Navigating the complexities of community property division can feel overwhelming, but understanding the essentials can simplify the process. Whether you're going through a divorce or a separation, knowing your rights and obligations regarding shared assets is crucial for a fair outcome. The good news is that there are clear guidelines and legal standards that can help you make informed decisions. Join me as we delve deeper into this important topic to uncover the ins and outs of community property division.

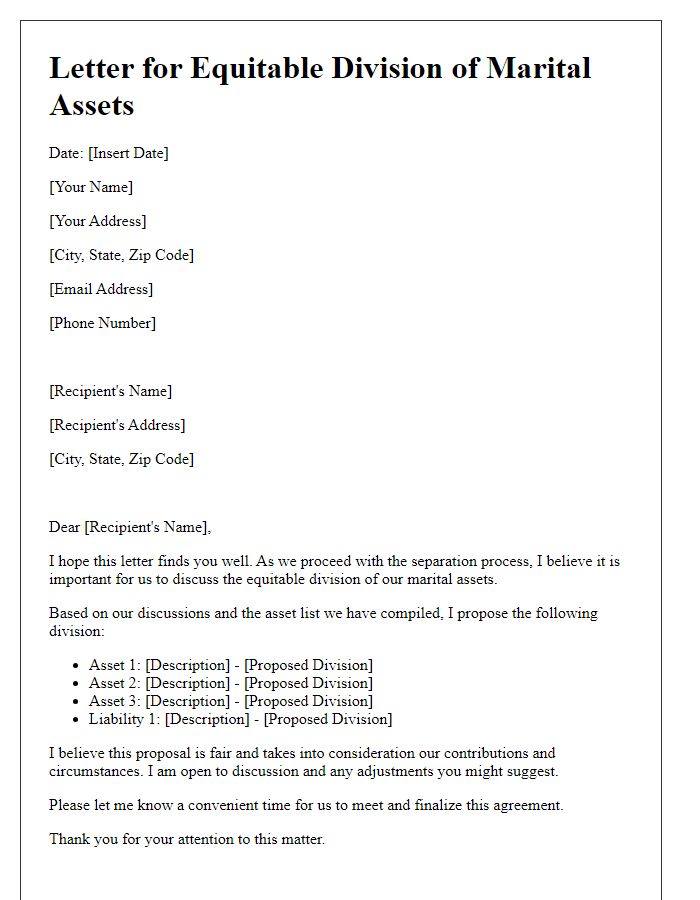

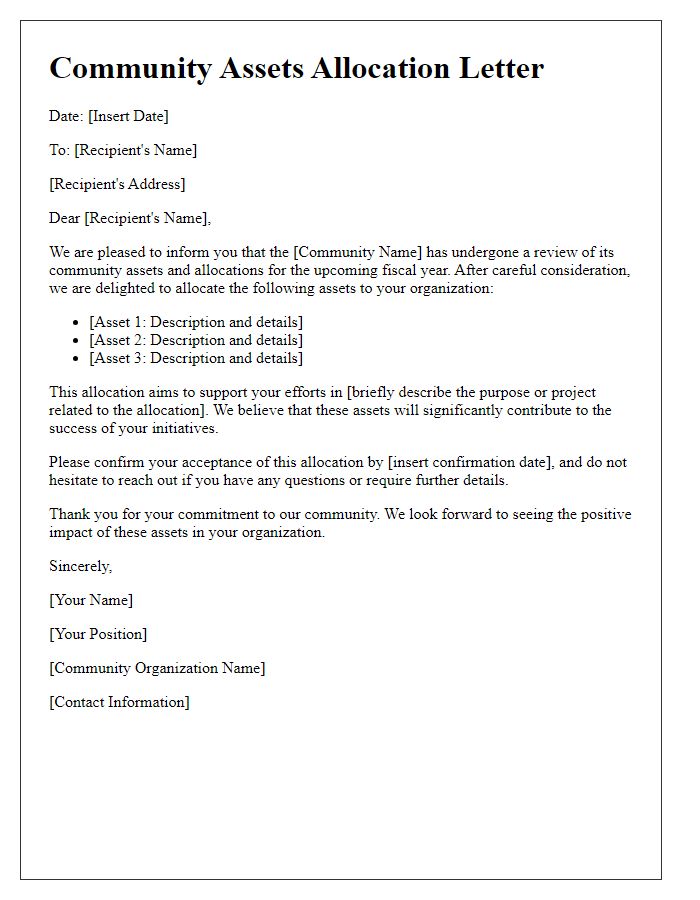

Legal Identification Information

Community property division involves the equitable distribution of assets acquired during a marriage. Legal identification information includes vital details such as the full names of both spouses, date of marriage, and the state of residence, impacting jurisdiction. Property types such as real estate, vehicles, and financial accounts must be identified, along with their estimated values at separation. Documentation such as tax returns and property deeds may be required to substantiate claims. Additionally, debts incurred during the marriage, including mortgages and credit card obligations, warrant inclusion for a comprehensive understanding of shared liabilities. Proper legal representation is essential to navigate the complexities of community property laws.

