Are you looking for a way to manage your payments more effectively? An invoice installment payment plan can offer you the flexibility you need without the added stress of lump-sum payments. In this article, we'll explore the benefits of setting up such a plan and how it can help ease your financial burden. Join us as we dive deeper into creating a successful installment payment strategy!

Header information (company name, address, contact details)

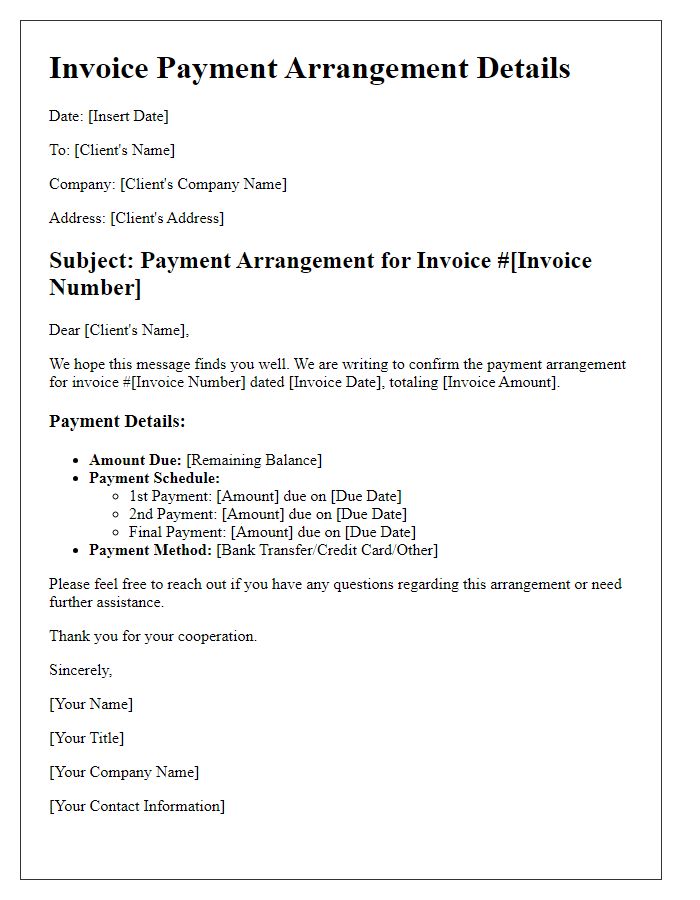

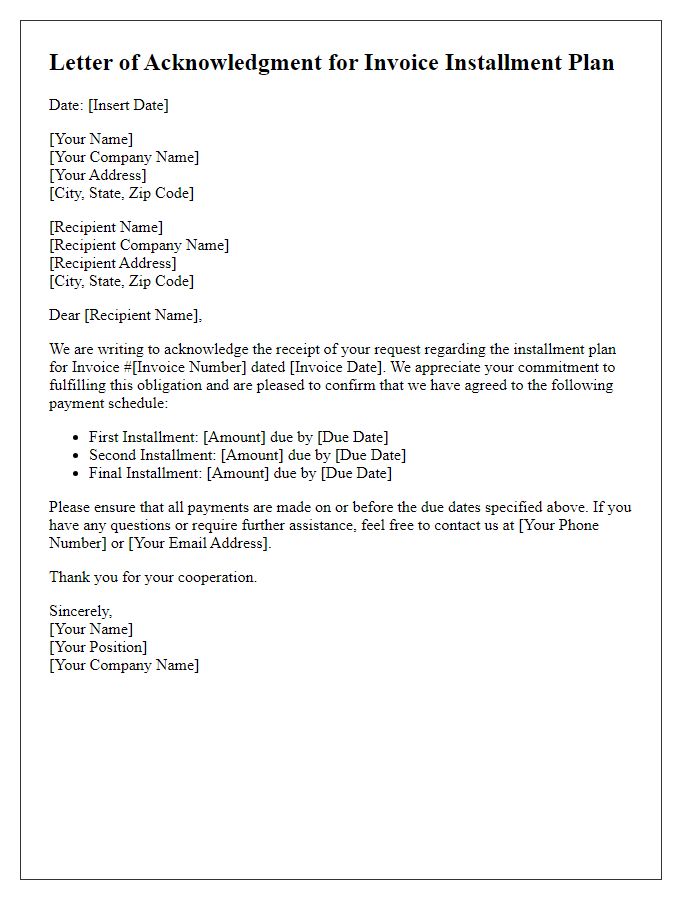

A well-structured invoice for an installment payment plan should include essential header information at the top. The company name, prominently displayed, serves to identify the billing entity clearly. Below the company name, the address including street name, city, state, and zip code ensures precise delivery and correspondence. Contact details, encompassing phone number and email address, allow for easy communication regarding the invoice. Additionally, an invoice number and date can facilitate records management. This structured presentation aids clients in recognizing the billing source, streamlining the payment process.

