Are you feeling overwhelmed by the complexities of tax compliance? If so, you're not aloneâmany individuals and businesses find themselves in need of a tax compliance waiver due to various circumstances. In this article, we'll guide you through the process of drafting a compelling letter to request your waiver, ensuring you know exactly what information to include. So, let's dive in and explore how you can navigate this essential step towards financial relief!

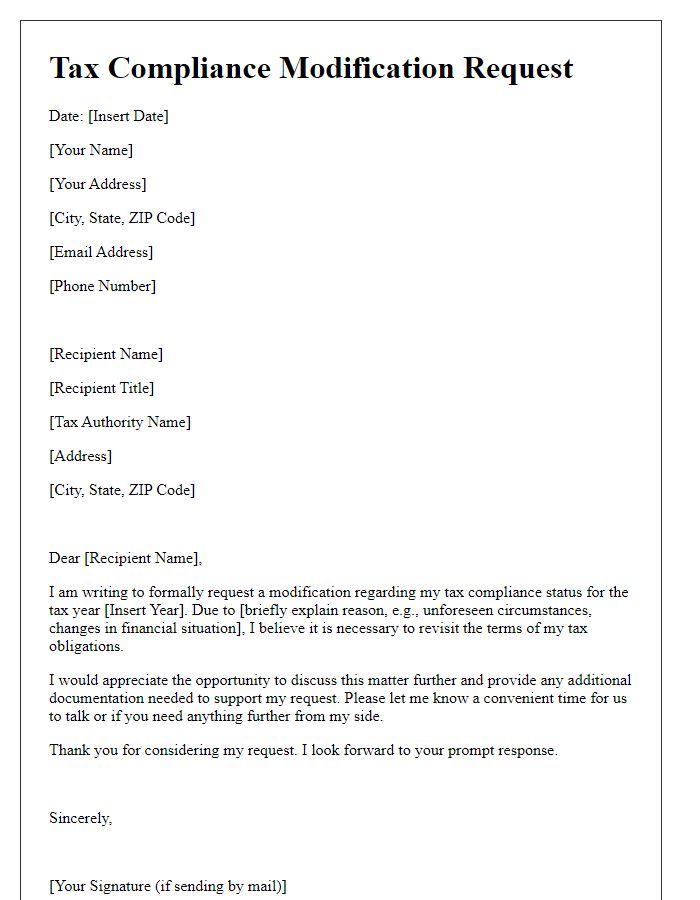

Clear subject line

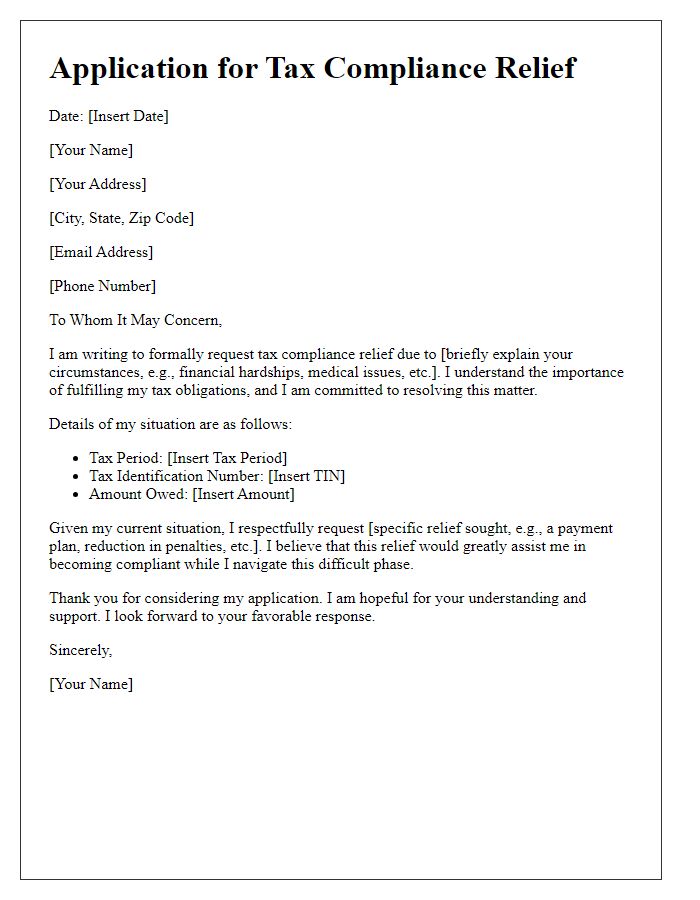

Tax compliance waivers can be requested to address specific circumstances that would otherwise impede adherence to tax obligations. For instance, small businesses in urban areas, typically defined by less than $1 million in annual revenue, may seek a waiver due to unexpected economic downturns. Detailed documentation is essential, including financial statements and relevant correspondence with tax authorities, to support the request. Effective communication with entities such as the Internal Revenue Service (IRS) is crucial, and following their guidelines ensures proper processing. Timeliness is important, as submitting the request within the specified timeframe, usually within 30 days of the noncompliance notice, can significantly enhance approval chances.

