Are you feeling overwhelmed by your recent residential tax assessment? It's not uncommon to question the fairness of these evaluations, especially when they don't seem to reflect the true value of your home. Understanding how to appeal your assessment can empower you to take control of your financial situation and potentially save you money. Let's dive into some essential tips and resources that can help you navigate this process â keep reading to find out more!

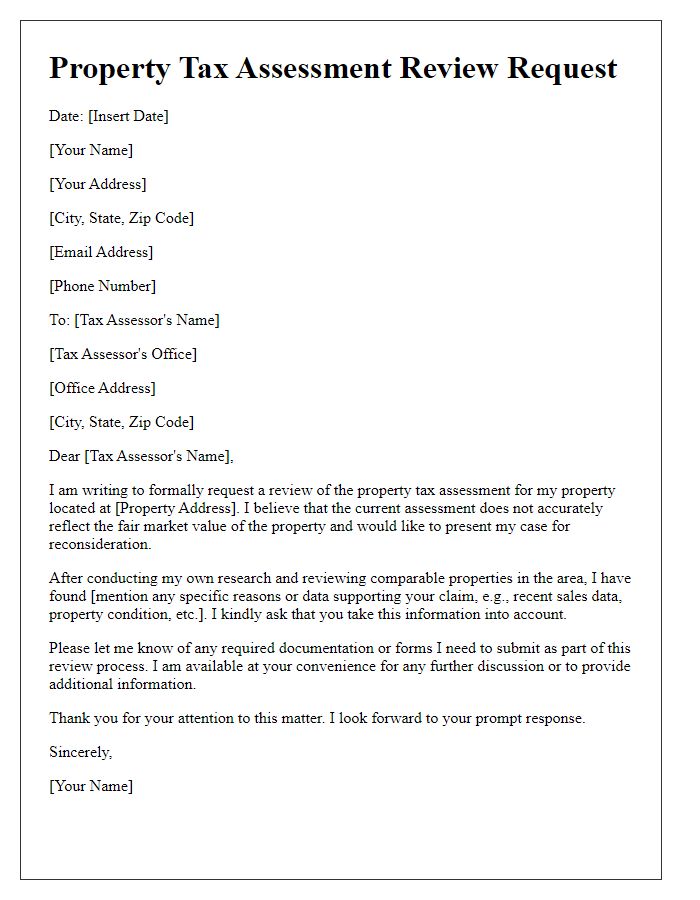

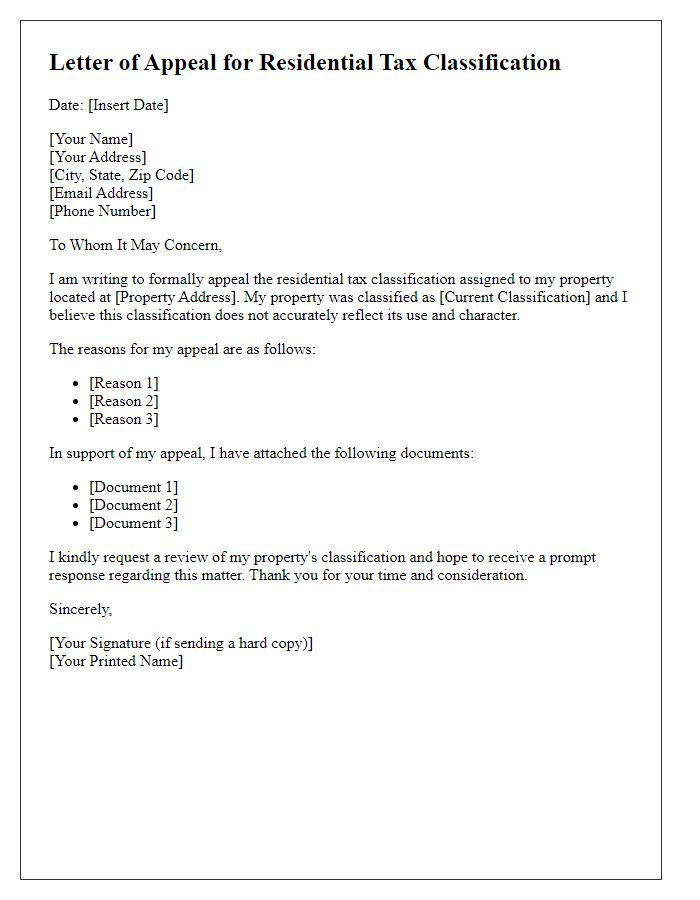

Clear and Accurate Property Information

Residential tax assessments play a crucial role in determining property tax liabilities for homeowners. Accurate property information such as square footage, number of bedrooms, and overall lot size significantly impacts the assigned value. Discrepancies in these details can lead to inflated assessment figures, prompting homeowners to file appeals. In some locales, like Los Angeles County, property assessments can vary widely, sometimes by thousands of dollars, based on incorrect data. Local tax assessment offices employ various methods to evaluate property values, including comparisons to recently sold similar properties in the neighborhood. It is vital for homeowners to gather and present clear evidence of accurate property details to support their appeals effectively.

