Hey there! Have you ever found yourself in a situation where an invoice just didn't add up? Mistakes happen, and knowing how to address them can make all the difference in maintaining good business relationships. In this article, we'll explore a user-friendly letter template for reissuing corrected invoices, ensuring clarity and professionalism every step of the way. So, let's dive in and find out more about crafting that perfect message!

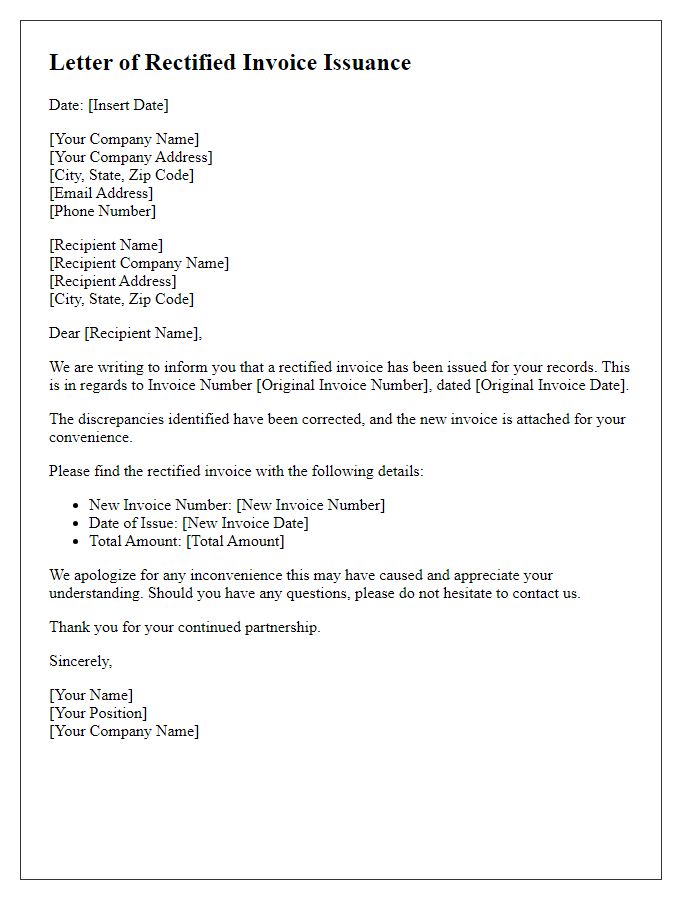

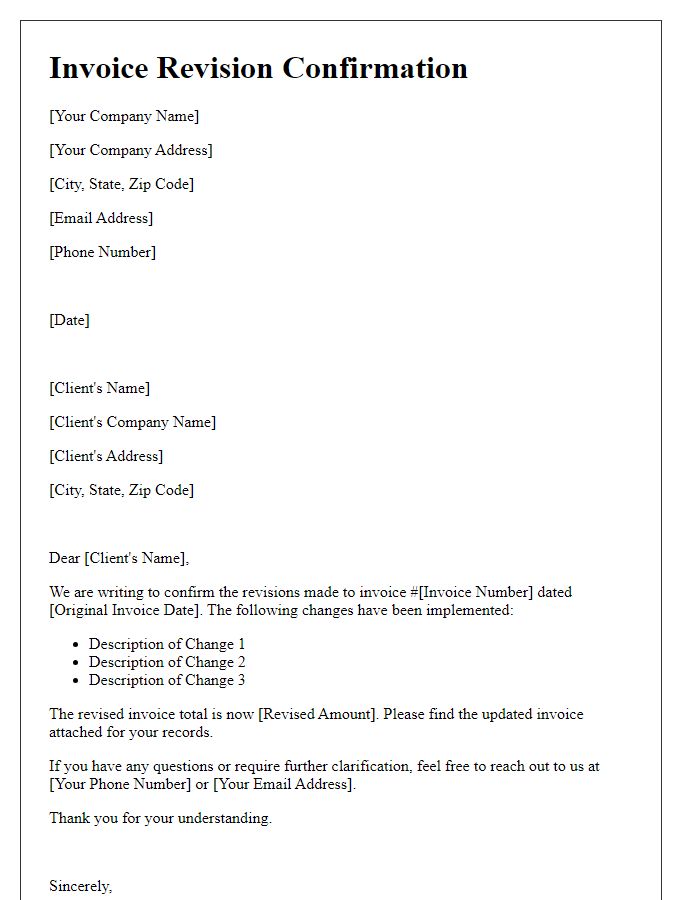

Clear Identification Details

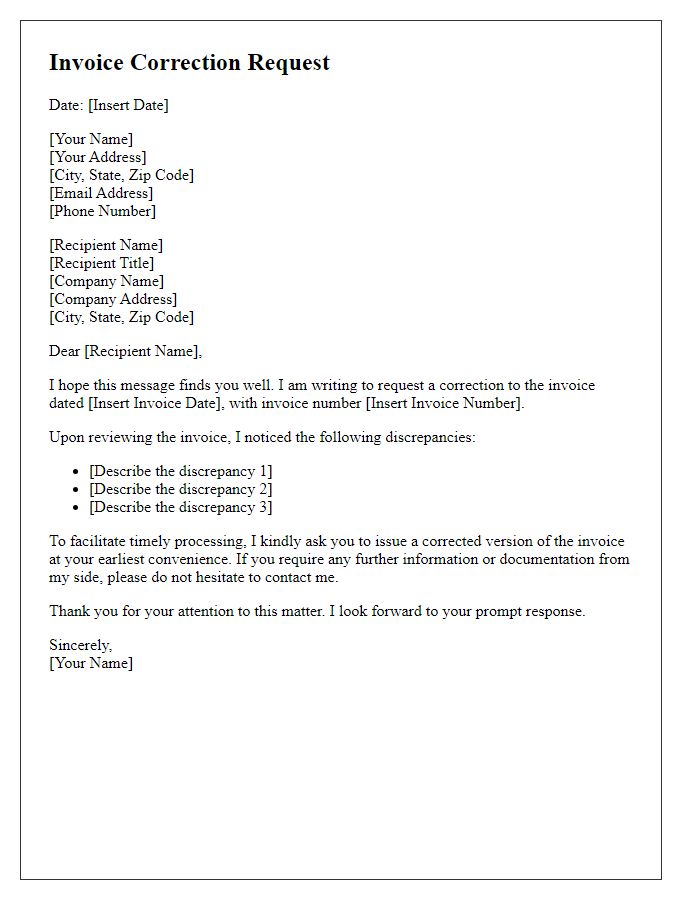

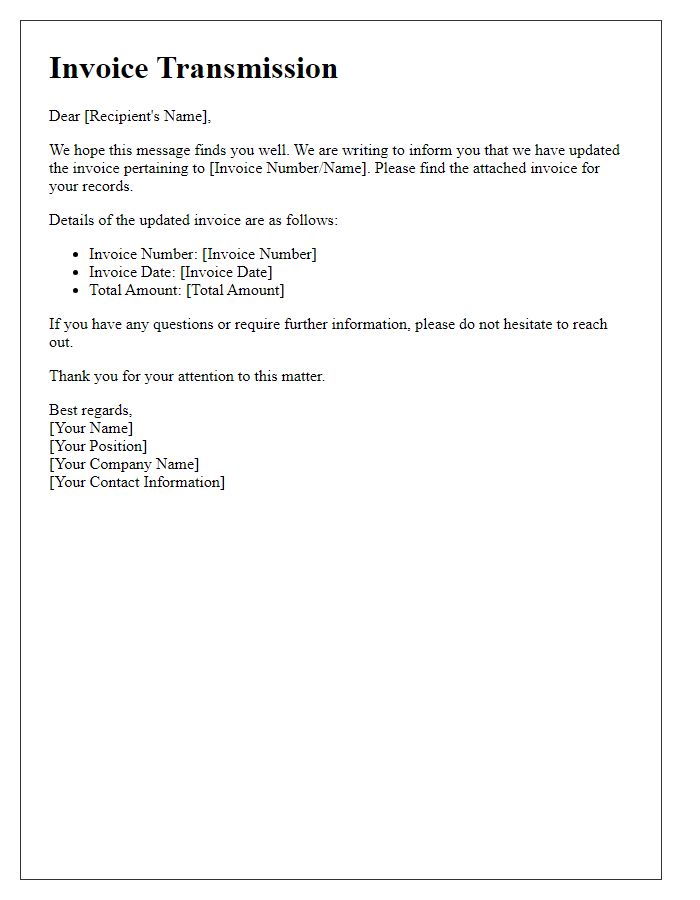

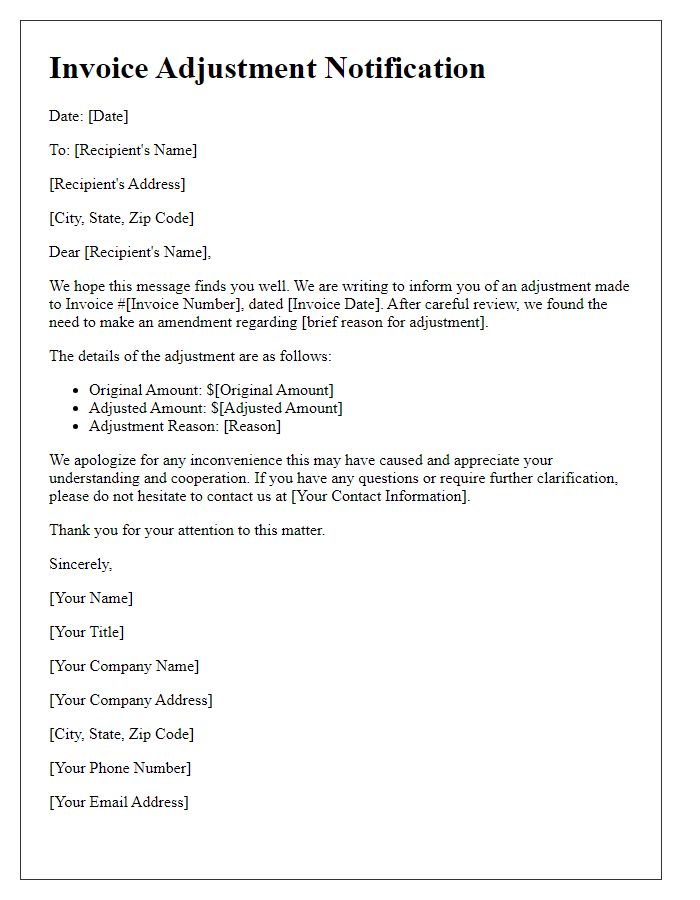

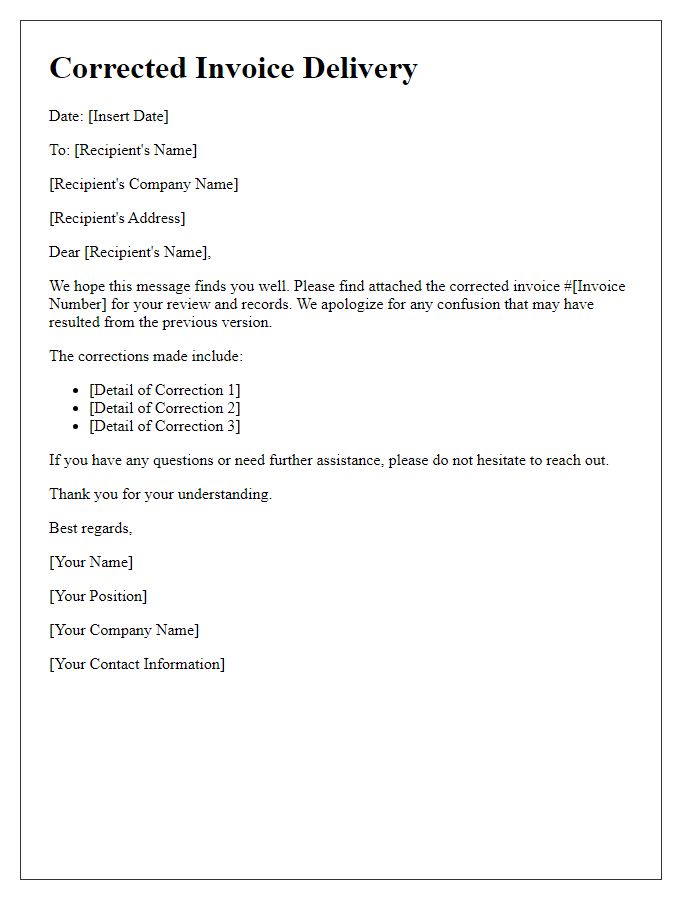

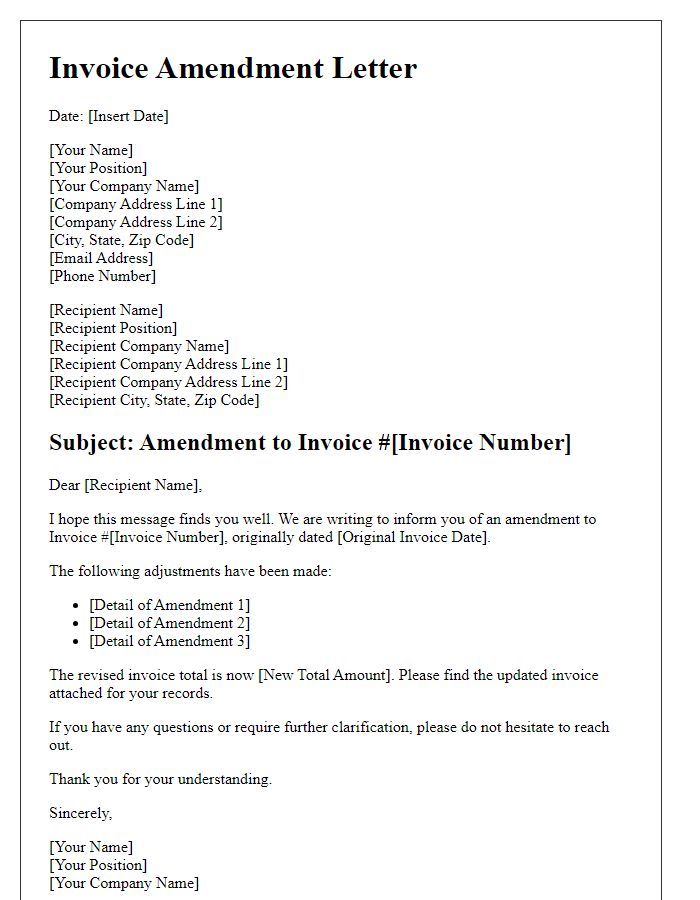

A corrected invoice reissuance requires precise identification details to ensure clarity and accuracy. Each invoice should prominently display specific elements such as the unique invoice number (a sequential figure like 001234), the date of issuance (e.g., March 15, 2023), and the corrected invoice total (for instance, $1,250.00). The billing address must include the complete name of the company (e.g., XYZ Corporation), street address (1234 Market Street), city (San Francisco), state (California), and ZIP code (94103). Additionally, the name of the accounting representative should be included, along with a direct phone number (e.g., 555-123-4567) for any inquiries. These identification details facilitate accurate record-keeping and ensure the recipient can easily reference the modifications made to the initial invoice.

