Navigating bankruptcy proceedings can feel overwhelming, but you're not alone on this journey. Whether you're facing personal or business financial struggles, understanding the process is essential for regaining stability. In this article, we'll break down the key steps involved in handling bankruptcy proceedings, offering clarity and support when you need it most. So, if you're ready to empower yourself with knowledge, let's dive in!

Legal Compliance Requirements

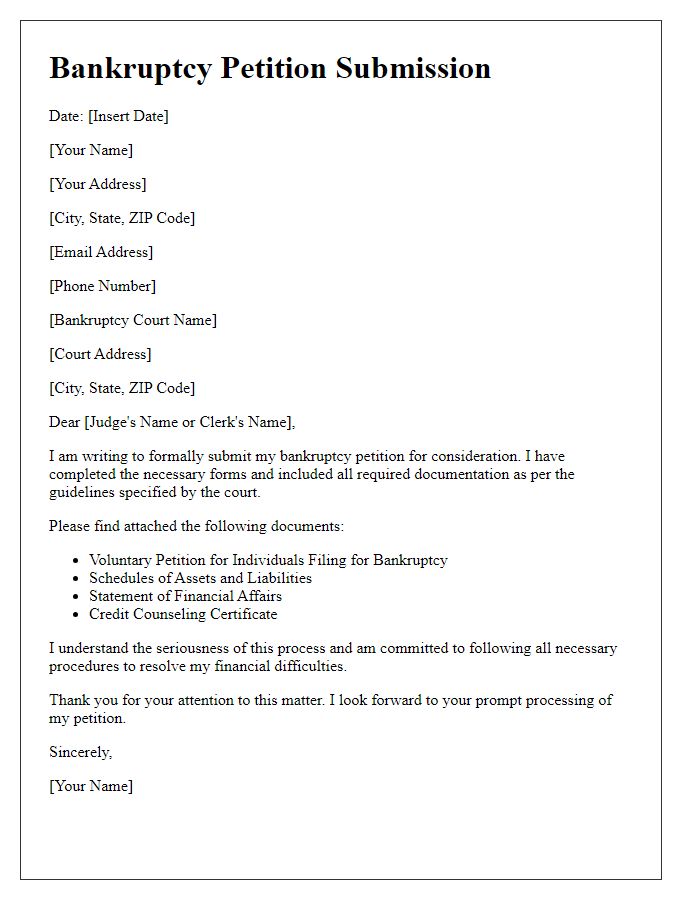

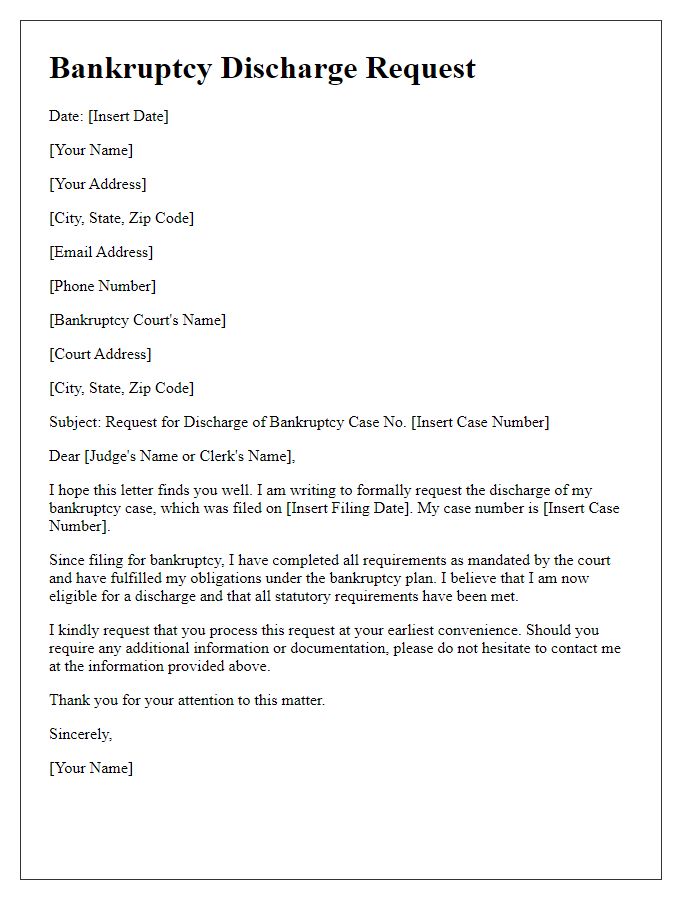

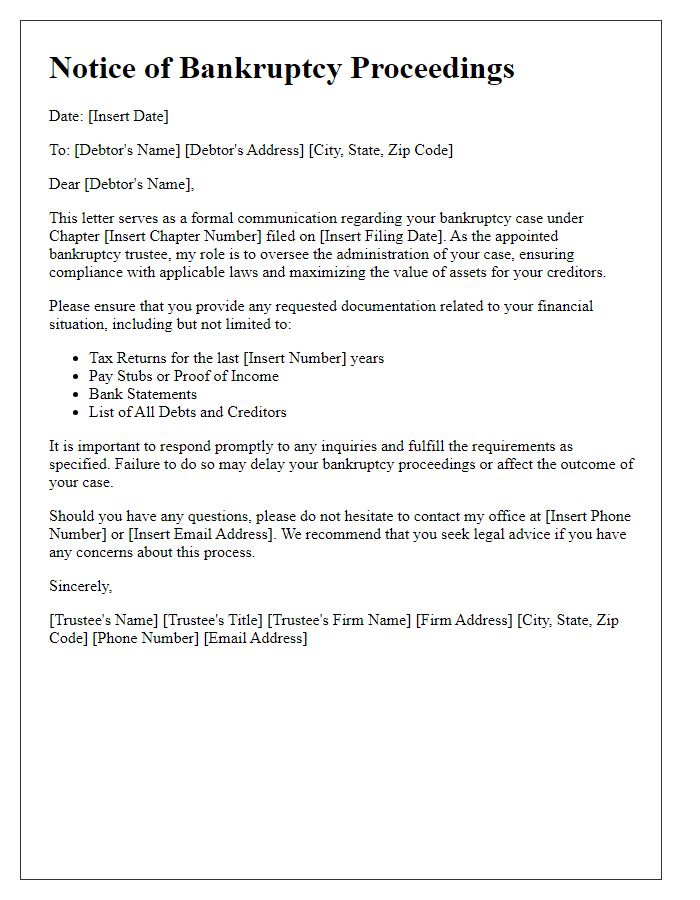