Formal greeting

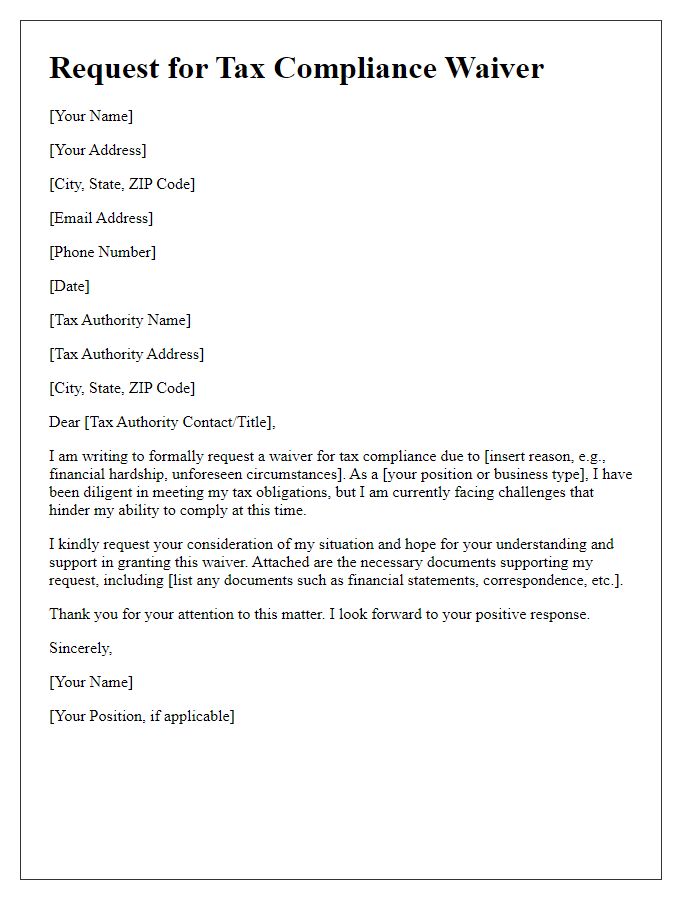

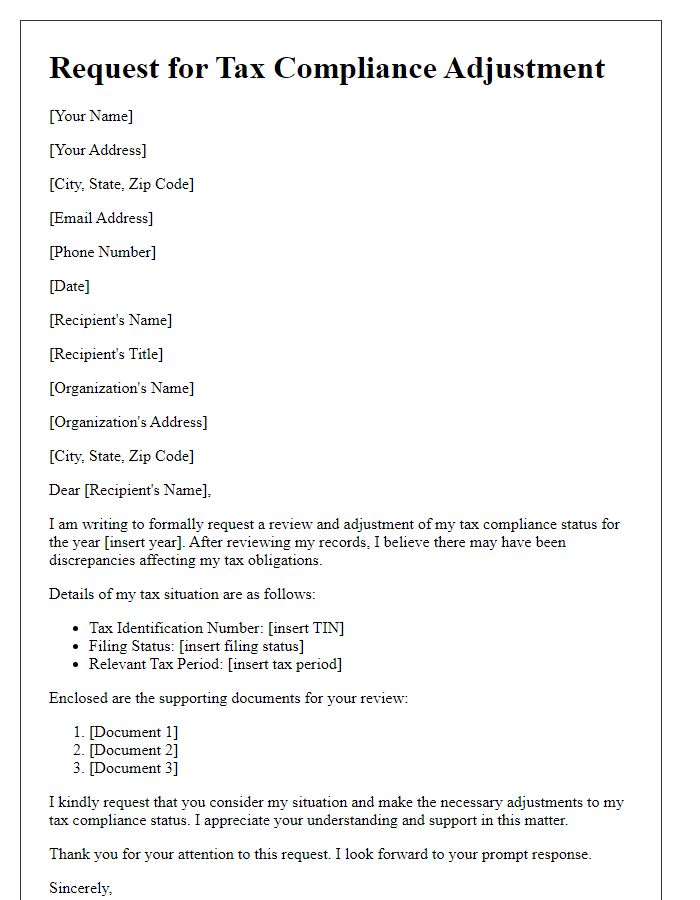

A tax compliance waiver request can be essential for individuals or businesses seeking relief from tax obligations under specific circumstances. This document typically outlines the reasons for the request and any relevant financial information that supports the case. Formal elements include the sender's address, the recipient's address, and a respectful salutation to ensure professionalism. Key components often include references to specific tax codes (e.g., Internal Revenue Code Section 6015) and supporting documents such as financial statements or hardship letters, providing context for the waiver's necessity. Addressing the request to the correct authority, like the Internal Revenue Service or the relevant state tax department, is crucial for effective communication.

