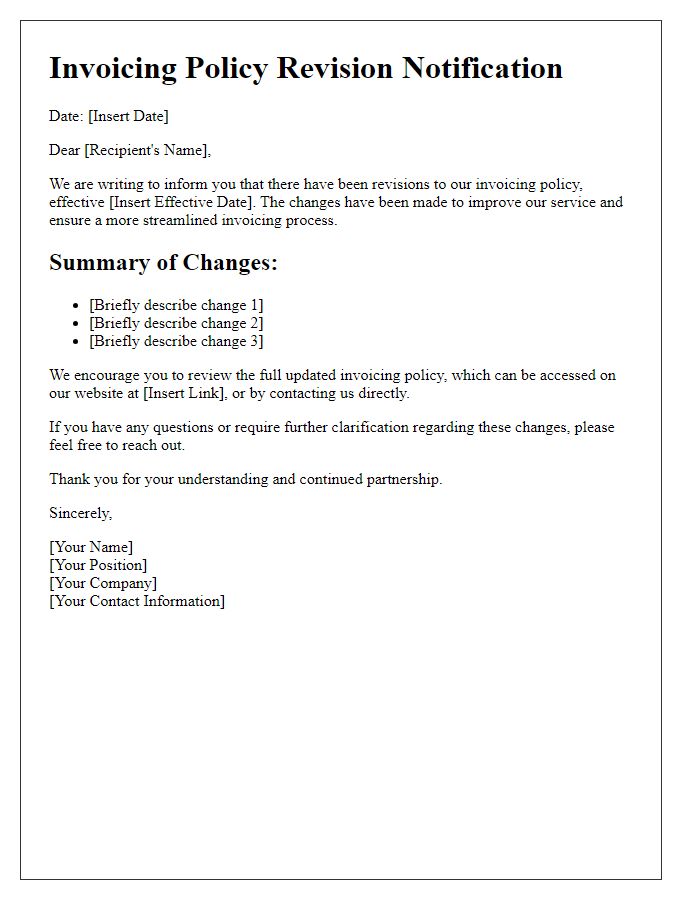

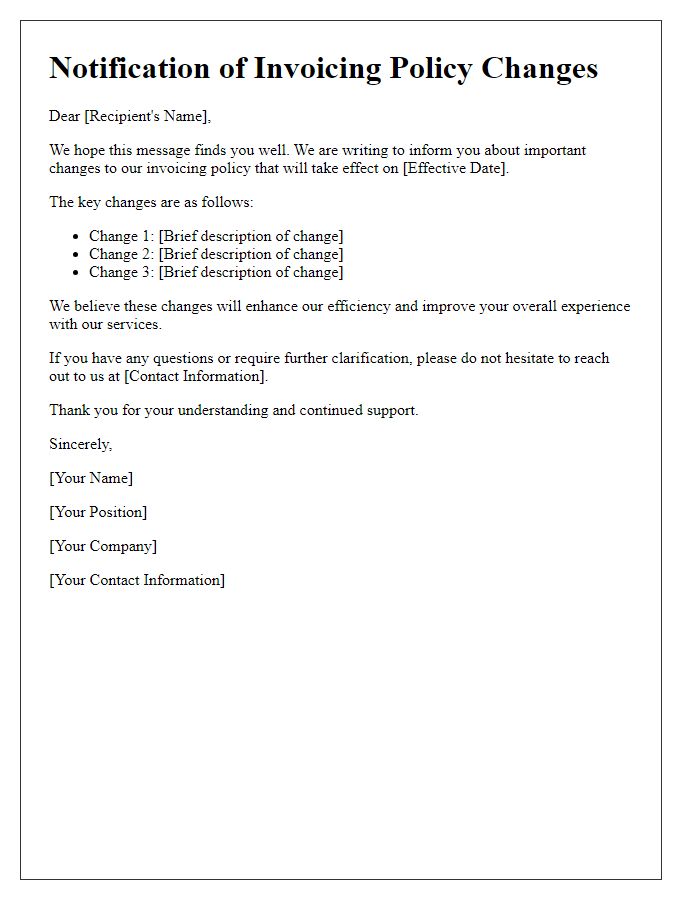

Hey there! We're excited to share some important updates regarding our invoicing policy that will help streamline our processes and enhance your experience. With these changes, we aim to provide clearer guidelines and ensure timely payments for our valued clients. We believe that staying informed is key to our successful partnership, so we encourage you to read on for all the details!