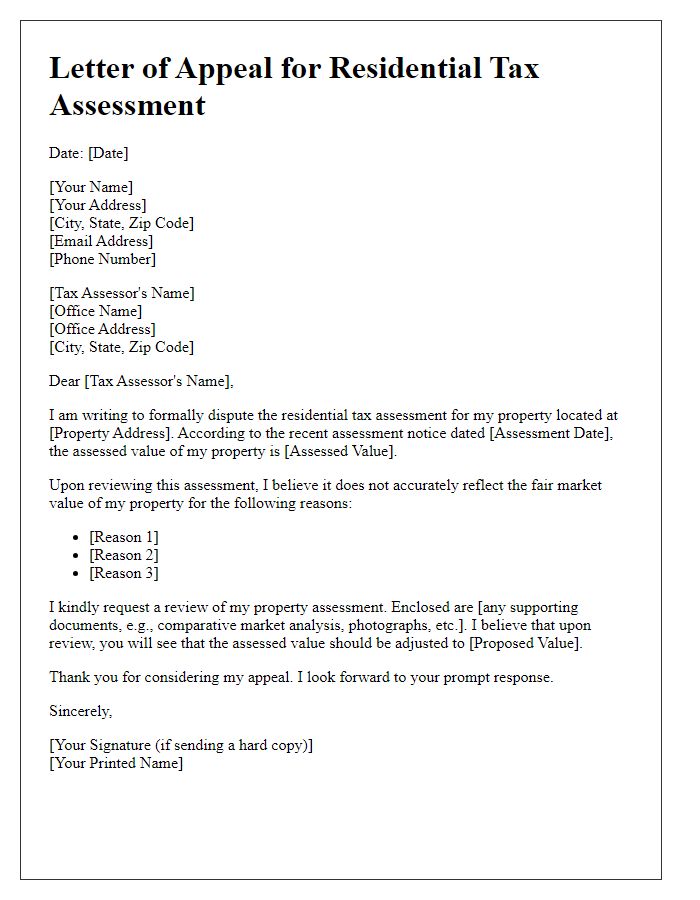

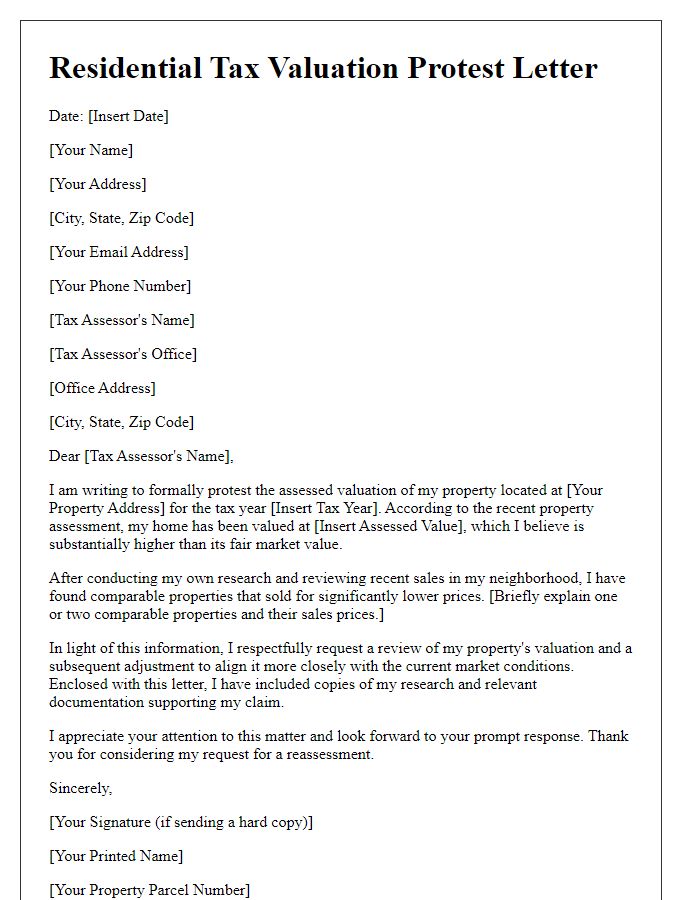

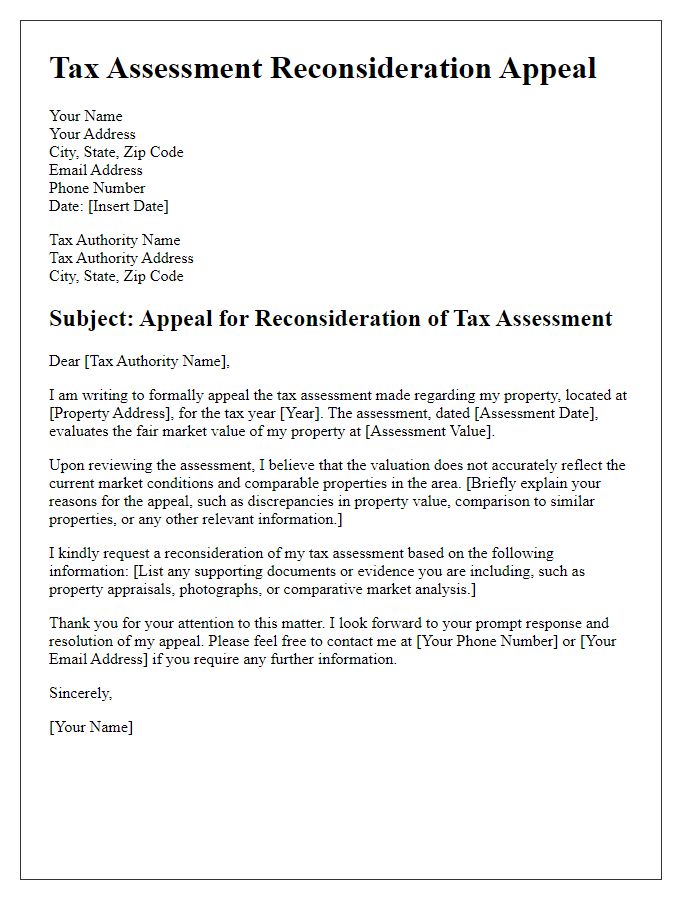

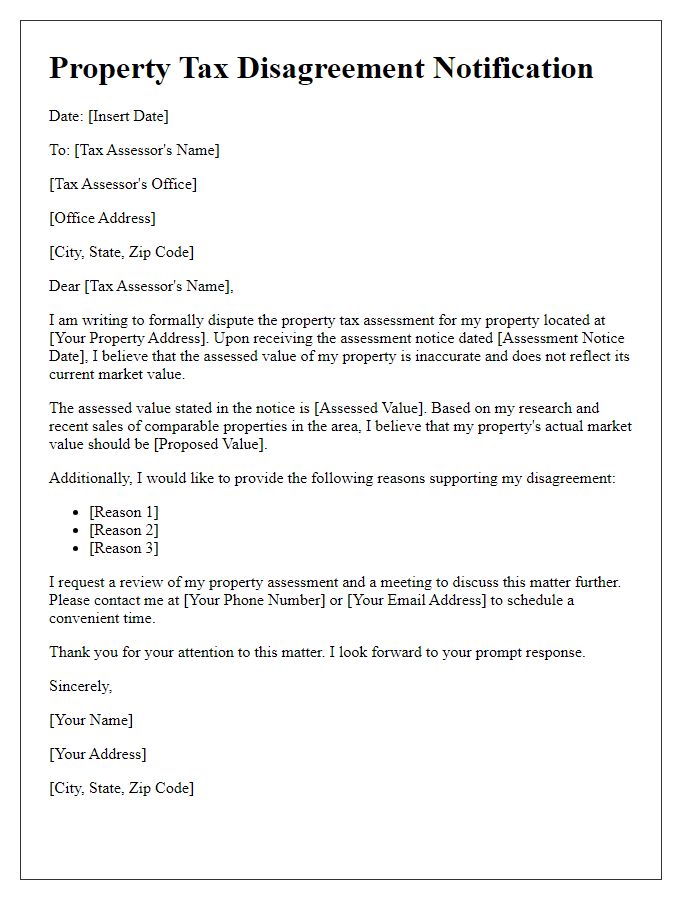

Detailed Reasons for Appeal

Residential property tax assessments often lead homeowners to seek revisions based on inaccuracies. Assessments may not accurately reflect the current market value of properties in specific neighborhoods, such as Elmwood Park. Comparable sales data indicates that similar houses, featuring three bedrooms and two bathrooms, in this area sold for approximately 15% less than the assessed value. Additionally, factors such as property condition, excessive wear, or necessary repairs might not have been accounted for during the assessment