In today's world, it's crucial for businesses to stay ahead of potential legal risks that could impact their operations and reputation. A proactive approach not only protects your organization but also fosters trust among stakeholders and clients. By implementing a well-structured legal risk disclosure strategy, you can equip yourself with the knowledge needed to navigate uncertain waters. Let's dive deeper into how you can effectively manage these risks and safeguard your businessâread on to learn more!

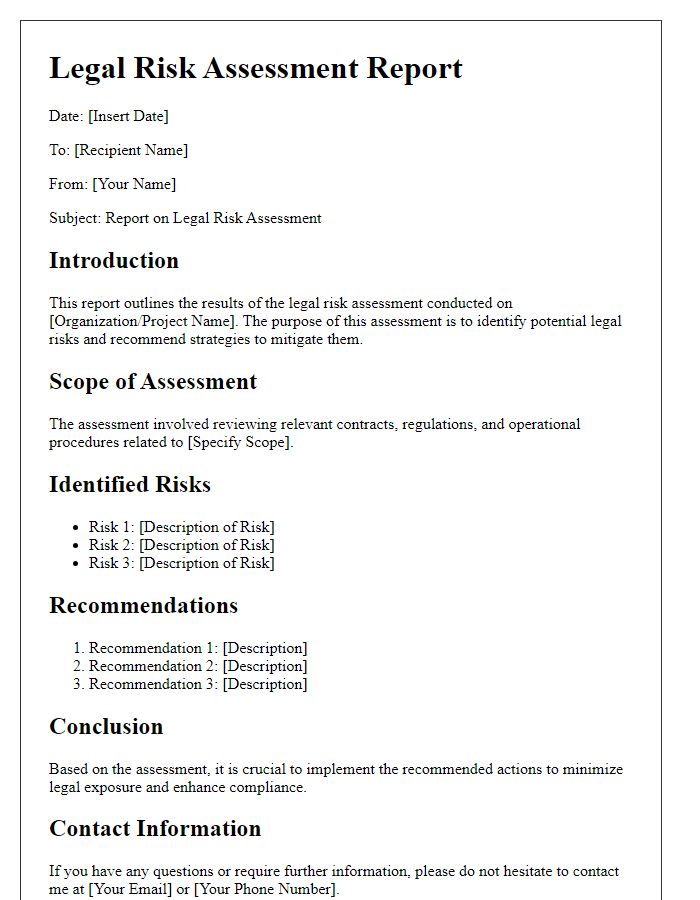

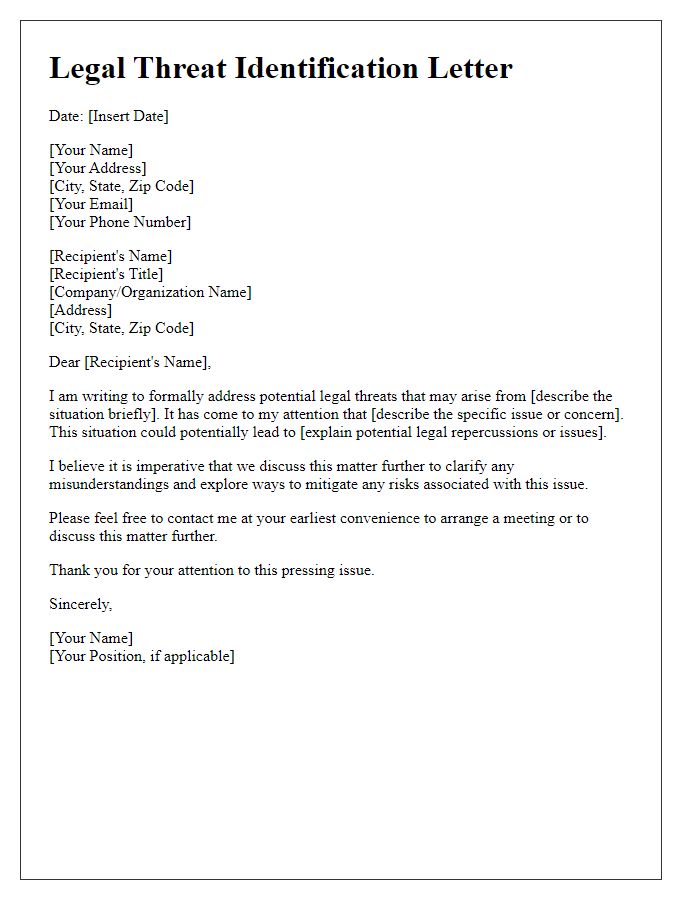

Clear identification of potential legal risks

Potential legal risks can arise from various factors in business operations, including contractual obligations, compliance with regulations, and employee conduct. Examples include breach of contract scenarios involving clients, where failure to meet agreed terms could lead to lawsuits. Regulatory non-compliance can occur in industries like finance and healthcare, potentially resulting in penalties from authorities such as the Securities and Exchange Commission or the Food and Drug Administration. Employment-related claims, including discrimination lawsuits, can also pose significant legal challenges, especially