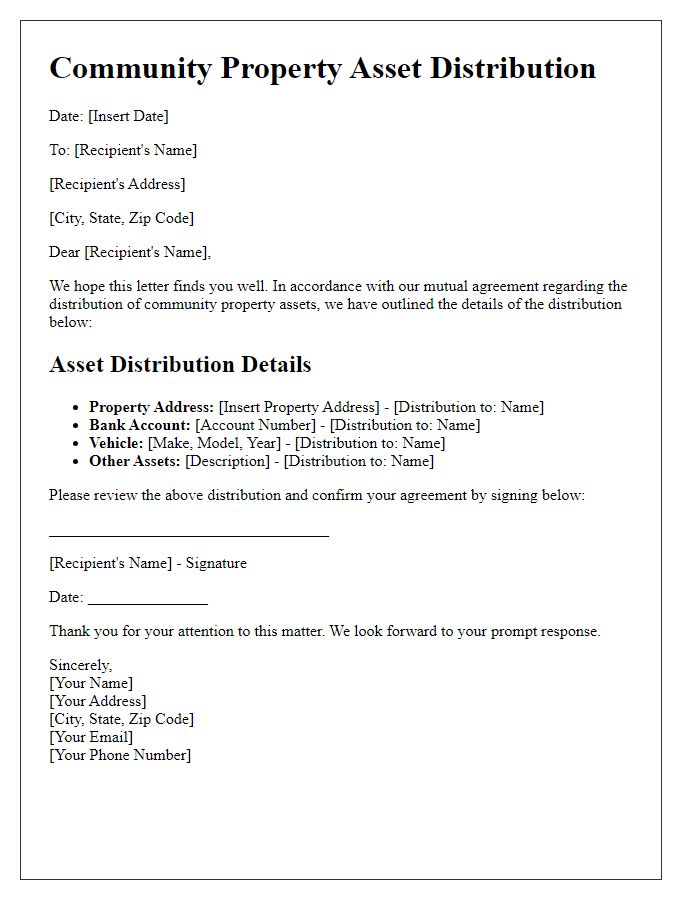

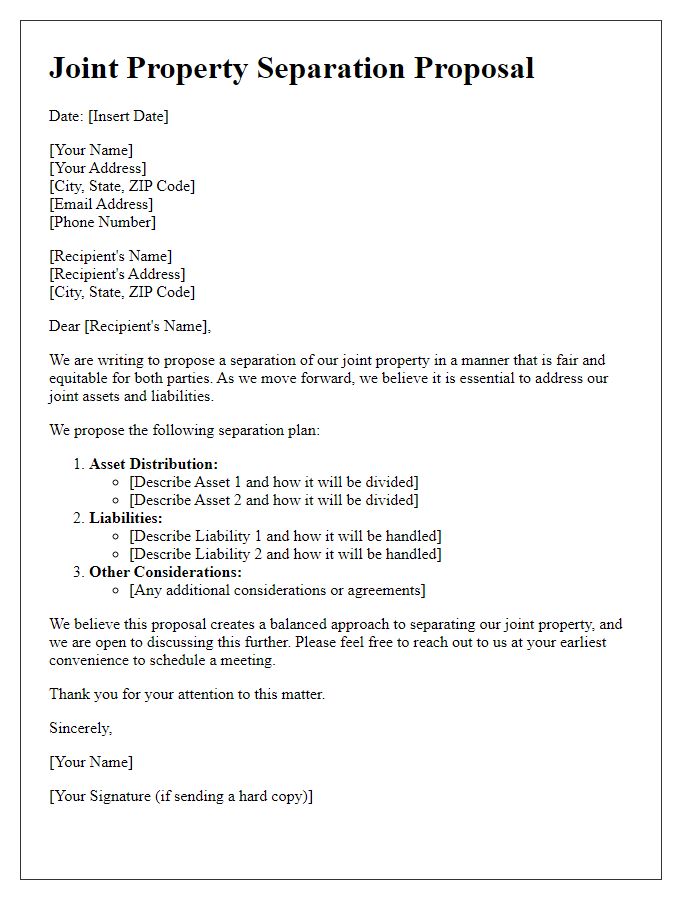

Asset and Liability List

Creating a comprehensive asset and liability list for community property division is essential during legal proceedings such as divorce or separation. This list should include key entities like real estate properties located in the county where the couple lived, vehicles registered under both names, bank accounts held jointly (or independently), investments such as stocks, bonds, or retirement accounts (including 401(k) plans), and any debts incurred during the marriage. Additionally, consider unique items like valuable collectibles, jewelry, or business ownership stakes that may require appraisal. Liabilities should encompass credit card debt, personal loans, and mortgages, ensuring an accurate valuation of each item. This detailed approach aids in fair asset distribution and aids in legal clarity.

