Writing a letter to acknowledge a donation is a thoughtful way to express gratitude, and it's important to keep it sincere and clear. A well-crafted acknowledgment not only thanks the donor but also details the contribution for their records. By including specific information about the donation, you not only enhance transparency but also strengthen the relationship with your supporter. Ready to dive into the essentials of creating the perfect donation receipt acknowledgment letter? Let's explore the key elements together!

Donor's Name and Contact Information

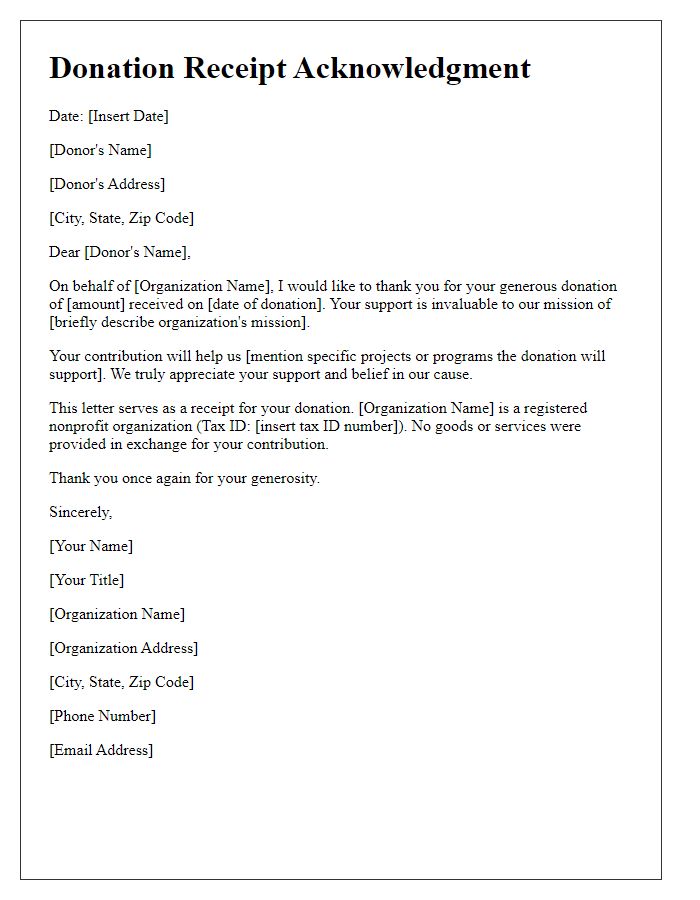

Private organizations often send donation receipt acknowledgments to express gratitude for contributions. These receipts usually include the donor's name, contact information, and the donation amount for tax purposes. For example, the acknowledgment can cite a specific donation amount made on a particular date, such as a $100 contribution on March 15, 2023. Including the organization's name, contact details, and tax identification number enhances the document's legitimacy and assists the donor in maintaining accurate records for IRS deductions. This serves not only as a record for the donor but also reinforces the relationship between the organization and the donor through appreciation.

