Are you navigating the often tricky waters of invoice refund processing? Dealing with refunds can sometimes feel overwhelming, but it's a necessary part of maintaining strong customer relationships. In this article, we'll break down a simple letter template that can streamline your communication and ensure clarity throughout the refund process. So, grab your pen and let's dive into the details that can make your life a little easier!

Contact Information

When processing invoice refunds, ensuring accurate contact information is essential for efficient communication. Key details include the business name, which identifies the entity responsible for the transaction, along with a physical mailing address that may be necessary for legal documentation. Email addresses, vital for digital correspondence, should be monitored to address queries swiftly. Additionally, providing a phone number allows clients to seek clarification or assistance in real-time, enhancing customer service experience. Including the date of the refund request and the invoice number allows for smooth tracking of the transaction history, facilitating timely processing and resolution of the refund.

Invoice Details

Processing an invoice refund requires careful attention to the associated details, such as Invoice Number 12345, which pertains to the transaction dated April 15, 2023. The refund amount specified at $150.00 is linked to Service Agreement SA6789 for digital marketing services rendered. The client, ABC Corporation, located at 456 Business Rd, Springfield, had requested the refund due to service dissatisfaction, documented in Email Thread #789. Additional documentation, including the original invoice PDF and signed contract, is necessary to ensure a smooth processing experience. Stakeholders involved include Finance Manager John Smith and Account Representative Sarah Brown, ensuring all parties are informed during the refund procedure.

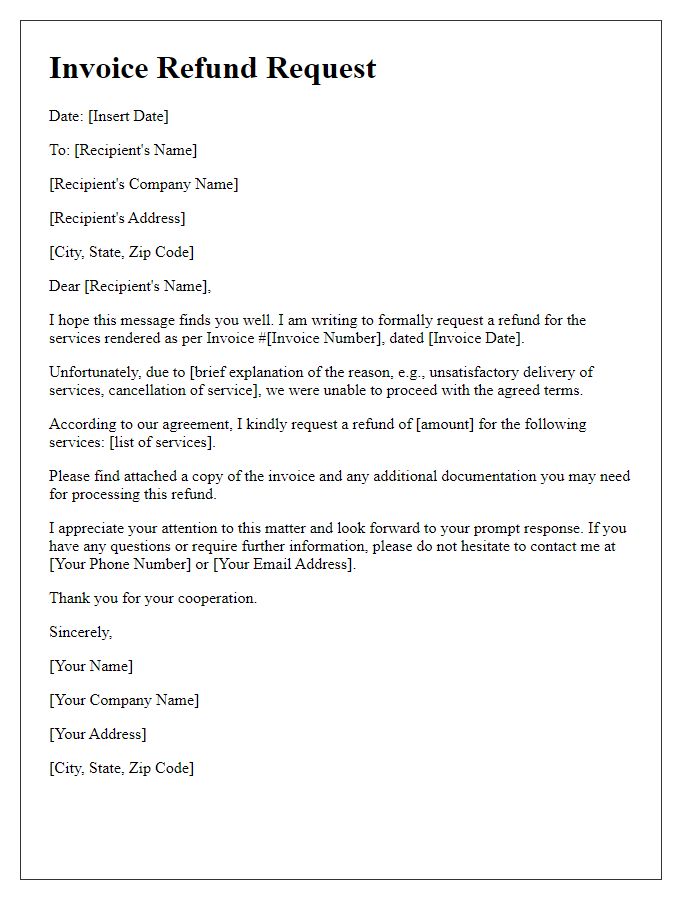

Refund Justification

Refund justification is an essential aspect of financial transactions, typically requested after a product purchase, such as consumer electronics or clothing. Customers might seek refunds due to various reasons, including defective merchandise, services not rendered, or unsatisfactory product quality. Documentation, such as purchase receipts and communication records, is crucial for substantiating refund claims and expediting processing. In many cases, companies like Amazon or eBay have specific guidelines that streamline refund processes, often requiring submission within a defined window, like 30 days from purchase date. Prompt and clear responses from customer service representatives can enhance customer satisfaction and facilitate swift resolution.

