Are you considering changing your invoice payment method? It's a common need for businesses looking to streamline their financial processes or offer more convenience to their clients. Making such a transition can not only enhance your cash flow but also improve customer satisfaction. Curious about how to effectively communicate this change? Let's dive into the details together!

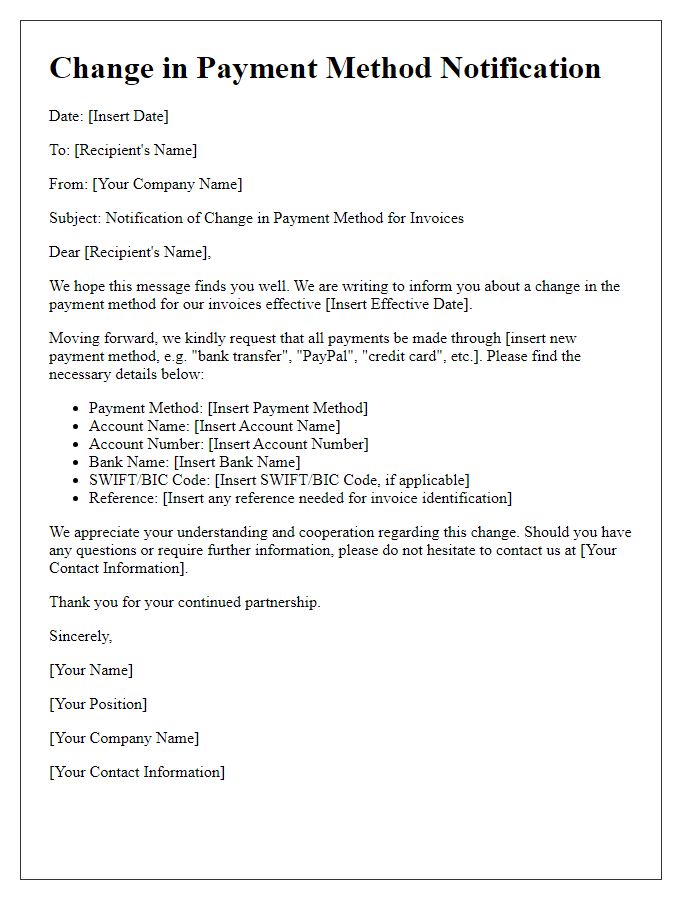

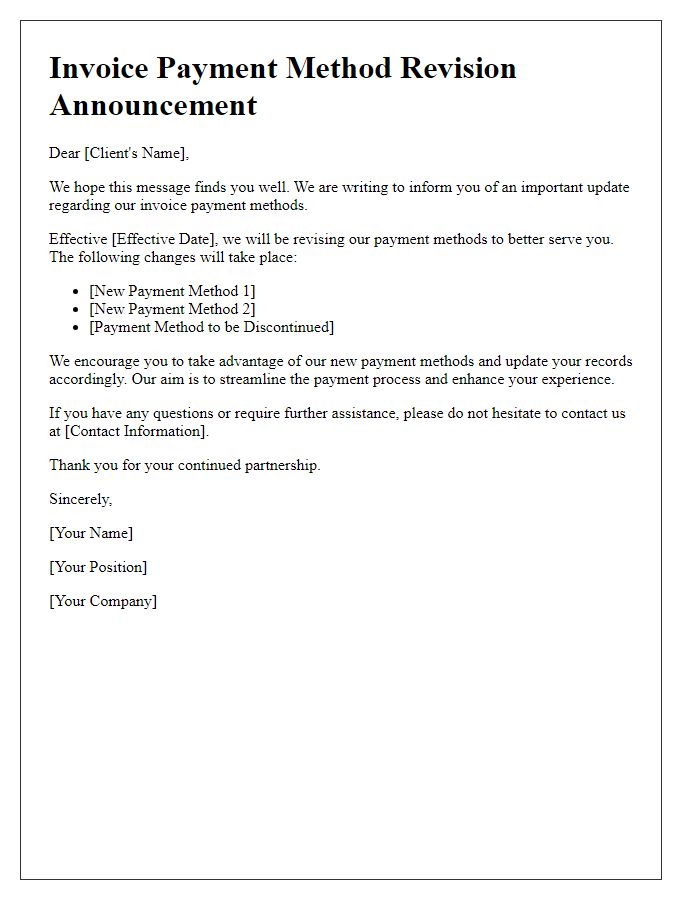

Clear Subject Line

Subject: Invoice Payment Mode Change Notification In a business environment, effective communication can enhance financial transactions. Notifications regarding changes in payment methods are vital for maintaining transparency between companies and clients. For instance, a shift from wire transfer to online payment platforms such as PayPal or Stripe can streamline the payment process. Clear subject lines, like "Invoice Payment Mode Change Notification," ensure recipients understand the purpose immediately. Important details include the invoice number (for instance, #INV12345), the current due date (e.g., September 30, 2023), and instructions on how to utilize the new payment method effectively. Maintaining clarity prevents confusion and fosters trust during financial dealings.