Clarity and precision in language.

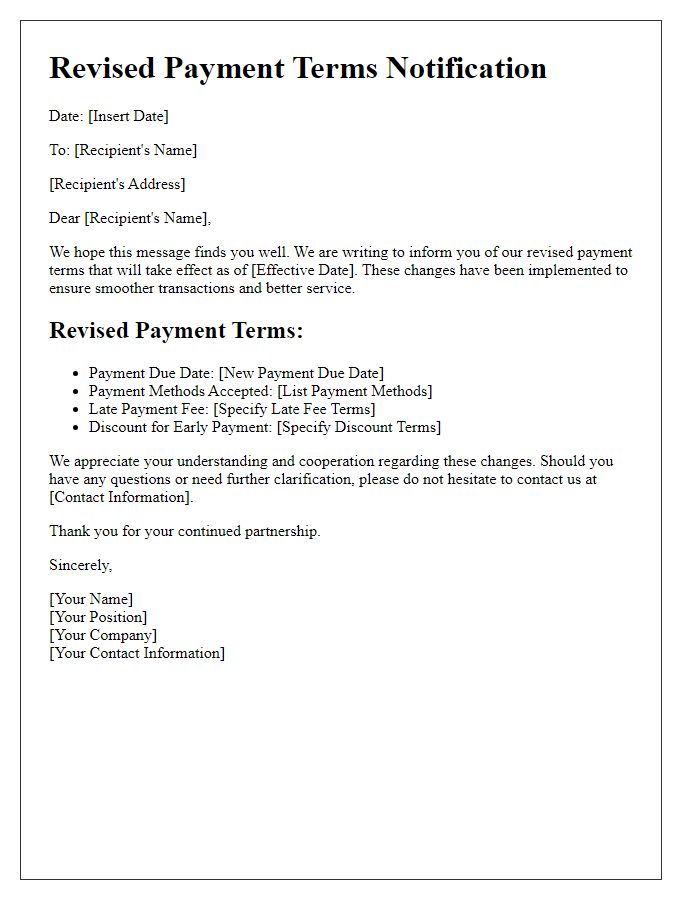

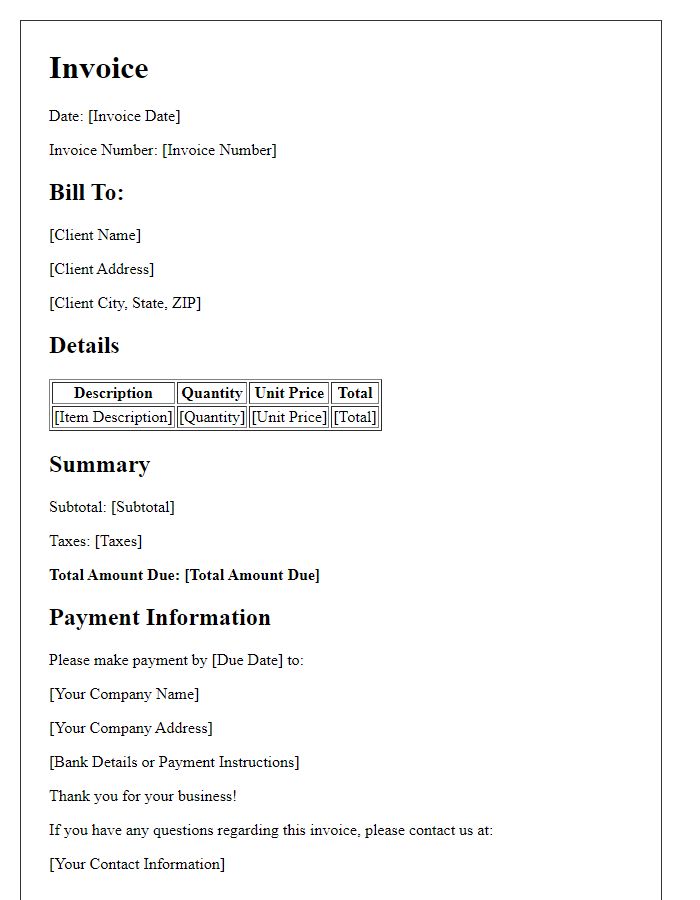

An invoicing policy update ensures clarity and precision in language for streamlined financial transactions. Consistent terminology, such as "net payment terms," (typically 30 days) outlines expectations for timely payments. Itemized billing statements highlight specific services or products, along with corresponding costs to avoid disputes. Clear instructions on acceptable payment methods, including credit cards and wire transfers, facilitate smooth processing. Additionally, specifying interest rates (such as 1.5% per month for late payments) reinforces accountability. Regular updates to terms, reflecting changes in business practices or regulations, maintain transparency. Effective communication of these policies enhances trust between businesses and clients, promoting long-lasting relationships.

