Have you ever found yourself in the frustrating situation of dealing with returned payment invoices? It can be confusing and time-consuming, but don't worry, we're here to help streamline the process for you. In this article, we'll walk you through a helpful letter template that makes updating your clients about returned payments a breeze. So, let's dive in and make your invoicing smootherâkeep reading to discover the best practices!

Clear Subject Line

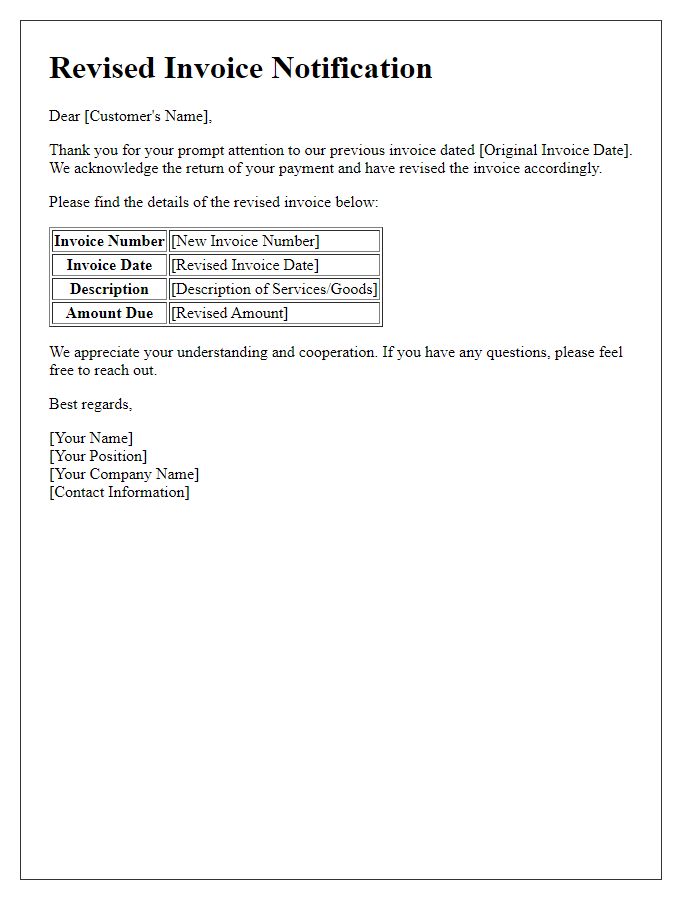

Returned payment invoices require prompt attention to ensure accurate accounting records. A clear subject line, such as "Update on Returned Payment Invoice #12345," aids in efficient communication. In the body of the message, outline the reason for the returned payment, whether due to insufficient funds, incorrect account details, or other factors. Include the invoice details like the date (e.g., April 15, 2023), total amount ($500), and the customer name (e.g., John Doe) to provide clarity. Acknowledge any previous correspondence regarding the issue, and emphasize the importance of resolving the matter expediently to maintain a positive business relationship.