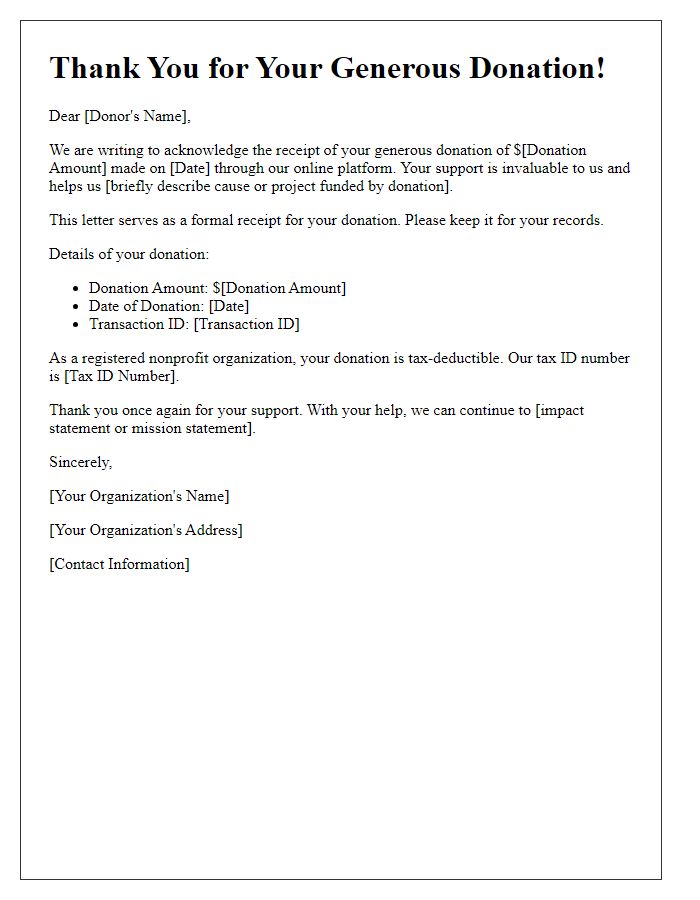

Donation Details (Amount, Date, and Method)

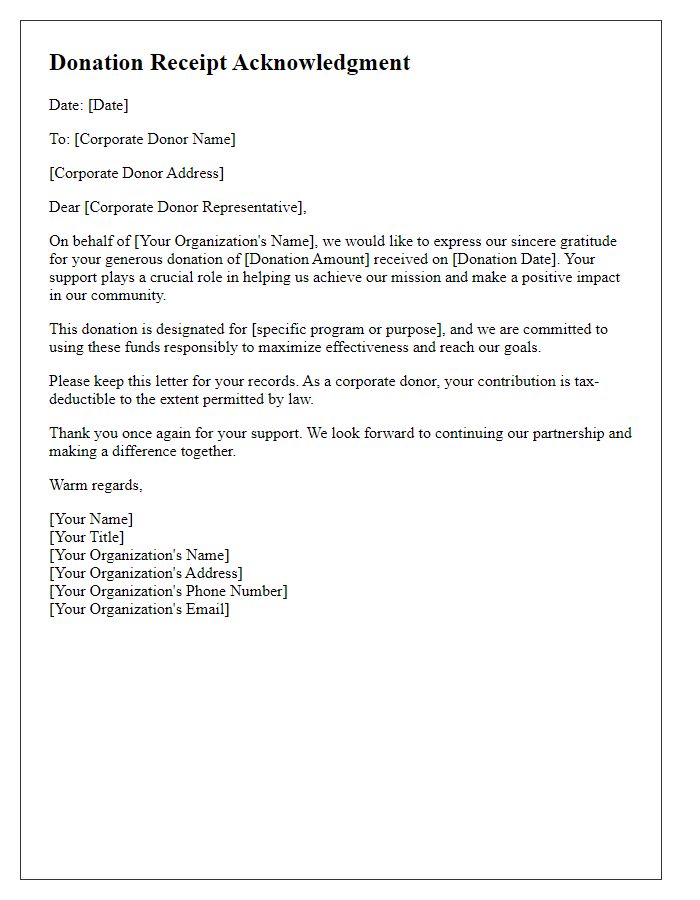

The generous contribution of $500, received on October 15, 2023, through a credit card transaction, has significantly bolstered our mission at the local community center in Springfield, Illinois. This donation, recognized as a charitable gift, will facilitate vital programs including educational workshops and health initiatives for underprivileged families. Detailed acknowledgment of this donation enables us to maintain accurate records for both our organization and the donor, ensuring transparency and supporting tax deduction claims as stipulated by the IRS guidelines. Your support plays a crucial role in sustaining these essential services within our community.

Nonprofit's Tax Information

Nonprofit organizations require accurate acknowledgment of donations for transparency and tax purposes. A donation receipt should include essential tax information as defined by the Internal Revenue Service (IRS). It should feature the nonprofit's legal name, address, and Employer Identification Number (EIN), typically a nine-digit number like 12-3456789. The receipt must explicitly state the amount of the donation, any goods or services received in return (which could affect tax deductibility), and a description of the donation type--cash, property, or services. Nonprofits should also mention that no goods or services were provided in exchange for the donation if applicable. This information helps donors substantiate their charitable contributions during tax filing, ensuring compliance with IRS regulations for donations over $250.