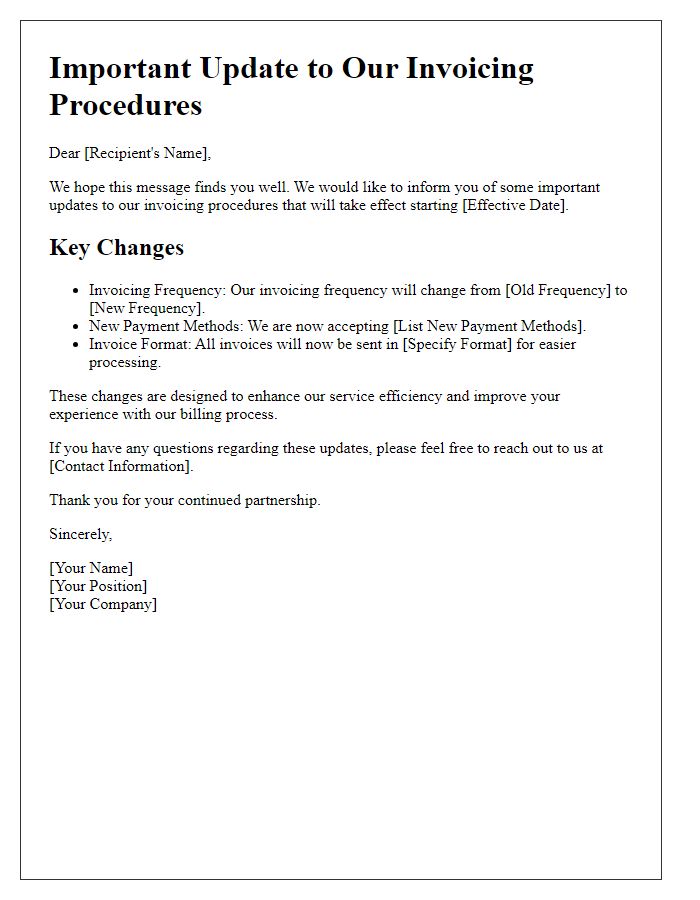

Consistent tone and formality.

The invoicing policy update will enhance transparency and efficiency in financial transactions. Effective January 1, 2024, all clients will receive invoices via email, ensuring prompt delivery. The payment terms will be updated to 30 days from the invoice date, promoting timely settlements. Detailed itemization on invoices will provide clarity on charges (service fees, materials, and labor), preventing misunderstandings. A late fee of 1.5% per month will apply after the due date, emphasizing the importance of punctual payments. Clients are encouraged to review these changes, ensuring adherence to the new policy for an improved invoicing experience. Further inquiries can be directed to the finance department.

Inclusion of key update details.