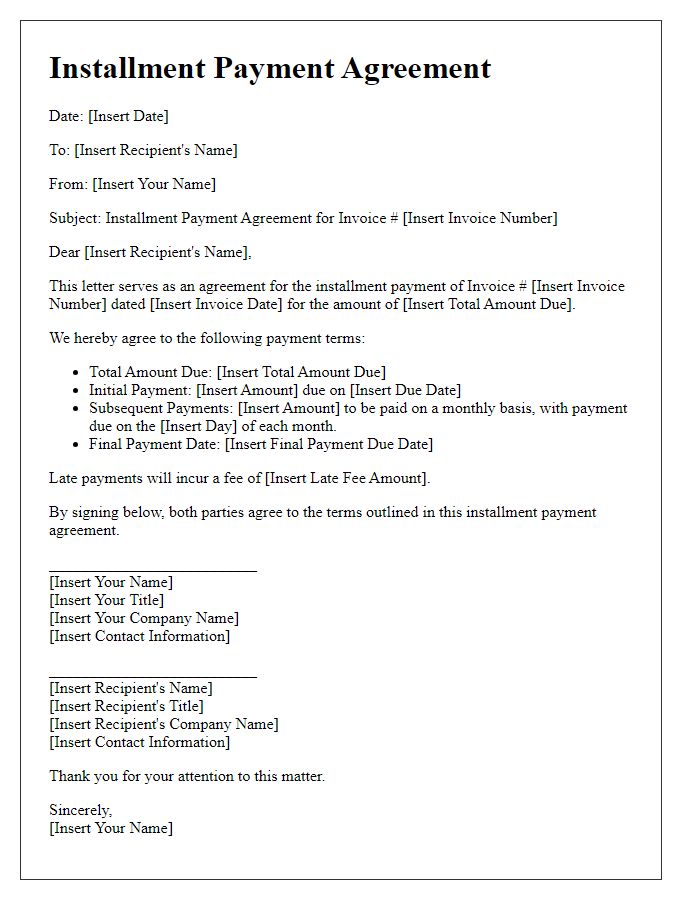

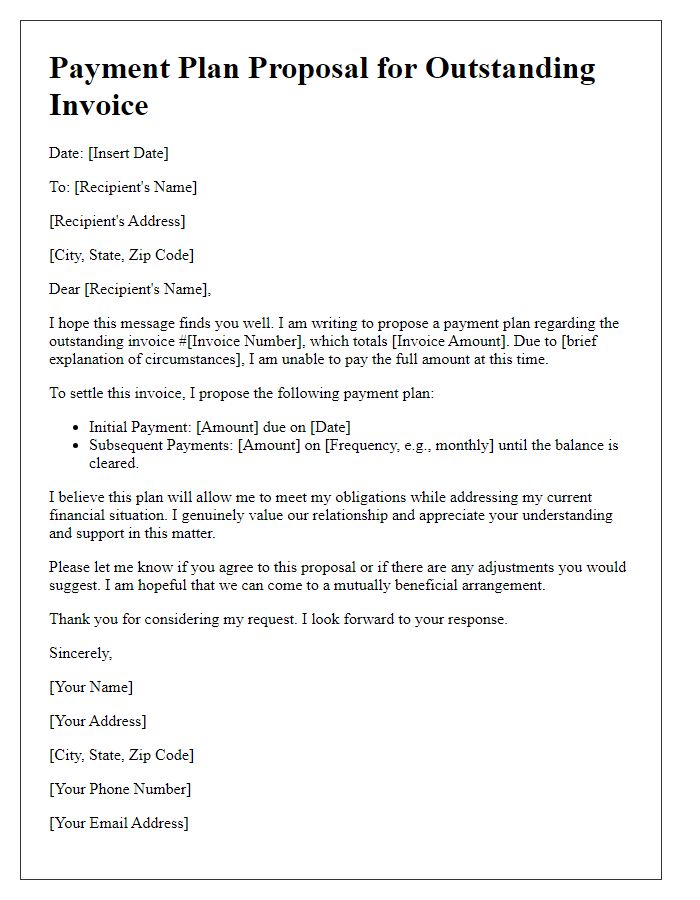

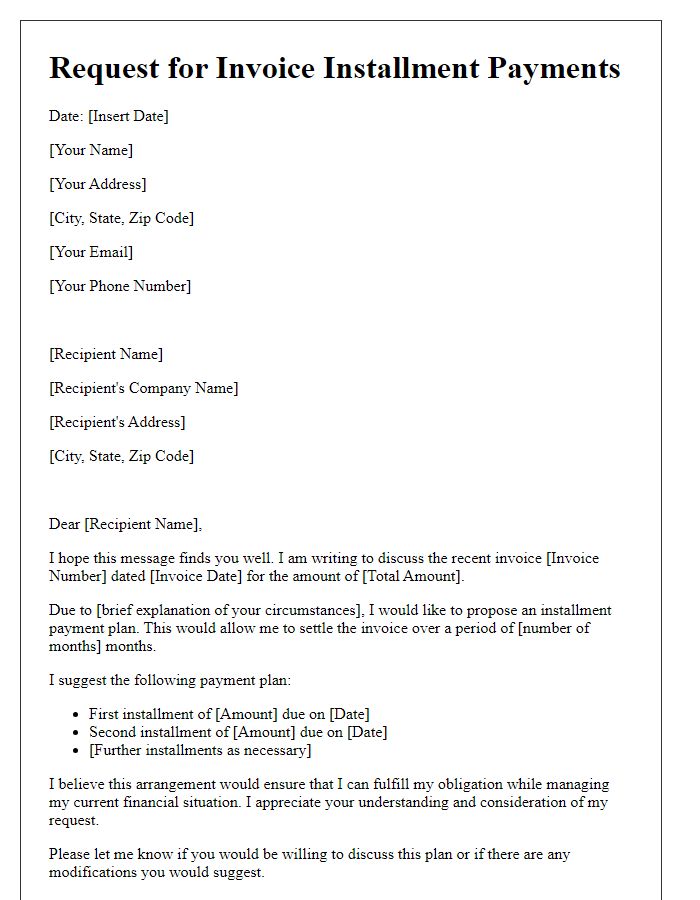

Date of letter and recipient details

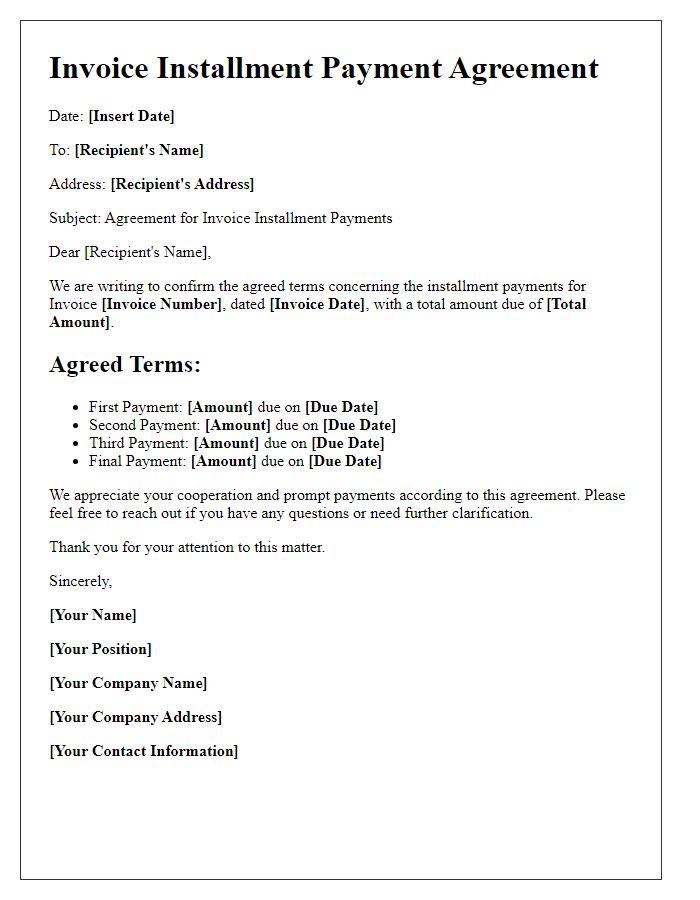

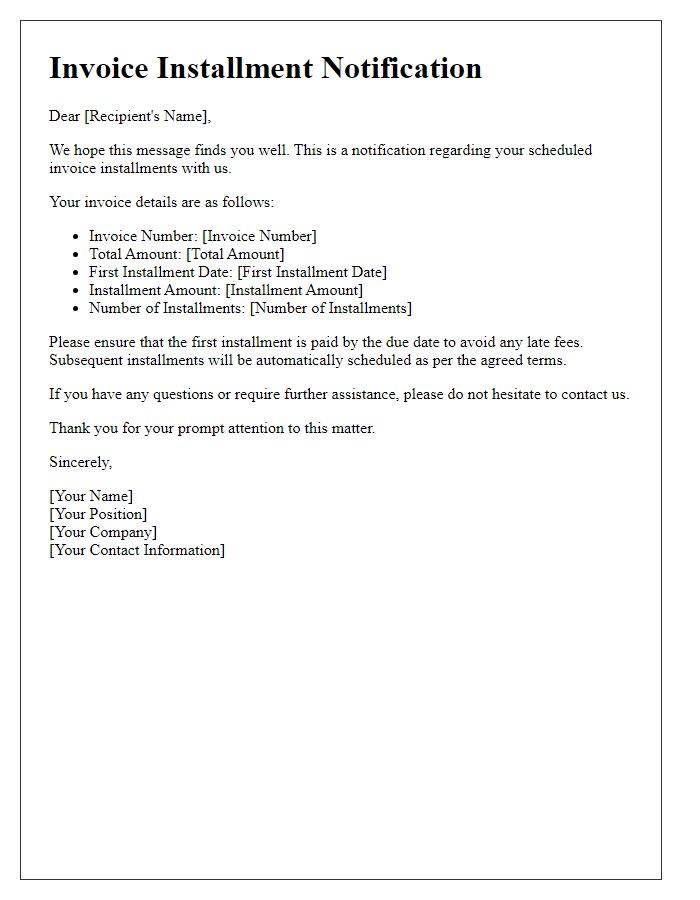

An effective invoice installment payment plan often includes clear stipulations regarding payment dates, amounts, and consequences in case of delays. The document should state the date of issuance prominently at the top, followed by the recipient's details, including name, address, and business identification number if applicable. It's essential to specify the total amount owed, the number of installments, amounts for each payment, and due dates for these payments. Providing a designated payment method, such as bank transfer or credit card, will facilitate processing. Additionally, outlining interest rates or late payment fees, if any, ensures transparency and sets clear expectations for both parties involved in the financial agreement.

Subject line indicating payment plan arrangement