process. Neighborhood amenities, including proximity to schools or crime rates, significantly affect desirability and should influence property values. Decreased market demand due to economic downturns, particularly in 2023, might also justify lower valuations. Collectively, these elements present a strong case for adjusting the current tax assessment to better reflect an accurate and fair valuation.

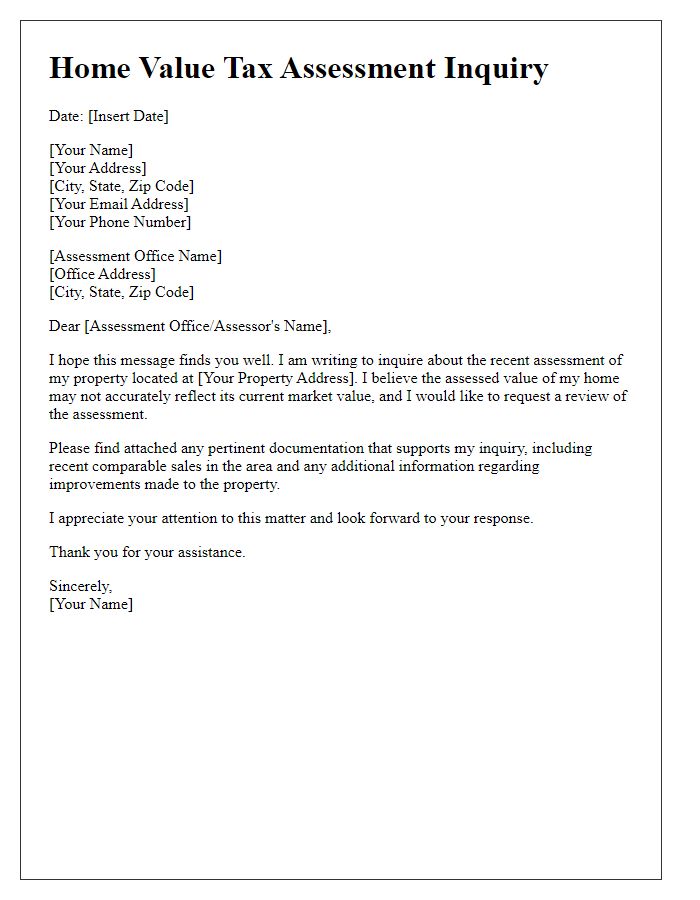

Comparable Property Data

When appealing a residential tax assessment, it's crucial to include detailed comparable property data to substantiate your claim. Comparable properties, or "comps," are similar homes located within the same neighborhood or district, generally within a one-mile radius. For instance, you might identify three properties: a 1,500 square foot home on Maple Street, sold for $350,000 in January 2023, a 1,450 square foot home on Oak Avenue, sold for $345,000 in February 2023, and a 1,600 square foot home on Pine Drive, which was listed for $360,000 but had multiple price reductions before selling for $340,000 in March 2023. Each of these properties provides a relevant benchmark to demonstrate discrepancies in your property's assessed value compared to recent market valuations. It's also essential to note the average assessment rate for similar homes in the locale, which can significantly differ from the evaluation your property received. Highlighting these differences may strengthen your case for reassessment.

