Are you looking to improve your credit score but facing discrepancies that are holding you back? Addressing inaccuracies in your credit report can feel daunting, but it's an essential step toward financial freedom. In this article, we'll walk you through a simple letter template designed for disputing errors and ensuring your credit history reflects your true creditworthiness. Read on to discover how to take control of your credit score and the steps to craft an effective dispute letter!

Relevant Personal Information (name, address, contact details)

When disputing a credit score, relevant personal information includes essential identifiers such as the individual's full name, residential address (including city, state, and ZIP code), and contact details (telephone number and email address). Providing accurate and up-to-date information ensures that the credit reporting agency can promptly locate the individual's credit file. In addition, including the last four digits of the Social Security Number (SSN) can help verify identity. Having this information organized ensures clarity and facilitates swift communication throughout the dispute resolution process, aligning with the Fair Credit Reporting Act guidelines.

Clear Dispute Reason and Item in Question

Credit score discrepancies can significantly impact financial opportunities. A consumer may encounter inaccuracies in their credit report, such as incorrect late payment entries from major credit bureaus like Experian or TransUnion. Disputes often arise when a reported late payment, dated June 2022, does not align with the consumer's records, leading to potential score drops exceeding 50 points. Addressing these discrepancies is crucial; individuals must gather supporting documentation, including bank statements, payment confirmations, and correspondence with creditors, to substantiate their claims. Timely resolution of such disputes can restore creditworthiness and improve eligibility for loans or favorable interest rates, ultimately ensuring financial stability.

Supporting Documentation and Evidence

Disputing an inaccurate credit score can be an essential step for individuals looking to improve their financial standing. Common inaccuracies may arise from credit reporting agencies like Experian, TransUnion, or Equifax, affecting individuals' ability to secure loans or credit cards. Supporting documentation can include bank statements, payment records, or accounts in question, often dated within the last 24 months. Furthermore, evidence of identity theft, such as police reports or identity verification documents, is crucial for addressing fraudulent activity on credit reports. Timely submission of these documents ensures adherence to the Fair Credit Reporting Act, setting a clear timeline for the dispute resolution process, typically lasting 30 days from receipt by the credit reporting agency.

Specific Resolution and Action Requested

A credit score dispute resolution involves a systematic approach to addressing inaccuracies in credit reports. Common instances include incorrect account details, payment history errors, or fraudulent accounts. The Fair Credit Reporting Act (FCRA) provides consumers with rights to dispute inaccuracies, emphasizing the necessity for evidence-backed claims. Essential documents may include copies of credit reports, identification proof, and any supporting evidence. Consumers typically reach out to credit bureaus like Experian, TransUnion, and Equifax, requesting specific actions such as corrections to account balances or removal of accounts that do not belong to them. Prompt resolution is crucial as inaccuracies can significantly impact consumer credit scores, which are pivotal for qualifying for loans, mortgages, and rental agreements. Steps may also include checking for updates after 30 days, in accordance with regulation protocols for credit reporting agencies.

Polite Closing and Further Contact Information

Checking your credit report for inaccuracies is crucial for maintaining a healthy credit score, especially reports from major agencies like Experian, Equifax, and TransUnion. Inaccuracies can significantly impact loan approvals, interest rates, and overall financial health, with a poor score defined as below 580. Clear documentation is essential when resolving disputes. Required documents might include proof of identity, account statements, and correspondence. Effective communication with dispute resolution departments entails concise explanations and a clear request for investigation. Keeping records of all contacts, including dates and representatives, aids in follow-up and ensures a structured approach to dispute resolution. Remember to regularly monitor changes to your credit score after submitting disputes to gauge the effectiveness of corrections made.

