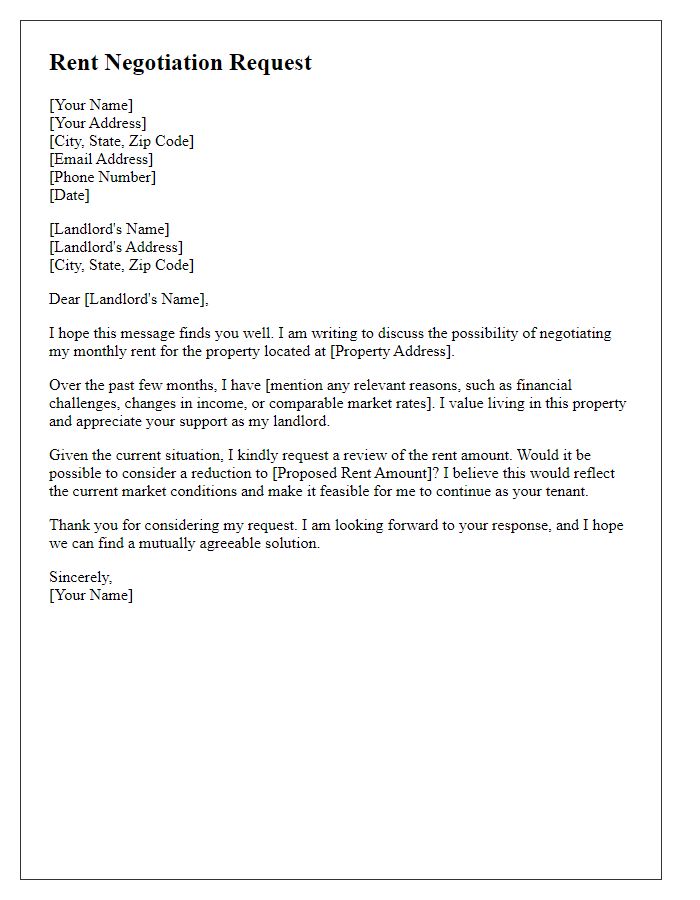

Are you feeling overwhelmed by rising rental costs and wondering how to approach your landlord for a negotiation? It's a common situation, yet many overlook the power of effective communication in achieving a favorable outcome. Crafting a well-structured letter can not only express your concerns but also set the stage for a constructive conversation. So, stick around as we explore an adaptable letter template that can help you negotiate your rental price with ease!

Current Market Analysis

Current rental market analysis shows significant fluctuations in pricing trends throughout metropolitan areas. For instance, recent studies indicate that rental prices in New York City have increased by approximately 5% over the past year, while neighborhoods like Brooklyn have seen a surge of 8% due to demand from young professionals. Similarly, cities such as San Francisco exhibit a rental price stabilization with an average monthly rate of $3,500 for one-bedroom apartments, influenced by high-tech job growth. Comparative analysis of nearby properties, like those in Los Angeles, reveals a competitive price point, where similar listings average about $2,800. These metrics provide a solid foundation for negotiating favorable rent terms based on localized economic conditions and property-specific evaluations.

Comparative Property Rates

Renting a property in urban areas like New York City often involves comparing rental prices across similar units. For example, a two-bedroom apartment in the Upper West Side typically ranges from $3,000 to $4,500 per month, depending on amenities such as views and proximity to Central Park. In contrast, the same apartment size in Brooklyn Heights may be priced between $2,500 and $3,800, influenced by factors like local attractions and subway access. Understanding these comparative property rates becomes crucial when negotiating a lease, as it provides leverage to advocate for a realistic rental price that reflects the current market. Additionally, features such as on-site laundry facilities or available parking can significantly impact perceived value and negotiating power.

Tenant Track Record

A strong tenant track record is crucial in rental price negotiations, demonstrating reliability and financial stability. Consistent on-time payments, documented through bank statements or rent receipts, highlight a history of responsibility, essential for landlords. A clean rental history, verified through references from previous landlords, instills confidence regarding property care and upkeep. Evidence of good communication skills during past leases fosters positive relationships, making landlords more amenable to discussions on rental price adjustments. Additional aspects, such as employment verification showing stable income and a solid credit score reflecting financial dependability, can significantly influence negotiations, leading to potential reductions in monthly rent or flexible lease terms.

Long-term Lease Benefits

Long-term lease agreements offer numerous advantages for both tenants and landlords, particularly in the context of rental price negotiations. For tenants, committing to a long-term lease, often spanning 12 months or more, can lead to more stable housing costs, safeguarding against annual rent increases that typically occur in urban areas, such as New York City, where average rents can rise by 3-5% each year. Landlords benefit from reduced turnover rates, saving on costs associated with advertising and vacancies, which can amount to thousands of dollars in losses during the rental search process. Long-term tenants tend to care for the property better, providing peace of mind for landlords, especially in competitive markets. In addition, both parties can establish a mutually beneficial relationship, potentially resulting in personalized terms and a sense of community, essential for thriving in neighborhoods like San Francisco's Bay Area, where rental stability is highly valued.

Economic Conditions and Trends

Economic conditions, such as inflation rates and increasing housing demand, significantly influence rental prices in urban areas like San Francisco. Recent trends show a 6% annual increase in rental prices, largely due to limited housing supply and rising interest rates affecting mortgage affordability. Landlords may be compelled to adjust prices based on local market dynamics, making it essential for tenants to negotiate favorable terms that reflect economic realities. Analyzing comparable listings (similar properties in the area) can provide leverage in discussions, ensuring that rental agreements align with budget constraints and prevailing market conditions.

Comments