in states with strict labor laws like California. Additionally, intellectual property infringements can arise, which may involve unauthorized use of trademarks or patents, leading to disputes in federal courts. Identifying these risks early is crucial for mitigating potential legal liabilities and safeguarding organizational interests.

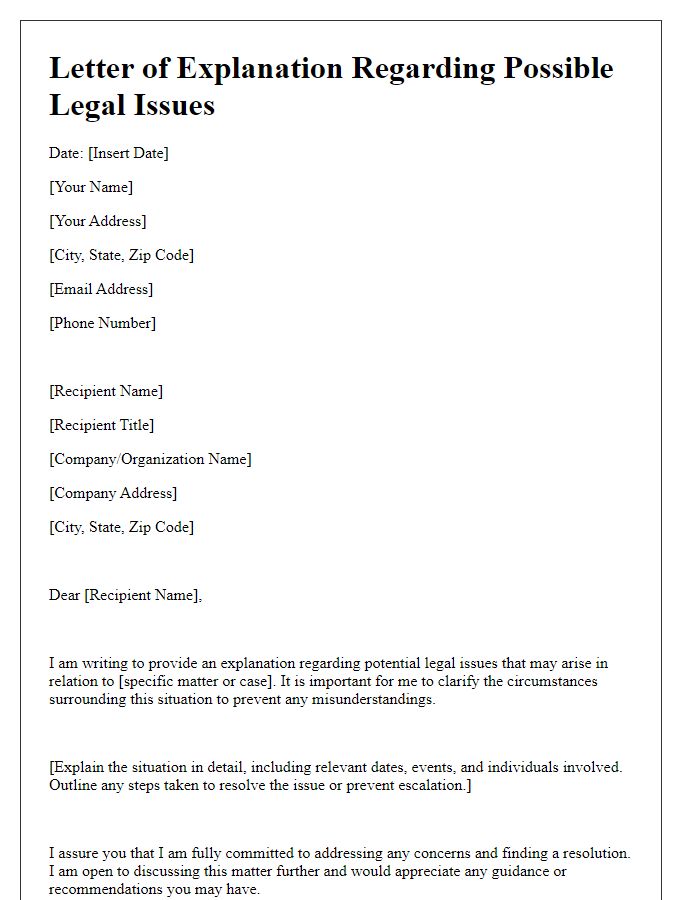

Detailed explanation of risk implications

Potential legal risks can significantly impact business operations and reputation. Regulatory violations, such as non-compliance with the General Data Protection Regulation (GDPR) in the European Union, can result in fines up to EUR20 million or 4% of annual global revenue, whichever is higher. Litigation from customers or employees can lead to costly legal battles and settlements, with cases often reaching six figures or more. Intellectual property infringement, especially in technology sectors, can cause financial losses and loss of competitive advantage. Furthermore, adverse publicity resulting from legal issues can damage brand image, reduce consumer trust, and lead to a decline in sales. Establishing robust risk management strategies is essential to mitigate these potential legal implications effectively.