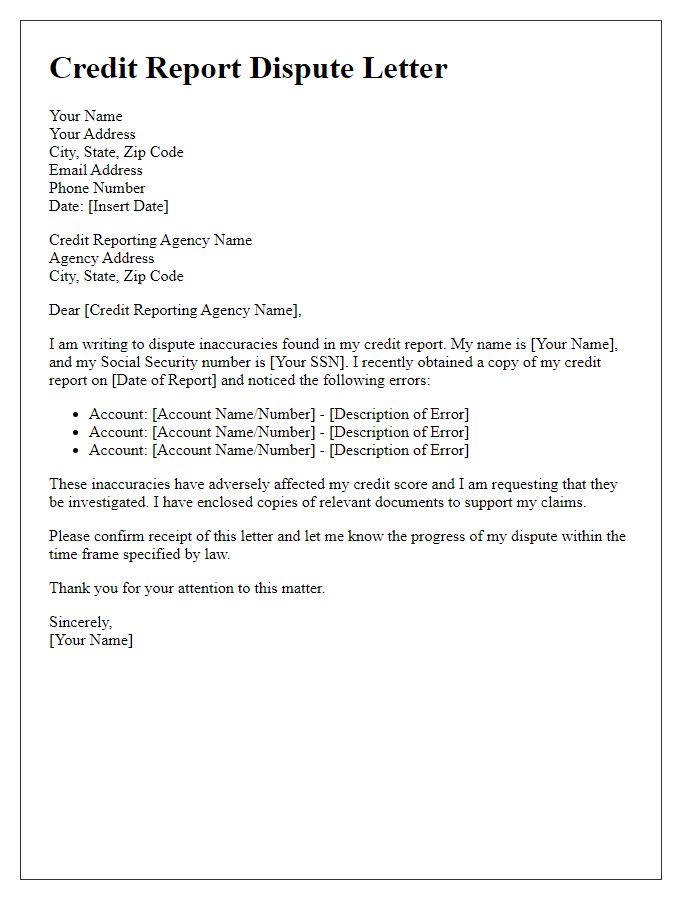

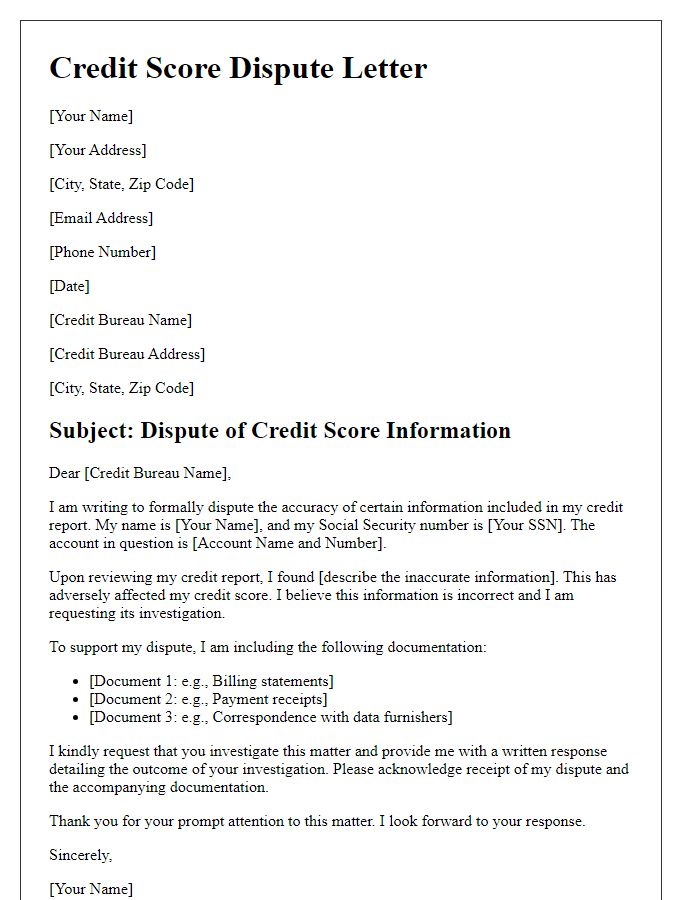

Letter Template For Credit Score Dispute Resolution Samples

