Are you navigating the complex waters of job applications and wondering about stock options? You're not aloneâthe intricacies of compensation packages can leave many candidates scratching their heads. Understanding stock options is crucial, as they can significantly influence your overall earnings and job satisfaction. Dive into our article to gain insights and tips on how to effectively inquire about stock options during your job application process!

Job Title and Role Understanding

Many job seekers seek clarity regarding stock options in their employment offers, especially for key roles such as Software Engineer, Marketing Director, or Sales Executive. Understanding the vesting schedule (which can range from four years with a one-year cliff) and exercise price (the price to buy shares) is crucial for making informed decisions. The potential for financial growth through stock options can significantly impact overall compensation, especially in technology companies like Google or start-ups in Silicon Valley. Additional factors like company valuations, exit strategies (such as IPOs or acquisitions), and current stock market conditions can also influence the desirability and value of stock options. Seeking detailed information about the number of shares offered, terms of options, and potential tax implications allows candidates to evaluate opportunities effectively.

Company Stock Option Policy

The company stock option policy outlines the framework for granting stock options to employees, providing them with a potential financial benefit tied to the company's performance. This policy typically includes eligibility criteria, such as employment status or tenure, which may require employees to have worked at the company for a minimum of one year. The options are often offered at a predetermined price, known as the exercise price, set at the market value of the stock at the time of the grant, usually defined in the company's annual financial report. Vesting schedules play a crucial role, with options often vesting over a period of three to four years, encouraging employee retention. Additionally, the policy may specify expiration dates for the options, often set at ten years from the grant date, requiring employees to exercise their options before they lapse. Considerations regarding tax implications on exercising stock options are also vital for employees, as they can influence financial decision-making concerning retention or selling of shares.

Vesting Schedule and Requirements

The inquiry regarding stock options, particularly concerning the vesting schedule and requirements, is a critical aspect of employee compensation in companies such as technology firms or startups. A typical vesting schedule could last over four years, allowing employees to earn rights to 25% of their stock options each year. Requirements may include continued employment during the vesting period, performance targets, or milestones specific to roles within sectors like finance or healthcare. Understanding these details is essential for navigating potential financial benefits and aligning personal career goals with company growth trajectories.

Tax Implications and Conditions

The topic of stock options in employment agreements holds significant implications for both financial interests and tax responsibilities. Stock options, which are rights granted to employees to purchase shares of their company's stock at a predetermined price (often referred to as the exercise price), can create substantial wealth if the company's stock performs well. However, the execution of stock options typically leads to complex tax scenarios, such as ordinary income tax liability upon exercising the options and capital gains tax upon selling the acquired shares. In various U.S. states, specific regulations, like the Alternative Minimum Tax (AMT), can complicate personal financial situations for employees. Understanding the vesting schedule (the period over which employees earn their options) and post-employment exercise periods is crucial for maximizing benefits from stock options while adhering to all IRS regulations and state laws. Seeking professional advice from a tax advisor or financial planner is recommended to ensure compliance and optimize the financial outcomes associated with stock options.

Potential Growth and Company Performance

Potential growth in stock options greatly influences long-term employee commitment to companies like Tesla and Amazon. High performing organizations often offer stock options, encouraging employees to align personal success with company performance metrics. An impressive increase in stock value, driven by strong quarterly earnings reports or product launches, can significantly enhance the overall compensation package. Additionally, companies with established paths for employees to negotiate stock options, based on individual performance and tenure, can exhibit a commitment to talent retention. Understanding the vesting schedule and market trends also proves essential for employees seeking to maximize their financial benefits through stock options.

