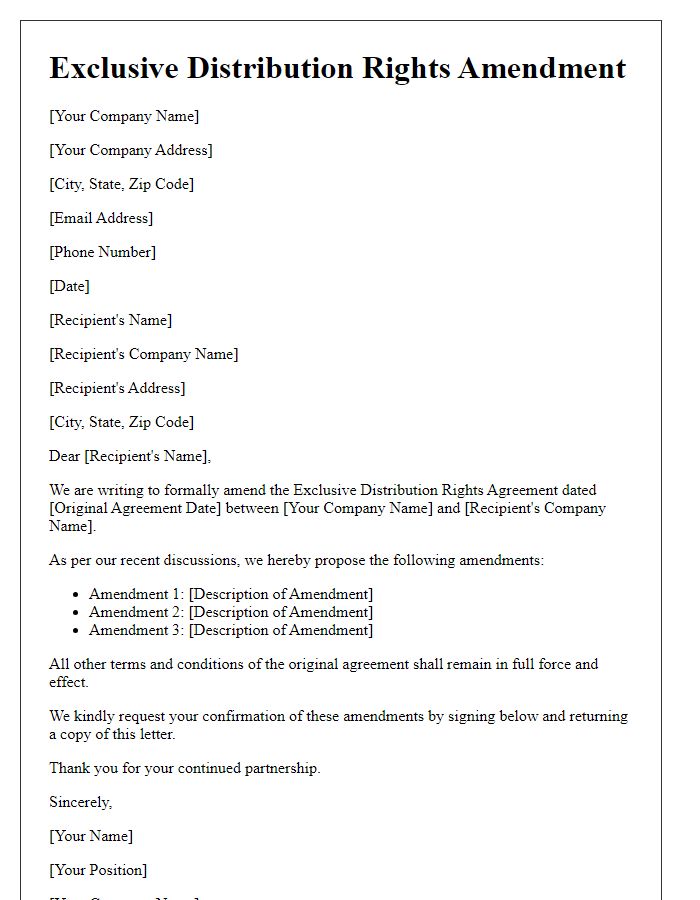

Are you considering entering into an exclusive distribution rights agreement? It's an essential step that can significantly impact your business's growth and market reach. In this article, we'll explore the key elements you should include in a letter template to formalize such an agreement while ensuring protection and clarity for all parties involved. Dive in to discover how to craft an effective letter that sets the stage for a successful partnership!

Parties Involved

The Exclusive Distribution Rights Agreement involves two primary entities: the Supplier and the Distributor. The Supplier, responsible for manufacturing and supplying products, is often a company specialized in a particular industry, such as consumer electronics or pharmaceuticals. The Distributor, on the other hand, operates within specific geographical areas, facilitating the sale and distribution of the Supplier's products to retailers and end consumers. This agreement grants the Distributor exclusive rights to market and sell the Supplier's products, covering important details such as territory, duration of the agreement, performance obligations, and terms of termination. The framework is critical for establishing trust and ensuring mutual benefit within the supply chain, enhancing market reach, and protecting intellectual property.

Duration of Agreement

The exclusive distribution rights agreement outlines the duration in which the distributor, identified as a specific business entity based in a notable location, holds the exclusive rights to sell and distribute a product or service, usually spanning a predefined period such as five years. This timeframe is crucial for both parties to establish their market presence, with renewal options available contingent upon performance metrics like sales thresholds. Clear delineation of the start date and expiration is essential, as well as any conditions under which the agreement can be terminated early, such as breach of contract or failure to achieve agreed-upon sales volumes. Additional clauses may address potential extensions, ensuring both parties remain aligned throughout the term of the agreement.

Territory Scope

Exclusive distribution rights agreements can define the territory scope for product distribution, often specifying countries or regions such as North America, Europe, or Asia-Pacific. The detailed definitions may include specific metrics, such as population size or market potential (for instance, a territory with 300 million potential consumers). Agreements should outline potential limits (e.g., state boundaries within the U.S. or provinces within Canada) and may consider local market laws. The agreement can also involve annual sales targets and performance metrics (e.g., achieving $1 million in sales within the first year) to maintain exclusivity in the designated territory. Key entities include the distributor's responsibilities and the manufacturer's rights to oversee compliance with local regulations.

Product Description

An exclusive distribution rights agreement outlines the distribution terms for a specific product, such as the Yeti Cooler (often used for outdoor activities like camping and fishing). This agreement grants a distributor the sole rights to sell the product in a designated territory, such as the United States, ensuring no other distributors can sell the same product in that area. Essential clauses in the agreement include pricing structure, minimum purchase requirements, and duration of exclusivity, typically ranging from one to five years. Additionally, it may stipulate marketing responsibilities, inventory management, and compliance with local regulations to safeguard the brand's reputation. This type of agreement is vital for managing supply chains and promoting market stability for both manufacturers and distributors.

Payment Terms and Conditions

Exclusive distribution rights agreements often include specific payment terms and conditions that define the financial relationship between the supplier and distributor. Typically, an initial upfront fee, which may range from thousands to millions of dollars, is required upon signing the agreement. Subsequent payments might be structured as royalties based on a percentage of sales revenue, commonly between 5% to 20%. Payment schedules can dictate monthly or quarterly remittances, with specific due dates stated clearly. Additionally, late payment penalties might be established, often calculated as a percentage of the overdue amount per month. Terms may also stipulate conditions for currency conversion if transactions involve different currencies, alongside any applicable taxes and fees based on local jurisdiction regulations. Regular audits may be mandated to ensure compliance with reporting standards and transparency in financial transactions.

Comments