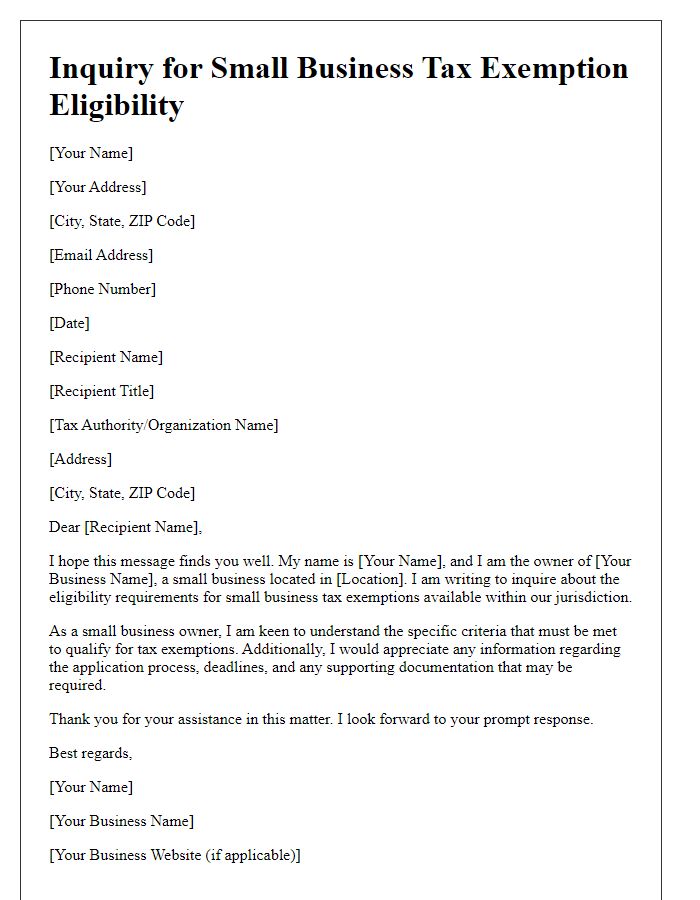

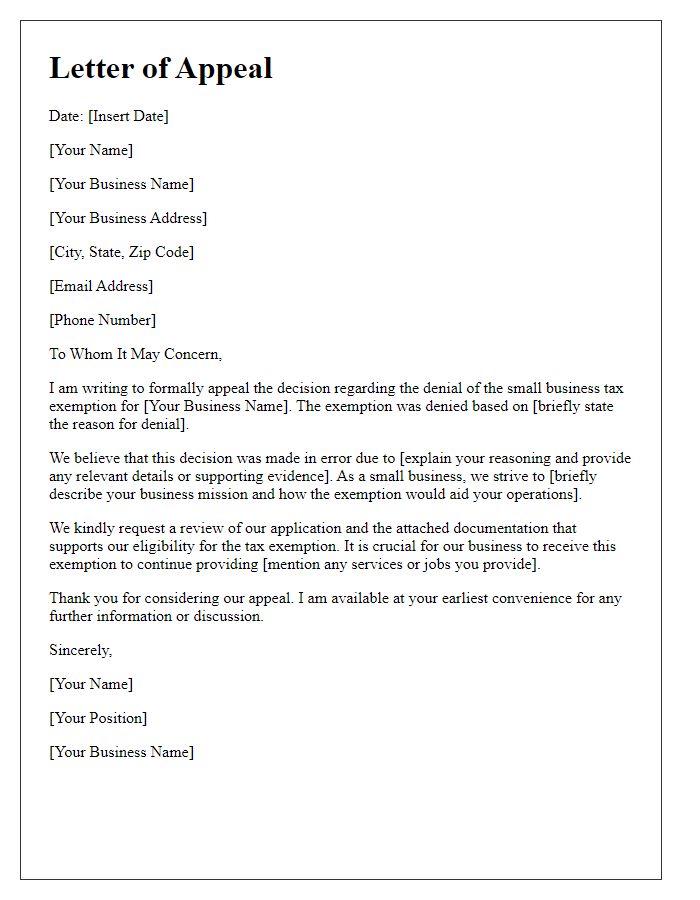

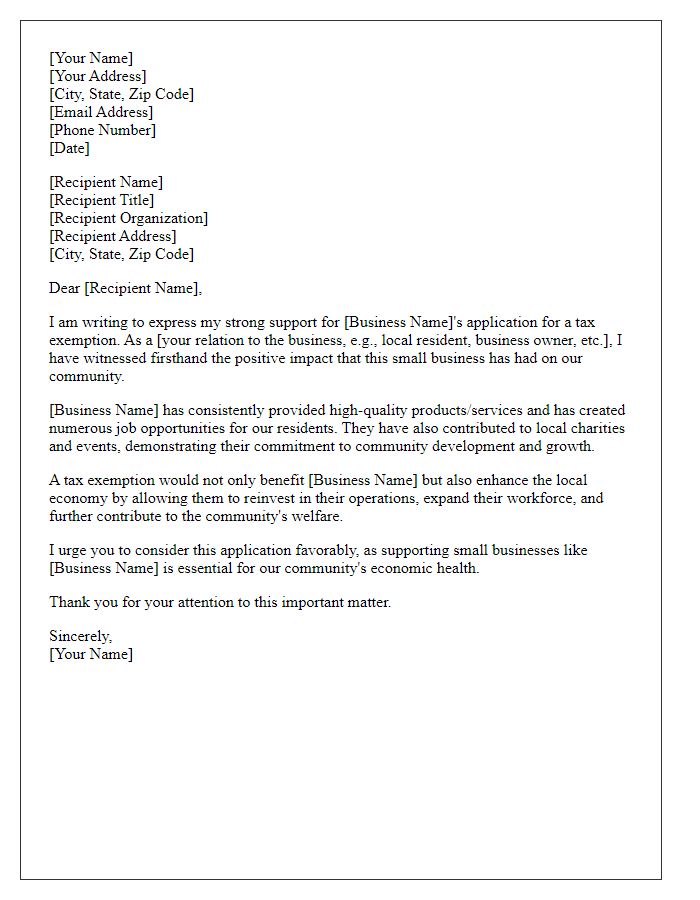

