Are you considering setting up a trust fund but unsure where to begin? Establishing a trust fund can be a valuable way to secure your assets and provide for your loved ones in the future. In this article, we'll break down the essential steps involved in creating a trust fund, including choosing the right type and understanding your legal options. So, let's dive in and explore the opportunities that a trust fund can offer for you and your beneficiaries!

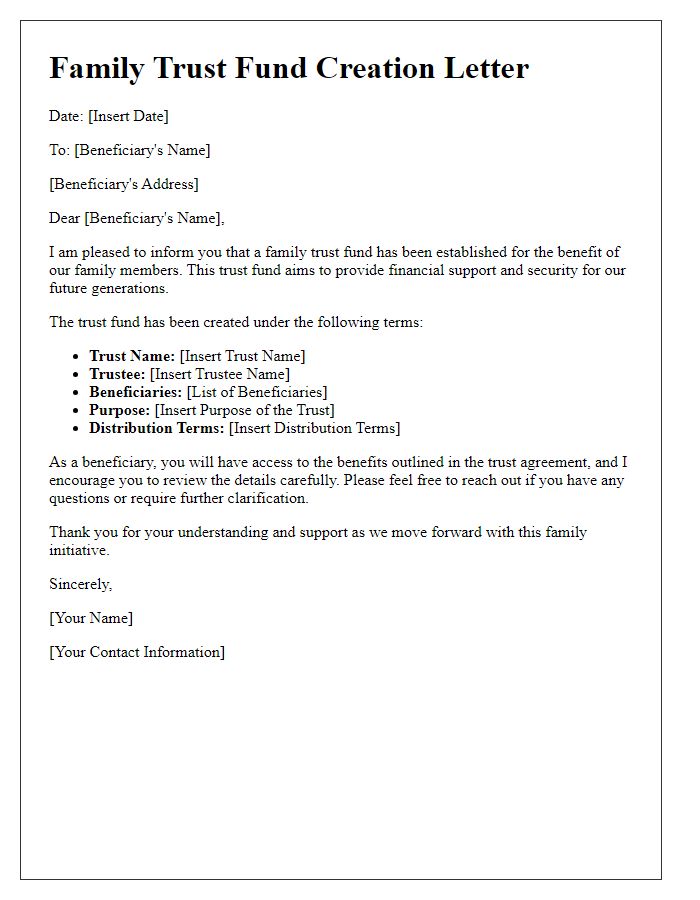

Beneficiary Information

A letter template for trust fund establishment focuses on providing essential beneficiary information. The beneficiary is the individual or entity entitled to receive assets or income from the trust. It is crucial to detail the beneficiary's full name, address, date of birth, and Social Security number for accurate identification and proper documentation. Additionally, stating the relationship of each beneficiary to the grantor, such as child, spouse, or charity, can clarify intentions and ensure smooth trust operations. Including contact information for future correspondence strengthens communication between the trustee and beneficiaries, promoting transparency and trust in the management of the fund.