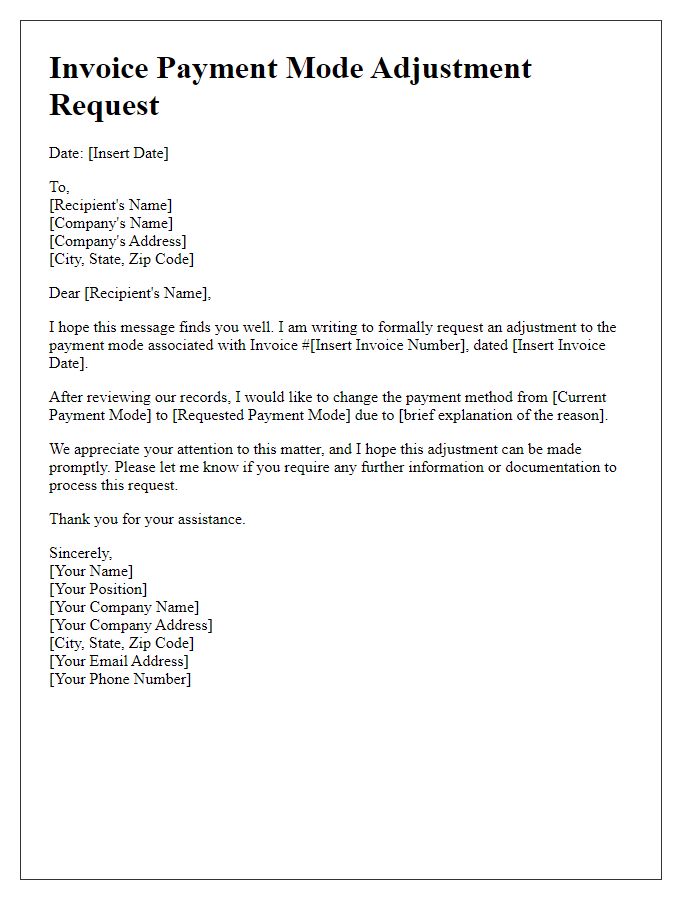

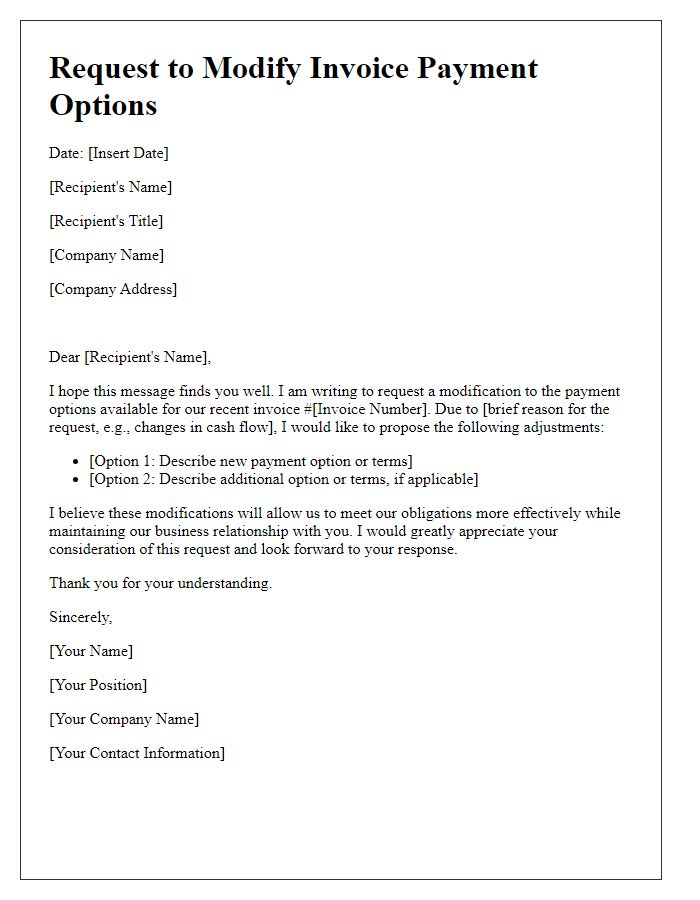

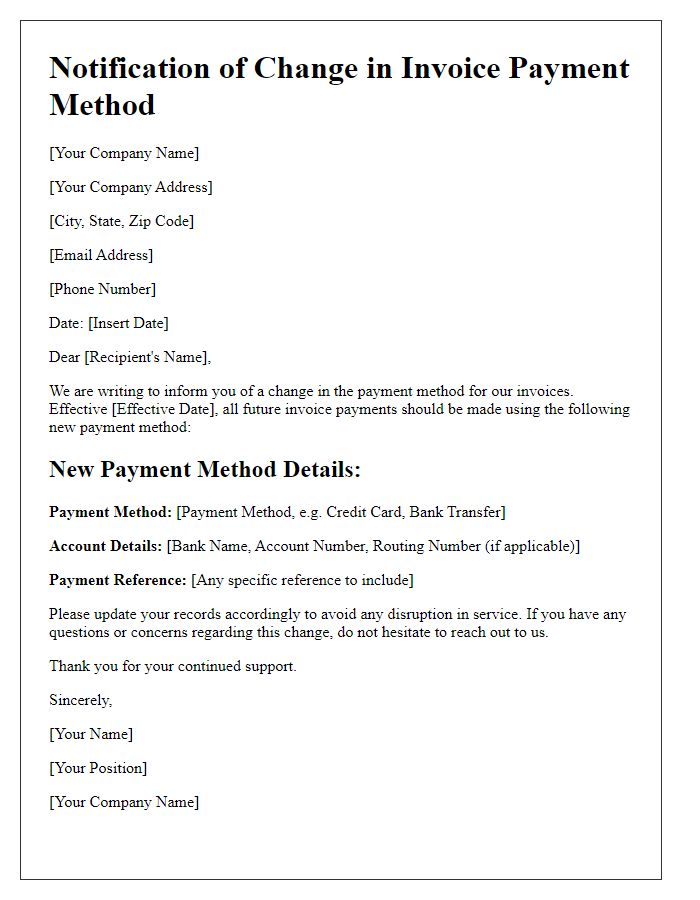

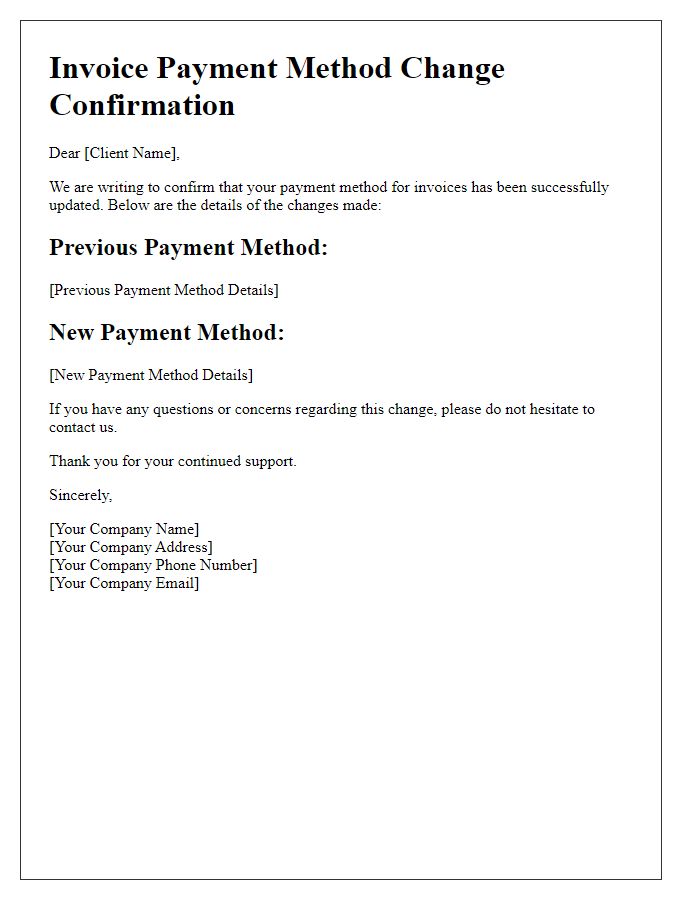

Recipient Details

Invoicing systems can be affected by payment mode changes, particularly within accounting platforms like QuickBooks or FreshBooks. Updates to recipient details, such as a business's bank account information or payment processing service (e.g., PayPal, Stripe), must be communicated promptly to prevent payment delays. Companies might experience disruptions when transitioning from traditional checks to electronic transfers, influencing cash flow and operational efficiency. Ensuring that the recipient's name, address, and taxpayer identification number are accurate is essential for compliance with tax regulations and for maintaining organized financial records.

