Are you considering ending a business partnership and unsure where to start? Crafting a dissolution agreement can feel daunting, but it's a crucial step to ensure a smooth transition for all parties involved. This document outlines the terms of the separation, addressing asset division, responsibilities, and any lingering obligations. Join us as we explore the essential components of a partnership dissolution agreement and provide you with a useful template to guide you through the process!

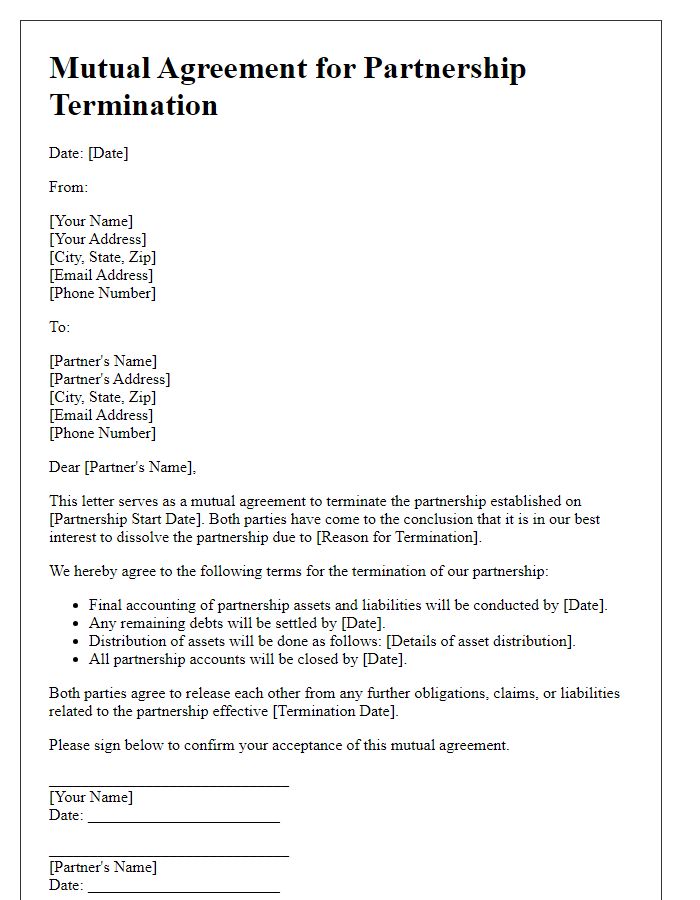

Parties Involved

The dissolution agreement outlines the formal process for terminating a partnership and addresses the interests of all entities involved, highlighting their respective contributions and obligations. The parties engaged in this process, such as Partner A (John Doe, 45 years, Entrepreneur) and Partner B (Jane Smith, 38 years, Financial Analyst), should specify their roles and the original partnership's formation date, which was April 15, 2020, in New York City. The agreement details asset division, including a commercial property (123 Business Lane, valued at $500,000) and inventory worth $150,000. Responsibilities regarding outstanding debts, such as a $50,000 business loan from Regional Bank, must also be clearly delineated. The document will stipulate the timeline for completion, intending to conclude all activities by November 30, 2023. Final signatures, dated and witnessed, ensure legal validation.