Personalized Greeting

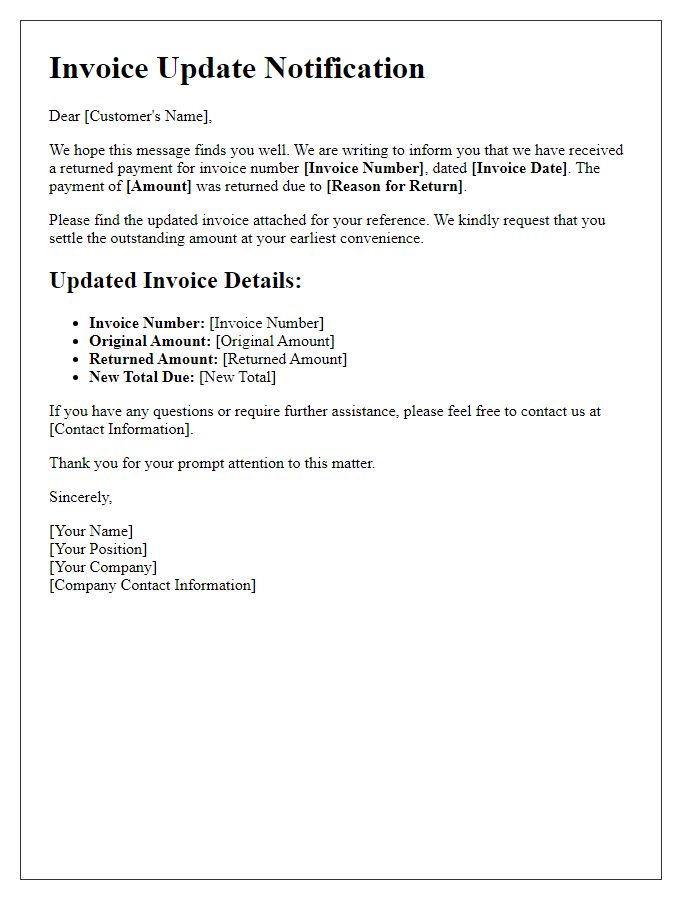

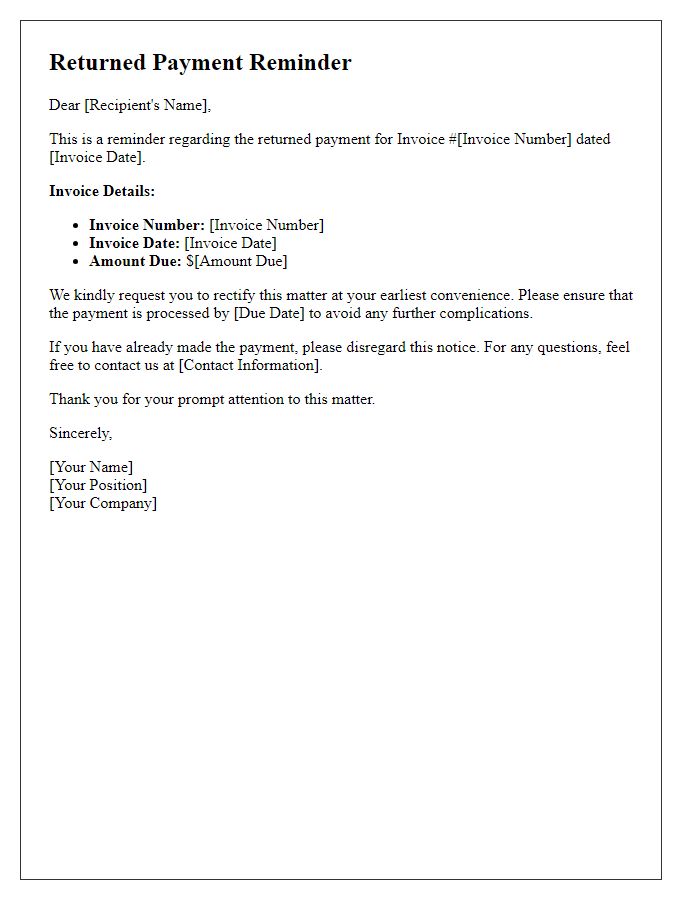

A returned payment invoice update can create confusion for customers, especially in financial transactions. The notification must clearly state the invoice number (e.g., #12345) associated with the returned payment, outlining the transaction date (e.g., August 15, 2023). The reason for the return, such as insufficient funds or closed accounts, should be specified to inform the customer of necessary corrections. Additionally, including the amount due (e.g., $150.00) and a revised payment deadline encourages prompt action. A courteous tone is essential, ensuring that customers feel valued and informed about the next steps in resolving the payment issue.

