Navigating rent payments can sometimes feel overwhelming, but don't worryâyou're not alone! Many landlords understand that financial situations can vary, which is why exploring an installment plan for rent payments is a practical solution. This approach not only helps in managing your budget better but also can foster a more supportive landlord-tenant relationship. If you're curious about how to present this idea effectively, read on for a helpful letter template that can guide you through the process!

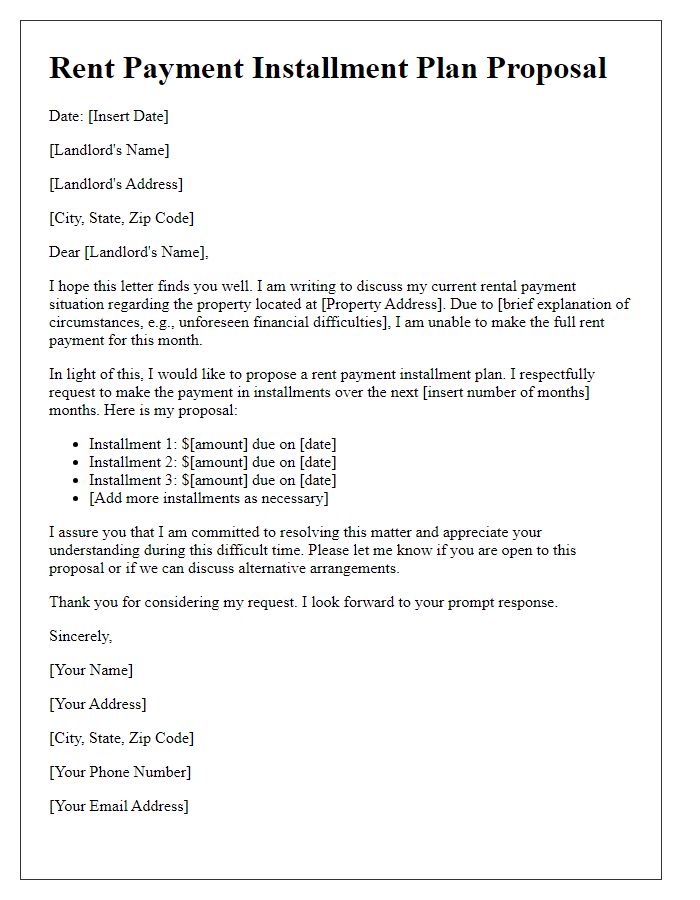

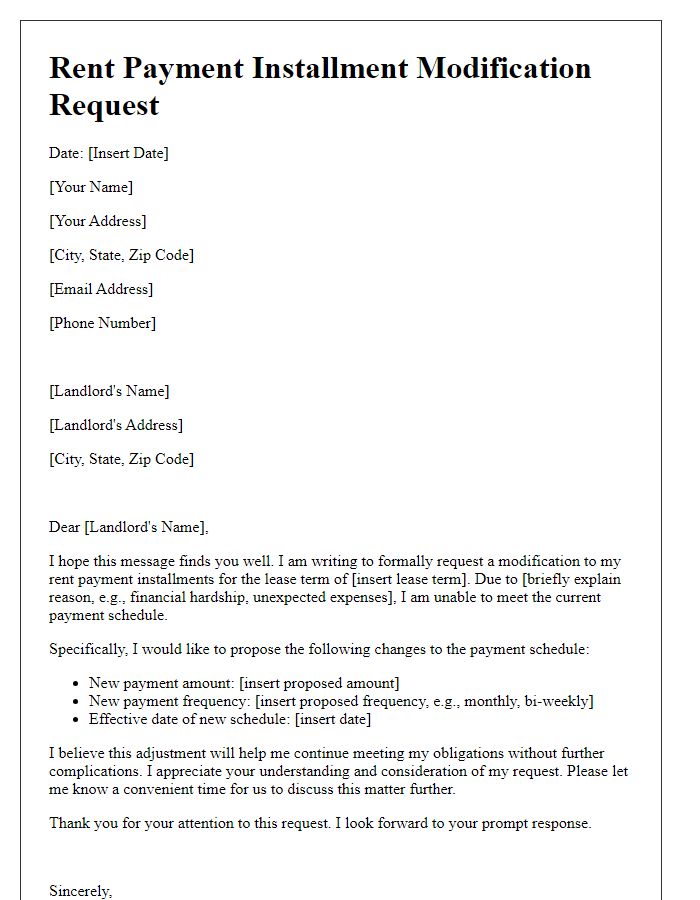

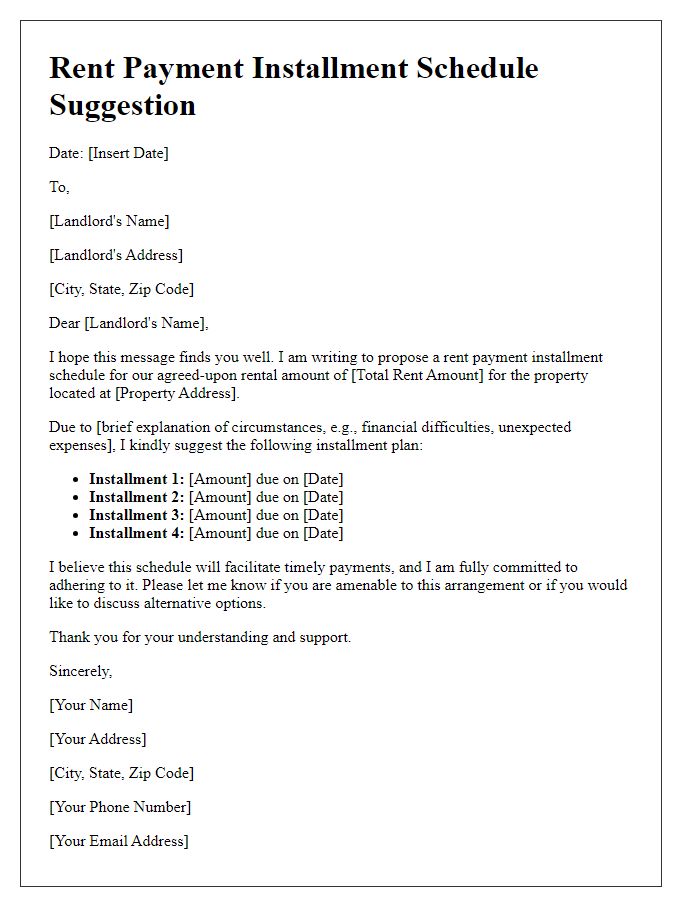

Payment schedule proposal

In numerous urban housing markets, tenants often face challenges with timely rent payments due to variable income levels. Implementing a payment schedule proposal can be a beneficial solution for both tenants and landlords. A well-structured installment plan allows tenants to divide their monthly rent (typically ranging from $1,000 to $3,000 in metropolitan areas) into smaller, more manageable payments. For example, instead of paying the full rent on the first of the month, tenants could propose a payment schedule that includes two or three installments within the month. This approach can support tenants facing financial constraints while ensuring landlords receive consistent cash flow. Additionally, clear terms specifying due dates, payment methods, and any applicable fees for late payments can foster a transparent agreement between parties, enhancing the overall rental experience.