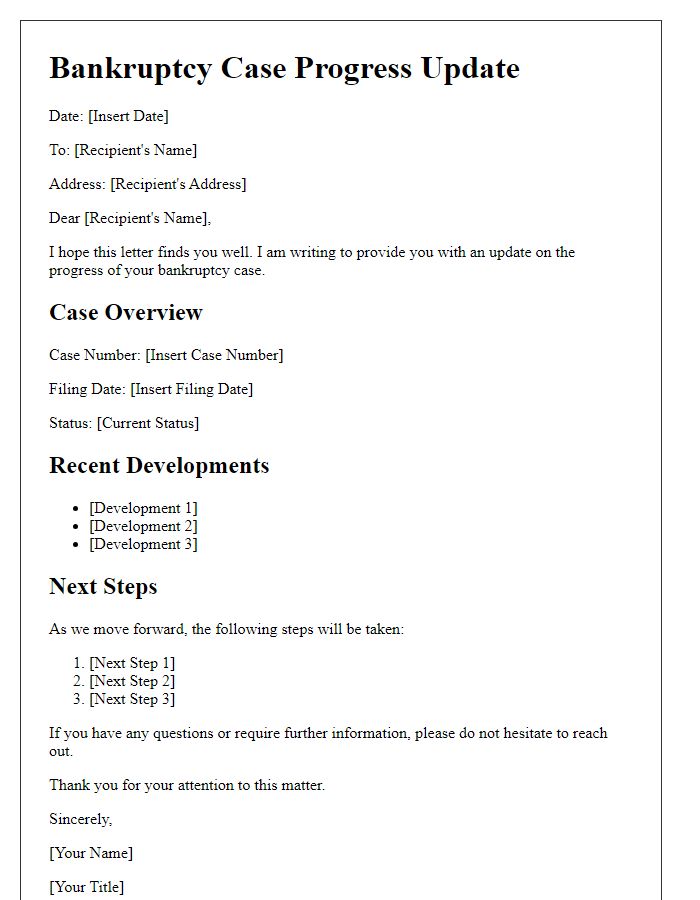

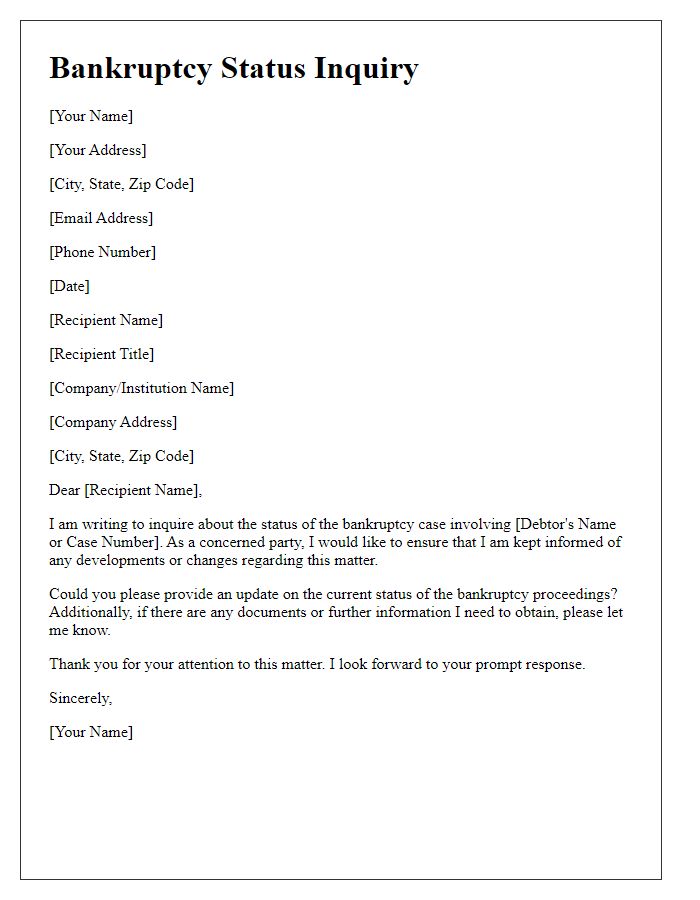

Bankruptcy proceedings involve rigorous legal compliance requirements to ensure fairness and transparency. Individuals or businesses filing for Chapter 7, Chapter 11, or Chapter 13 bankruptcy must submit accurate financial statements detailing assets, liabilities, income, and expenses. These documents, crucial for the court's review, include forms such as the Bankruptcy Petition and Schedule of Assets and Liabilities, typically filed in federal bankruptcy court locations, such as the United States Bankruptcy Court in their respective jurisdiction. Additionally, the mandatory credit counseling certificate (obtained from a government-approved agency) must be submitted within 180 days before filing. Compliance with the Bankruptcy Code, established by the United States Congress, is essential, as violations can lead to dismissal of the case or denial of discharge of debts. Moreover, adherence to deadlines for filing claims, attending the Meeting of Creditors, and providing requested information to the bankruptcy trustee is critical to navigate the complexities of the bankruptcy process successfully.