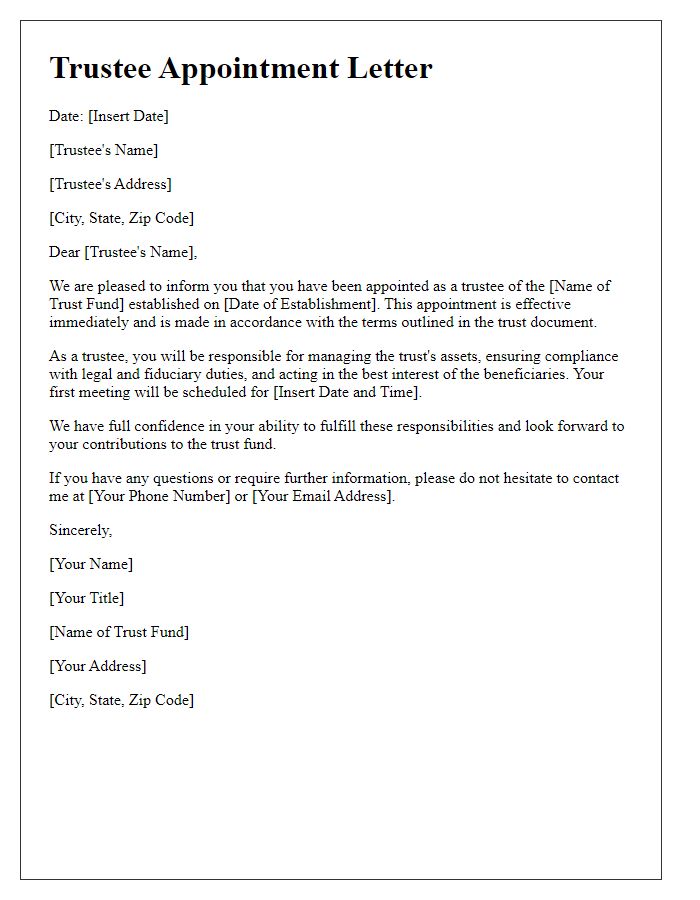

Trustee Designation

Establishing a trust fund requires careful consideration of the trustee's role and responsibilities. The trustee serves as the appointed individual or organization responsible for managing and safeguarding the trust fund's assets, ensuring they are distributed according to the trust document's terms. The designation of a trustee may involve factors such as fiduciary duty, requiring the trustee to act in the best interests of the beneficiaries. In many cases, selecting a bank or a legal professional with experience in estate planning can provide specialized knowledge and security. The trust fund can encompass various assets, including cash, real estate, stocks, or bonds, which are to be managed according to specified directives often outlined in a legally binding agreement. Proper trustee designation helps ensure the longevity and integrity of the trust fund for future generations.

Purpose and Intent

Establishing a trust fund serves as a strategic mechanism for financial management and inheritance, with a purpose to allocate assets for specific beneficiaries such as children or charitable organizations. The intent often includes ensuring long-term financial security, funding education (typically covering tuition fees for universities like Harvard or MIT), and mitigating estate taxes (which can sometimes reach up to 40% in the United States). Key components of the trust document cite the designated trustee (often a legal firm or a trusted family member), the assets being placed in the trust (such as real estate or stocks), and stipulations on how and when distributions can occur (often linked to reaching milestones like age 21 or graduating from college). This structured approach allows for the protection and efficient management of wealth across generations while fulfilling the grantor's vision for their assets.

Fund Management and Distribution Terms

Establishing a trust fund involves detailed planning concerning fund management and distribution terms to ensure effective oversight and clarity for beneficiaries. The trust agreement should specify the type of assets, including cash, investments, or real estate (such as properties in New York valued at over $500,000), under the trust's control. Designating a fiduciary, typically a financial institution or an individual with extensive experience in managing trusts, ensures professional handling of funds adhering to legal and ethical standards. Distribution terms must clarify when and how beneficiaries receive income or principal, for instance, at ages 25, 30, and 35, or upon achieving specific milestones, like graduating from college or purchasing a first home. Additionally, guidelines for investments should align with the long-term goals of the trust, emphasizing growth strategies or income generation depending on the grantor's intent. Documenting changes, such as revisions due to the beneficiaries' life events, is crucial for maintaining compliance with applicable trust laws, such as the Uniform Trust Code.

Legal and Compliance Requirements

Establishing a trust fund involves adhering to specific legal and compliance requirements to ensure proper administration and protection of assets for beneficiaries. First, one must draft a trust document, which outlines the terms of the trust, trustee duties, and beneficiaries' rights, adhering to state laws, such as the Uniform Trust Code (UTC) in the United States. Next, choosing a suitable trustee is critical; this individual or institution must manage the trust responsibly and act in the best interest of the beneficiaries. Registration of the trust may be required in certain jurisdictions, entailing filing necessary documents with state authorities, often including tax identification numbers for the trust itself. Legal compliance entails conducting periodic audits and annual tax filings, ensuring adherence to IRS guidelines and state laws to avoid penalties. Beneficiaries should be informed about their rights and any distributions, aligning with fiduciary responsibilities to uphold transparency and ethical management of the trust's assets.

Comments