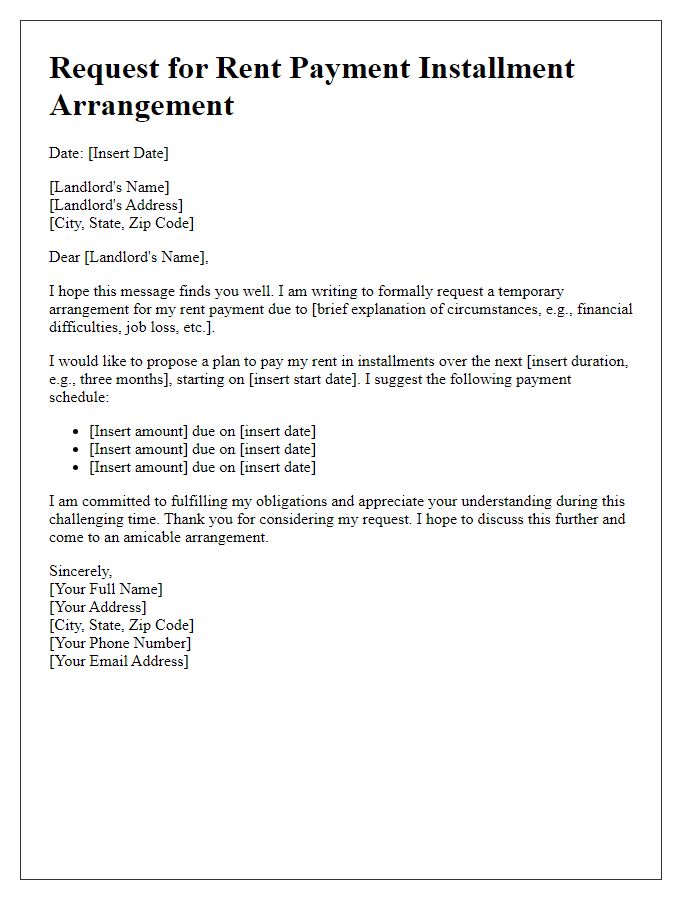

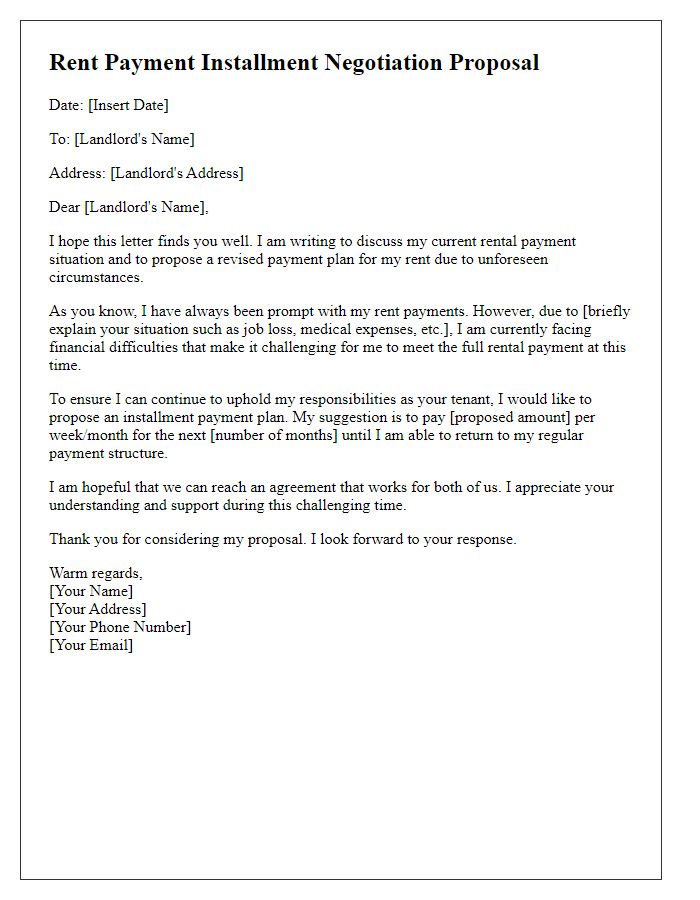

Tenant financial situation

A tenant experiencing financial hardship may propose a rent payment installment plan to their landlord to ease the burden of monthly payments. For example, a tenant whose income has decreased by 30% due to unexpected employment changes may suggest splitting the rent into smaller, more manageable payments over a specific period. This approach allows the tenant to maintain housing stability while gradually meeting their rental obligations. Landlords often consider such proposals, especially during economic downturns like the 2020 pandemic, which impacted many in urban areas such as New York City and Los Angeles, where rent prices are significantly higher than the national average. Open communication and a reasonable plan can foster a positive landlord-tenant relationship during challenging times.