Concise Explanation of the Issue

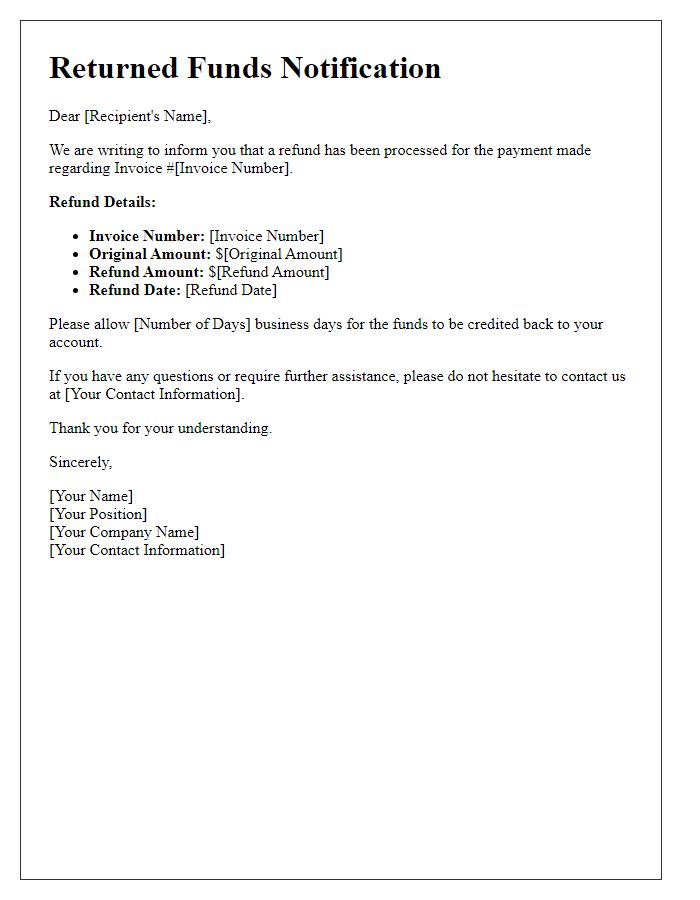

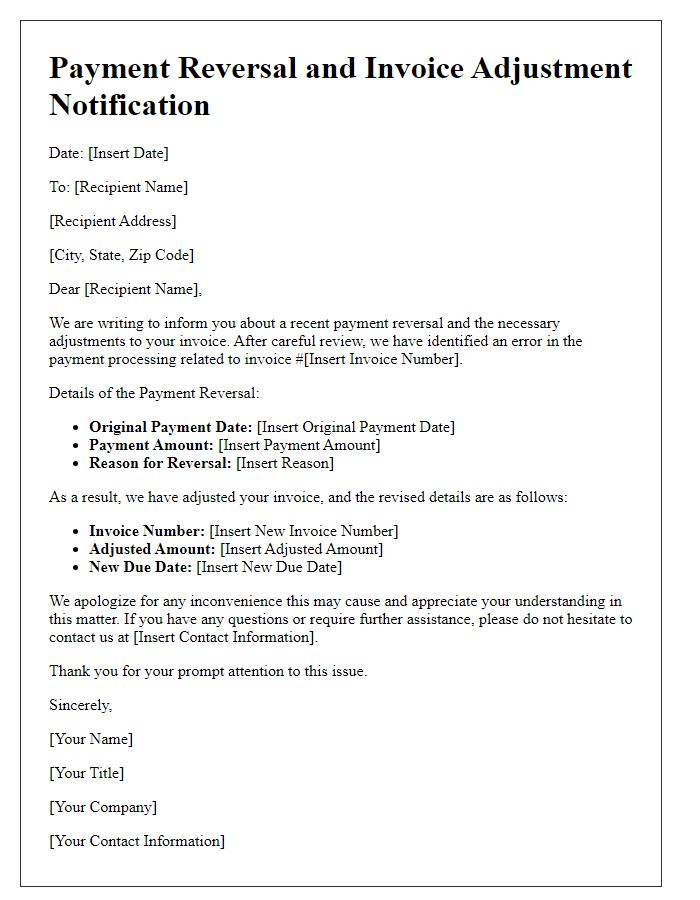

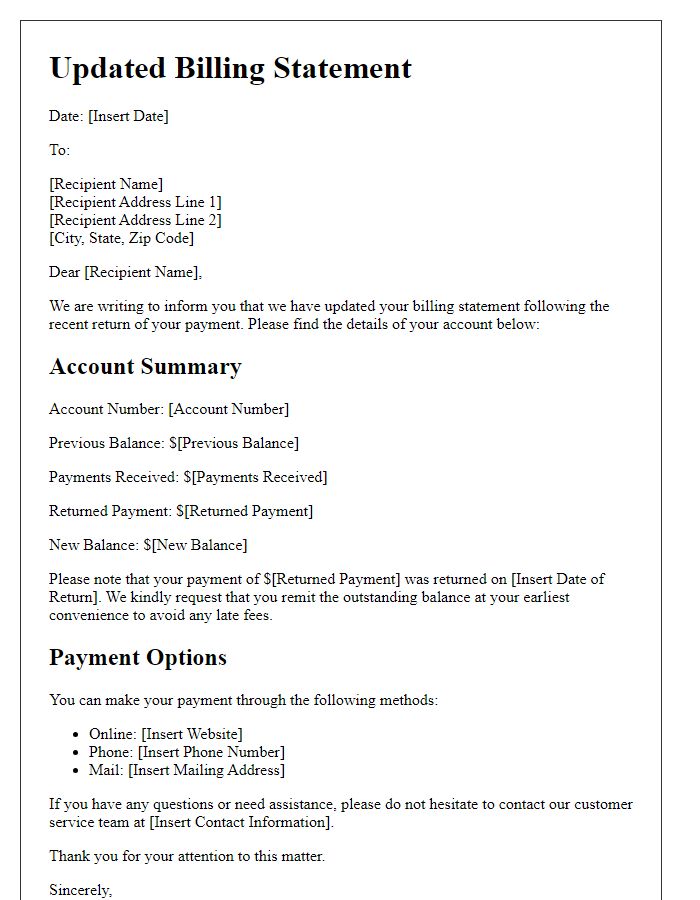

Returned payment invoices can cause significant disruptions in accounting processes. When a payment, such as a check or electronic transfer, is returned due to insufficient funds or incorrect account information, it can lead to additional fees from banks, impacting the overall financial health of a business. The invoice, detailing the original transaction, needs to be updated promptly to reflect the status change. Accurate record-keeping is essential, particularly for tracking outstanding balances and maintaining healthy cash flow. Clear communication about the returned payment is crucial for resolving the issue with the client and preventing future errors.

Detailed Payment Information

Returned payment invoices require careful attention to detailed payment information to ensure accurate processing. Various reasons may cause a return, including insufficient funds, incorrect account numbers, or timing issues with bank transfers. It is essential to update the invoice with critical data such as the original invoice number, payment amount (for instance, $150.00), transaction date (e.g., September 15, 2023), and the client's account details. Additionally, listing the payment method (check, credit card, electronic transfer) alongside any associated fees or penalties for the returned payment, which can range from $25.00 to $40.00, assists in clarity. Clear communication regarding the due date for reprocessing the payment and reconciling the account will facilitate smoother transactions in the future.

Contact Information for Assistance

Returned payment invoices require prompt action to resolve discrepancies. Contact information is essential for efficient communication. For assistance regarding returned payment invoices, reach out to the finance department at Foxtrot Corporation located in San Diego, California, phone number (619) 555-7890, or email inquiries to finance@foxtrotcorp.com. Responses typically occur within 24 hours. Ensure to have invoice numbers and relevant transaction details ready for a quicker resolution process.