Formal Tone and Language

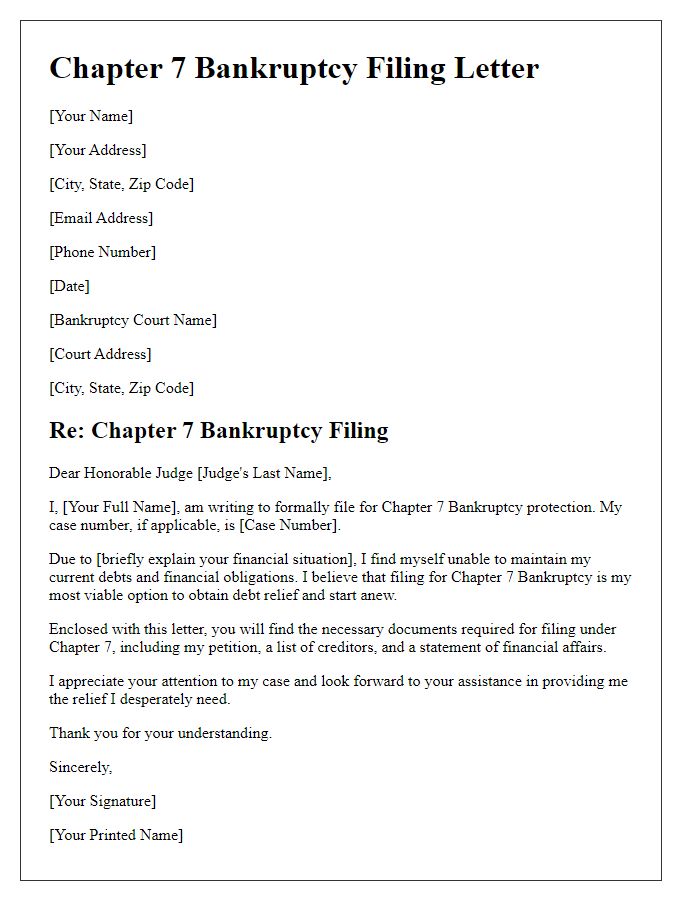

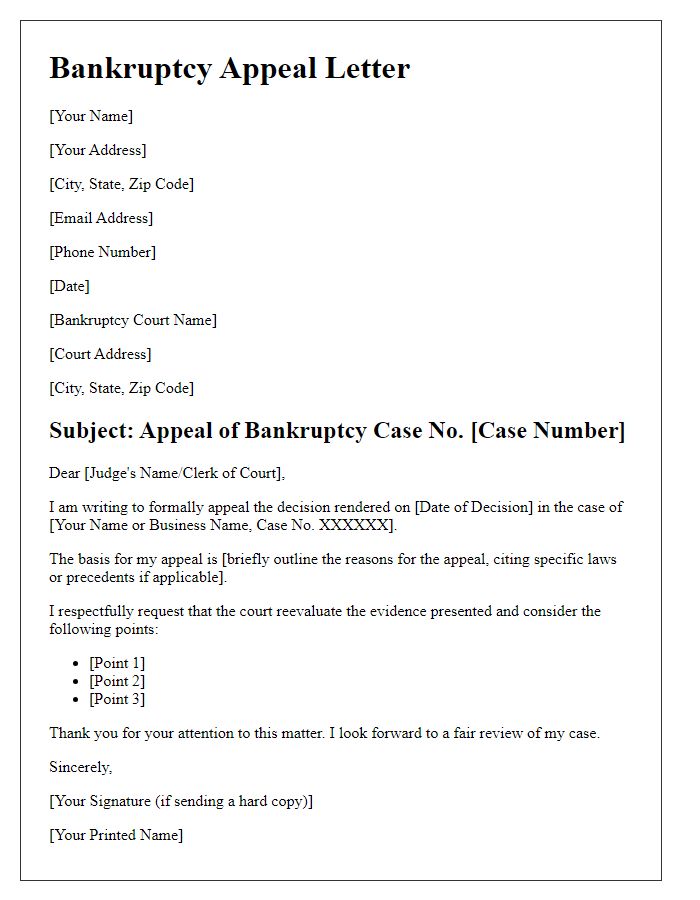

Bankruptcy proceedings can significantly impact financial obligations and future credit. Individuals or businesses in this situation often face court mandates defining asset liquidation (sale of property to pay debts) and debt restructuring. This legal process, governed by the U.S. Bankruptcy Code, involves Chapter 7 liquidation or Chapter 11 reorganization, with differences in asset treatment and discharge of liabilities. Key entities include the bankruptcy trustee, overseeing asset distribution, and creditors, who will submit claims to the court. Court hearings at federal district courts can provide opportunities for claim negotiations or contesting debts, ultimately aiming for a fresh financial start for the petitioner.