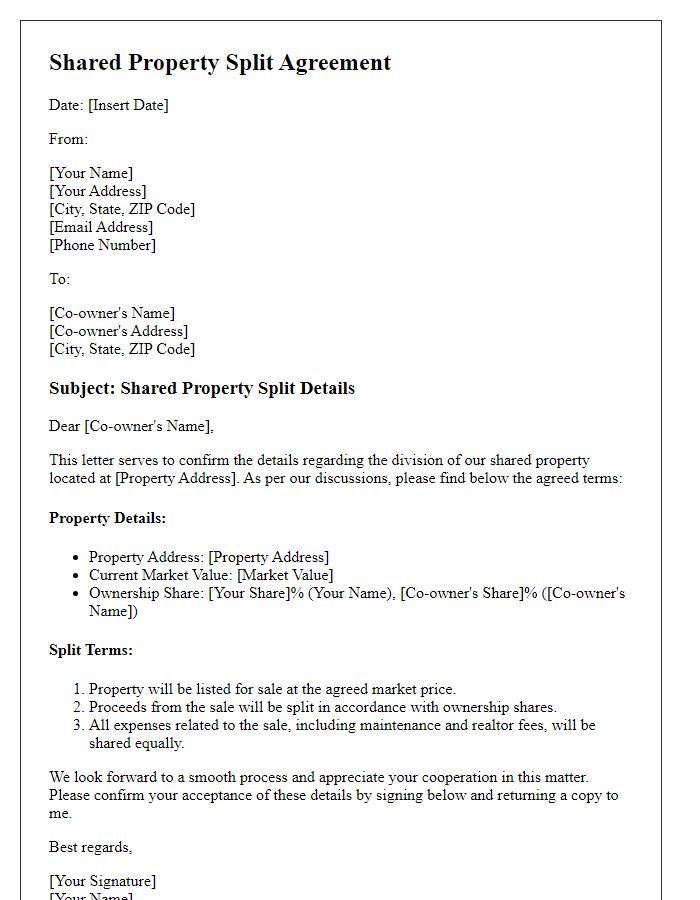

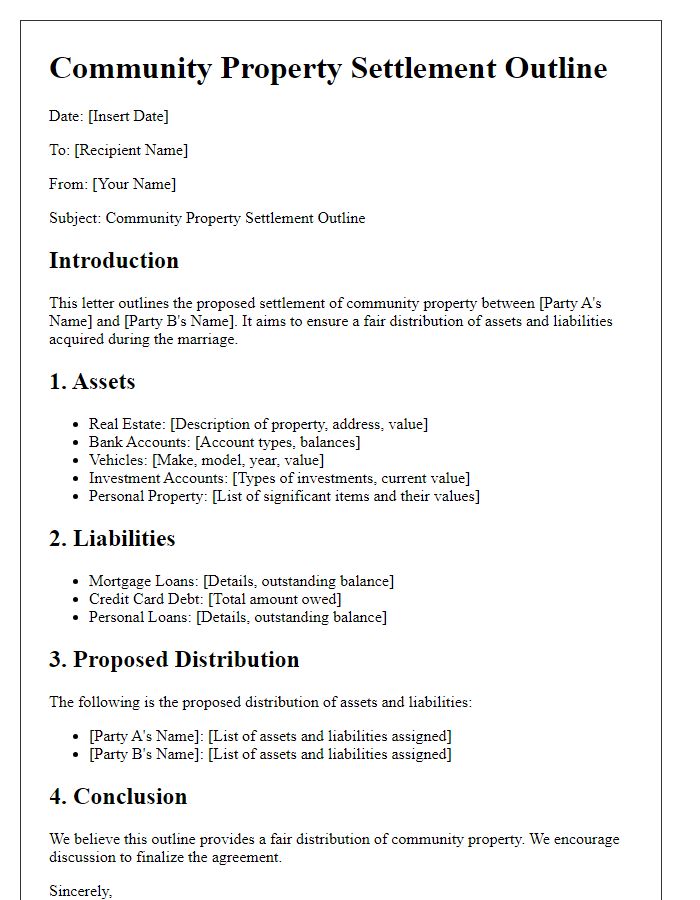

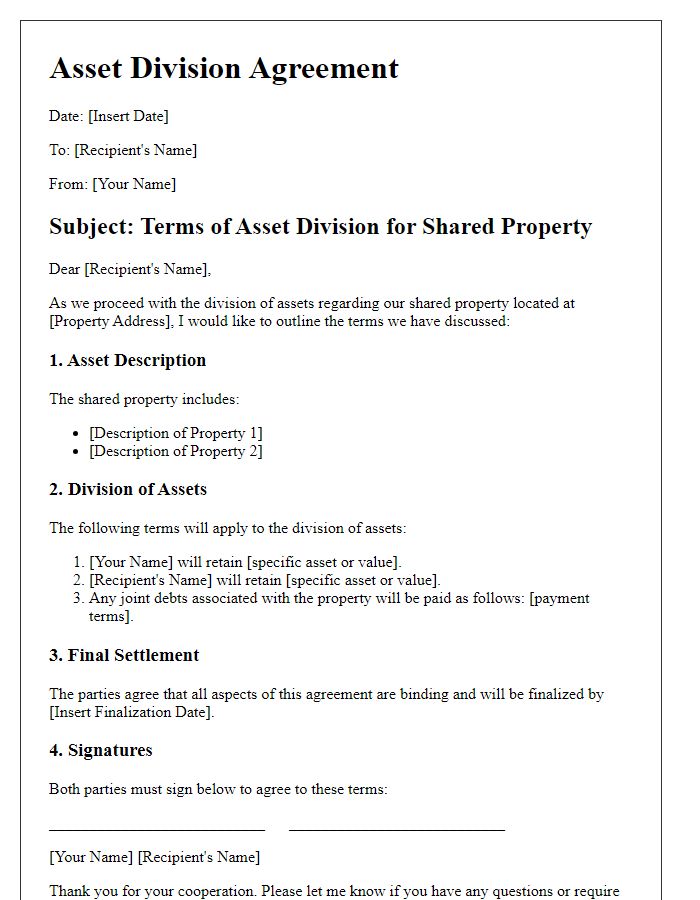

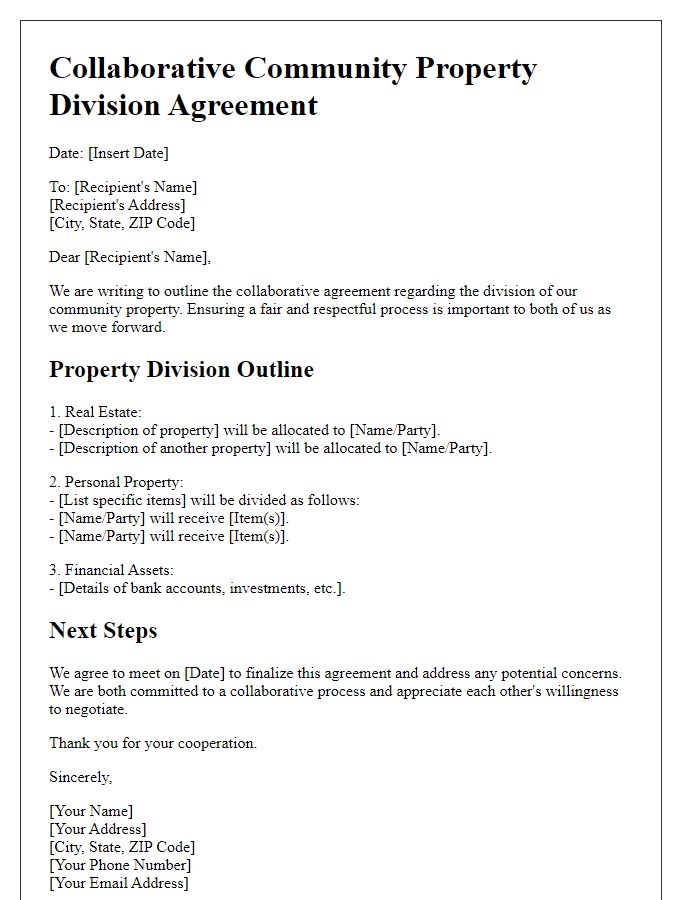

Division Proposal

In community property division cases, both spouses must navigate the equitable distribution of assets acquired during the marriage, which can include real estate, vehicles, bank accounts, and retirement funds. The state of California, with its community property laws, mandates that marital assets be divided equally, often leading to negotiations on the appraised values of properties, such as a family home valued at $600,000 or a jointly owned vehicle worth $30,000. Assets like pensions or 401(k) plans, which may include significant balances (averaging $100,000), require careful analysis to ensure fair division. Debts also factor in, as liabilities such as credit card debt or a mortgage on a jointly owned residence must be assessed alongside assets to reach an equitable settlement. Mediation may be utilized to facilitate discussions, aiming to resolve disputes amicably and thereby avoid lengthy litigation and associated costs.