To establish a payment plan for installment invoices, a detailed outline is essential. An invoice typically includes specifics such as the invoice number, total amount due, payment terms, and due dates. The payment plan can allow for installments spread over a specified duration, emphasizing clarity on the number of installments and each installment amount. Providing contact details for inquiries is crucial, alongside a breakdown of progress payments to ensure transparency. Clear documentation of both parties' agreement on this installment structure helps avoid misunderstandings and assures compliance. Ensure all information adheres to local financial regulations and best practices for professional communication.

Detailed breakdown of installment amounts and schedule

An invoice payment plan outlines the structured repayment method agreed upon for outstanding amounts, typically used in commercial transactions. The detailed breakdown includes the total invoice amount (for example, $10,000), number of installments (like 5 payments), and individual installment amounts (e.g., $2,000 per month). The payment schedule outlines due dates (such as the first payment on March 1 and subsequent payments on the first of each month) along with accepted payment methods (such as bank transfers or credit card payments). This structured approach helps both the payer and the payee maintain transparency regarding financial obligations, ensuring that deadlines are met and fostering a reliable business relationship.

Sender's contact information for inquiries or assistance

A well-crafted invoice installment payment plan clearly outlines payment scheduling and amounts while providing comprehensive contact information for client inquiries or assistance. Incorporate details such as the sender's company name, physical address in the United States, email address, and a dedicated phone number for customer service. Multiple contact channels facilitate communication, ensuring clients can easily resolve concerns or clarify payment terms. It is essential to present this information prominently, potentially including it at both the top and bottom of the invoice, highlighting the sender's commitment to customer support and transparency in financial transactions.

Comments