Reference to relevant laws or regulations

Potential legal risks can arise from various business practices, influenced by local laws such as the Sarbanes-Oxley Act in the United States, which mandates strict financial disclosures for publicly traded companies. Additionally, regulations like the General Data Protection Regulation (GDPR) in the European Union impose stringent requirements on data privacy and protection. Non-compliance with these regulations can lead to severe penalties, including hefty fines that can reach up to 4% of annual global turnover for GDPR violations. Companies must also consider industry-specific guidance, such as the Health Insurance Portability and Accountability Act (HIPAA) in healthcare, which governs the handling of sensitive patient information. Understanding and integrating these legal frameworks into business operations is critical to mitigating potential risks and ensuring compliance.

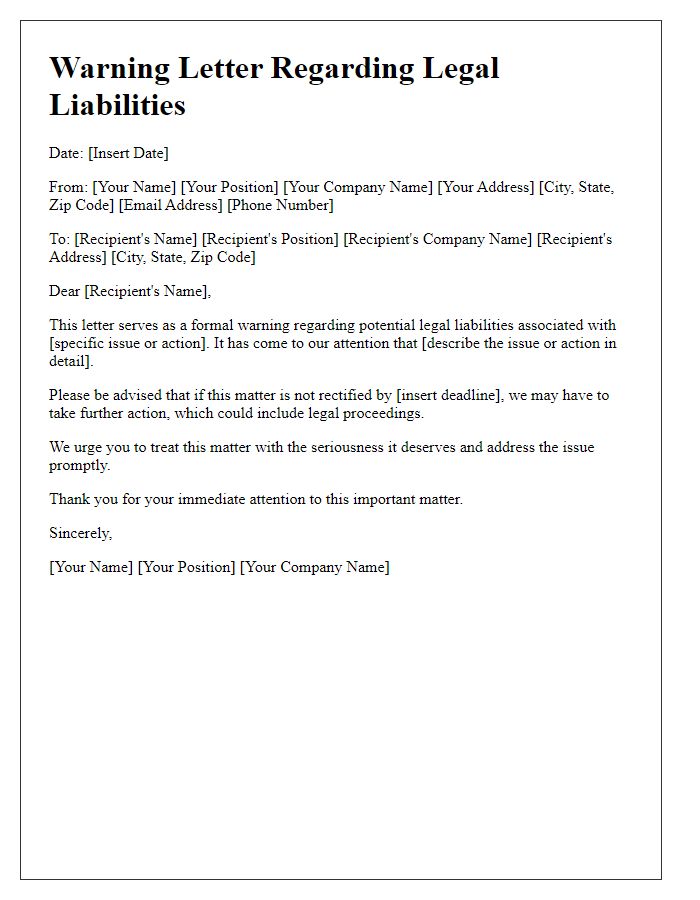

Mitigation plans or strategies

Mitigation plans for potential legal risks often involve comprehensive strategies designed to reduce exposure to liability. Implementing regular compliance audits (conducted quarterly) ensures adherence to applicable laws, such as the General Data Protection Regulation (GDPR) or Environmental Protection Agency (EPA) guidelines. Establishing a robust training program for employees, covering key topics like workplace safety (OSHA standards) and discrimination laws (Title VII of the Civil Rights Act), minimizes risks related to employee misconduct. Creating a dedicated legal team, with expertise in corporate governance and intellectual property law, proactively addresses and prevents potential litigation. Utilizing risk assessment tools, such as SWOT analysis, allows identification of vulnerabilities within the organizational structure, enabling timely corrective measures. Strong insurance policies, like general liability and directors and officers (D&O) insurance, provide financial protection against unforeseen legal challenges. Regular communication with industry consultants ensures the organization remains informed about emerging legal trends and compliance requirements.