Statement of Gratitude

Charitable organizations often express gratitude to donors through acknowledgment receipts that detail the contributions made. These receipts typically include substantial information, such as the organization's name, the donor's name, donation amount, and date of donation. For instance, a non-profit organization called "Helping Hands Foundation" may send a receipt after a $500 donation received on March 15, 2023. This statement of gratitude serves not only as a confirmation of the donation for tax purposes but also emphasizes the positive impact of the contribution on ongoing projects, such as providing meals to homeless individuals in metropolitan areas like New York City. Such acknowledgement fosters a sense of community support and encourages future contributions.

Description of Donation Impact

The generous donation of $1,000 received on October 1, 2023, greatly contributes to the mission of the Community Food Bank in Springfield, Missouri. This financial support allows the organization to provide approximately 3,000 meals to local families in need, addressing food insecurity that affects 12% of the population in the region. Each dollar donated enables the purchase of nutritious food items from local suppliers, helping to stimulate the local economy. The impact of your contribution extends beyond just meals; it fosters community resilience during challenging times, ensuring that children and families do not experience hunger. Your support plays a vital role in creating a positive change and promoting health and wellness within the Springfield community.

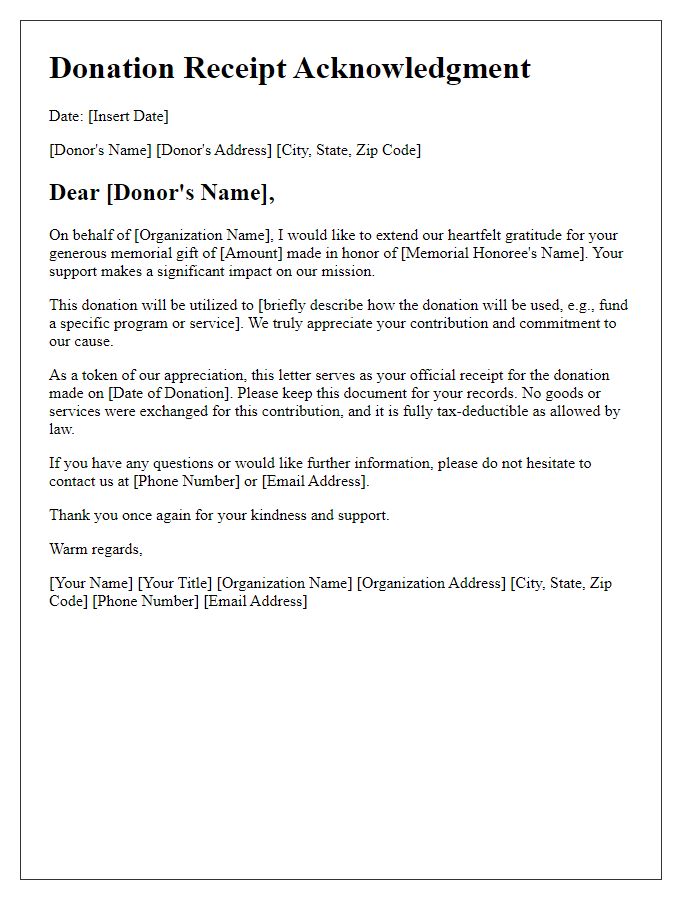

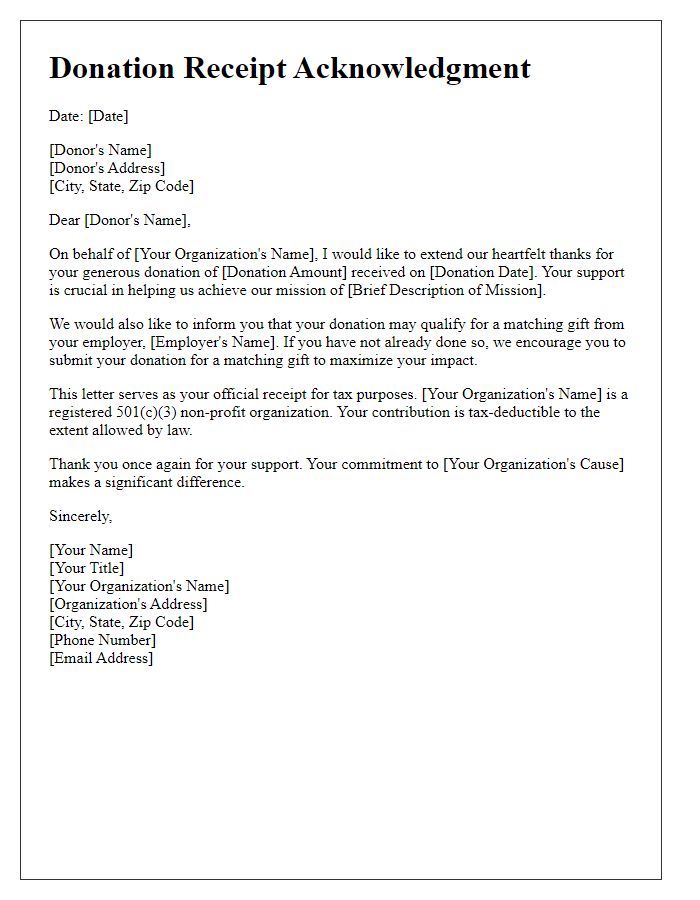