Refund Amount and Method

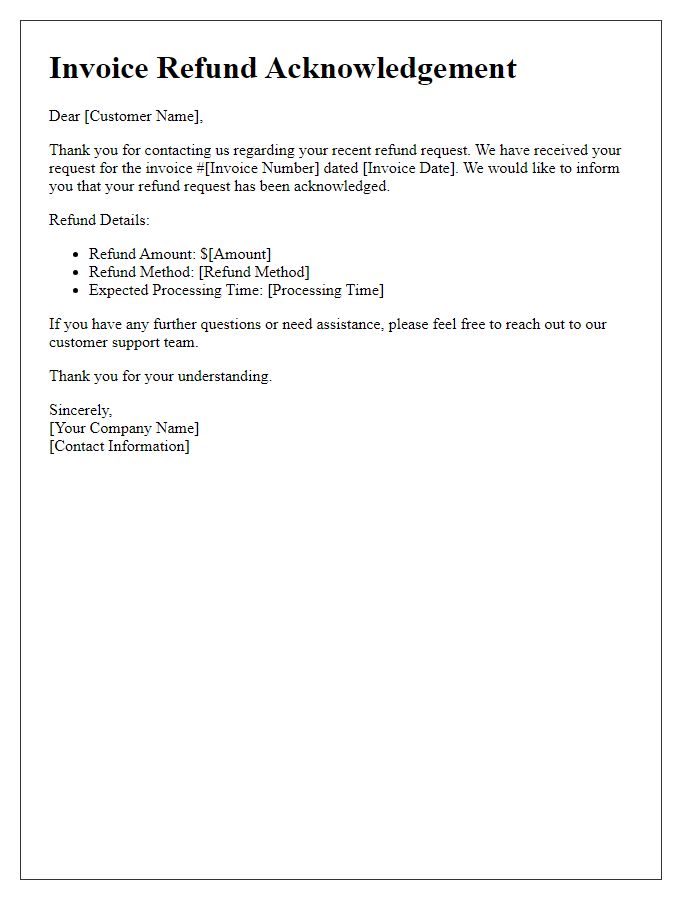

Processing invoice refunds requires attention to detail to ensure accuracy and customer satisfaction. The refund amount should reflect the total eligible credit from the original transaction, including applicable taxes such as VAT or sales tax. The refund method specifies how the money will be returned to the customer, which could include options like direct bank transfer, credit card reversal, or store credit issued for future purchases. Documentation (like the original invoice number, refund request reason) must be maintained for accounting records. Timely communication with the customer regarding the expected timeline of the refund process is essential for customer trust and loyalty.

Timeline and Next Steps

Processing an invoice refund requires careful attention to detail and adherence to a structured timeline. Upon receiving the refund request, typically submitted through designated customer service channels, an initial review is conducted within 3 to 5 business days to verify the validity of the claim. Following verification, the finance team will initiate the refund process, which can take an additional 7 to 10 business days, depending on the payment method (credit card, bank transfer, or third-party service like PayPal) used in the original transaction. An email notification will be sent to the customer once the refund has been processed, including transaction details for their records. For any questions or updates, customers are encouraged to contact the support hotline at (123) 456-7890 during regular business hours (9 AM to 5 PM, Monday to Friday).