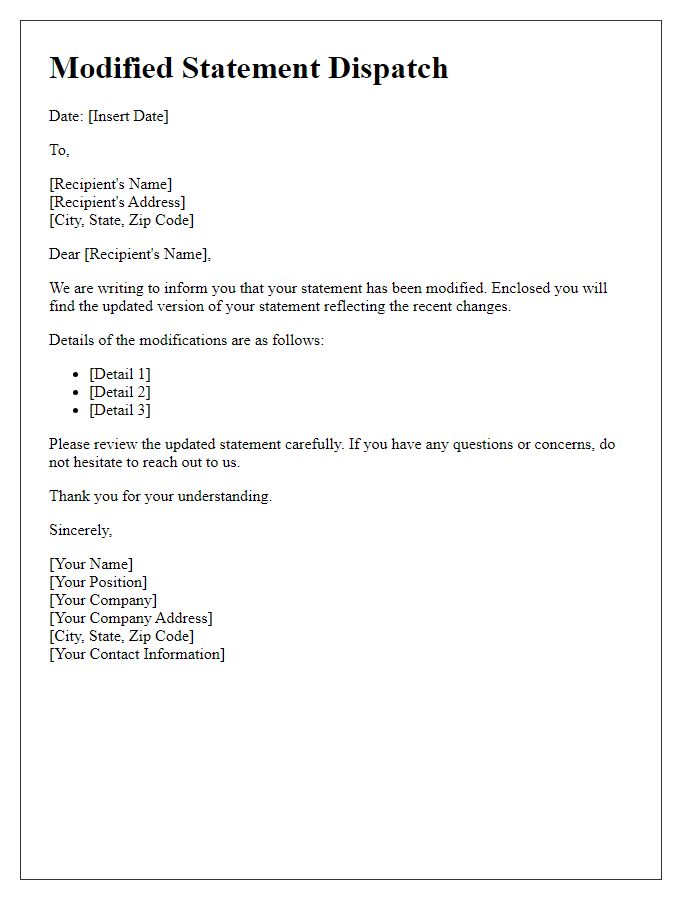

Reason for Correction

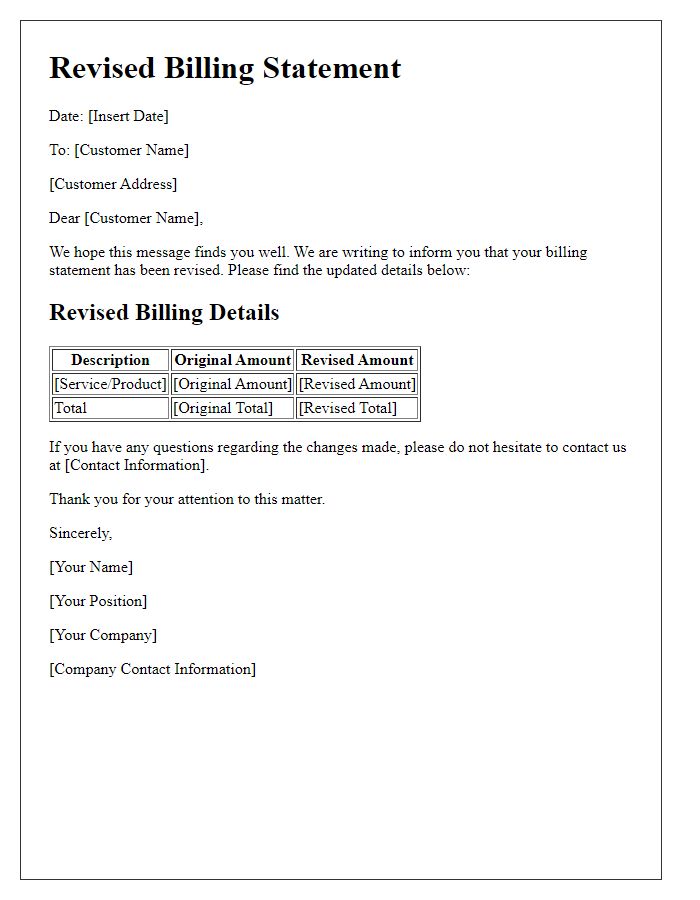

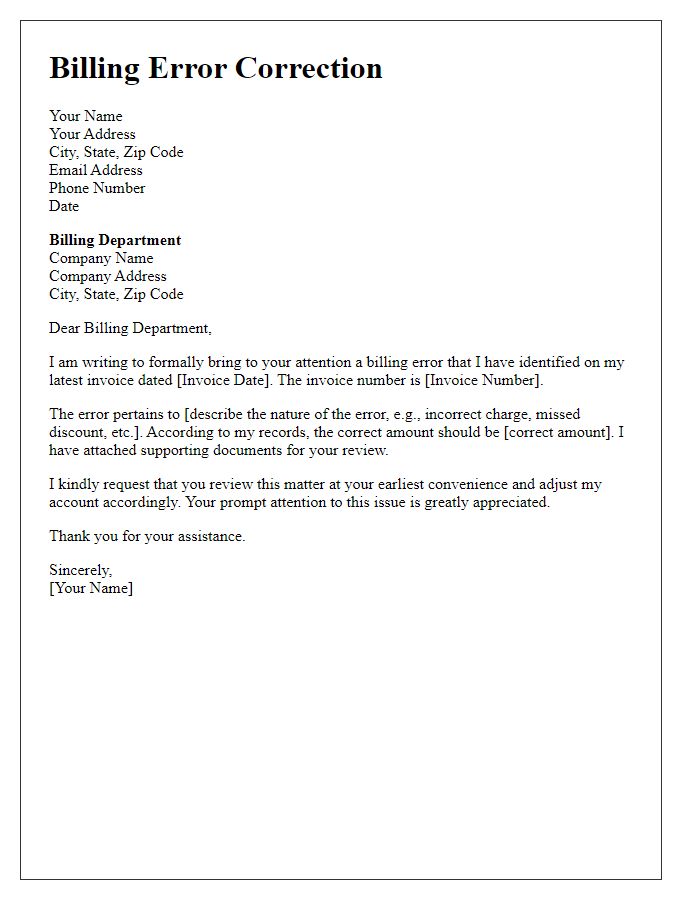

Incorrect invoices can significantly impact financial records and client relationships. Common reasons for invoice corrections include typographical errors in amounts, incorrect billing addresses, or misapplied discounts. For instance, a service invoice dated October 1, 2023, for graphic design work amounting to $1,200 may require reissuance due to a misprint that listed the total as $1,500. Additionally, if the billing address was incorrectly stated as 123 Elm Street instead of 456 Maple Avenue, a correction becomes necessary to ensure accurate record-keeping. These corrections enhance transparency and maintain trust between businesses and clients, ultimately supporting smoother transactions and improved financial management.

Corrected Invoice Details

A corrected invoice reissuance is essential for maintaining accurate financial records and ensuring clear communication between parties involved in a transaction. The corrected invoice must include specific details such as date of issuance, invoice number for tracking, and a statement indicating the reason for the reissuance, which could be due to pricing errors or adjustments in product quantities. Essential elements like the business name, address, and contact information of the issuer, as well as the recipient's details, should be clearly outlined. Additionally, it is important to list line items accurately, including descriptions, unit prices, quantities, and the total amount due, ensuring compliance with applicable taxation laws. This helps facilitate payment processes and provides transparency for financial audits.

Updated Payment Instructions

A corrected invoice reissuance must include updated payment instructions to ensure proper processing of financial transactions. The document should clearly outline the invoice number, which might be specific to the transaction (e.g., Invoice #12345), date of issuance (e.g., October 5, 2023), and the recipient's details (e.g., company name and address). Additionally, the updated payment instructions should specify the preferred payment method (e.g., bank transfer, credit card), providing relevant account information, such as bank name, account number, and routing number for bank transfers. Also, include any payment deadlines or terms to facilitate timely payments while avoiding fees associated with late payments. Finally, a clear point of contact should be presented for any inquiries regarding this updated invoice process, ensuring a streamlined communication channel.

Contact Information for Queries

A corrected invoice reissuance is essential for maintaining accurate records and fostering transparent communication between businesses and clients. The invoice may include details such as the invoice number, date of the original invoice, and the specific corrections made. For any inquiries regarding the corrected invoice, clients can contact the dedicated customer service team at the company's headquarters in New York City through the phone number (555) 123-4567 or via email at support@company.com. Ensuring prompt responses enhances customer satisfaction while resolving discrepancies efficiently.

Comments