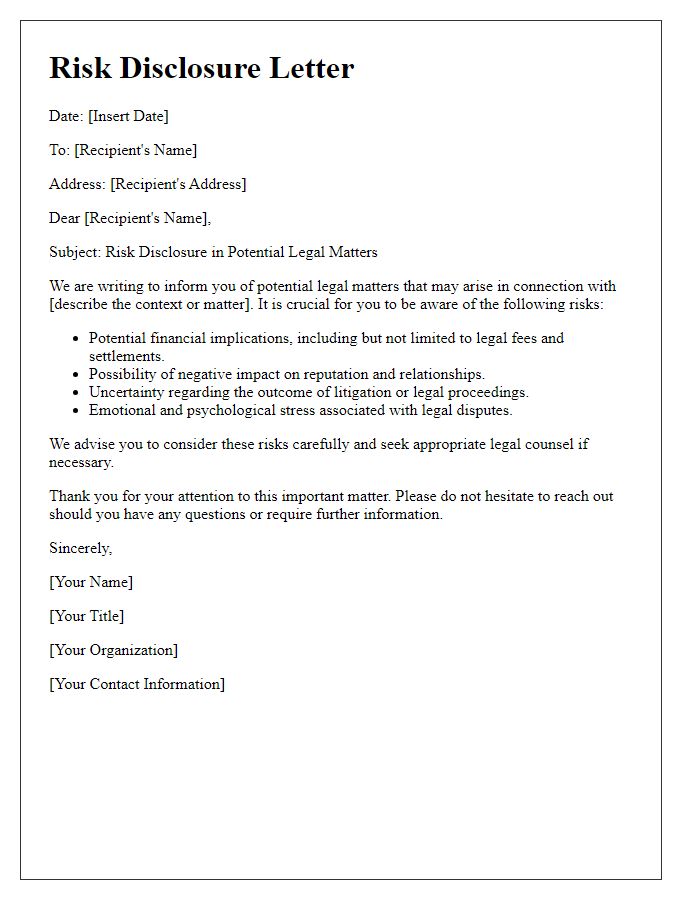

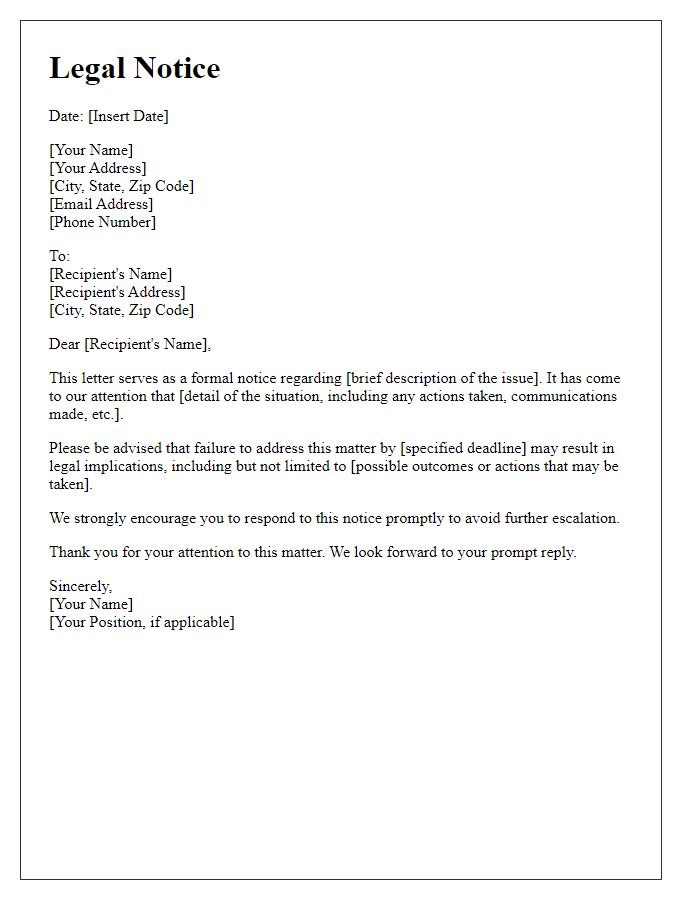

Contact information for further inquiries

When exploring potential legal risks, it is essential to provide comprehensive contact information for further inquiries. Clear communication channels facilitate transparency and ensure that stakeholders can reach the appropriate legal representatives for clarifications. Essential details include a designated legal department email address, such as legal@companyname.com, and a direct phone line, ideally a toll-free number, to ensure ease of access (e.g., 1-800-555-0199). In addition, including the office mailing address, such as 123 Main St, Suite 100, City, State, Zip Code (United States), allows for formal communications or document submissions. Establishing these contact points helps to foster trust and ensures all inquiries regarding legal disclosures can be addressed promptly and effectively.

Comments