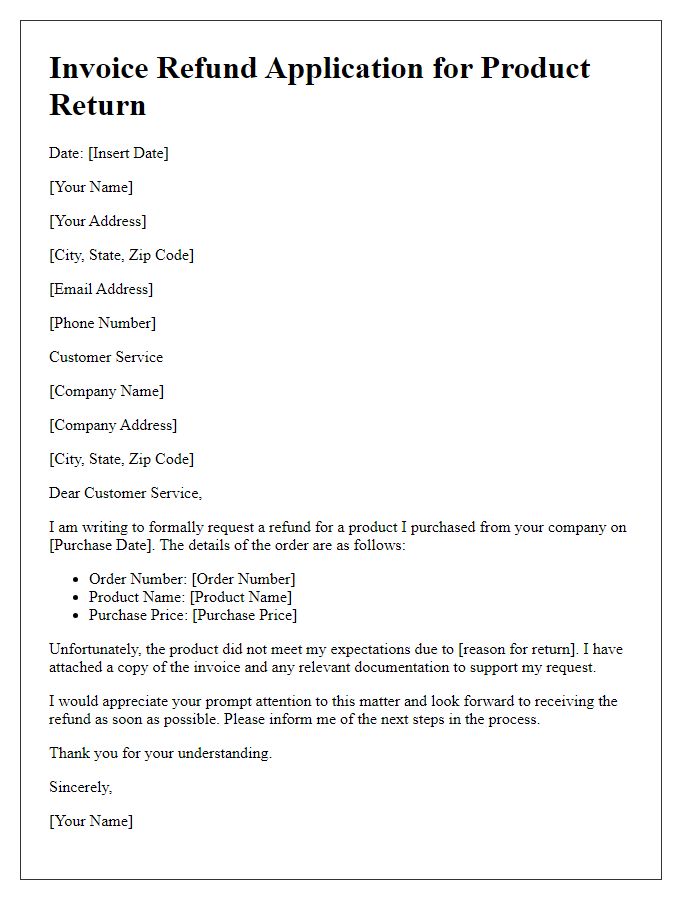

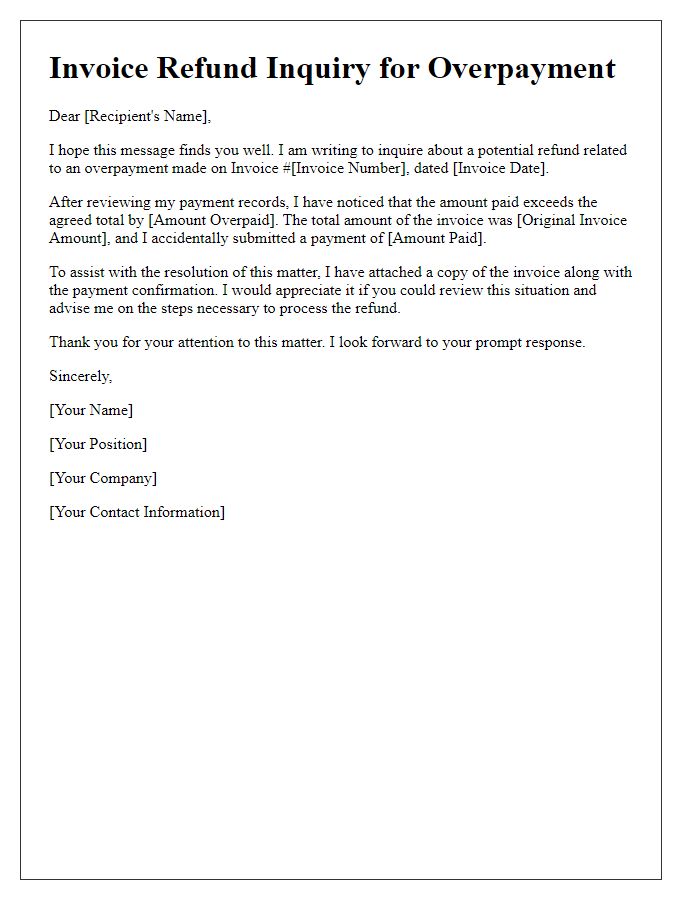

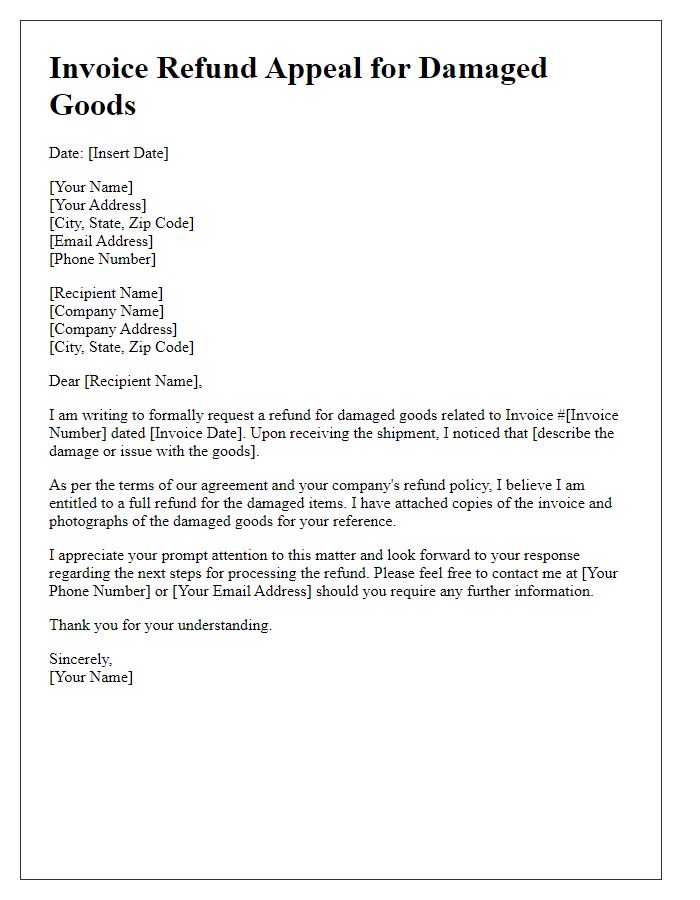

