When it comes to addressing legal matters within a religious institution, having the right template can make all the difference. A well-crafted letter can help ensure clear communication and maintain transparency while navigating complex issues. Whether you're managing property disputes, governance concerns, or compliance with regulations, a solid template lays the groundwork for effective dialogue. Ready to dive deeper into how to craft your letter effectively? Let's explore the essential elements together!

Formal salutation and address

The legal matters concerning religious institutions often involve significant complexities, stemming from various regulations governing tax-exempt status, employment law for clergy, and the protection of religious freedoms. In the context of legal correspondence, it is vital to maintain a formal tone while addressing issues pertinent to the institution's governance. The correspondence typically includes the full name of the religious institution (for example, "Saint Mary's Church"), specific legal representatives or counsel, and addresses, often including details like city, state, and zip code to ensure proper delivery and recognition. Furthermore, the salutation should reflect respect and formality, employing terms such as "Dear Reverend [Full Name]," or "To Whom It May Concern," depending on the recipient's identity and role within the institution. Proper formatting of these elements establishes professionalism and sets the appropriate tone for legal discussions.

Precise subject or purpose statement

Religious institutions often encounter legal matters that require a precise understanding of various guidelines and regulations. Compliance with laws such as the Religious Freedom Restoration Act (RFRA) established in 1993 is essential for maintaining the rights of individuals to practice their faith without government interference. Additionally, understanding the implications of tax-exempt status under the Internal Revenue Code Section 501(c)(3) is crucial for maintaining financial support and community trust. Effective communication concerning legal disputes may involve civil matters like property ownership disputes, which can arise regarding church lands or assets, often necessitating consultation with established legal entities or local government agencies. The importance of adhering to state-specific statutes and federal regulations cannot be overstated, as they provide a framework to handle issues ranging from employment practices to zoning laws for houses of worship.

Reference to relevant religious or legal texts

Legal matters within religious institutions often require reference to specific texts that guide their governance and practices. For example, in Christianity, the Bible, specifically passages such as Matthew 18:15-17 (addressing conflict resolution), serves as a foundational text for internal disputes. In Islamic contexts, the Quran and Hadith provide frameworks for organizational conduct and ethical decisions, often referencing Surah Al-Ma'idah (5:8) regarding justice. In Judaism, the Torah and Talmud outline community laws and ethical standards, notably in texts like Deuteronomy 16:20 which emphasizes pursuing justice. Additionally, secular legal frameworks, such as the First Amendment of the U.S. Constitution, must be considered when addressing issues of religious freedom and institutional governance. Such references to both religious and legal texts are essential for ensuring compliance and maintaining the integrity of the institution's operations.

Clear statement of concerns or requests

Religious institutions often face legal matters requiring clear communication regarding concerns or requests. For example, if a church (a community place of worship) is facing zoning challenges (legal restrictions on land use) impacting its expansion plans, the leadership may express specific legal concerns about compliance with local ordinances (regulations set by local government). Additionally, if there are requests for clarification about tax exemption status (the ability to not pay certain taxes), precise language outlining the basis for these requests is necessary to avoid confusion. Furthermore, if there are issues related to membership rights (legal entitlements of congregation members) or any alleged misconduct (wrongful actions potentially leading to legal consequences), documenting these matters with relevant dates, names, and case references is crucial for effective resolution.

Contact information and closing signature

Legal matters involving religious institutions require careful consideration of various factors such as laws governing nonprofit organizations, tax-exempt status, and adherence to constitutional provisions related to religious freedom. In the United States, entities like the Internal Revenue Service (IRS) play a crucial role in overseeing tax exemptions under Section 501(c)(3) for churches and religious organizations. Issues might arise, such as property disputes over land used for worship or community outreach events, and are often settled in courtrooms within local jurisdictions. Furthermore, communication surrounding legal matters should include official contact information, such as the address of the institution located in a significant city, including phone numbers and email addresses, followed by a formal closing signature from the designated representative, ensuring clarity in correspondence.