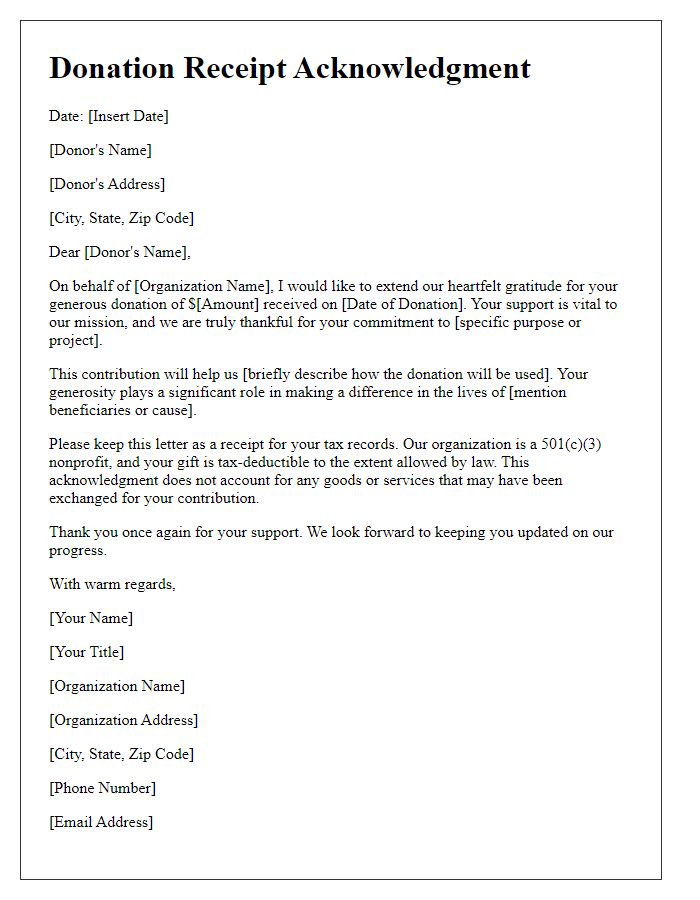

Letter Template For Donation Receipt Acknowledgment Samples

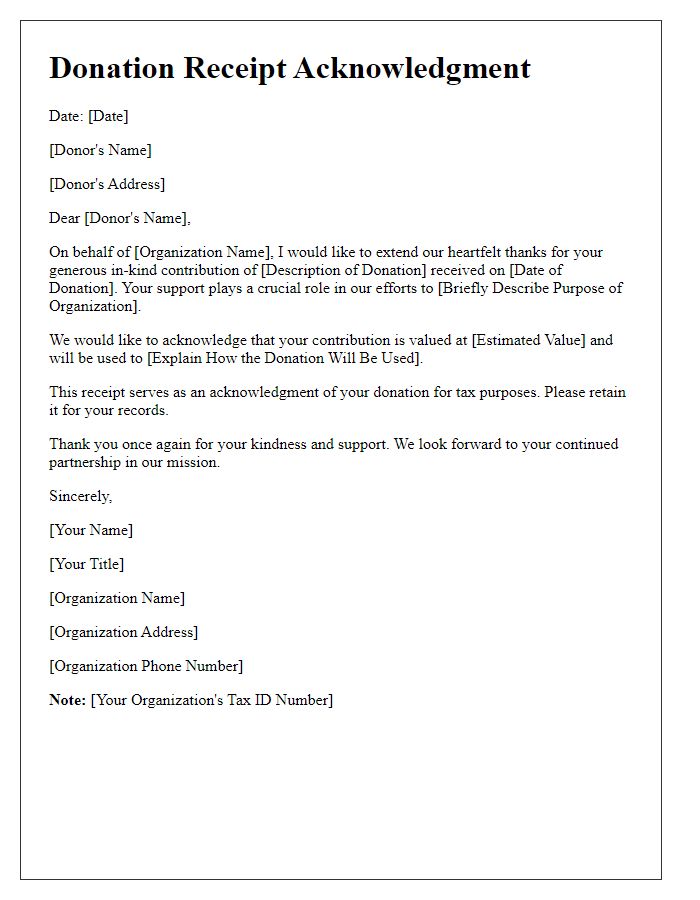

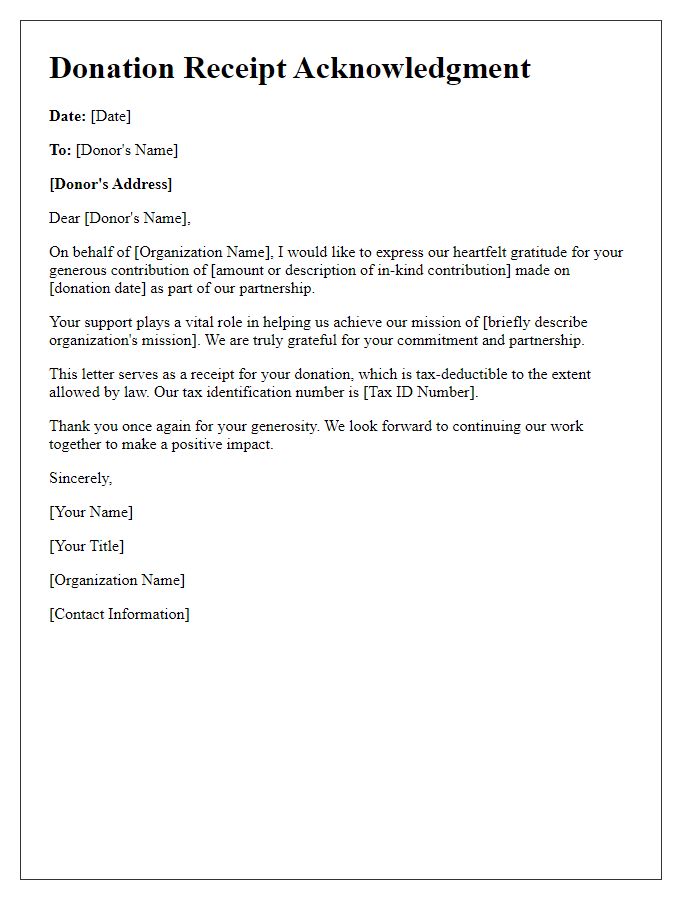

Letter template of donation receipt acknowledgment for in-kind contributions

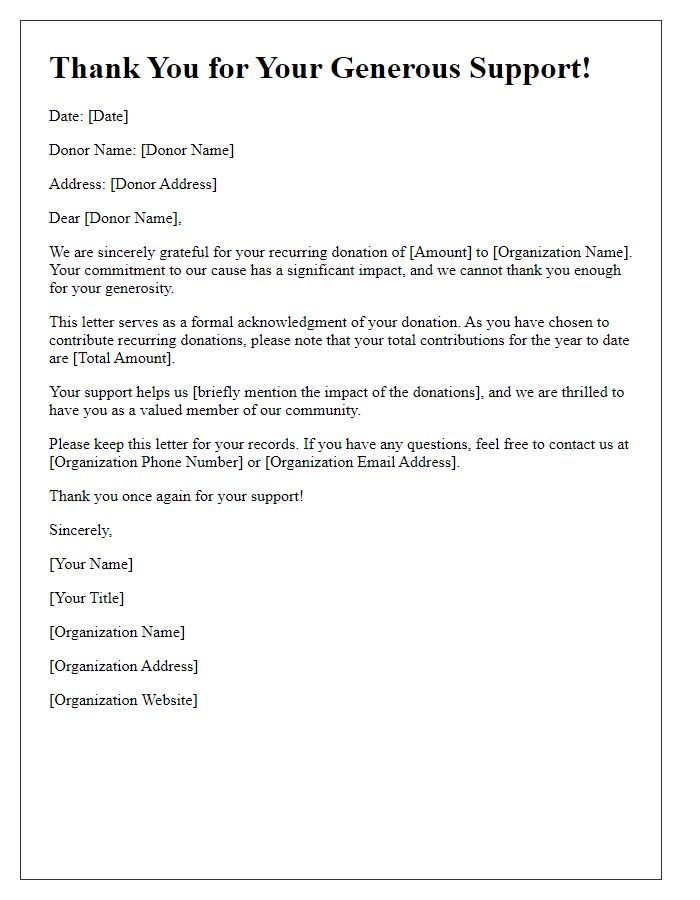

Letter template of donation receipt acknowledgment for recurring donations

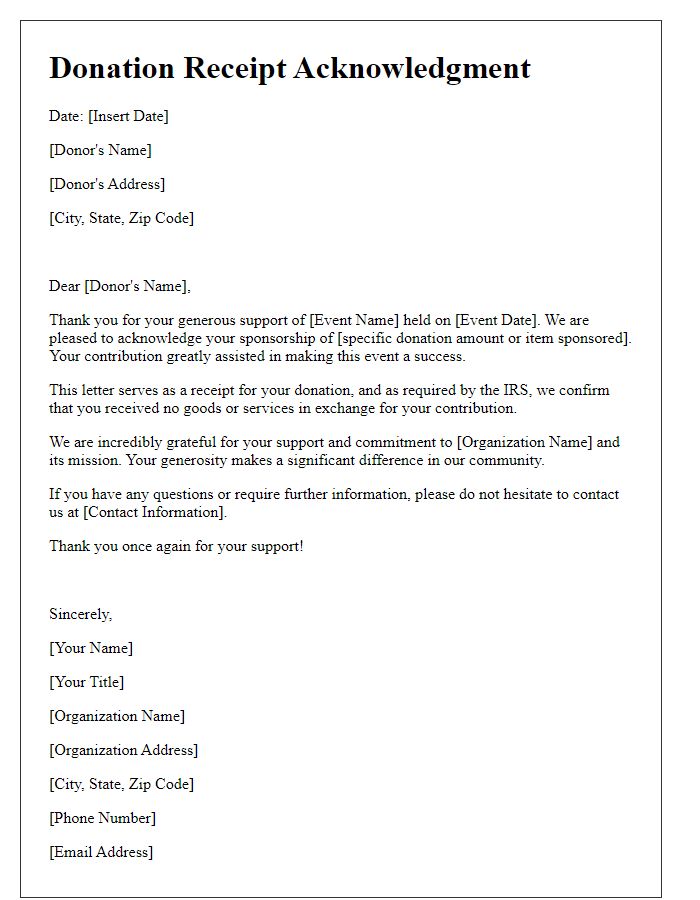

Letter template of donation receipt acknowledgment for event sponsorships

Letter template of donation receipt acknowledgment for partnership contributions

Comments