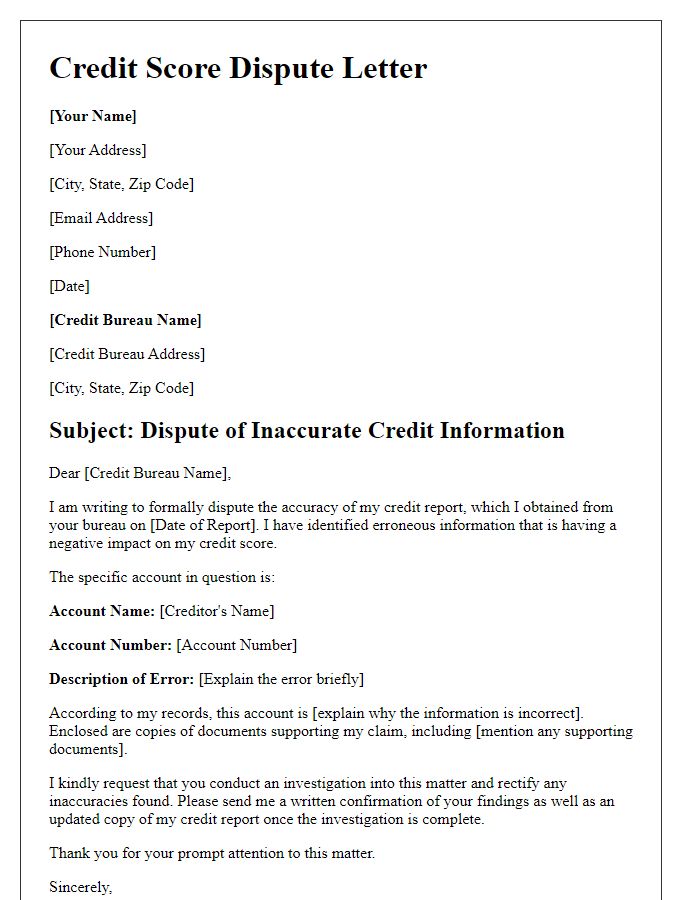

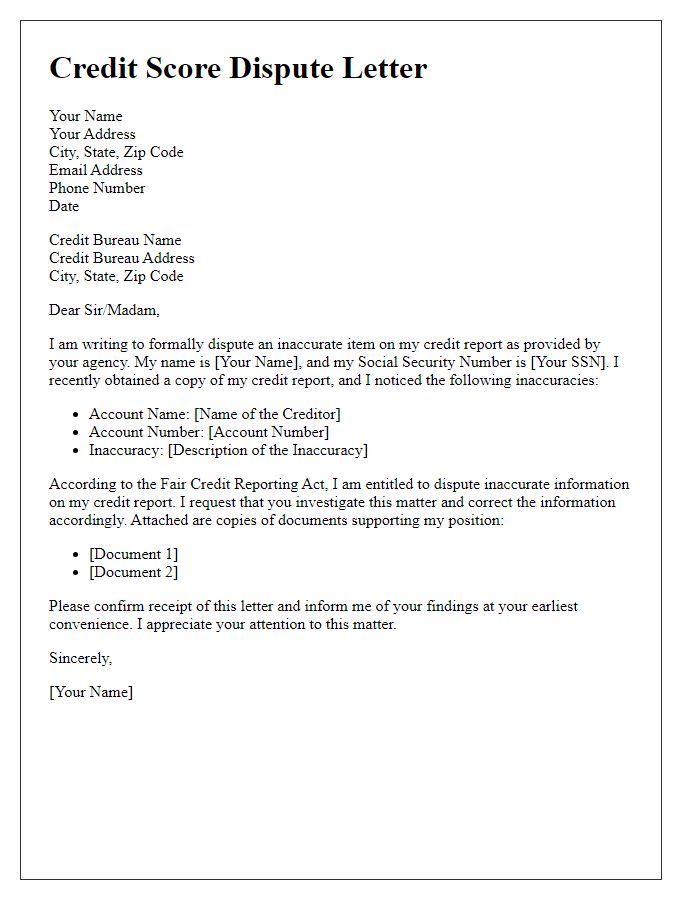

Letter template of credit score dispute due to erroneous account information.