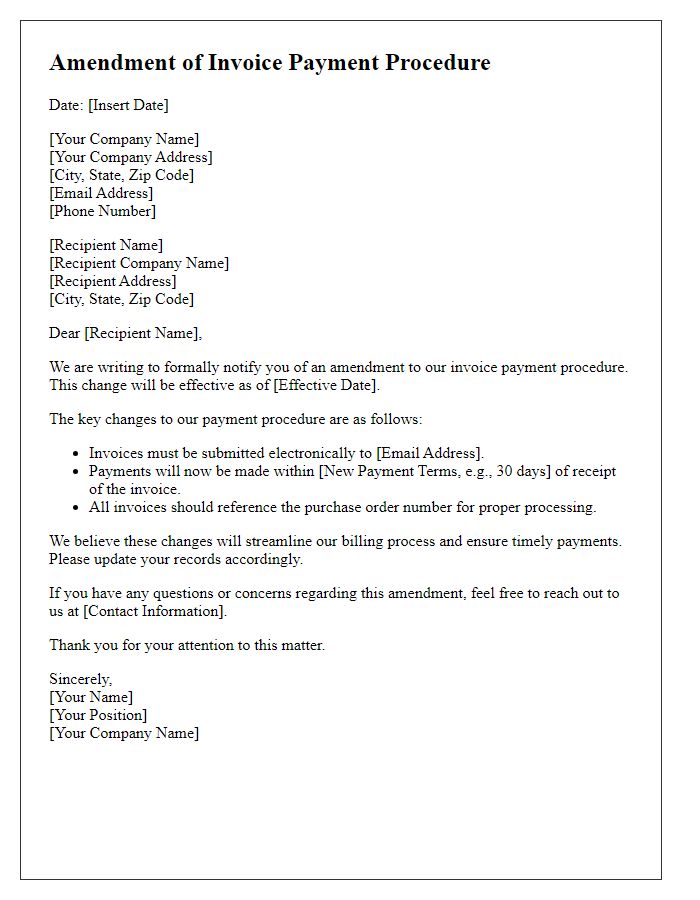

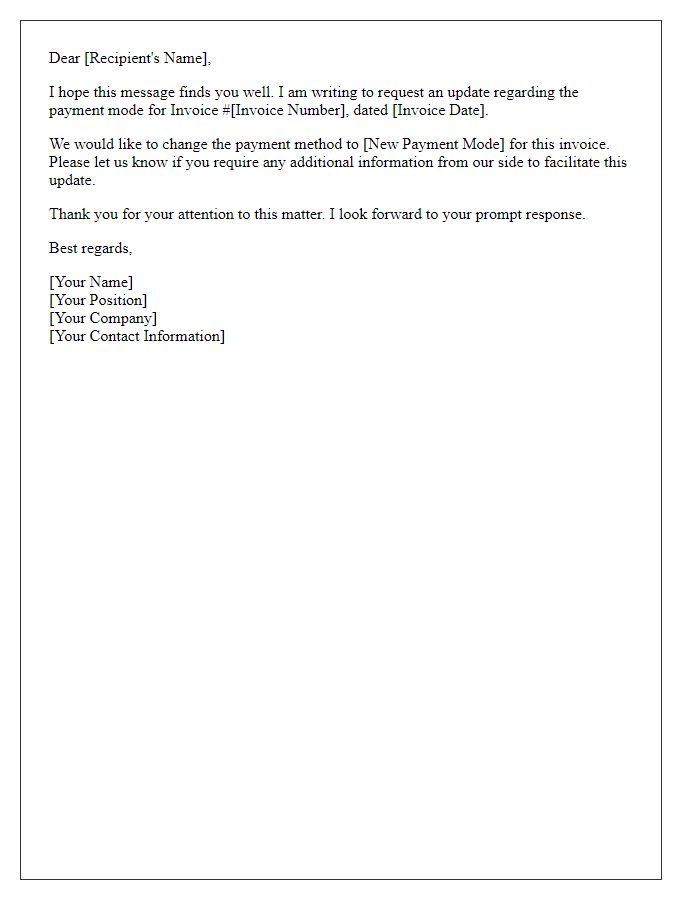

Reason for Change

The transition to an electronic payment method, such as bank transfer or online payment platforms, has become essential for businesses to enhance transaction efficiency and security. Traditional forms of payment, including checks or cash, often lead to delays, increased processing time, and higher risks of loss or theft. By adopting a digital payment method, organizations minimize operational costs associated with paper processing and improve cash flow management. Furthermore, digital transactions provide unparalleled tracking capabilities, allowing for real-time updates and simplified bookkeeping processes. This change aligns with the growing trend of contactless transactions, which have surged in popularity, especially following global events like the COVID-19 pandemic that emphasized hygiene and convenience in financial dealings.