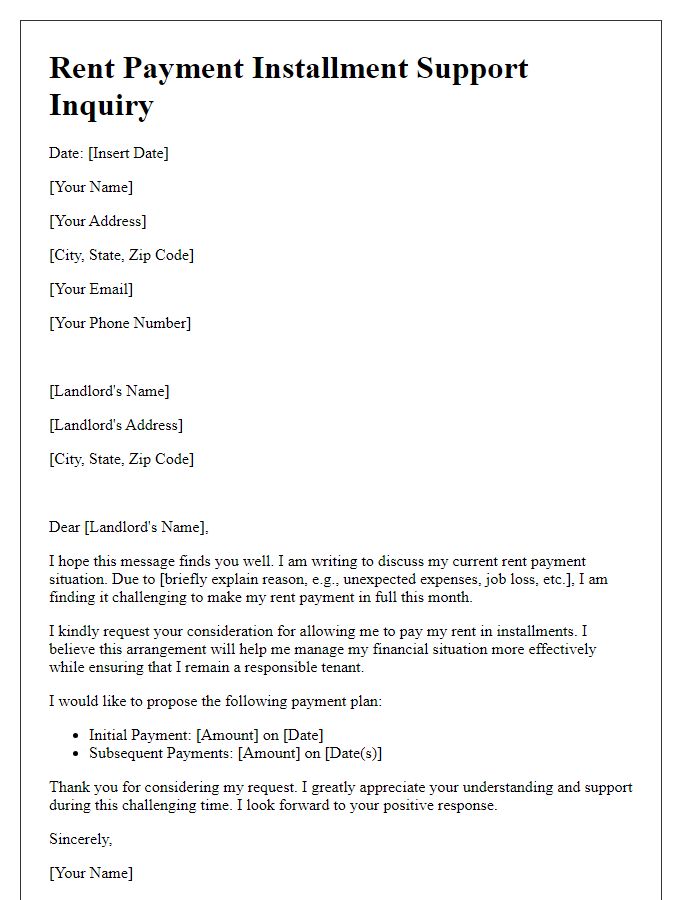

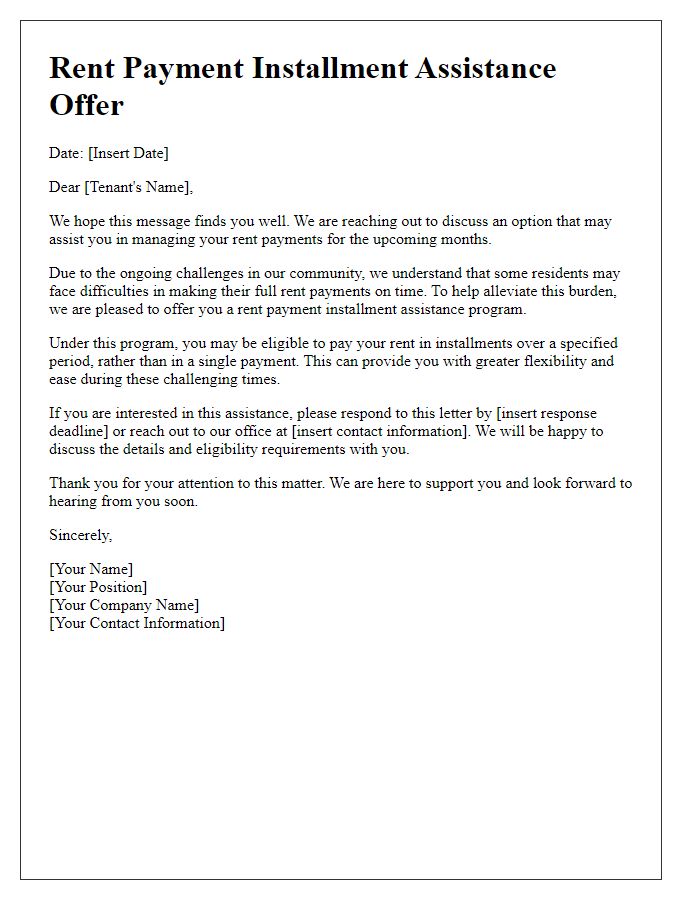

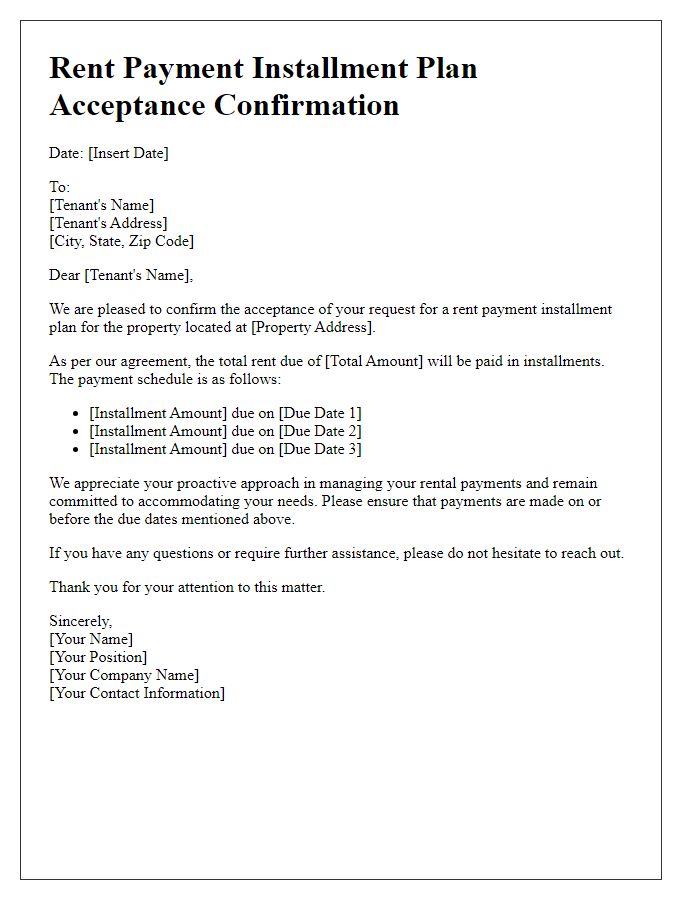

Landlord consent and agreement

The offer for a rent payment installment plan requires clear agreement between tenant and landlord to ensure all parties understand terms. A proposed plan may divide total rent (typically based on lease agreement) into manageable monthly installments, allowing the tenant to meet obligations despite financial difficulties. Important details include payment dates (e.g., by the 5th of each month), accepted payment methods (e.g., bank transfer, check), and potential late fees for missed payments. Additionally, communication regarding the situation necessitates written consent from the landlord to formalize the arrangement, ensuring both parties uphold responsibilities outlined in the lease agreement. This agreement benefits both tenants maintaining housing stability and landlords receiving timely payments.