Letter Template For Religious Institution Legal Matters Samples

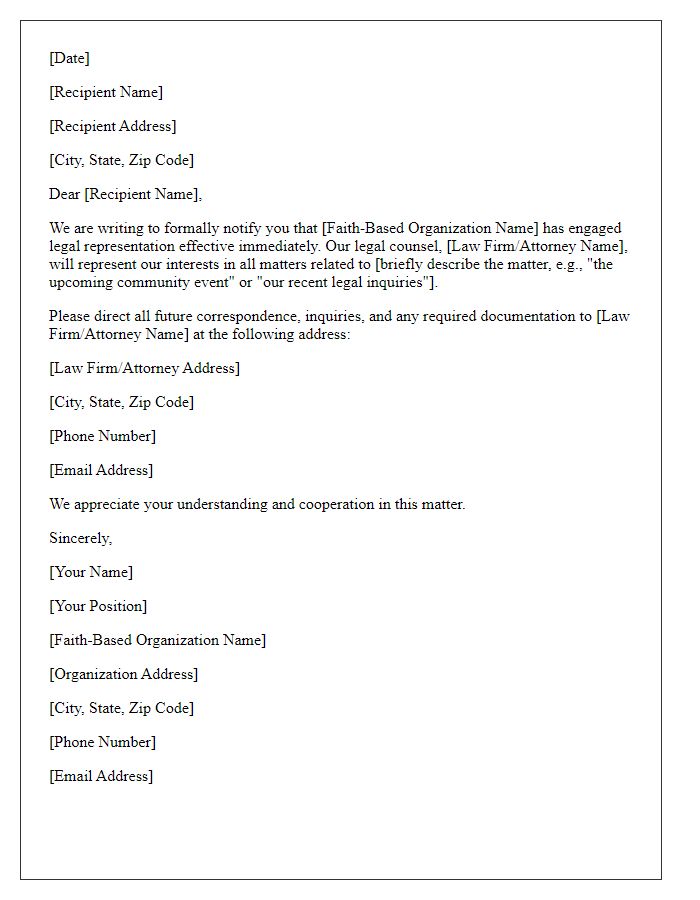

Letter template of notification of legal representation for a faith-based organization.

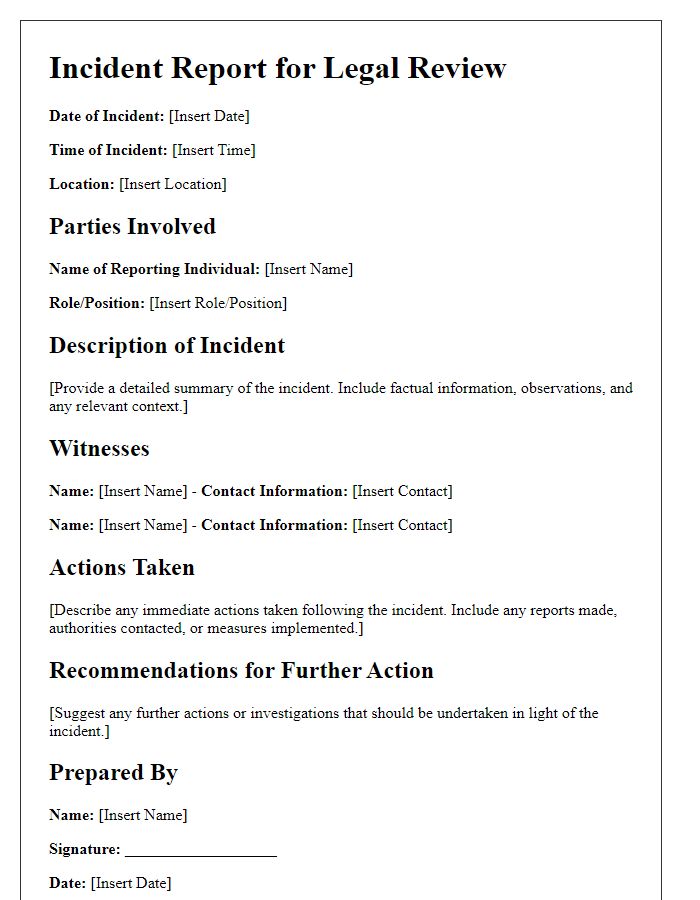

Letter template of incident report for legal review in religious settings.