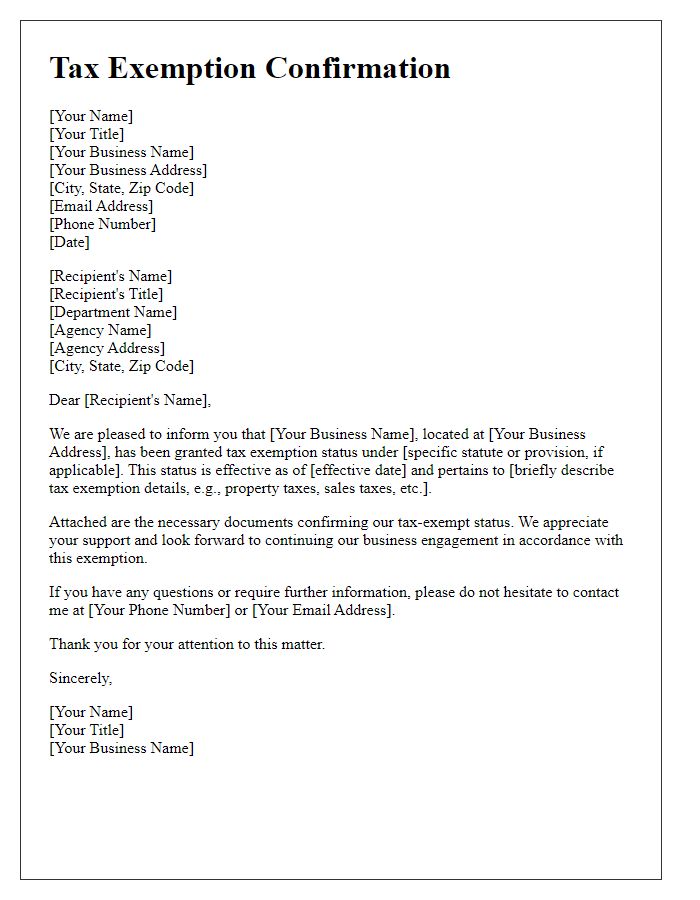

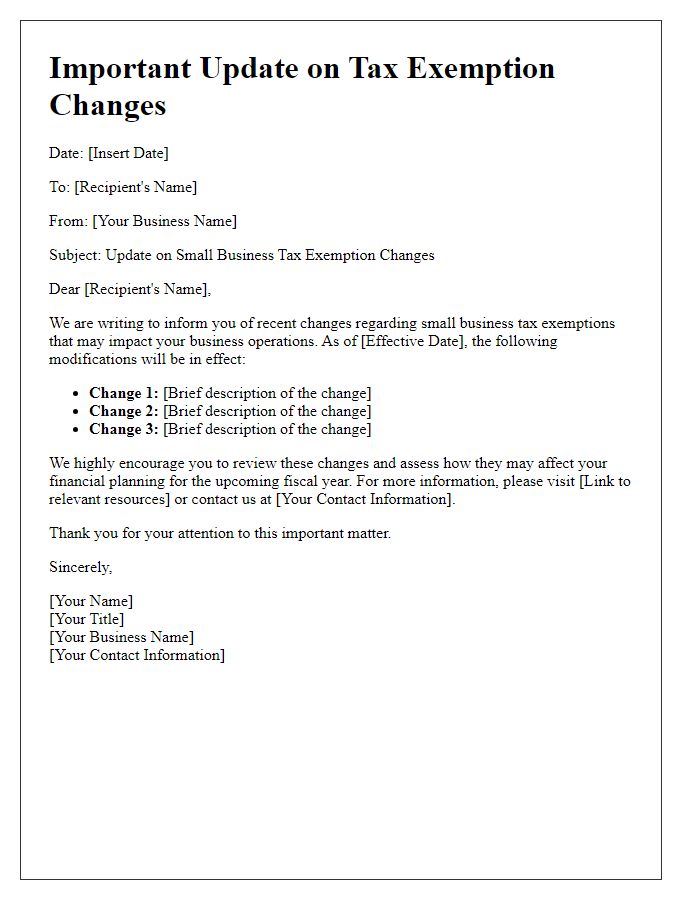

Letter Template For Small Business Tax Exemption Samples