Clear Communication of Financial Status

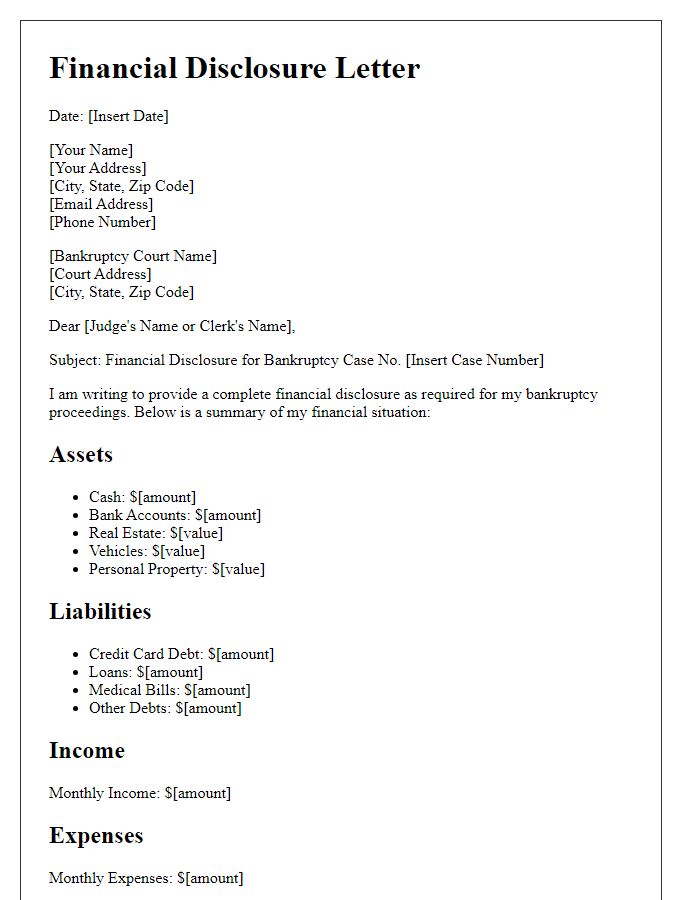

Clear communication of financial status is crucial during bankruptcy proceedings to ensure transparency and effective management of debts. Individuals or businesses facing financial distress should outline key details such as total debts, which may amount to hundreds of thousands of dollars, assets valued at varying amounts, and monthly income streams that reflect their ability to repay obligations. Documentation of financial records, including bank statements and tax returns for the past three years, is essential for presenting a clear picture to creditors and the bankruptcy court. Engaging with qualified attorneys or financial advisors familiar with local bankruptcy laws, such as Chapter 7 or Chapter 13 options, can facilitate proper filing while adhering to regulations in relevant jurisdictions. Clear timelines for payment plans or asset liquidation can promote better negotiations with creditors and improve outcomes for all parties involved.

