Have you ever found yourself confused by an unexpected invoice or a billing error? You're not alone; many people face similar situations, and addressing them can feel daunting. In our article, we'll guide you through a clear and effective letter template for following up on an invoice dispute, ensuring you communicate your concerns professionally and assertively. Curious to learn how you can navigate this process smoothly? Read on!

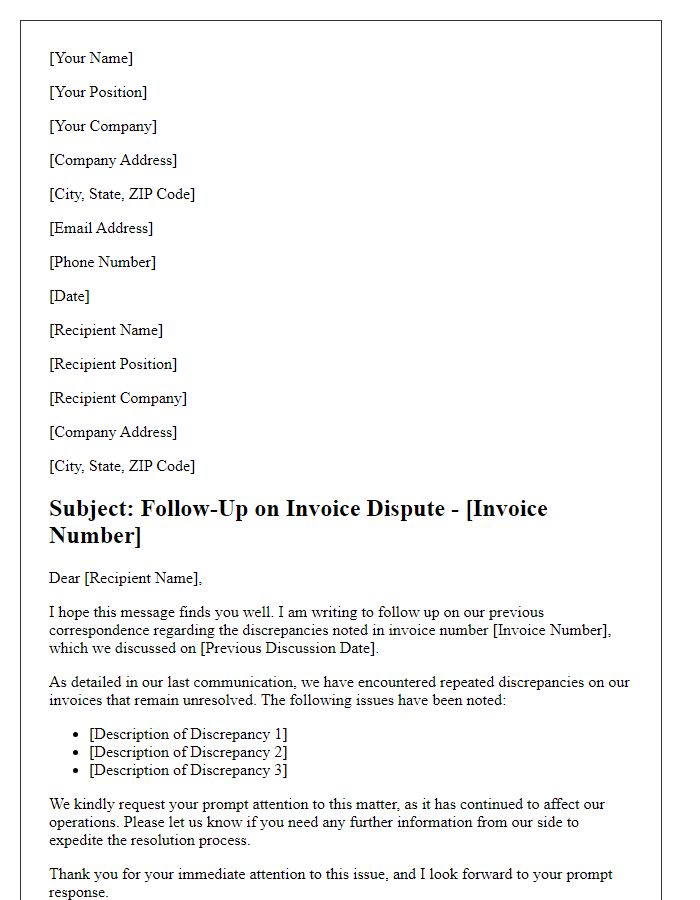

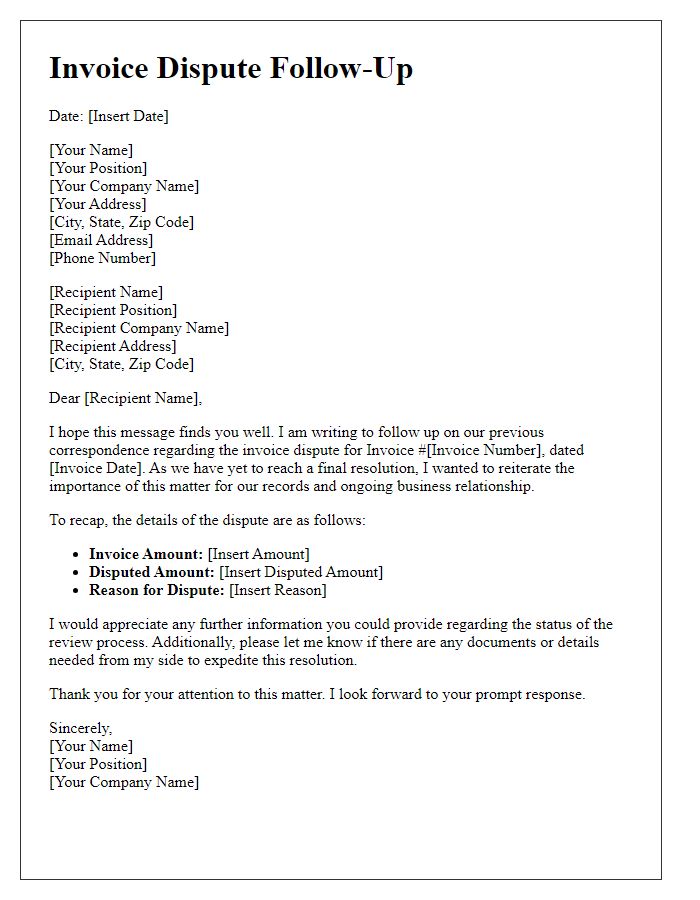

Recipient's contact information

Effective communication following an invoice dispute requires clarity and accuracy. Clearly list the recipient's contact information, including the name of the individual responsible for financial matters, their email address, and phone number. Ensure to specify the company name, physical address, and any relevant department (such as Accounts Payable). Providing a complete overview aids in efficient resolution. Highlight any reference numbers associated with the invoice and include details of the disputed amount for further contextual understanding. Thorough and concise contact details streamline the process, ensuring swift responses and resolution of the dispute.

Invoice details (invoice number, date, amount)

In the realm of business transactions, invoice disputes can arise, necessitating follow-up communications for resolution. An invoice typically includes critical details such as the invoice number (a unique identifier assigned to the document), the date of issuance (often a pivotal date for payment terms), and the total amount (which reflects the agreed sum for goods or services rendered). Prompt follow-up is crucial to ensuring clarity and resolving issues efficiently, especially in cases where discrepancies in amounts or misunderstandings about services completed, as documented in the invoice, are present. Accurate record-keeping and timely communication can prevent further complications in financial reconciliations and maintain professional relationships.

Clear statement of dispute reason

A clear statement of dispute reason regarding an invoice typically involves discrepancies in billed amounts, services not rendered, or incorrect pricing. For instance, a recent invoice dated October 15, 2023, from XYZ Services AM Inc. lists a charge of $1,200 for website development, whereas the agreed contract amount was $1,000, resulting in an unjustified overcharge of $200. Additionally, the invoice includes charges for services outlined in a prior document, such as social media management, explicitly stated to be excluded from the current billing cycle. These inconsistencies necessitate a formal review and prompt resolution to uphold the integrity of our agreement.

Request for resolution or adjustment

Invoice disputes often arise due to discrepancies in billing details and require prompt attention for resolution. Discrepancies could include incorrect line item quantities, pricing errors, or missing discounts promised during negotiations. It is essential to refer to the specific invoice number (for instance, Invoice #12345) and outline the disputed amount clearly (for example, $500). Communication should include the date of the original invoice (e.g., August 12, 2023) and reference any prior correspondence related to the dispute. Timely resolution can improve client relationships, leading to smoother transactions in the future. Requesting a revised invoice or adjustment not only clarifies financial records but also reinforces accountability between businesses.

Contact information for further communication

In a business setting, an invoice dispute follow-up often requires direct communication, ensuring resolution efficiency. Essential contact information includes the name of the account manager or customer service representative involved, typically located at the business address, such as 1234 Business Lane, Springfield, or reachable via phone number (555) 123-4567. Additionally, email contact, for instance, support@businessdomain.com, facilitates quick exchanges of documents or clarifications. Including the dispute reference number enhances tracking and organization, especially in environments where multiple transactions occur concurrently. Moreover, the timeline of the initial invoice date may also be relevant, as it typically falls on a standard accounting period, such as month-end reviews.

Letter Template For Invoice Dispute Follow-Up Samples

Letter template of invoice dispute follow-up for contract discrepancies.

Letter template of invoice dispute follow-up for service quality issues.

Letter template of invoice dispute follow-up for unacknowledged correspondence.

Letter template of invoice dispute follow-up for unresolved balance issues.

Comments