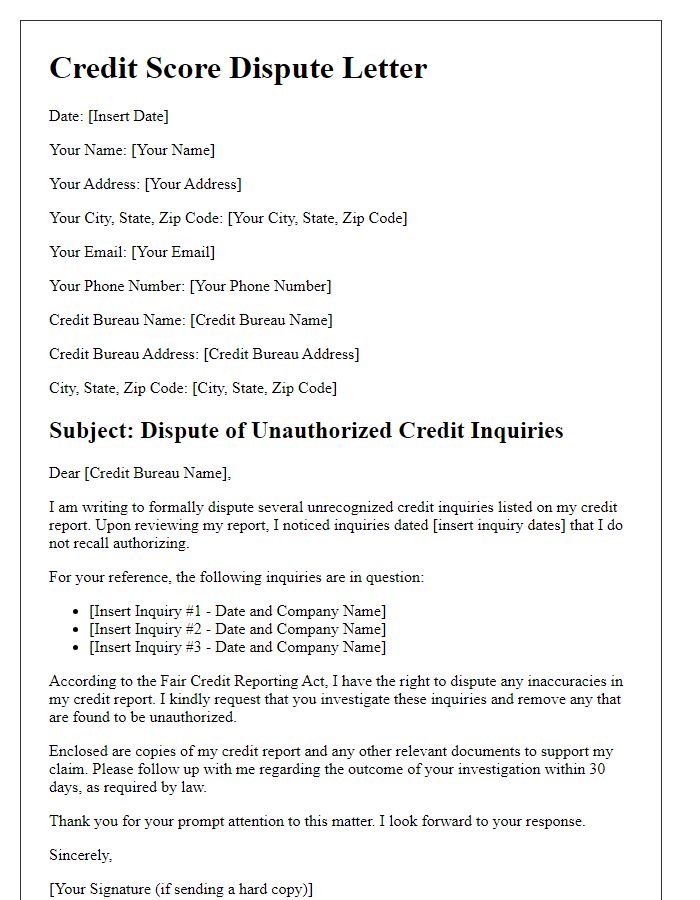

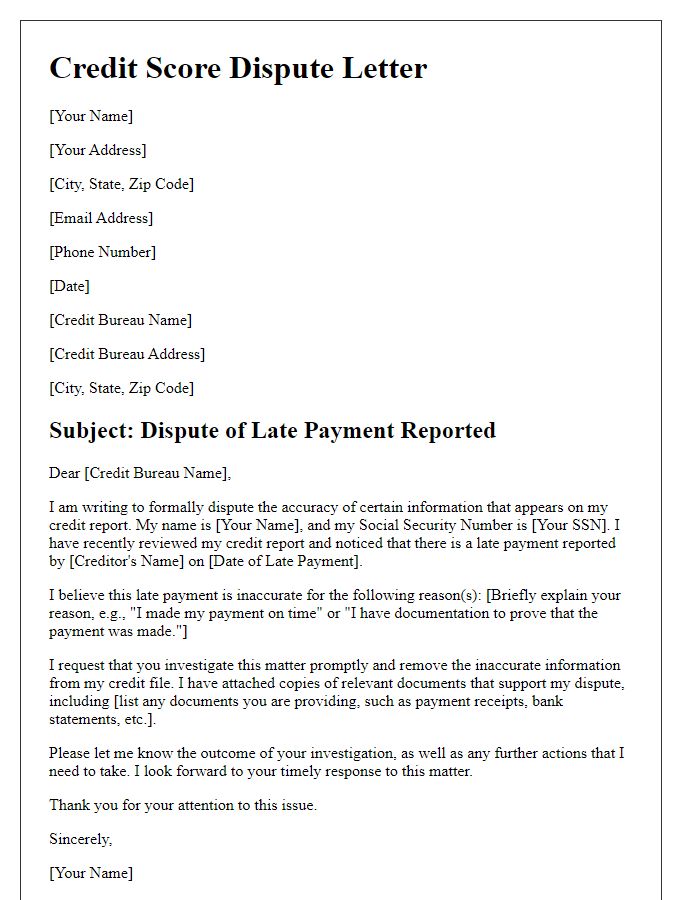

Letter template of credit score dispute about unrecognized credit inquiries.