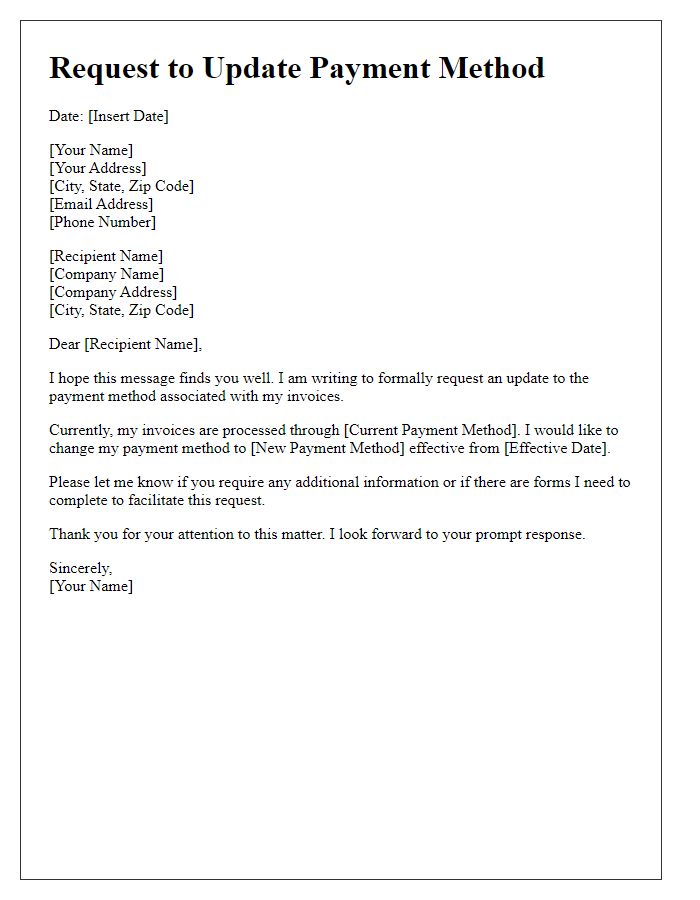

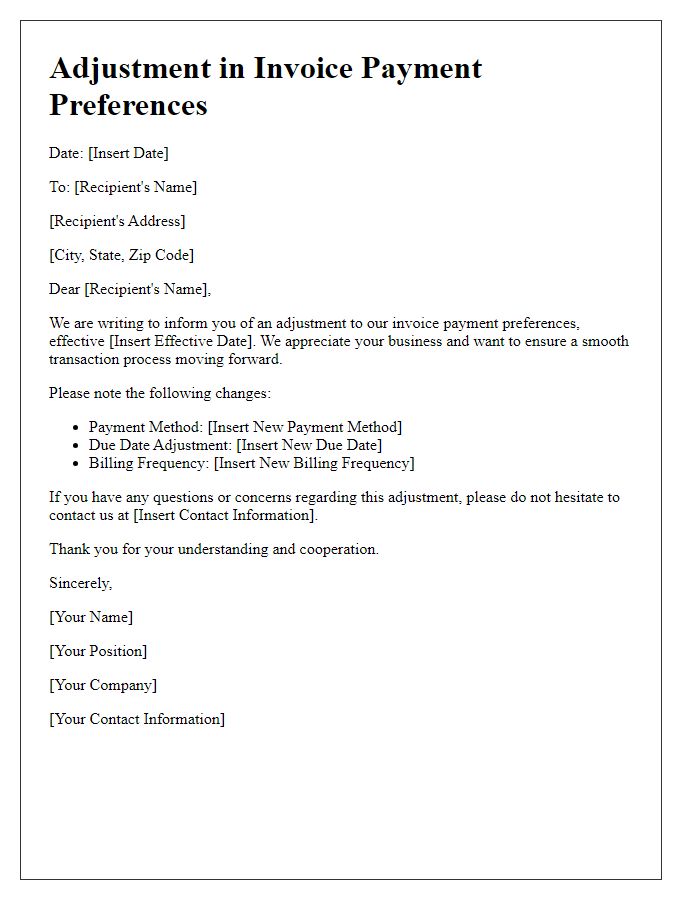

New Payment Instructions

Changing payment instructions for invoices can impact financial processes and cash flow management. Organizations might need to update information to reflect new payment methods, such as transitioning from checks to electronic transfers. This change is essential to streamline operations, particularly if companies aim to enhance efficiency in accounts payable. Clear communication is crucial during this transition to avoid payment delays. Specific details, like bank account numbers, payee names, and due dates, should be clearly outlined to ensure smooth financial transactions. Implementing these new payment instructions can ultimately improve cash management and vendor relationships.

Contact Information for Queries

Invoicing processes within businesses often require clarity, especially regarding payment mode changes. Ensuring accuracy in contact information is crucial for resolving payment queries efficiently. Updated contact information, like an email address (e.g., accounts@business.com) or a dedicated phone line (e.g., +1-800-555-0199), should be prominently displayed on the invoice. Providing a direct point of contact, such as a customer service representative (e.g., Jane Doe, Customer Service Manager), enhances customer relations. Quick response times (typically within 24-48 hours) for queries related to payment modes, including bank transfers or credit card payments, can significantly improve the overall client experience. Ongoing communication can prevent misunderstandings and streamline the invoicing workflow.

Comments