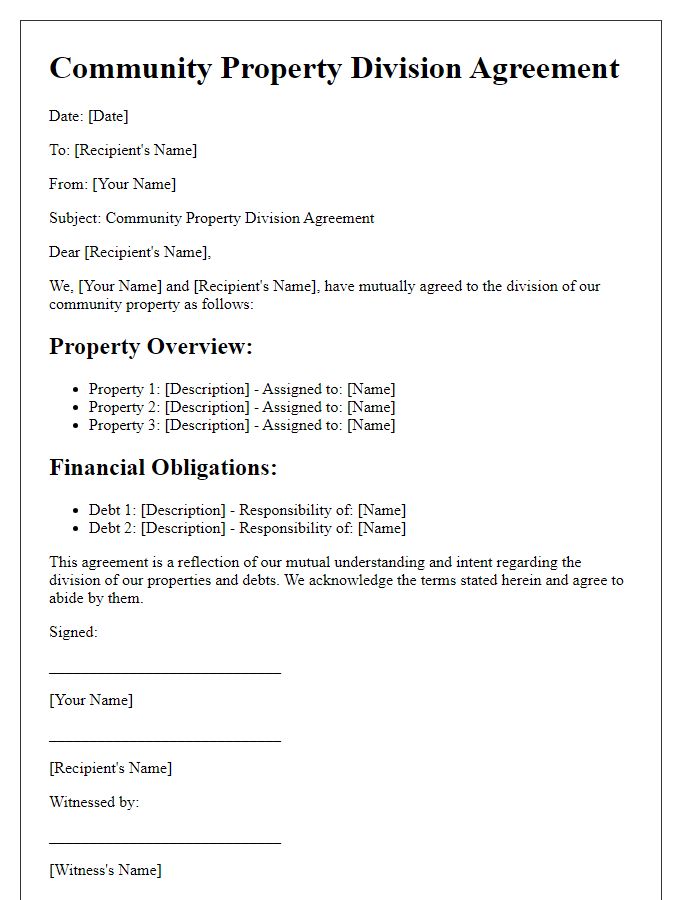

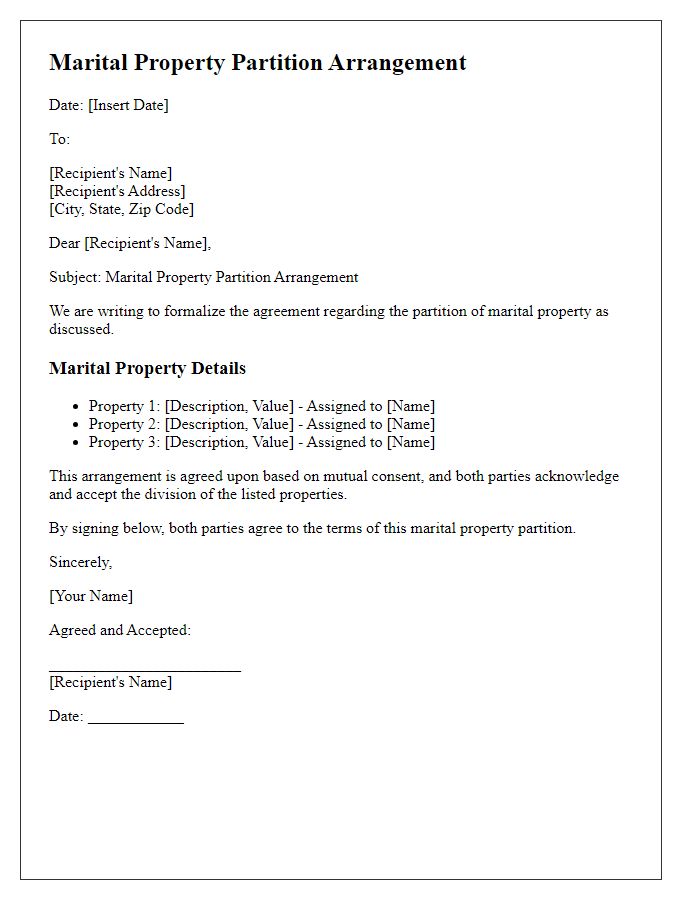

Spousal Agreement Statement

The division of community property in the event of a divorce or legal separation can involve significant financial assets, real estate, and personal belongings accumulated during the marriage. Specific items such as the family home located on Elm Street, valued at approximately $350,000, and joint bank accounts holding $50,000 must be detailed in the Spousal Agreement Statement. Additionally, the division may include vehicles like a 2021 Toyota Camry worth $25,000 and retirement accounts with varying balances, such as a 401(k) account totaling $100,000. Both parties should evaluate outstanding debts, including a mortgage of $200,000 and credit card balances, ensuring fair distribution. Clear identification of responsibility for these assets and liabilities protects both individuals' financial interests post-separation. Legal guidance remains essential to navigate state-specific community property laws effectively, ensuring compliance with necessary arrangements.

Signatures and Notarization

Dividing community property in legal matters requires meticulous documentation to validate the agreement among parties involved. Essential components include signatures from both parties (often spouses or partners) attesting to their agreement on property allocation, such as real estate or shared financial assets. Notarization by a licensed notary public is crucial, ensuring authenticity and preventing future disputes. This process typically involves the notary verifying identities, witnessing the signing of documents, and affixing a notarial seal, which is a vital step in states like California, Texas, or Florida, where community property laws significantly influence asset division in divorce proceedings.

Comments