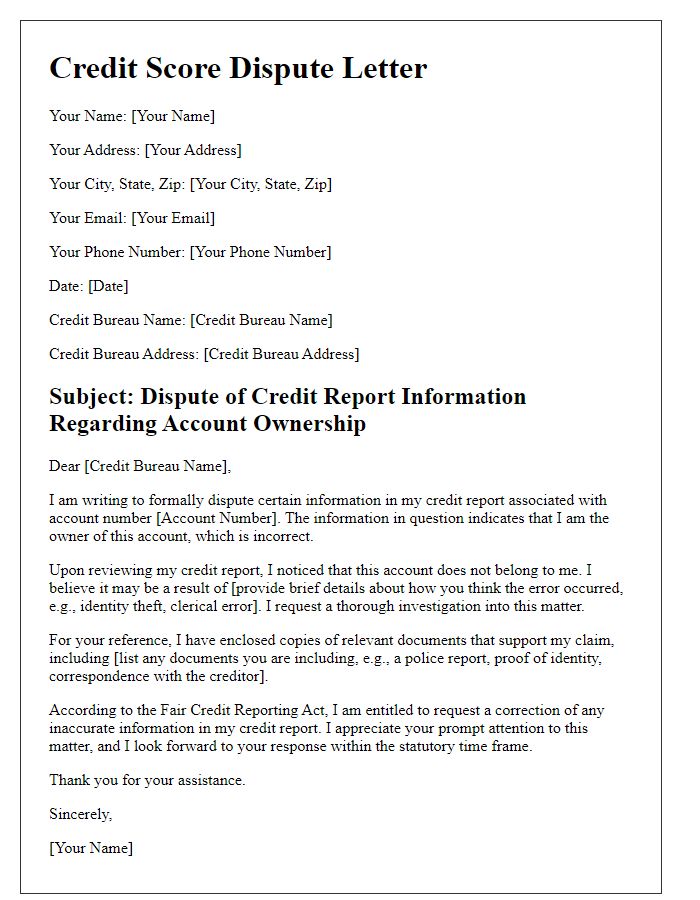

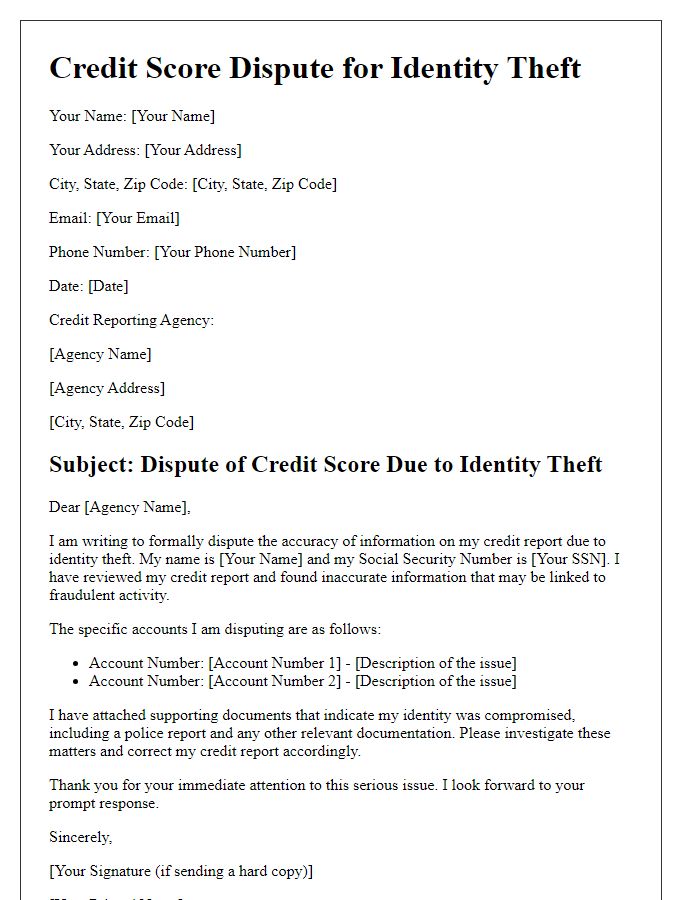

Letter template of credit score dispute concerning account ownership disputes.