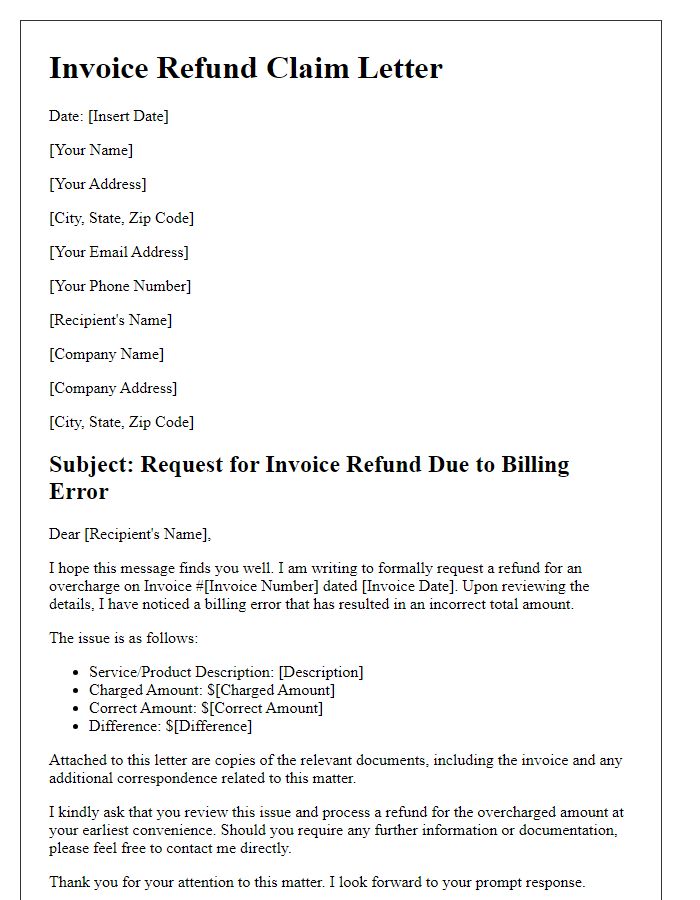

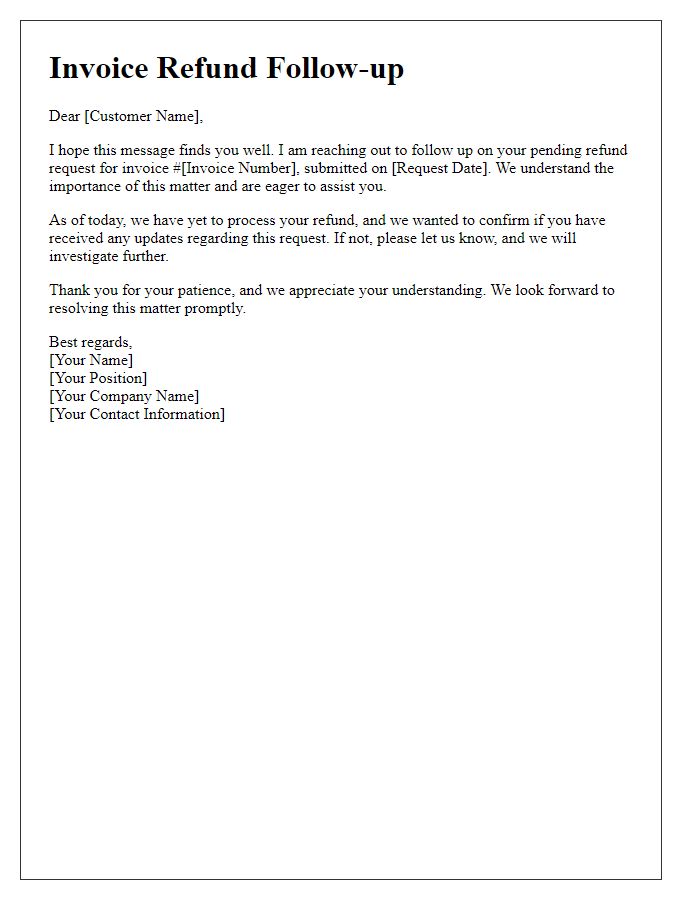

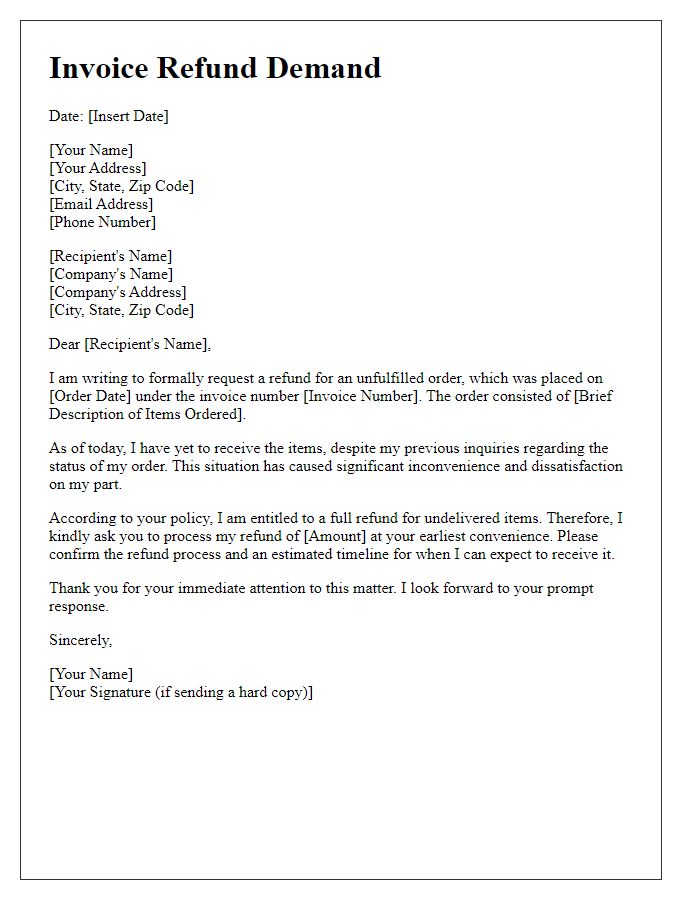

Letter Template For Invoice