Letter Template For Job Application Stock Options Inquiry Samples

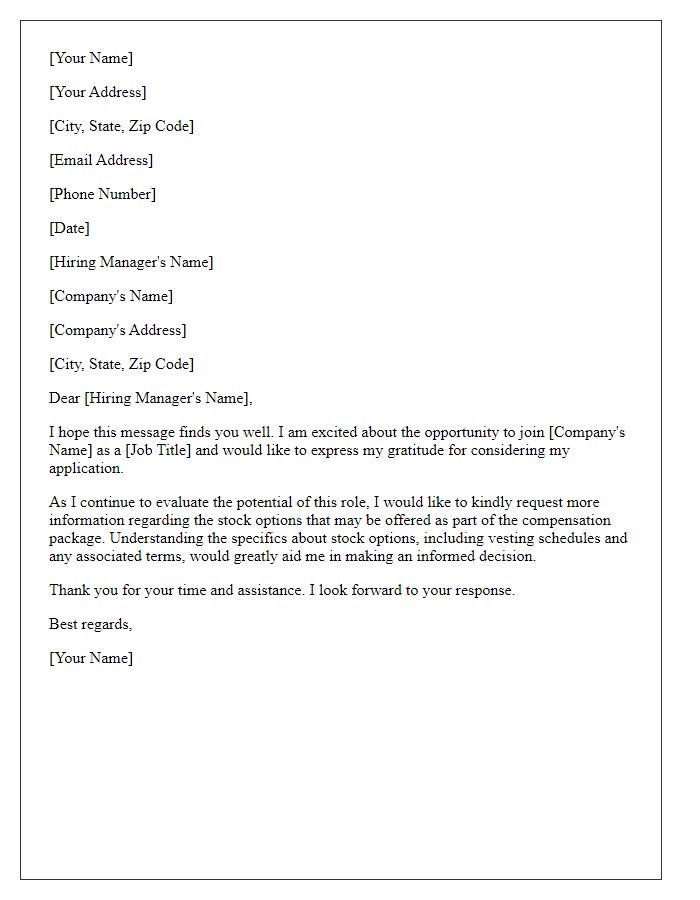

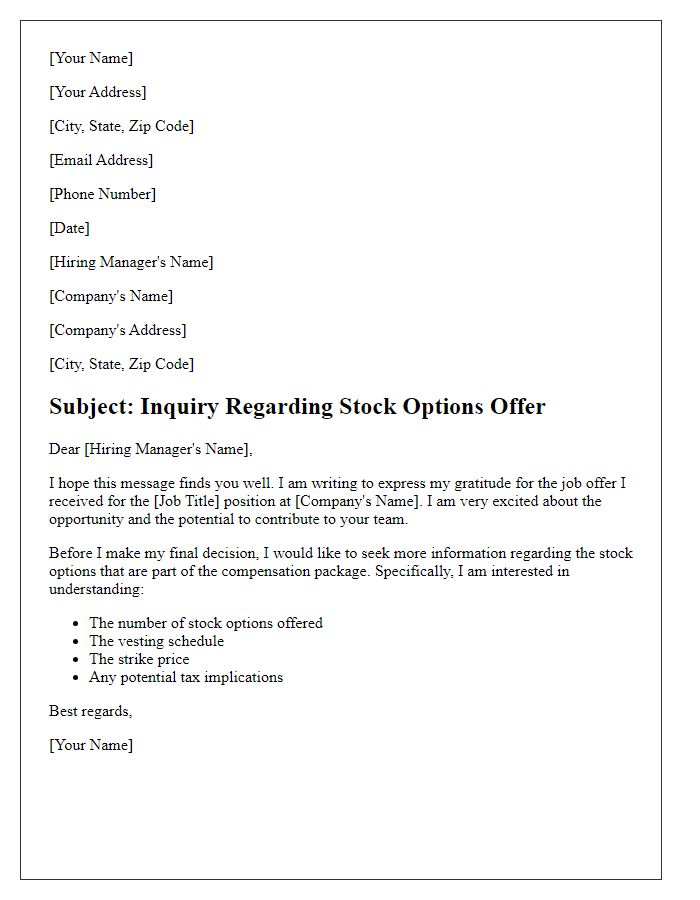

Letter template of request for stock options details in job application.