Letter Template For Returned Payment Invoice Update Samples

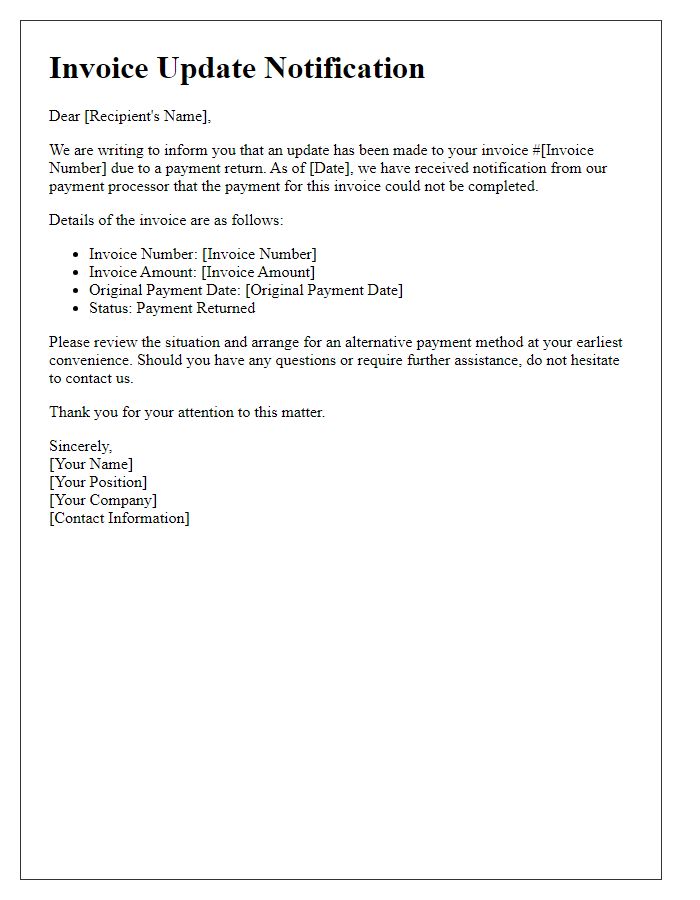

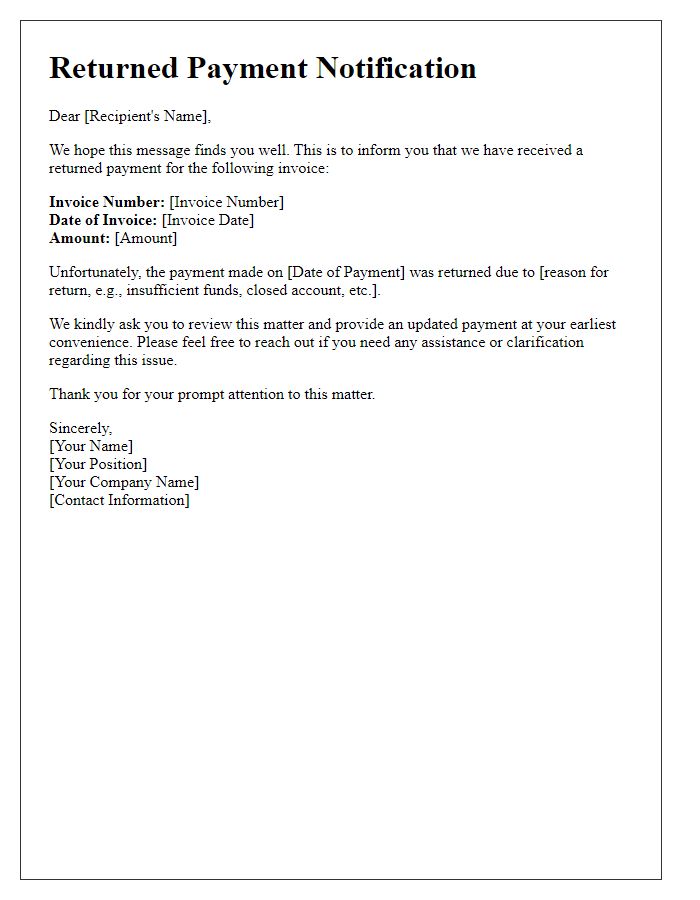

Letter template of notification for invoice update caused by payment return