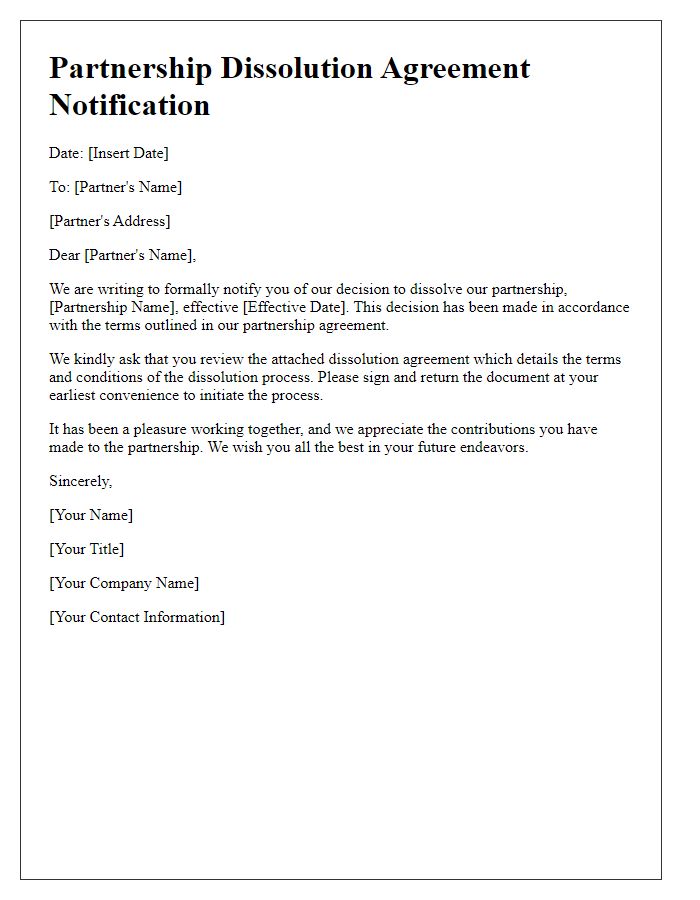

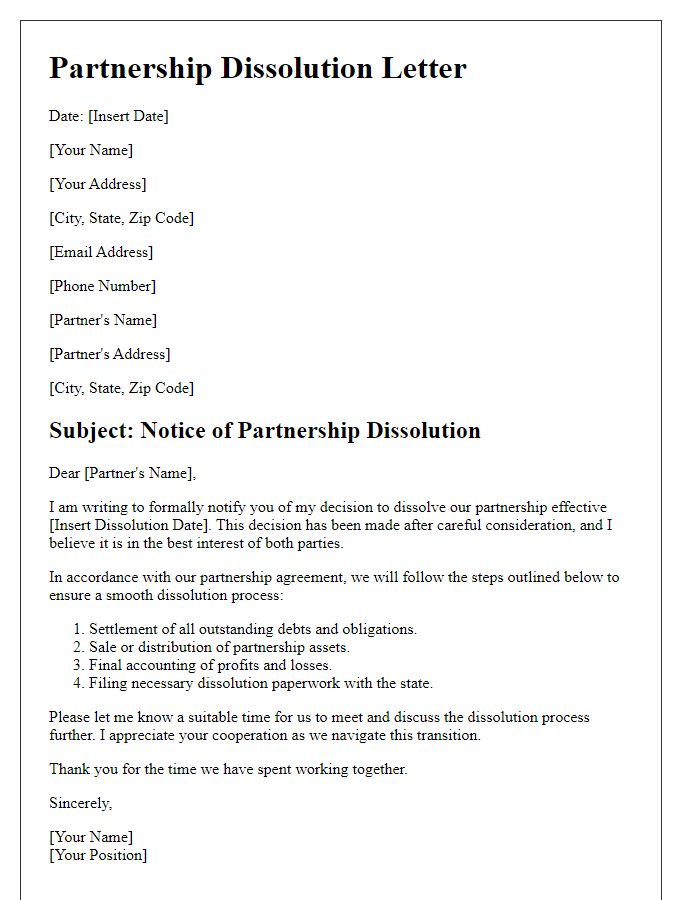

Purpose Statement

The purpose statement within a partnership dissolution agreement outlines the specific intent behind the formal termination of the business partnership. It addresses the mutual decision made on [Date], involving [Partner Names] from [Business Name], located in [City, State], acknowledging that continued collaboration is no longer viable due to factors such as [list reasons, e.g., differing business goals, financial challenges, or personal circumstances]. This document serves to clarify the terms of dissolution, ensuring an equitable distribution of assets and liabilities, while also protecting the rights of all parties involved. Each partner's contributions, investments, and obligations to creditors, along with timelines for the completion of the dissolution process, are explicitly detailed to prevent future disputes and facilitate an amicable separation.

Asset Distribution

Partnership dissolution agreements outline the process for dividing assets among partners in a business. Specific assets include tangible items like real estate, vehicles, and inventory, as well as intangible assets such as intellectual property and customer lists. Legalities surrounding asset distribution must adhere to local regulations (such as those under the Uniform Partnership Act) and may involve appraisals to determine fair market value. Currency distribution, divided based on the percentage of ownership, may include cash reserves, accounts receivable, and business equipment. The agreement must clearly specify timelines for distribution, obligations for settling debts, and responsibilities for tax implications that may arise post-dissolution.

Liabilities and Obligations

A partnership dissolution agreement outlines the liabilities and obligations of each partner during the separation process. In a partnership, such as a limited liability partnership (LLP), partners like Firm A and Firm B must clearly define the division of financial responsibilities, including outstanding debts (amounting to $50,000) and remaining assets (valued at $80,000). Significant obligations may include the settlement of vendor contracts, employee wages, and tax liabilities owed to the Internal Revenue Service (IRS). Additionally, any pending litigation claims or contractual obligations with clients must be addressed to prevent future disputes. Each partner's share must be documented to ensure a fair distribution, considering their initial capital contributions and profit-sharing ratios established at the inception of the partnership in 2019. Responsibilities for notifying stakeholders such as creditors and government agencies about the dissolution should also be outlined to ensure transparency and compliance with legal requirements.

Termination Clause

The termination clause in a partnership dissolution agreement outlines the specific processes and conditions under which the partnership (a business arrangement between entities or individuals) can be dissolved. Such clauses typically include the required notice period, commonly 30 to 90 days, to inform all partners regarding the intent to terminate the partnership. It should detail circumstances leading to dissolution, which may include mutual consent, expiration of the partnership term, or a significant breach of agreement. Furthermore, the clause should address the method of asset distribution, focusing on partnership assets (like property, equipment, and intellectual property) and liabilities (such as debts and obligations), ensuring clarity on financial settlements. Lastly, the clause might establish conditions for handling ongoing business operations during the dissolution process, advising on any necessary actions to minimize disruption in business activities.

Comments