Purpose of request

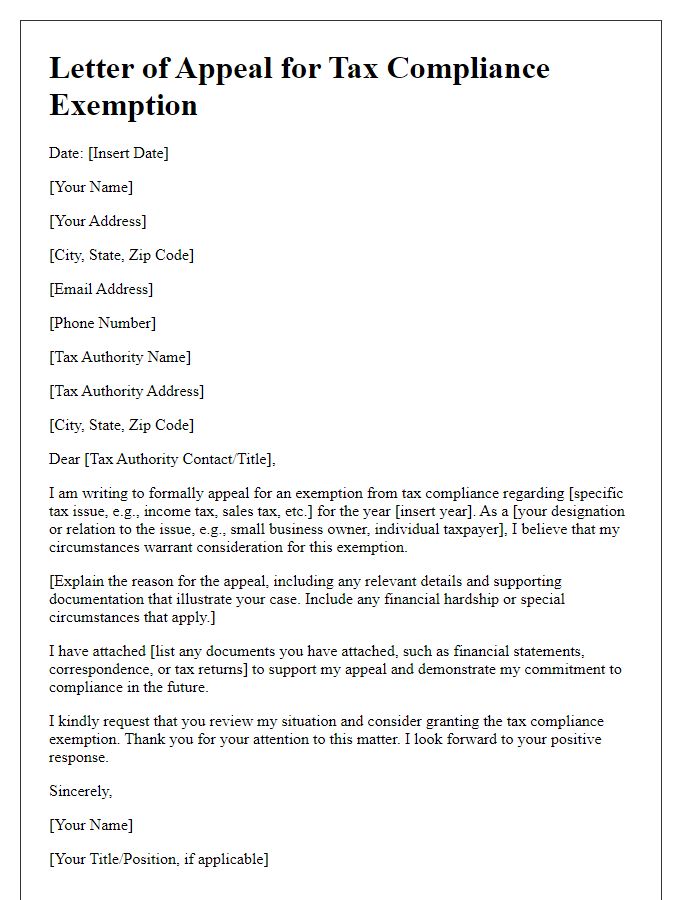

A tax compliance waiver request aims to obtain an exemption or relief from certain tax obligations, often due to unique circumstances such as financial hardship, natural disasters, or specific events affecting the ability to meet taxation deadlines. Taxpayers, including individuals and businesses, may submit this request to relevant tax authorities, like the Internal Revenue Service (IRS) in the United States, citing precise reasons for the waiver. Supporting documentation, such as proof of income loss or disaster impact, may be included to strengthen the case. Clarity and conciseness in articulating the purpose of the request can significantly influence the decision-making process of tax officials.

Explanation for non-compliance

Tax compliance waivers can be requested due to various circumstances. Economic hardships, such as loss of employment or business downturns, significantly contribute to non-compliance. Specific conditions like natural disasters, for example, the 2020 California Wildfires, overwhelm taxpayers, preventing timely filing or payment of taxes. Additionally, instances of serious medical emergencies can incapacitate taxpayers, leading to inability to meet tax obligations. Miscommunication or lack of awareness regarding new tax regulations also plays a significant role in non-compliance. Taxpayers should provide supporting documentation such as financial statements, medical records, or disaster declarations to substantiate their request for waivers.

Request for waiver and justification

A tax compliance waiver request is often submitted to the relevant tax authority, such as the Internal Revenue Service (IRS) in the United States, to seek relief from certain tax obligations. One typically includes detailed explanations about the circumstances leading to the inability to comply, which might involve unexpected medical expenses, natural disasters like hurricanes impacting financial stability, or unforeseen events such as job loss. Providing supporting documentation, like medical bills or proof of income loss, strengthens the justification. Tax compliance waivers can be crucial for individuals or businesses facing financial hardship, offering a pathway to regain stability without incurring penalties or additional interest. Adhering to specific guidelines set by the tax authority increases the chances of a favorable outcome in this formal request.

Comments