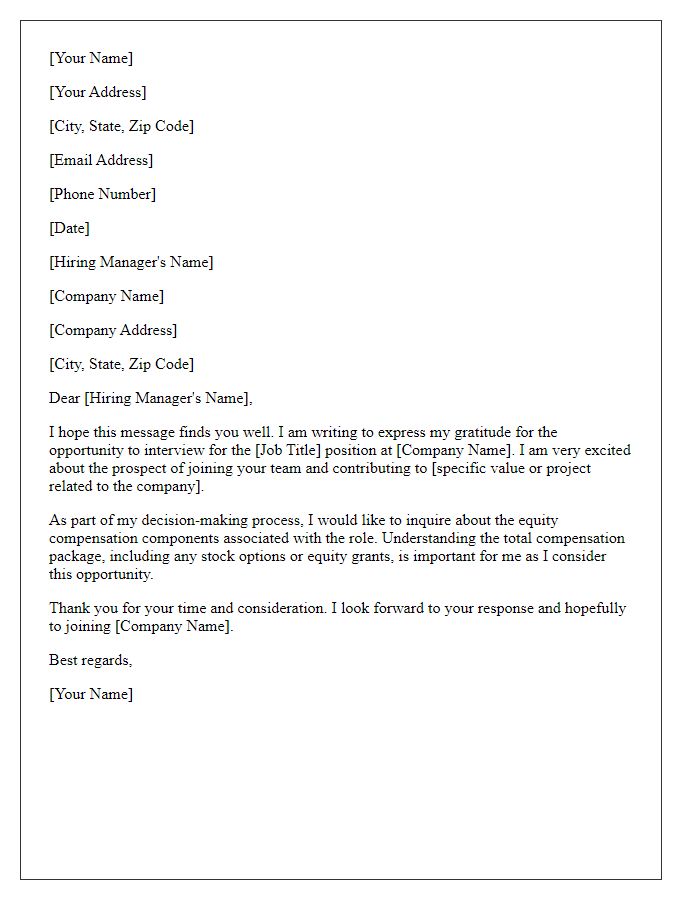

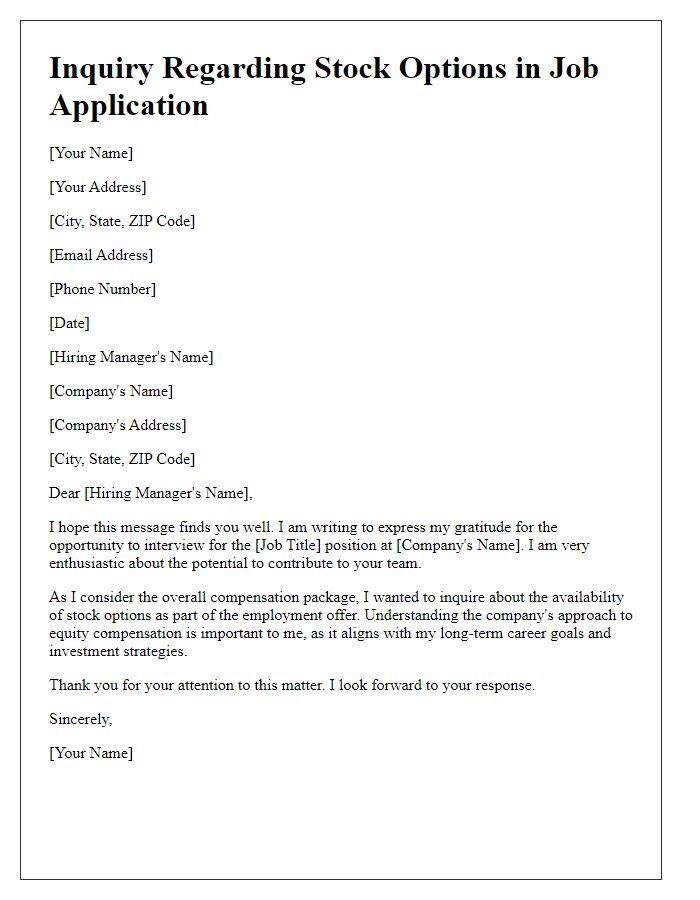

Letter template of inquiry into equity compensation during job application.

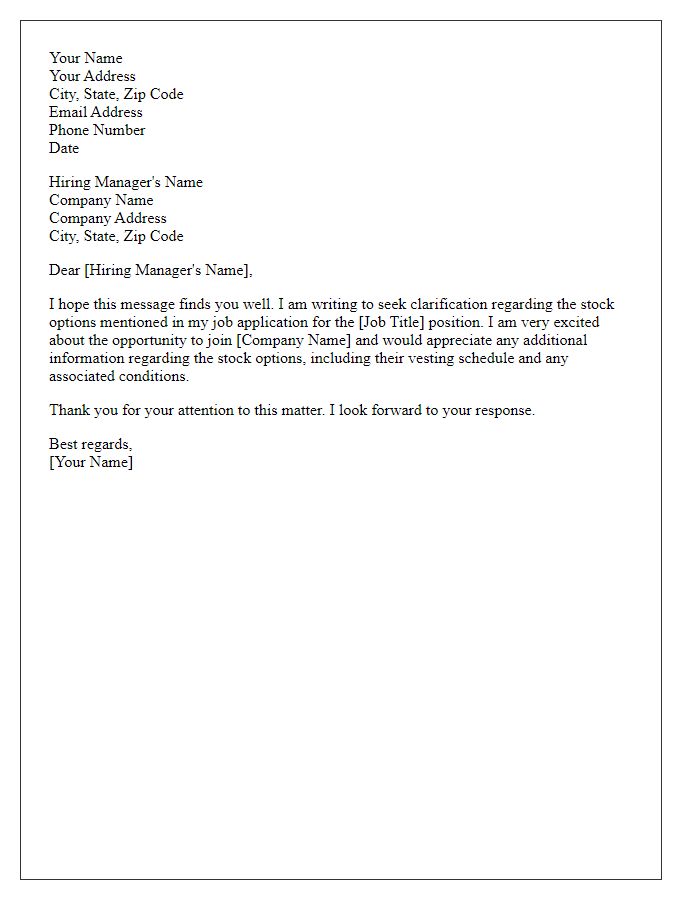

Letter template of clarification request about stock options in job application.

Letter template of follow-up on stock options discussion in job application.

Letter template of inquiry for potential equity benefits in job application.

Letter template of question regarding stock options package in job application.

Letter template of request for clarification on stock incentives in job application.

Comments