Invoicing policies are crucial for maintaining financial clarity and operational efficiency. Recent changes include the introduction of electronic invoicing platforms, which streamline the billing process. Updated invoice formats will feature itemized lists, ensuring transparency in charges. Payment terms have shifted to a net 30-day cycle, reducing the previous net 45-day practice. Late fees, now set at 1.5% per month for overdue balances, encourage timely payments. Additionally, weekly billing cycles for projects exceeding $10,000 are implemented for better cash flow management. Compliance with these updated policies is essential for seamless transactions and strengthened relationships with clients.

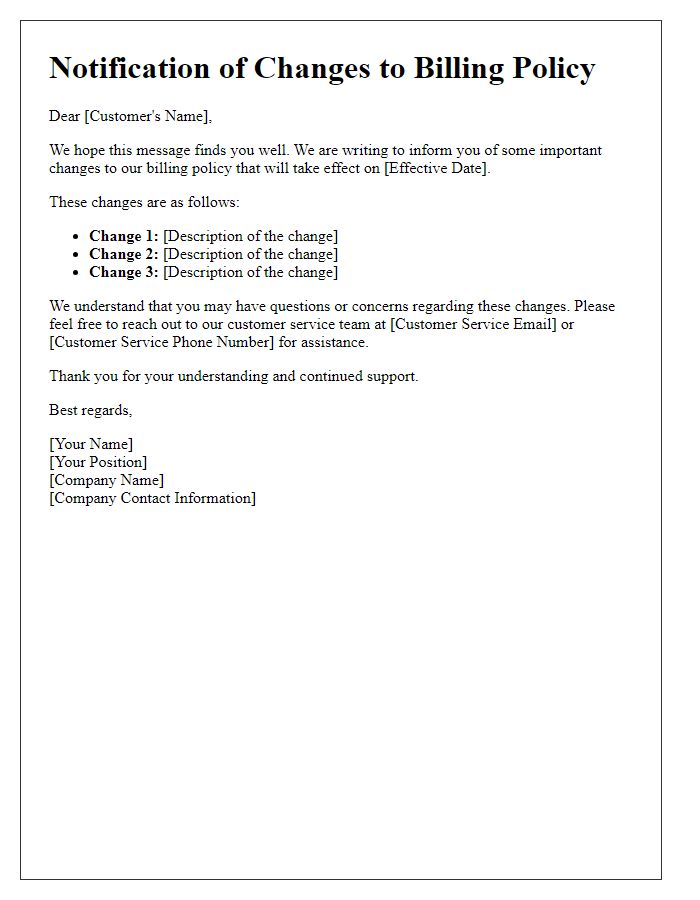

Structured format and layout.

Invoicing policies play a crucial role in maintaining effective financial communication between businesses and clients. An updated invoicing policy should clearly outline key elements including payment terms, methods accepted (credit card, bank transfer), and due dates. Ensure that the format is structured, utilizing headings such as "Payment Terms," "Accepted Payment Methods," and "Invoicing Schedule." Integrate bullet points for clarity, detailing specific timelines (e.g., "Invoices are issued bi-weekly on Fridays"), and emphasize late fees or penalties for overdue payments (typically around 1.5% per month). Consistency in layout throughout the document fosters professionalism and enhances readability, making it easier for clients to understand their responsibilities and adhere to the updated policies.

Legal and compliance considerations.

Invoicing policy updates must adhere to legal regulations, including the Fair Debt Collection Practices Act. Compliance with tax-related laws, like the Internal Revenue Code, ensures accurate reporting of sales tax for various jurisdictions, like California and New York, where tax rates differ significantly. Clear invoicing guidelines must also align with international regulations such as the General Data Protection Regulation (GDPR) to safeguard customer information when processed and stored. Established timelines for payment terms, like net 30 or net 60, must reflect industry standards for businesses in sectors including retail and services. Proper documentation is imperative for audit trails, allowing for transparent transactions and mitigating potential disputes. Regular audits of invoicing practices can reveal discrepancies, ensuring adherence to both internal policies and external legal requirements.

Comments