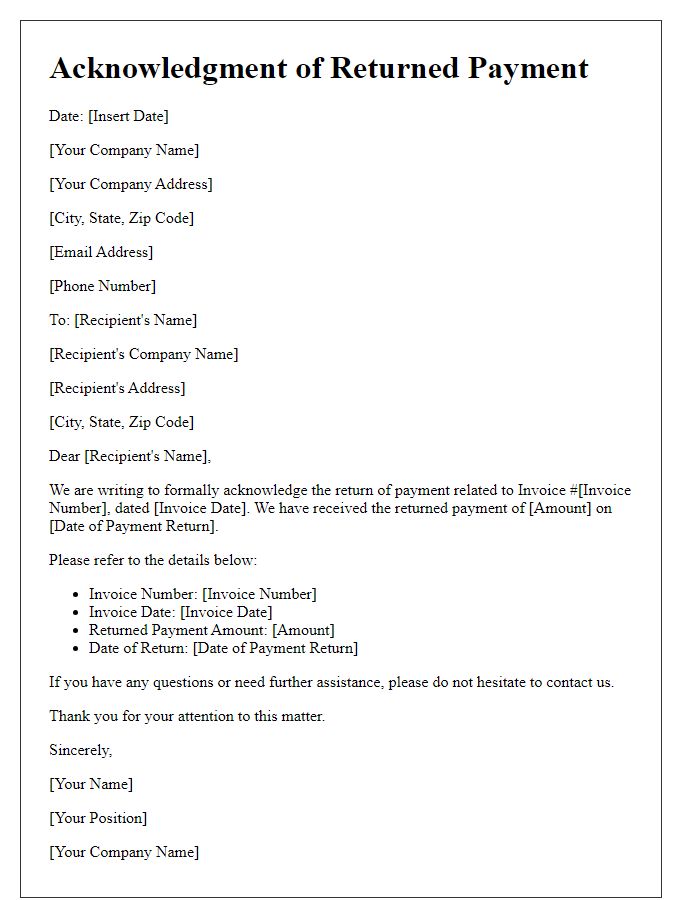

Letter template of acknowledgment for returned payment linked to invoice

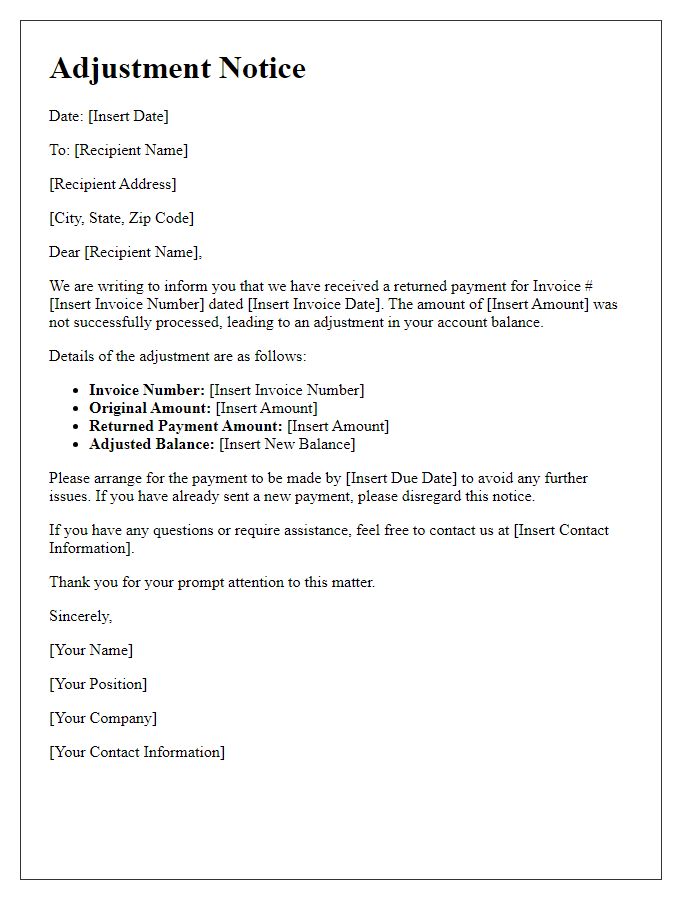

Letter template of adjustment notice for invoice due to returned payment

Comments