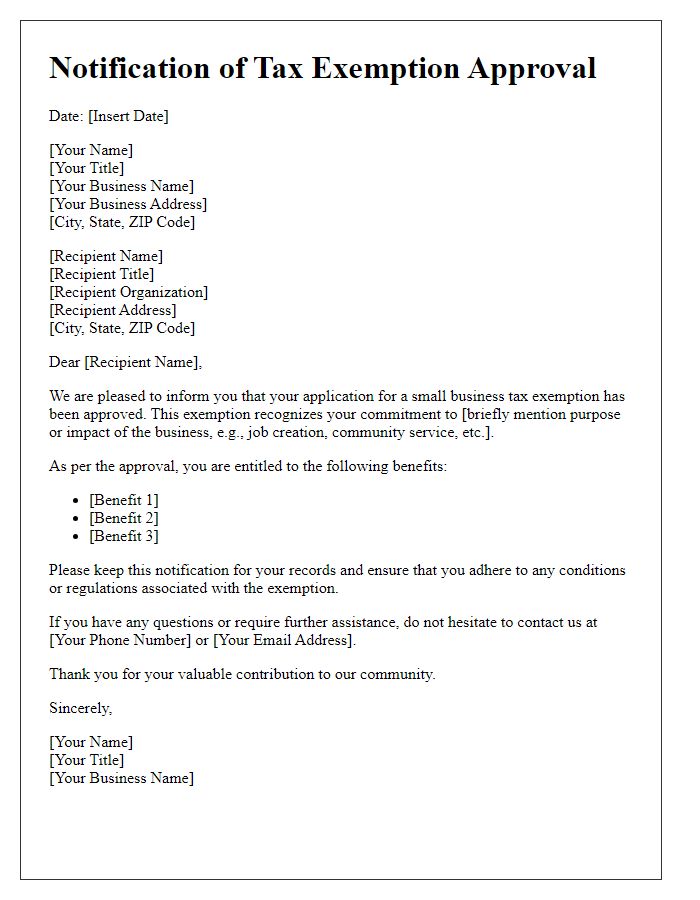

Letter template of notification for small business tax exemption approval

Comments