Evidence of Errors or Discrepancies

Inaccuracies in residential tax assessments can significantly impact homeowners' financial obligations. Common discrepancies include incorrect property valuations, such as overestimating the square footage of a home (multiply incorrect square footage by the local price per square foot to illustrate potential overcharge). Assessment records may also feature erroneous data regarding the number of bedrooms or bathrooms, affecting the overall value assigned; for instance, a three-bedroom house being assessed as having four can lead to inflated taxes. Additionally, comparisons to similar properties (known as comparables) in the neighborhood (specific area, like a zip code or district) might reveal inconsistencies, such as a higher tax burden for identical properties; using these comparables can provide evidence to contest the assessment. Homeowners should gather documented evidence, such as photographs and official records, to support claims during the appeal process, crucial for ensuring fair taxation.

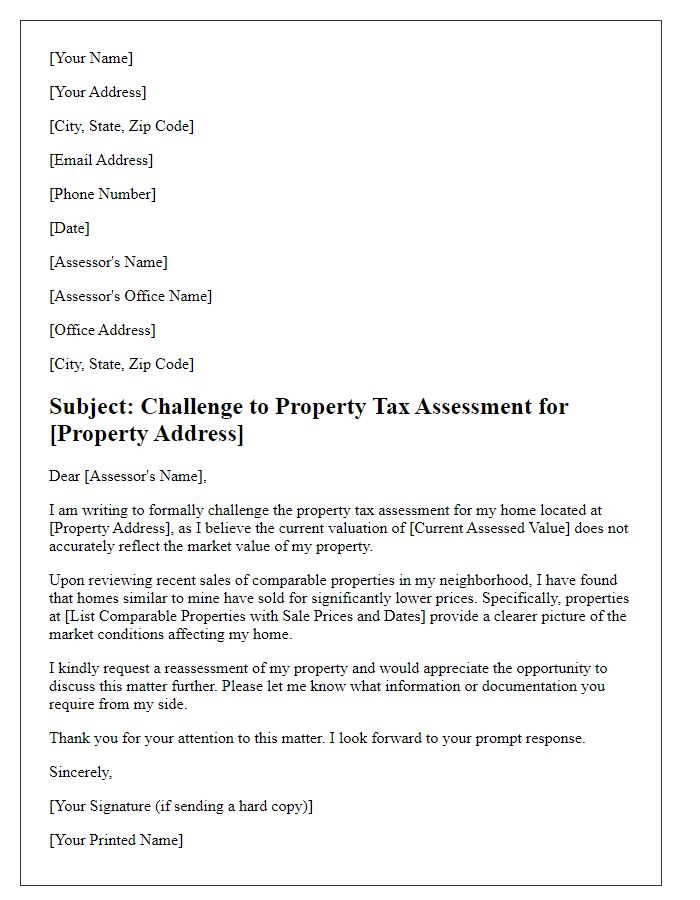

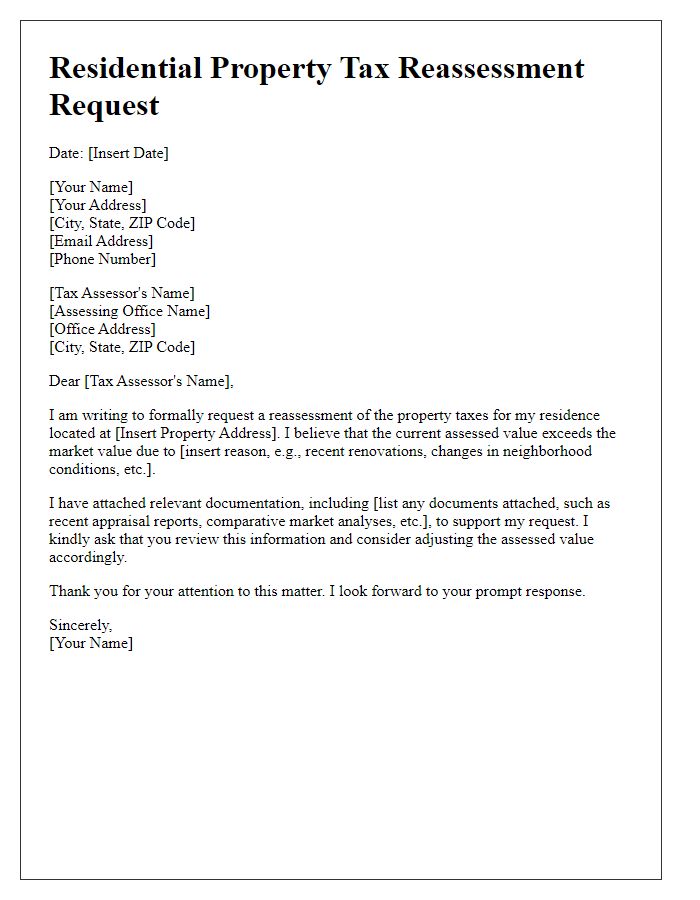

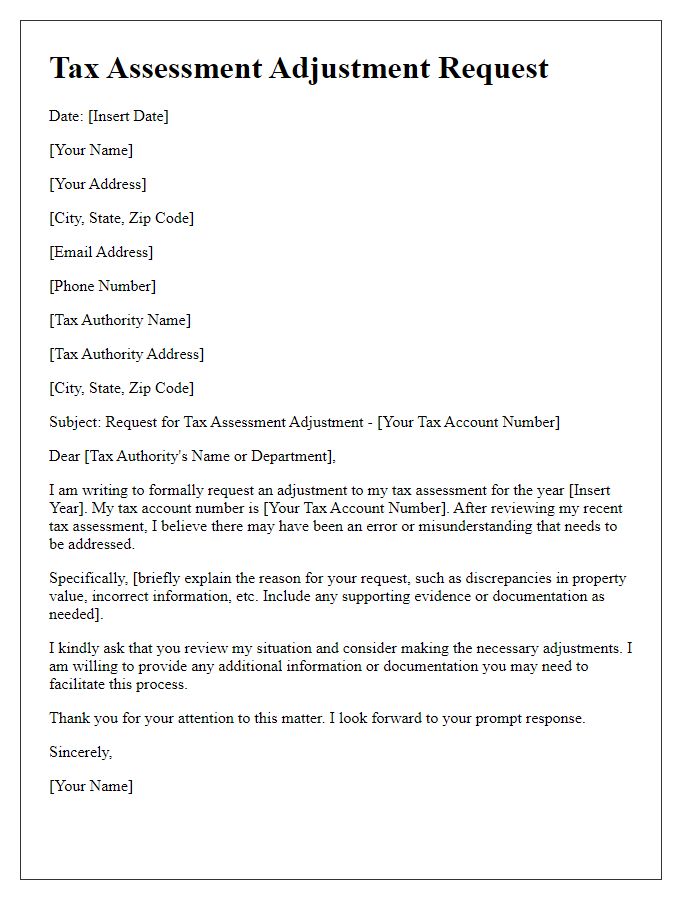

Contact Information and Request for Response

Residential tax assessments can significantly impact homeowner finances. Individuals may seek to appeal their property tax assessment to ensure they are accurately paying taxes based on current market values. Information such as property address, assessment year, and discrepancies in valuation can strengthen the appeal. Homeowners often contact local tax assessment offices, like the Cook County Assessor in Chicago or the Harris County Appraisal District in Houston, to initiate the process. A prompt response is typically requested, with deadlines often ranging from 30 to 60 days for formal submissions. Supporting documents may include recent sales data from comparable properties, photographs of the property, and any relevant inspection reports. Engaging with taxation experts or legal advisors can also enhance the appeal's likelihood of success.

Comments