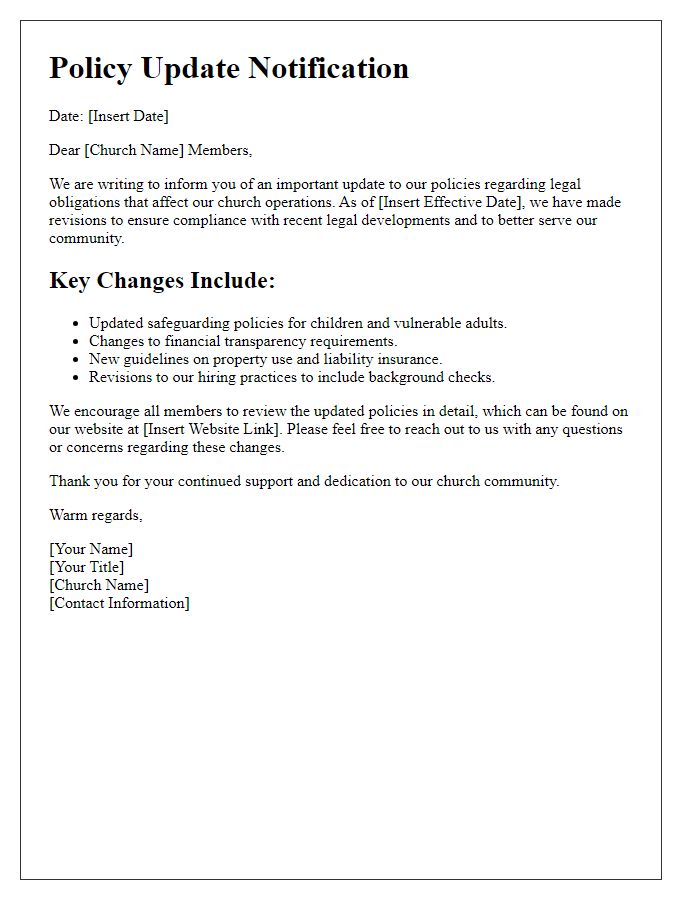

Letter template of policy update regarding legal obligations for churches.

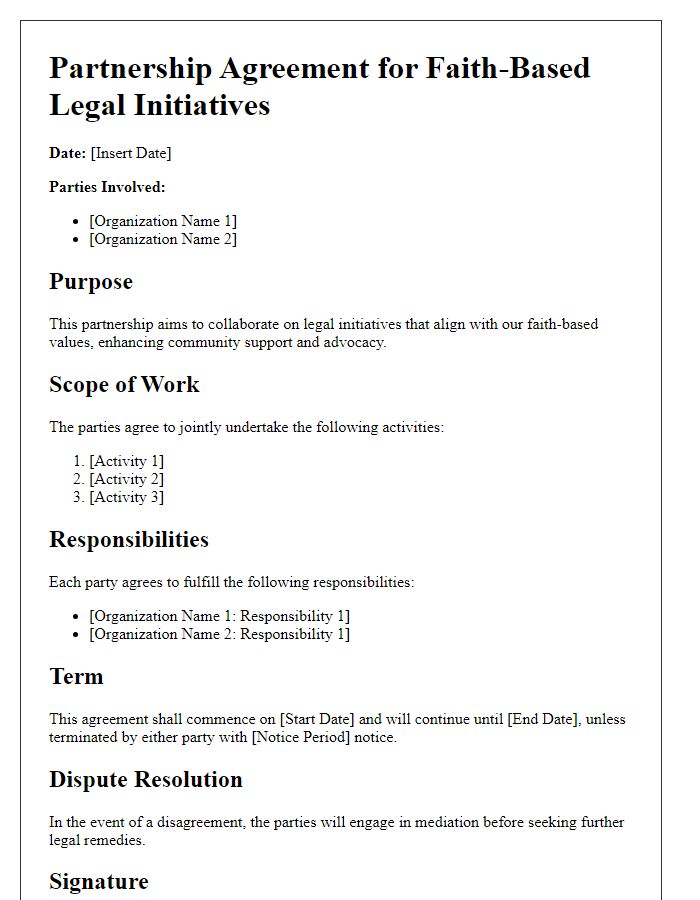

Letter template of partnership agreement for faith-based legal initiatives.

Letter template of appeal for legal decisions within a religious community.

Letter template of grievance submission concerning religious institution practices.

Letter template of audit request for legal adherence in a religious organization.

Comments