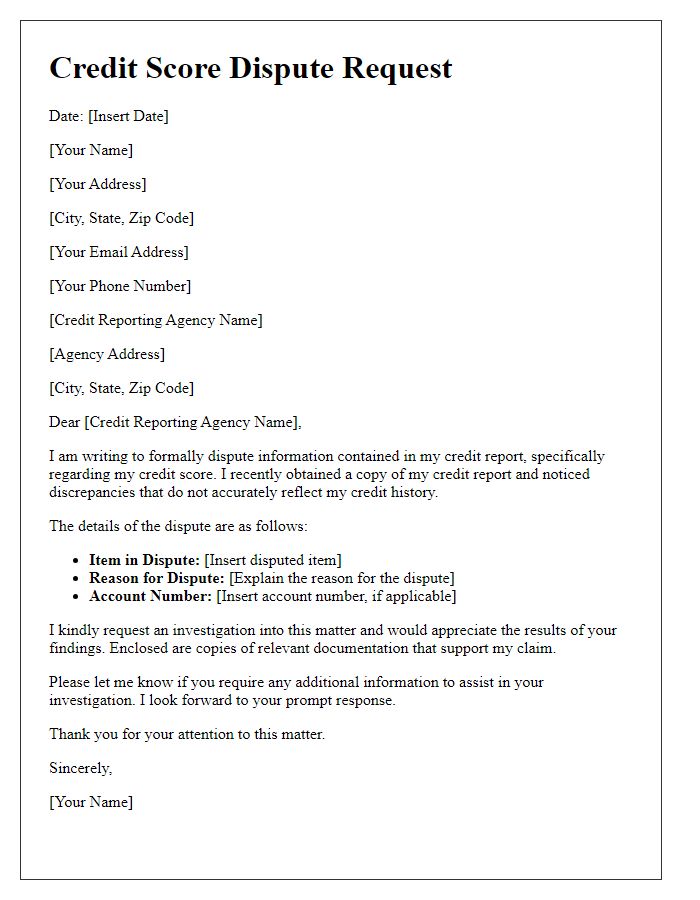

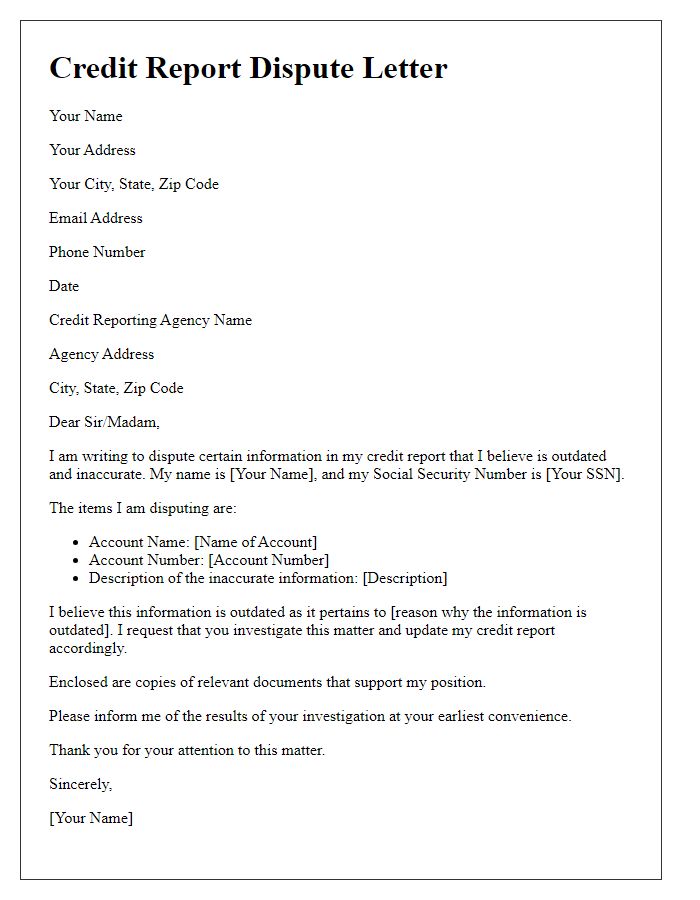

Letter template of credit score dispute when requesting investigation results.

Comments