List of Creditors and Debtors

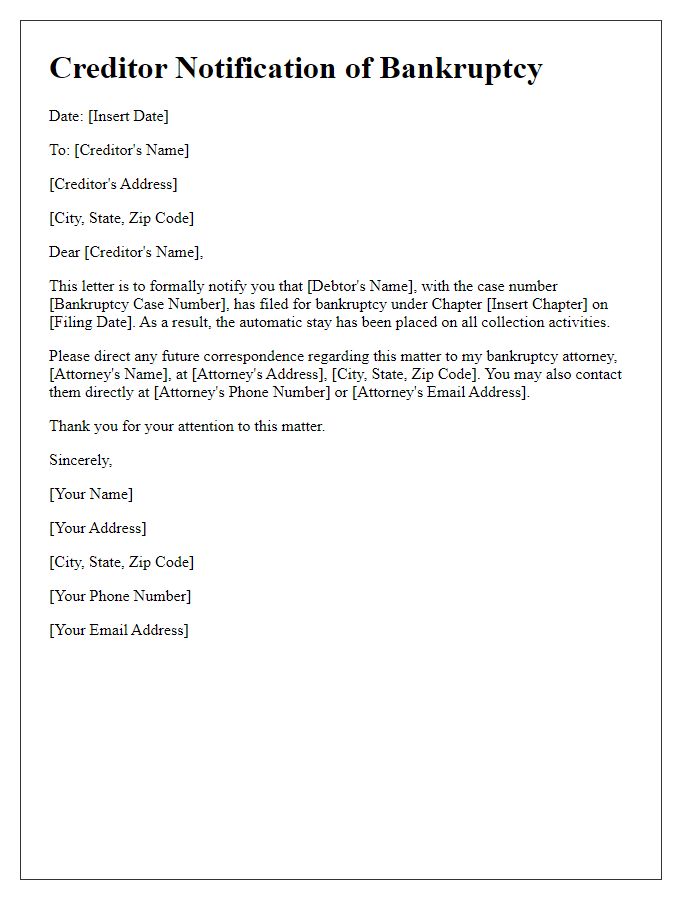

In bankruptcy proceedings, the compilation of a detailed list of creditors (entities owed money) and debtors (entities that owe money) is essential for transparency and efficient resolution. Creditors, such as banks, suppliers, and service providers, should be identified along with outstanding amounts, account numbers, and contact information to facilitate communication regarding repayment plans. Debtors may include individuals and organizations, with specifics about the nature of their debts, terms of repayment, and any collateral involved. Under bankruptcy laws (e.g., Chapter 7 or Chapter 11 in the United States), all claims must be accurately documented to ensure fair treatment of all parties involved and to initiate the legal process for debt relief or restructuring effectively.

Proposed Plan for Debt Resolution

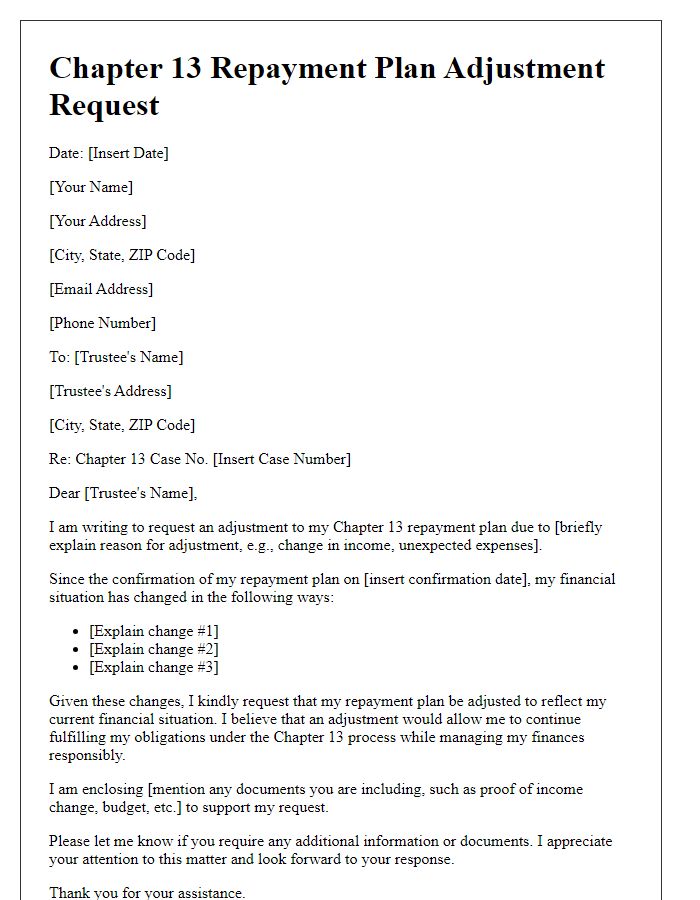

Bankruptcy proceedings often involve intricate negotiations aimed at achieving a viable plan for debt resolution. The proposed plan typically outlines key components such as repayment terms, structured timelines, and involvement of stakeholders (including creditors). Financial figures are crucial, with specific percentages indicating potential debt repayment (for instance, a proposed 30% repayment over five years). Expert reviews of asset valuations (notably real estate and personal property) can inform realistic expectations for recovery. Legal compliance with federal bankruptcy laws (like Chapter 11 or Chapter 13 regulations) is essential to protect debtor rights and ensure fair negotiations. Regular communication channels must be established to maintain transparency with all parties, fostering trust throughout the process. Additionally, post-bankruptcy projections may detail the importance of rebuilding credit scores and financial health toward a stable future.

Comments