Refund Processing Samples

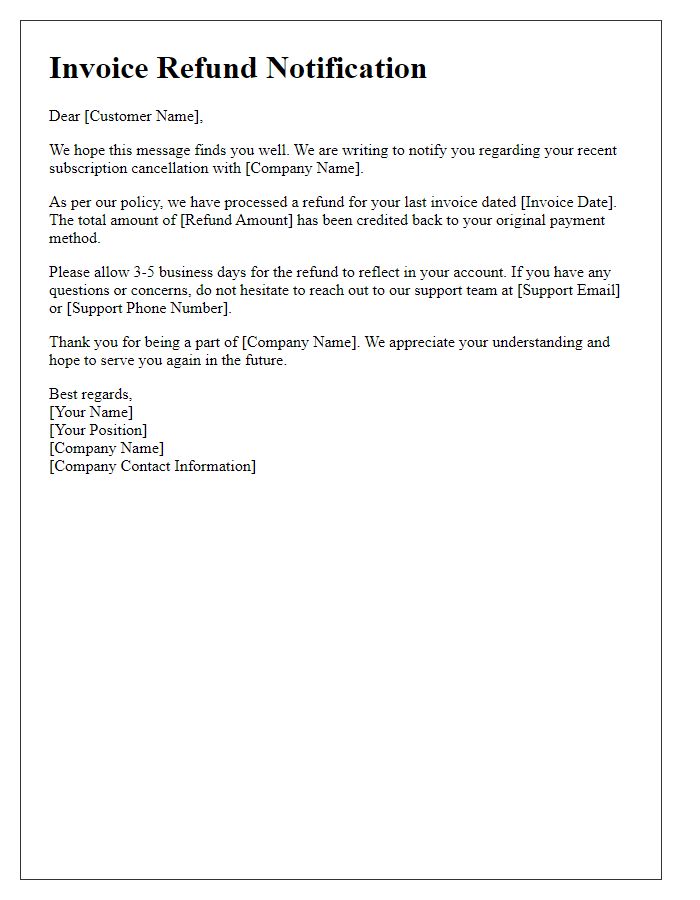

Letter template of invoice refund notification for subscription cancellation