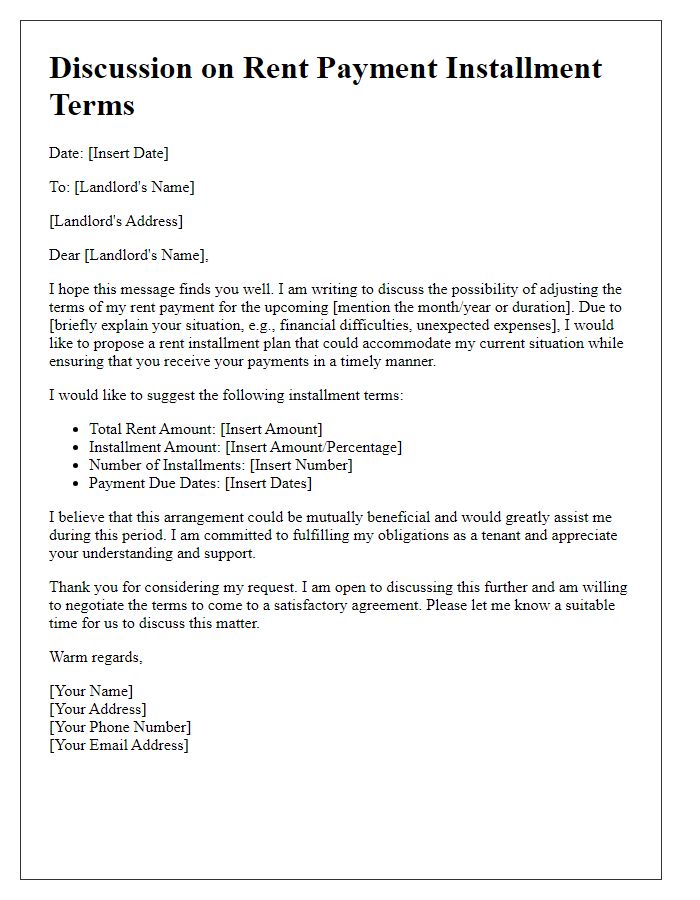

Interest or late fee considerations

Tenants experiencing financial difficulties may benefit from a rent payment installment plan, enabling them to split total rental payments into manageable portions. In this arrangement, crucial factors include potential interest rates, often ranging from 0% to 10% annually, which can impact the total amount repayable. Late fee considerations are also significant; many landlords impose fees averaging between $25 and $50 for late payments, with policies varying by state or region, affecting overall tenant obligations. It's essential for tenants to communicate openly with landlords about their circumstances to negotiate favorable terms, ensuring consistent housing stability while adhering to lease agreements without incurring excessive penalties.

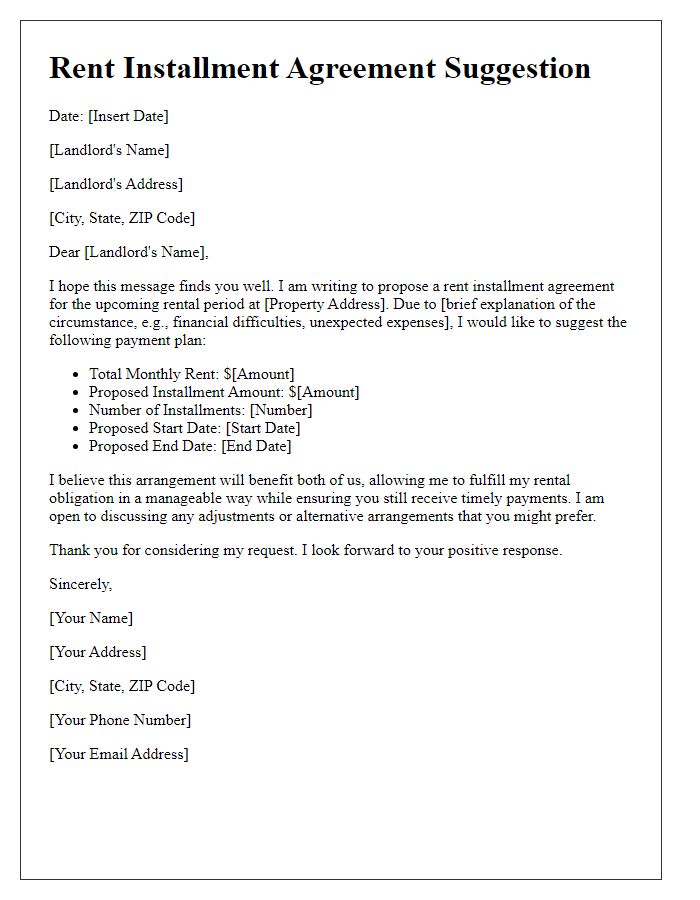

Legal compliance and documentation

A rent payment installment plan can provide tenants with financial flexibility during difficult times. Detailed documentation is necessary to ensure legal compliance and protect both parties' rights. A clear agreement should outline payment schedules, including specific dates and amounts, to avoid misunderstandings. Relevant clauses may include consequences for late payments, default terms, and the duration of the installment plan, which typically spans three to six months, depending on individual circumstances. Both landlord and tenant should acknowledge and sign the agreement, ensuring all terms are understood. Storing a copy of the signed document is crucial for future reference and legal protection.

Comments