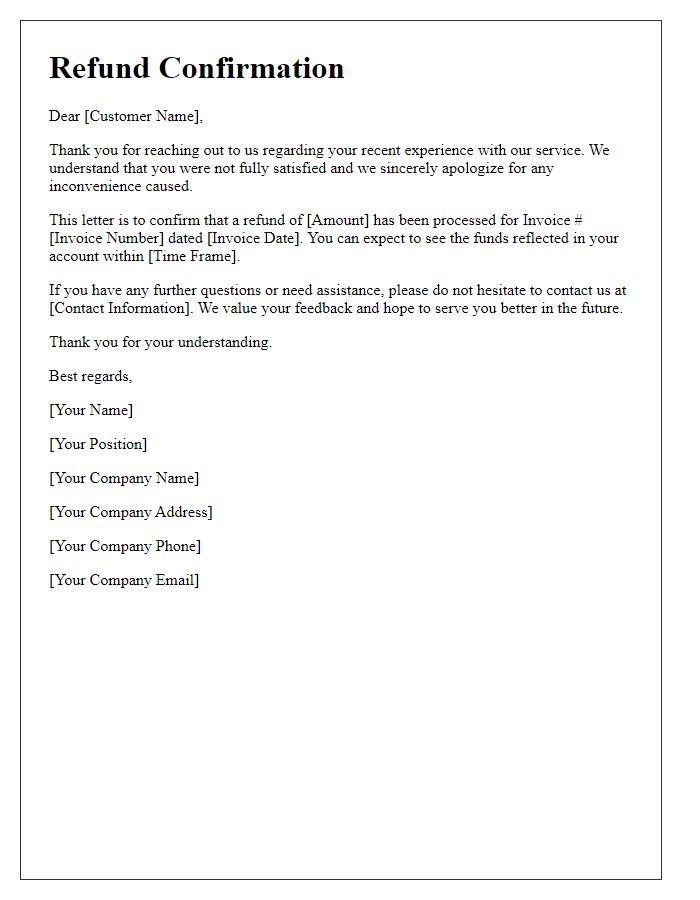

Letter template of invoice refund confirmation for service dissatisfaction

Comments